Ethereum transitioned to Proof-of-Stake (PoS) in September 2022, introducing a staking structure where validators deposit 32 ETH and receive rewards. In April 2023, the Shapella upgrade activated withdrawal functionality. With the emergence of liquidity staking platforms like Lido and Rocket Pool, small-scale participation became possible, and the practicality expanded to asset liquidity and DeFi utilization. The staking trend serves as a key indicator of Ethereum's security and value creation structure, which can be understood by examining ▲deposit amount and withdrawal trends ▲number of validators ▲reward rates. [Editor's Note]

According to Dune Analytics (@hildobby), as of 4:45 PM on the 12th, the total staked amount on the Ethereum network was 34,512,689 ETH, accounting for 28.08% of the total Ethereum circulation.

From the 5th to the 11th, 332,091 ETH was newly deposited. During the week, 18,107 ETH in rewards were withdrawn, and 128,861 ETH in principal was withdrawn.

Since the 'Shanghai Upgrade' that implemented withdrawal functionality, the net inflow of staking has been 13.44 million ETH, with a net inflow of 16.34 million ETH excluding rewards.

According to Validatorqueue, the annual staking yield (APR) decreased from 3.22% on the 14th of last month to 2.95% on this day.

Staker Status

The current number of active validators is around 1,065,166. In the Entry Queue waiting to start staking, 1,573 validators are waiting, with an expected waiting time of about 39 minutes.

In the Exit Queue waiting to unstake (withdraw), 7,100 are waiting, with a waiting time of about 2 hours and 58 minutes. The sweep delay, which is the time taken for funds to move to the actual withdrawal address after exiting, averages 9.2 days.

Withdrawals come in two types: ▲full withdrawal (validator termination) ▲partial withdrawal (rewards only). Full withdrawals must pass through the exit queue.

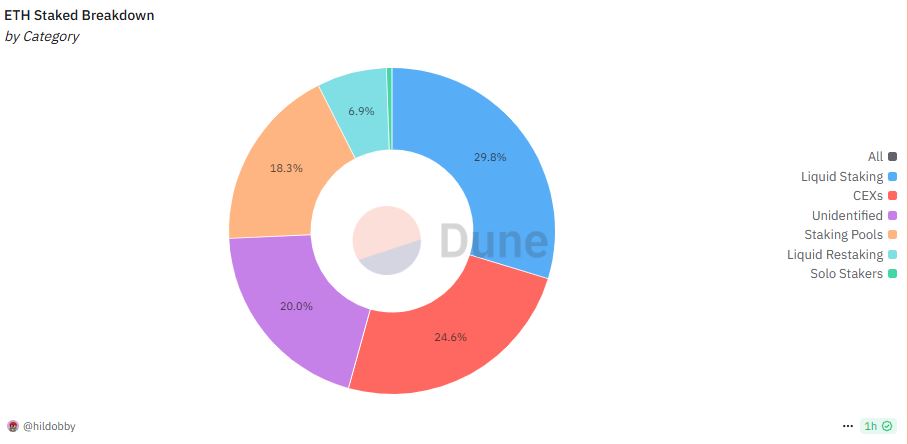

As of May 12th, 'Liquid Staking', which improved liquidity and accessibility, occupied the largest proportion of Ethereum staking participation at 29.8%. Staking through centralized exchanges (CEX) followed at 24.6%.

▲Unidentified validators: 20% ▲Staking pools: 18.3% ▲Liquid restaking: 6.9% ▲Individual validators: 0.5%.

In the single staker ranking, the liquidity staking protocol 'Lido' has deposited about 9,124,000 ETH, recording the highest market share of 26.56%. Following are Coinbase CEX with about 2,661,100 ETH (7.7%), and Binance with 2,423,900 ETH (7%).

▲Liquidity restaking protocol ether.fi: 1,983,400 ETH (5.7%) ▲Staking pool Kiln: 1,495,000 ETH (4.3%) ▲Kraken: 1,145,200 ETH (3.3%) rank 4-6.

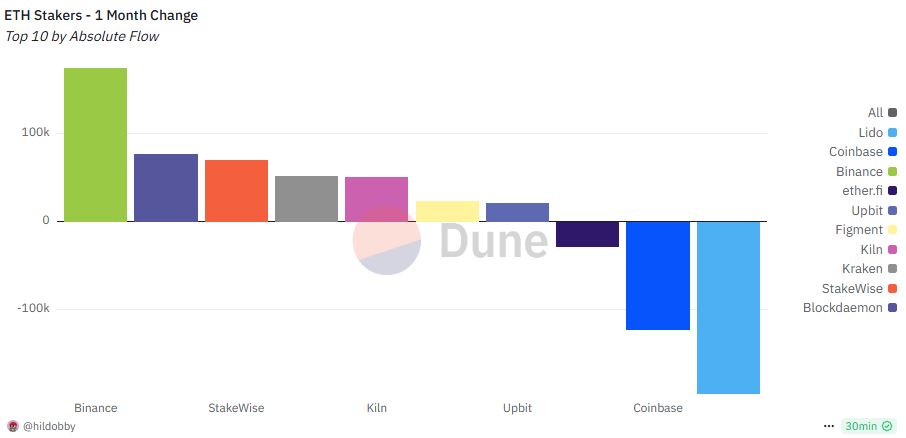

In the weekly absolute inflow/outflow record, Binance (73,600 ETH), ether.fi (70,820 ETH), and Coinbase (21,824 ETH) recorded the highest net inflows for the week. In contrast, Lido saw the largest decrease with 48,448 ETH in net outflows, followed by Redacted Pirex (4,452 ETH) and Cluster 0x0f5b (3,968 ETH).

On a one-month basis, Binance (about 170,000 ETH), BlockDaemon (about 76,000 ETH), and Stakewise (about 70,000 ETH) increased their deposits, while Lido (about 196,000 ETH) and Coinbase (about 123,000 ETH) showed outflow trends. Domestic exchange Upbit additionally deposited about 21,000 ETH during the same period.

Get news in real-time...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>