As of 1:50 PM on May 12, 2025

After Bitcoin formed a short-term peak, differences in trading volume and investment sentiment have been detected. While inflow liquidity is maintained, decreased user activity and net inflow conversion could pose challenges.

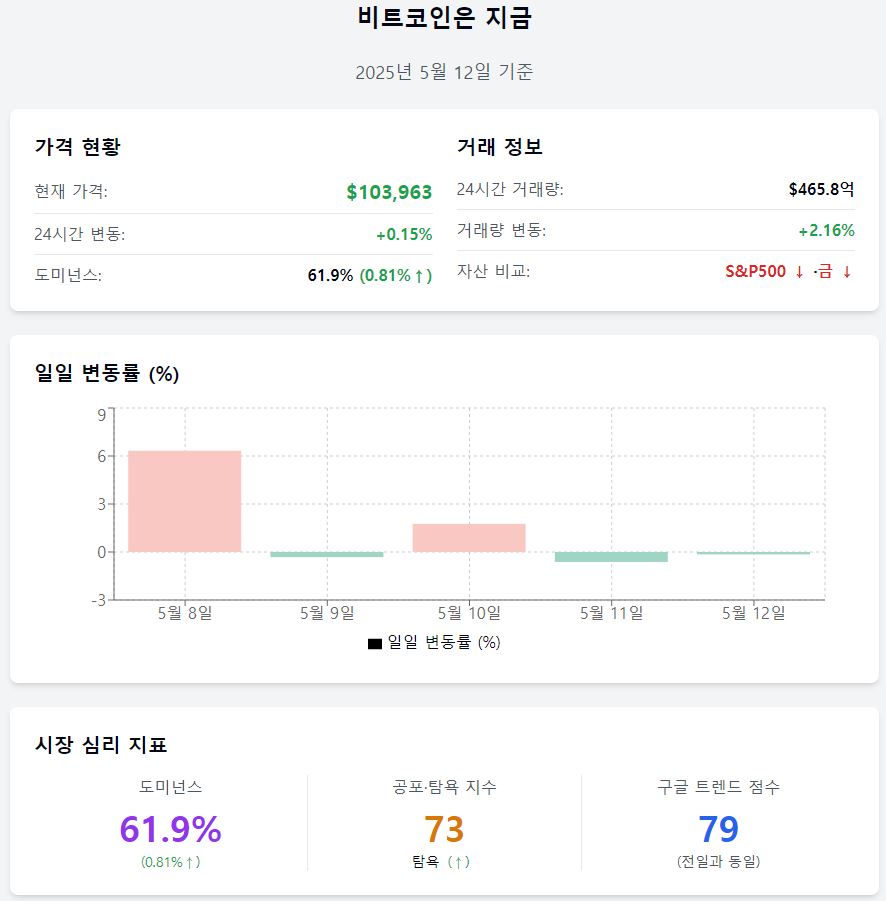

📈 Price now

Price $103,963 (+0.15%) Maintaining stability above the psychological resistance level of $100,000. Volatility has somewhat eased, and a sideways trend may continue for the time being.

Trading volume $46.58 billion (+2.16%) Slightly increased compared to the previous day, maintaining demand. However, trading vitality has slowed compared to the previous rapid surge period.

Daily fluctuation rate -0.15% Looking at the recent 5-day trading flow, after a sharp rise on the 6th (+6.33%), short-term fatigue is reflected with a decline (-0.32%), rebound (+1.76%), and subsequent declines (-0.62%, -0.15%). This is interpreted as gradually returning the rise after a strong upward movement, currently entering a phase of market digestion and profit-taking.

Asset comparison S&P500↓·Gold↓ Last Friday (9th), S&P500 dropped 0.07%, and gold prices fell 1.84%, showing a weak trend across traditional assets. Amid concerns of liquidity tightening, both safe and risky assets experienced slight adjustments, while the digital asset market centered on Bitcoin shows a relatively stable trend.

MACD +636.18 The MACD indicator maintains a strong rebound energy of +636.1. The weekly indicator is +683.09, also showing a reversal trend and raising expectations for medium-term trend recovery.

❤️ Investor sentiment now

Dominance 61.9% (+0.81%) Bitcoin's market share is again showing an upward trend, continuing the phenomenon of relative stability and concentrated supply and demand.

Fear & Greed Index 73 (Greed) Quickly transitioned from neutral to greed phase last week. While short-term optimism is strengthening, the possibility of overheating should also be considered.

Google Trend Score 79 Declined from the recent peak (100) but still at a high level. Market interest is maintained near the psychological peak.

🧭 Market now

SSR 17.5 As the BTC price ratio to stablecoins increases, price pressure has somewhat grown. Short-term upside potential may be limited.

NUPL 0.566 The net realized profit/loss indicator has risen to 0.566, increasing the proportion of investors in a profit state. This is similar to the period when profit-taking began in past cycles, suggesting the possibility of some selling pressure in the short term.

Exchange balance 2,458,800 BTC Bitcoin exchange holdings increased by 0.08% to 2,458,800 BTC compared to the previous day. The increase in holdings may reflect on-chain movement for profit-taking, interpreted in line with the recent trend of investor profit realization.

Exchange net inflow +1,957 BTC The net inflow of Bitcoin exchanges increased by 1,957 BTC in a day, transitioning to a net inflow trend. This means that the potentially sellable volume in the market has increased short-term, suggesting that some market pressure may resurface.

Active wallets 966,443 (-15.18%) Recorded 966,443, a significant 15.18% decrease from the previous day, showing a substantial slowdown in user activity. With trading and on-chain participation temporarily contracting, short-term momentum appears weakened.

For real-time news...Go to Token Post Telegram

<Copyright ⓒ TokenPost, Unauthorized reproduction and redistribution prohibited>