Compiled by: KarenZ, Foresight News

Raoul Pal, a former Goldman Sachs executive, author of "Global Macro Investor", and founder of Real Vision, is renowned for successfully predicting the 2008 financial crisis. Recently, in a conversation with "When Shift Happens" and a speech at the Dubai Sui Basecamp, Raoul Pal delved into how to steadily accumulate wealth in the cryptocurrency field and discussed topics such as Bitcoin, ETH, meme, AI, Non-Fungible Token, Sui ecosystem, Bitcoin strategy, investment strategies, macro trends, and market directions.

Raoul Pal's Dialogue with When Shift Happens Highlights

I. How to Get Rich in Crypto Without Luck?

How to get rich in Crypto without luck? Simply buy Bitcoin and use the DCA (Dollar Cost Averaging) strategy.

Newcomers often fall into the trap of pursuing quick wealth, which is actually fraught with danger.

When you start envying others who have gained 100x returns, you have already entered a dangerous zone. Once you lose rationality and greed takes over, you are likely to completely mess up your investment.

The Crypto field is filled with risks such as DeFi attacks and wallet theft, which requires investors to always remain alert and rational.

II. About Meme

Regarding meme coins, Raoul Pal stated that he does not hold Fartcoin but owns SCF (Smoking Chicken Fish) and DODE. Although SCF has dropped 90%, it is currently showing a good rebound. He particularly warned investors not to let meme coins like Fartcoin, WIF, or BONK occupy too large a proportion in their portfolio, as there is an 85% chance they will go to zero. He was even surprised that LUNA did not evolve into a meme coin, as he originally thought people would buy it frantically.

III. Stay Away from Market Panic and Return to Value Investing

If investors feel panicked about the market, Pal suggests calmly returning to life and staying away from trading screens. Those 5-minute and 1-hour K-line charts actually do not substantially help investment decisions.

Many people fantasize about becoming successful traders earning 100x returns, but the reality is that those who truly accumulate wealth in this field are investors who persist in buying and holding long-term.

IV. Beware of Crypto Yield Risks

Regarding Crypto Yield, such as earning through staking, risks still exist. For ordinary investors, when facing an opportunity that seems to bring 20% returns, one must be clear about the risks involved.

V. How to View Michael Saylor's Bitcoin Purchasing Strategy?

Strategy's Bitcoin strategy is creating leverage in the system. Strategy purchases Bitcoin by issuing convertible bonds, which is essentially selling options at a lower cost. These options are bought by arbitrageurs (options traders) who hedge on exchanges to manage Bitcoin price fluctuations and MicroStrategy stock option risks.

Arbitrageurs also trade using the fluctuations between MicroStrategy's NAV and Bitcoin prices, as well as market tools like perpetual contract and spot price differences, futures and spot price differences.

Currently, Strategy's convertible bond buyers are mainly TradFi hedge funds and other institutions. Sovereign wealth funds like Norway Bank may only care about the Bitcoin element, while large hedge funds such as Citadel, Millennium, and Point72 also engage in arbitrage. These institutions are experienced in risk management, possibly receive systemic support, control position sizes reasonably, and are not easily liquidated.

In stark contrast, traders who excessively use high leverage face enormous risks, with cases of trading failures due to over-leverage frequently seen in the market.

VI. Raoul Pal's Capital Allocation

Regarding capital allocation, Raoul Pal stated that Sui accounts for 70%, now far exceeding Solana. Sui's adoption and developer activities are performing well. In addition, he also owns some DEEP (DeepBook), a liquidity layer protocol in the Sui ecosystem.

VII. The Value and Potential of Non-Fungible Token

As an innovative technology for permanently storing and trading non-transferable assets, Pal is full of expectations for Non-Fungible Token. From a macro perspective, the current Crypto industry is worth $3 trillion. If it grows to $100 trillion in the next 10 years, it will create $97 trillion in wealth; even with a conservative estimate of $50 trillion, it will generate $47 trillion in wealth increment.

This wealth will flow to different people. Art is upstream of everything, and digital art, as an emerging field, is expected to become an important destination for wealth. In the digital art field, we have XCOPY and Beeple, which later gave rise to the generative art movement. I spent a lot of time talking to some very famous people, and these high-end individuals are very interested in this field. After crypto OGs earn enough money, their desire to collect art becomes extremely strong. For example, CryptoPunk symbolizes your identity and allows you to meet like-minded people. From institutions to super-rich to ordinary people, everyone is gradually realizing the importance of digital art. We are still in the early stages. I hold many artworks, and I believe this is a span of more than 10 years.

VIII. ETH's Advantages and Prospects

Regarding ETH, its network capacity has exceeded current system requirements, and it may adjust some mechanisms in the future to return to Layer1. EVM's position is like Microsoft, with many banks, insurance companies, and large enterprises relying on Microsoft, not Apple or Google.

Once you have an enterprise sales model, it's almost impossible to remove it from the company because you don't want to change it or take risks. From the Lindy effect (the longer something has existed, the higher the probability of its continued existence), ETH has stood the test of time and can well meet financial market needs. Would Goldman Sachs and JPMorgan build on Solana? Unlikely. ETH may bring a new narrative to the market and is expected to outperform Bitcoin in the short term. Looking ahead to the next five years, unless they mess everything up, its importance will become increasingly prominent.

Bitcoin Lightning Network and payment concepts have limited effect on price increases. Bitcoin's core value lies in its role as a store of value; the same thing will happen to ETH.

IX. About AI

AI's development is rapid, and its performance has exceeded 99% of analysts. After deep reflection, Pal believes that AI's rise has triggered profound questions about consciousness and the future role of humans. He suggests that people actively participate in, deeply understand, and skillfully use AI technology.

Secondly, we don't know what this means for employment and how we create wealth, but I know what humans are best at? What can humans do that AI cannot? That is to be human.

I developed an AI Raoul that can read news daily, with news also written by AI, and built a chatbot based on voice training, with training data covering all its X content, YouTube content, and 100 books. Now, Real Vision users can interact with this chatbot. Pal predicts that these two technologies will soon merge, and this transformation will have a profound impact on the podcast and media industries, with future media content being uniquely personalized. Moreover, human memories and behaviors may ultimately become "nutrients" for AI, achieving a kind of "immortality" in a certain sense.

X. Market Attention and Quality Project Selection

This is an attention game. People's focus on key tokens is dispersed, and the duration of various narratives is relatively short. Pal emphasizes that holding Bitcoin is always a wise choice. Additionally, buying Solana at the bottom of the cycle and SUI last year were also good strategies.

Investors should focus their attention on the top 10 or top 20 tokens, concentrating on projects that can continuously improve network adoption rates, which often have higher investment value. According to Metcalfe's law, project potential can be assessed from aspects such as active user numbers, total transaction value, and user value.

The Bitcoin network has numerous users and involves sovereign nation purchases, which is why Bitcoin is more valuable; Ethereum has a massive user base and rich applications. Although the emergence of L2 slightly complicates the situation, it still possesses significant value. Investors should actively seek projects with simultaneous growth in user numbers and value application, such as Solana, which at the cycle bottom had a continuously expanding developer community, stable user numbers, and Bonk's emergence further enhanced market confidence in Solana (Note: The host previously mentioned in a conversation with Toly that Mad Lads was Solana's turning point); Sui is similar.

Highlights of Raoul Pal's Speech at Sui Basecamp in Dubai

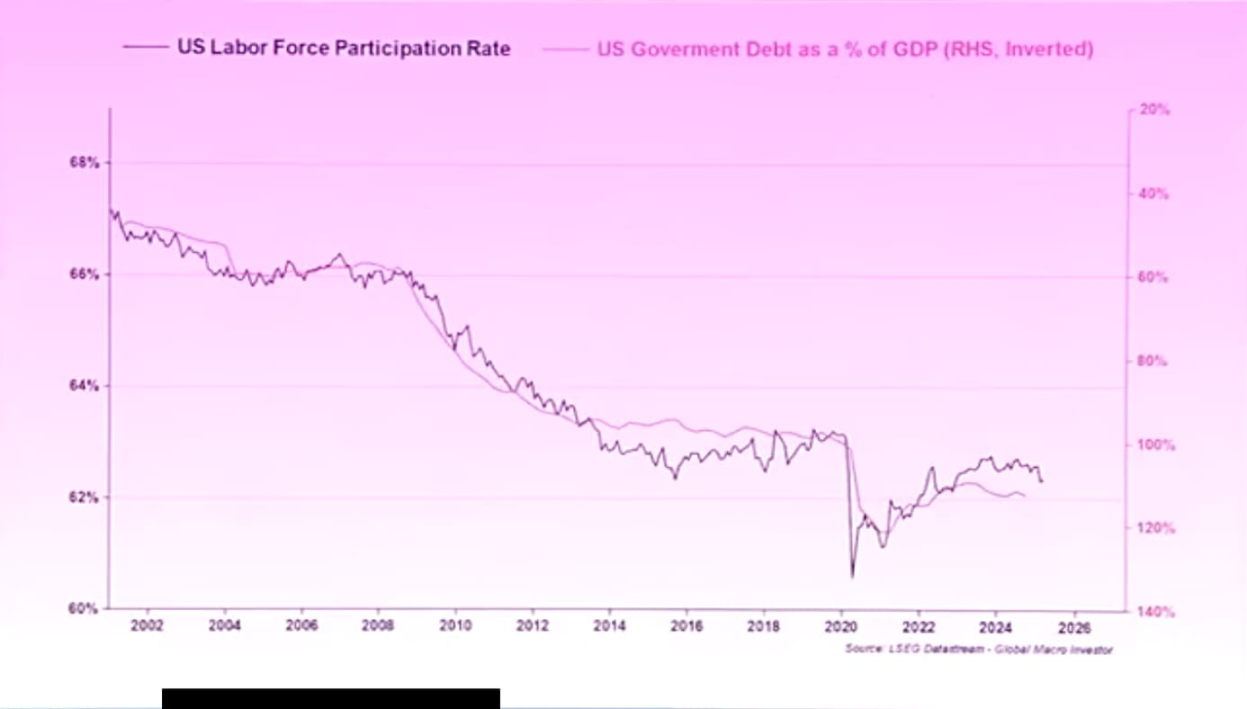

1. Macro Core Factors: Liquidity and currency depreciation. Cryptocurrencies and the economy present a four-year cycle, driven by the debt refinancing cycle. Since the global debt peak in 2008, we have been maintaining economic operations by borrowing to repay old debts.

2. Population Aging and Economic Growth: Population aging leads to economic growth slowdown, and more debt is needed to maintain GDP growth. This phenomenon is widespread globally, which can be clearly observed through the correlation chart between debt and GDP.

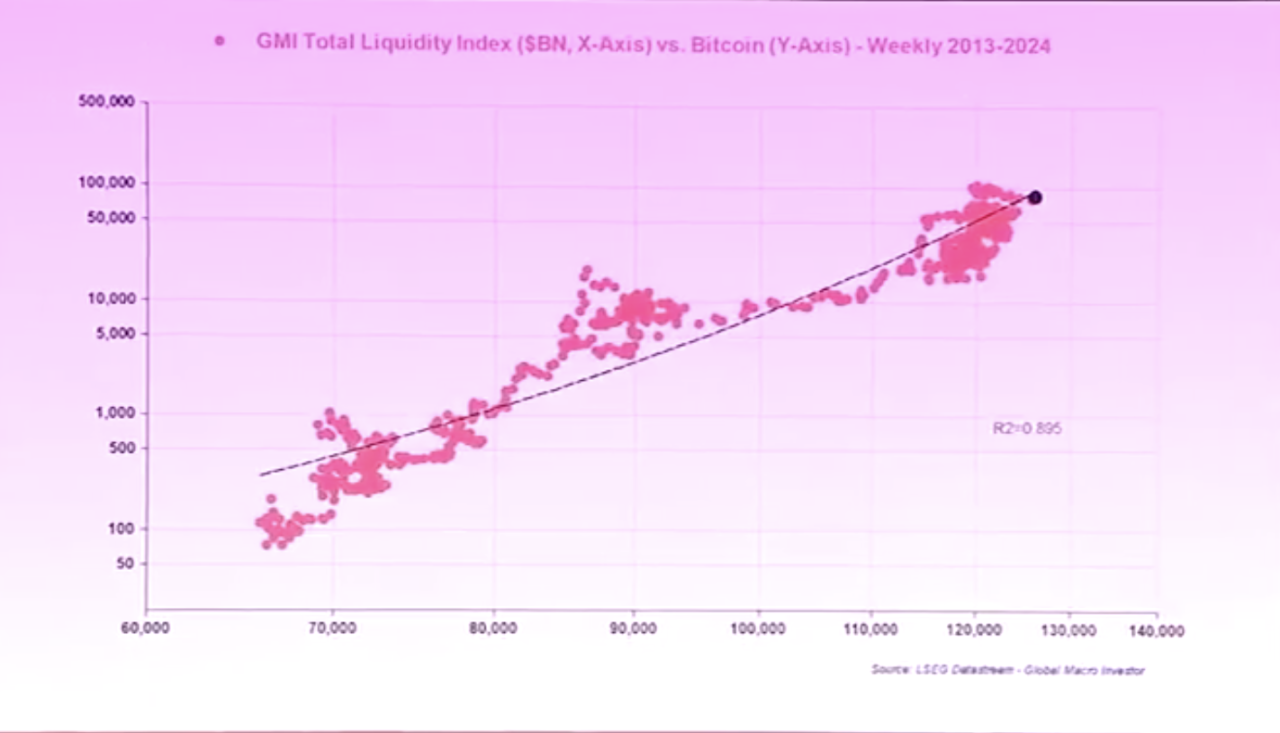

3. Liquidity Drives Everything: The Federal Reserve's net liquidity is a core indicator. From 2009-2014, liquidity was mainly provided through balance sheet expansion, and later added tools like bank reserve regulation. Currently, total liquidity (including M2) is crucial, with an astonishing explanatory power to Bitcoin (90% correlation) and Nasdaq (97% correlation).

4. Currency Depreciation Mechanism: Currency depreciation is like a global tax, with an 8% hidden inflation tax globally each year, plus 3% explicit inflation, meaning you need an 11% annual return to maintain wealth. This explains why young people are flocking to crypto—traditional assets (real estate, stocks, etc.) have insufficient returns, forcing them to choose high-risk assets for excess returns.

5. Wealth Disparity and Crypto Opportunities: The rich hold scarce assets, while the poor rely on labor income (declining purchasing power year by year). The crypto system subverts this pattern—young people seek breakthroughs through high-risk assets.

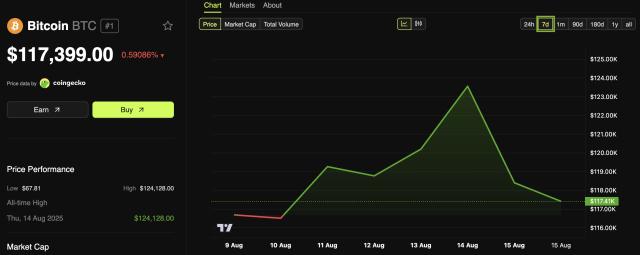

6. Crypto Asset Performance: Annualized 130% since 2012 (including three major pullbacks), Ethereum 113%, Solana 142%. Bitcoin's cumulative increase is 2.75 million times, extremely rare in investment, and crypto assets are gradually becoming a "super black hole" attracting funds.

7. Sui Ecosystem Has Enormous Potential. DEEP (DeepBook Liquidity Layer Protocol) has recently performed best. SOL/SUI ratio shows SUI is relatively strong.

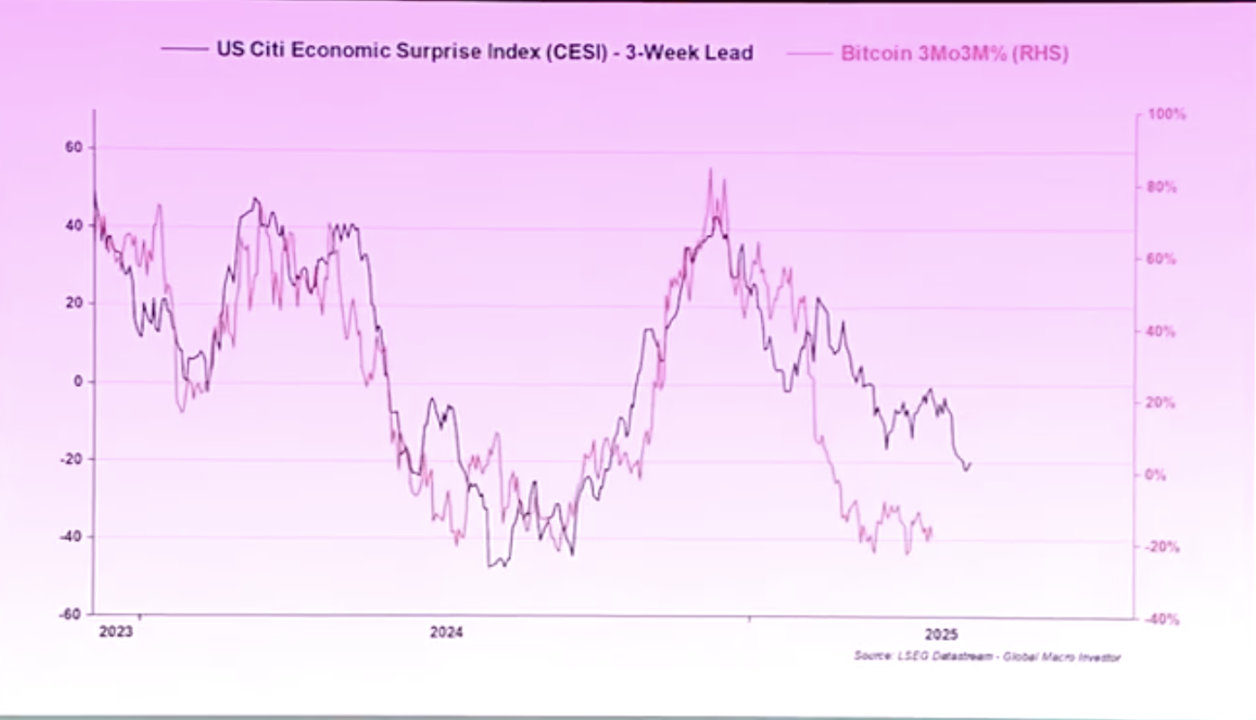

8. Current Market Misjudgment Analysis: People often interpret current market narratives using liquidity conditions from three months ago (such as tariff panic), which is biased. Actually, tightened financial conditions in Q4 2024 (rising US dollar rates, oil prices) produced a three-month lag effect. The economic surprise index (comparing US and global) indicates the current economic weakness is only temporary. Reviewing the 2017 Trump tariff cycle, the dollar rose first, then fell, followed by liquidity driving asset prices significantly higher.

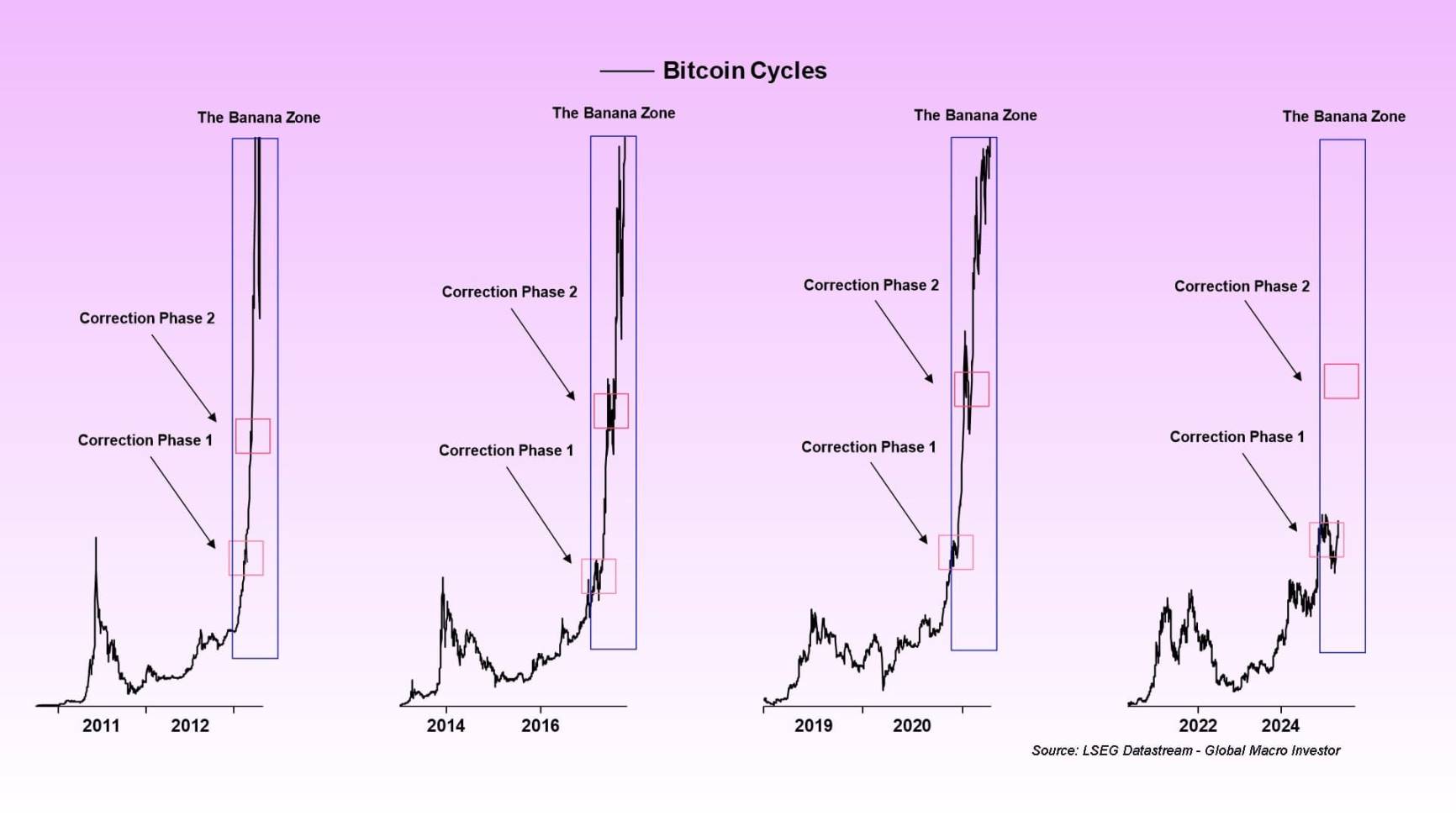

9. Global M2 and Asset Relationship: When global M2 reaches a new high, asset prices should rise synchronously. Taking Bitcoin as an example, its price trend usually shows a breakthrough, pullback, and then acceleration in the "banana zone". Comparing the 2017 cycle, Bitcoin rose 23 times that year. Although the current market differs, considerable appreciation is still expected. The market is currently in the correction phase after the first part of the "banana zone" breakthrough, about to enter the second part, which typically brings an Altcoin market.

10. Business Cycle and Bitcoin Trend: The ISM Manufacturing Index is an important forward-looking indicator. When this index breaks 50, it signals economic growth recovery, increased corporate earnings, and active fund reinvestment, which will accelerate Bitcoin price increases. If the ISM index reaches 57, Bitcoin price could even reach $450,000. As the business cycle recovers and household cash increases, risk appetite rises, making Altcoin investment logic similar to junk bonds and small-cap stocks.

Note: Raoul Pal is also a board member of the Sui Foundation.