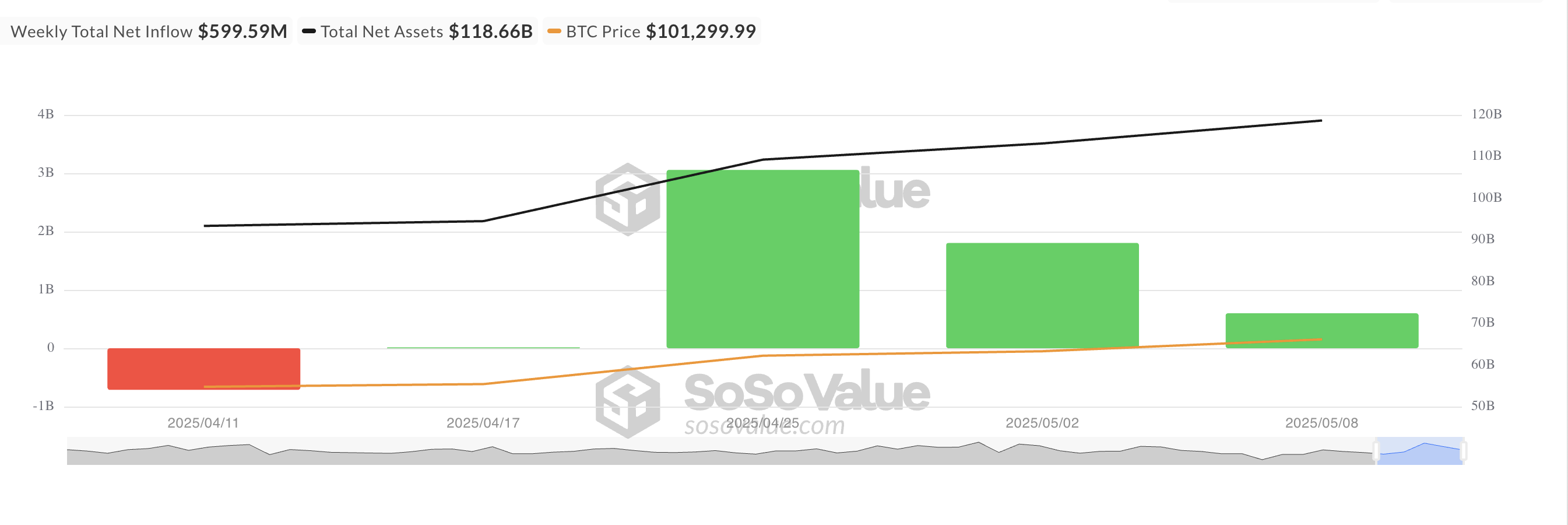

Last week, the Bit support fund recorded a net inflow of $600 million. While this was a positive capital inflow, it represents a 67% drop from the $1.81 billion recorded in the previous week.

Interestingly, this institutional inflow slowdown occurred even as BTC broke through the $100,000 price range for the first time since early February. What does this difference tell us about investor sentiment?

Bitcoin ETF Fund Inflow Decrease... Investors Cautious

Last week's total inflow into physical BTC ETFs was $600 million. While this was a net capital inflow, it represents a 67% decrease from the $1.81 billion inflow in the previous week.

Notably, this trend occurred in the same week that the major coin definitively broke through the $100,000 price range for the first time since February. This suggests that the breakthrough did not trigger a buying frenzy but instead led some ETF holders to realize profits or hold off on new entries.

The decrease in inflow last week indicates that institutional interest in BTC exposure remains, but the pace is slowing. This could be due to caution or fear. It reflects a wait-and-see attitude of investors who have waited three months to break through $100,000 and are now observing whether they can maintain and stabilize at that level.

Bitcoin Shows Strength in Derivatives Market

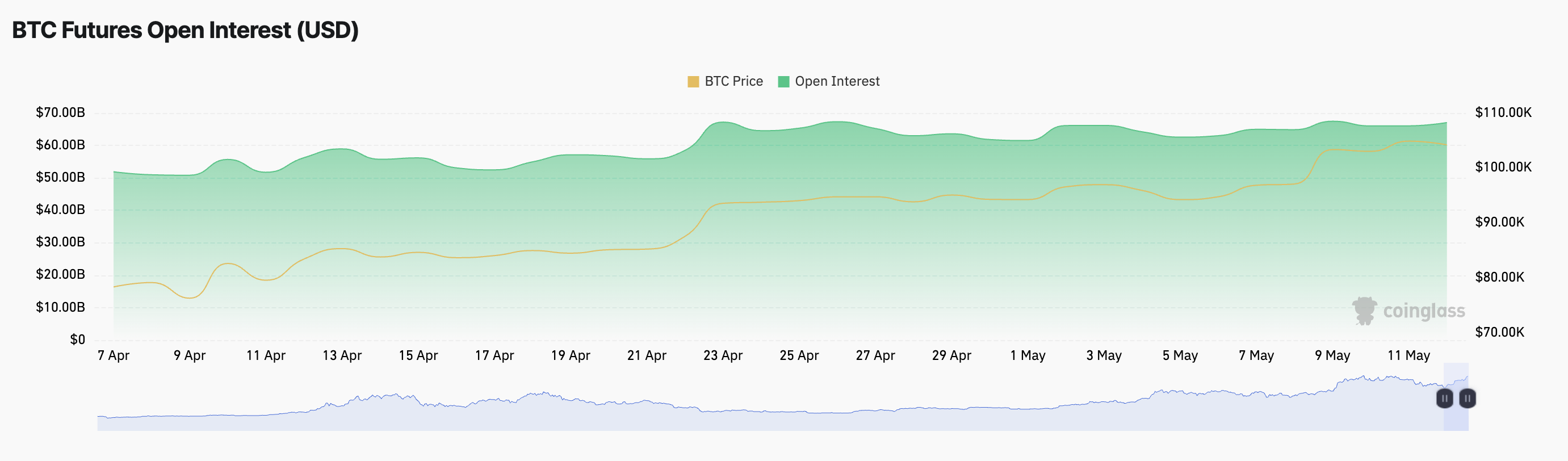

BTC is trading at $103,979, rising 0.24% in the past 24 hours. During this period, BTC futures open interest increased by 2%, reflecting increased trading participation. At the time of reporting, this stands at $6.704 billion.

The rise in BTC price and open interest indicates confidence. More traders are taking positions. This combination suggests a strong trend, showing that traders expect price movements to continue in the current direction.

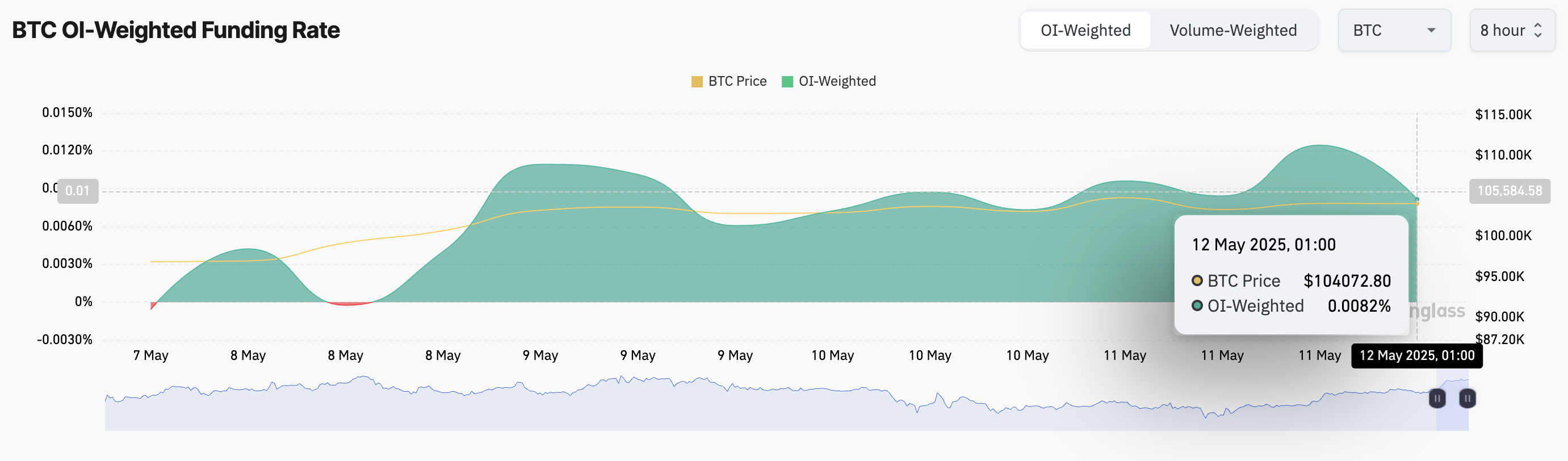

Additionally, the coin's funding rate is 0.0082%, which is positive. This means long positions are paying costs to short positions, indicating market participants are anticipating an upward trend.

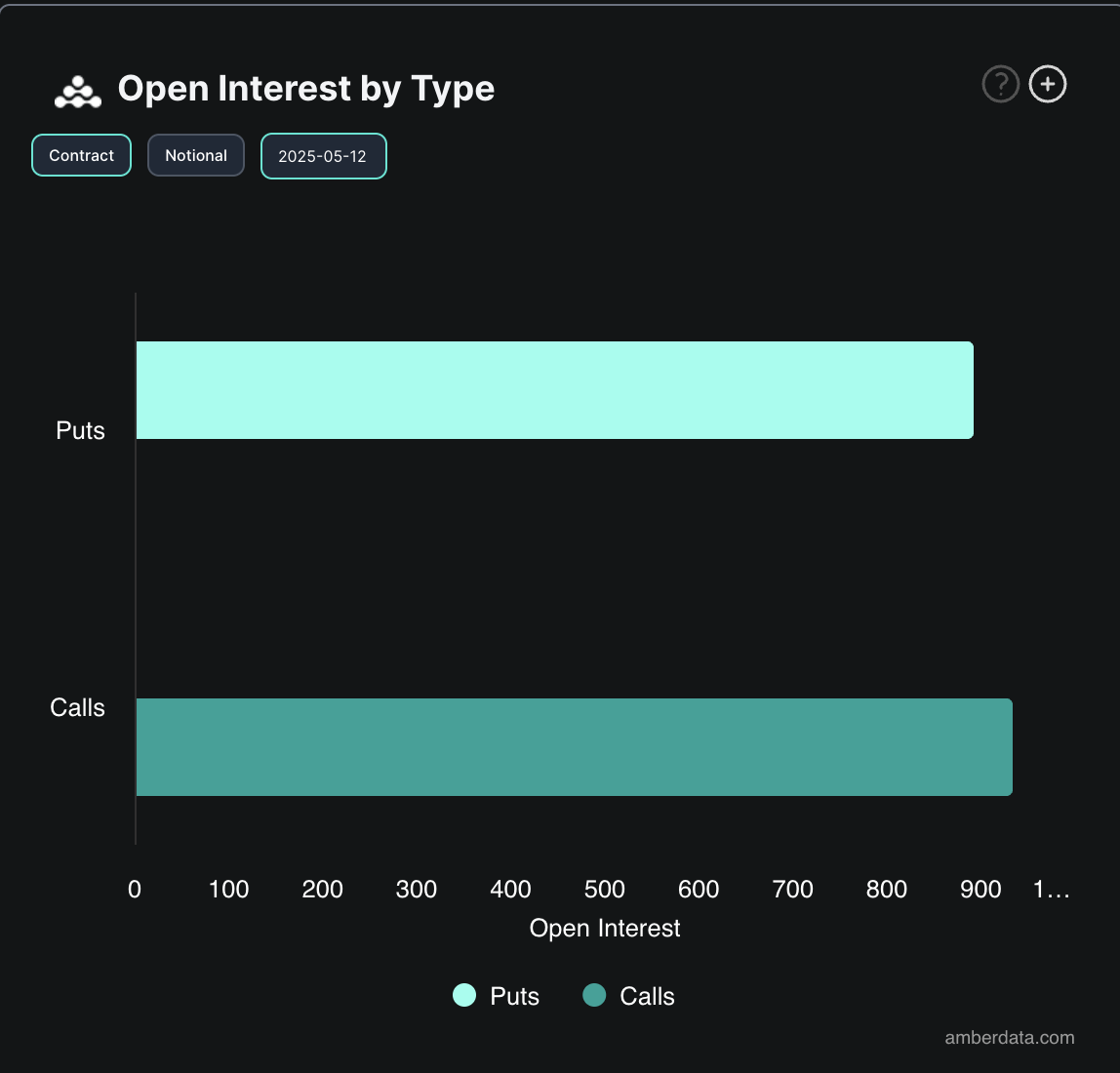

Options market activity also reinforces this upward outlook. Today, call contracts exceed put contracts, showing traders expect further increases.

The comprehensive interpretation of these indicators suggests that even with decreased ETF inflows, the broader market sentiment remains confident and risk-taking.