Tracking the Bitcoin supply and demand flow in the US market and monitoring changes in investment sentiment. In particular, analyzing market participants' psychology and supply environment through key indicators such as inflow and outflow status of Coinbase, a major exchange used by US institutional investors, premium index, and OTC trading volume. This can be used as a reference to gauge the short-term market trend and overall investment temperature. [Editor's Note]

At Coinbase, the primary trading platform for US institutional investors, a large-scale net outflow and a surge in OTC trading volume are occurring simultaneously, showing a renewed trend of physical Bitcoin buying.

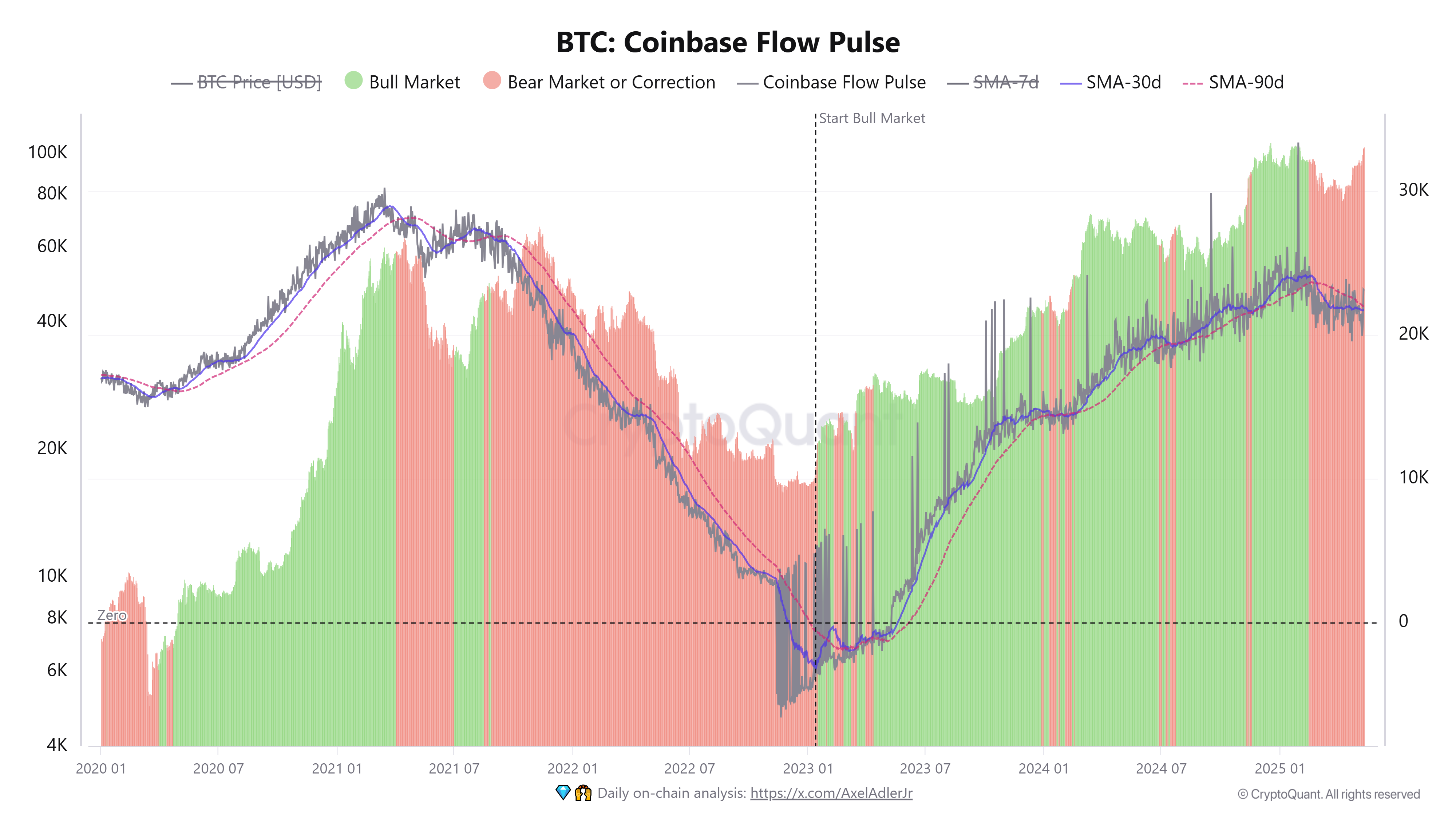

The 'Coinbase Flow Pulse (CB FP)' representing Bitcoin inflow and outflow from Coinbase wallets decreased slightly from 23,169 BTC on the 10th to 23,107 BTC on the 11th. This suggests that the inflow of buying from the US may have temporarily slowed down.

Currently, the 30-day moving average (21,748 BTC) is slightly below the 90-day moving average (22,014 BTC). This is interpreted as a phase where short-term trends are approaching medium to long-term averages, attempting a gradual shift to a flat market during an adjustment period.

CB FP is an indicator for determining the intensity of buying inflow from the US. Since Coinbase is primarily used as a trading platform for US institutional investors, when funds flow into this exchange, it tends to be interpreted as a preliminary movement for physical buying rather than selling. The larger the inflow, the more it is seen as a signal that the buying intention of US institutions is strengthening.

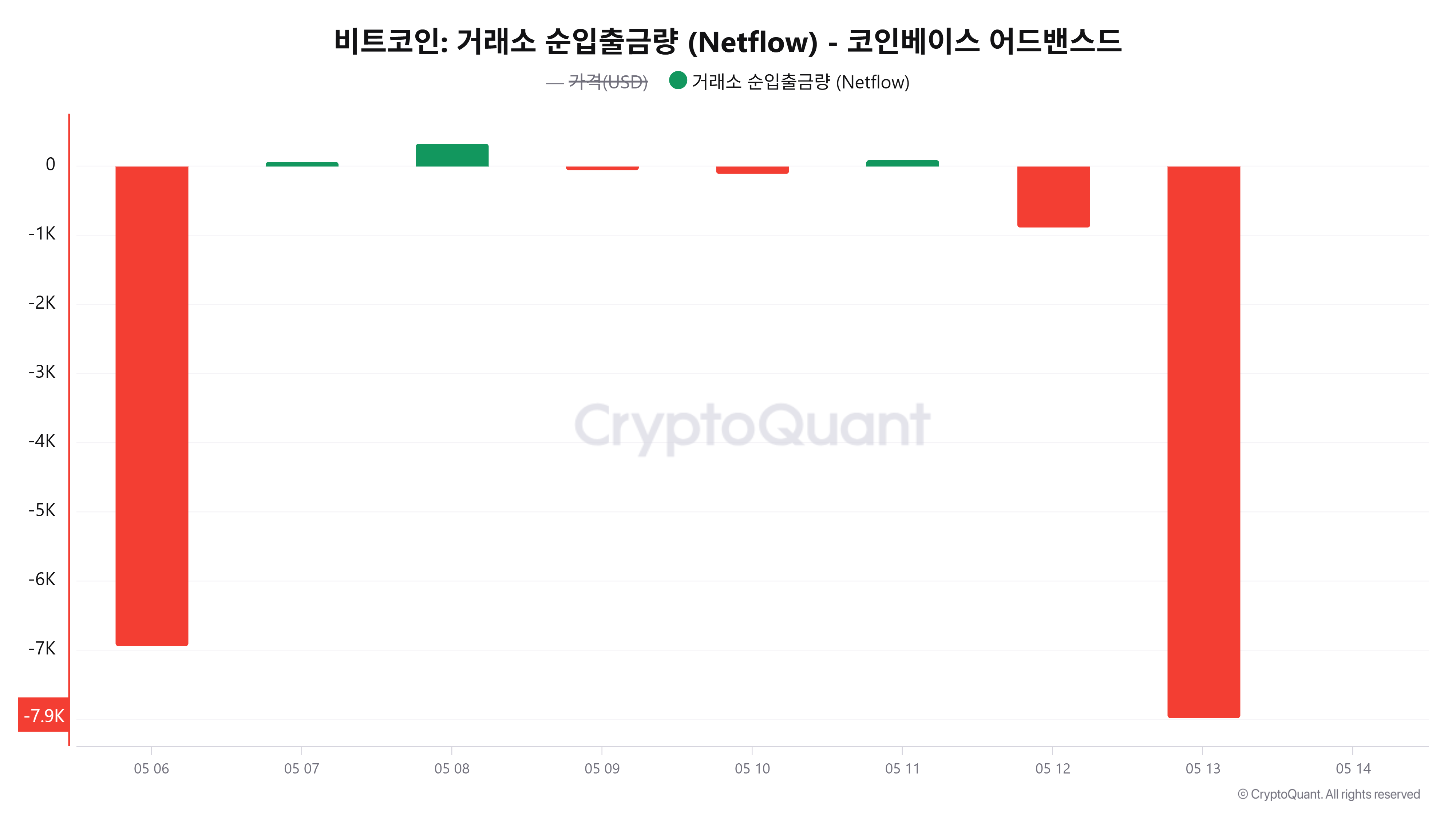

Meanwhile, according to CryptoQuant's 'Coinbase Exchange Netflow' data, 875.76 BTC was net outflowed from Coinbase on the 12th. Based on the same-day incomplete data, a large net outflow of 7,972.61 BTC was confirmed.

This is an increase in outflow of about 9 times compared to the previous day, showing that the movement of large US institutional investors to secure physical Bitcoin is becoming visible again.

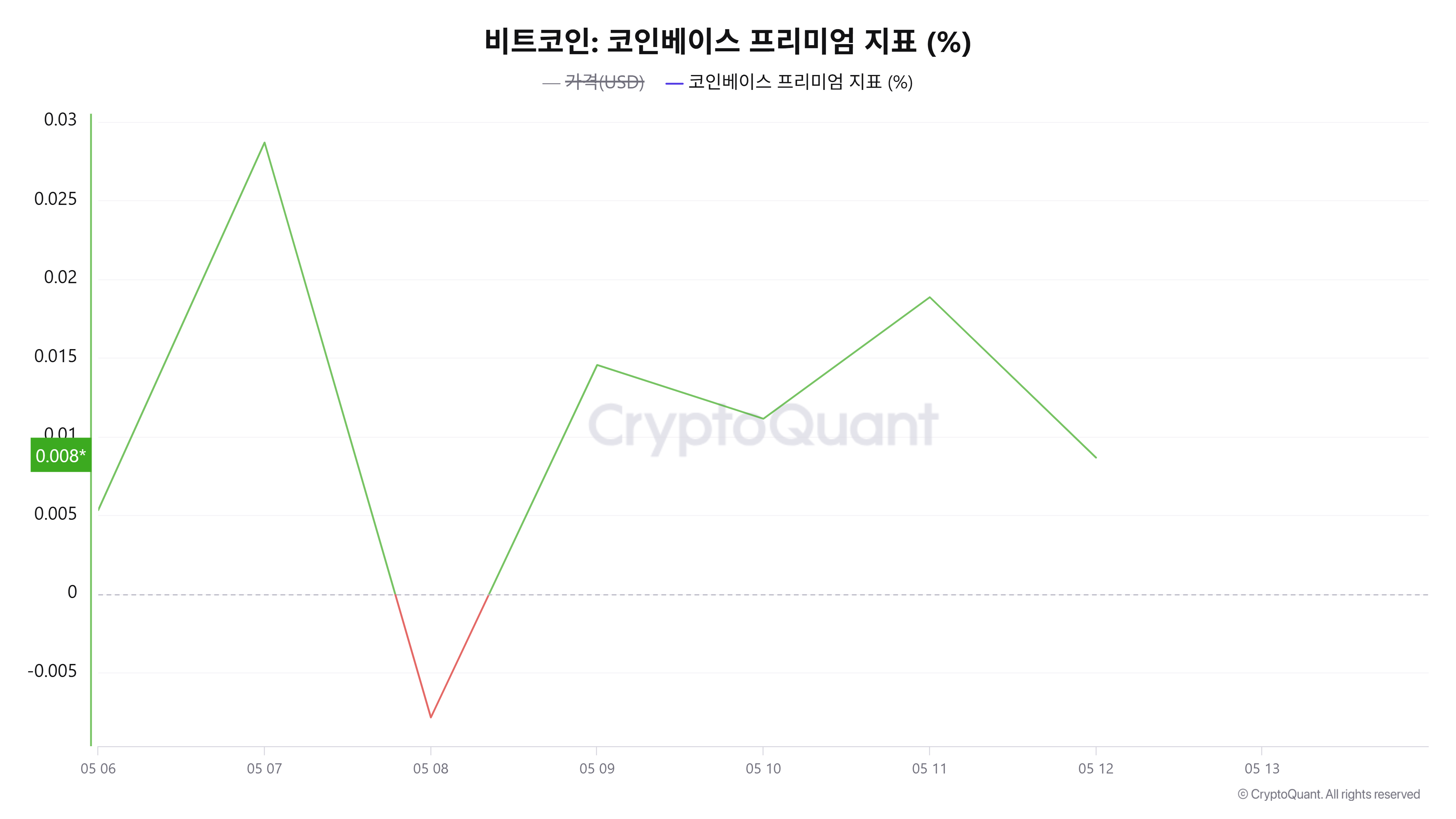

The 'Coinbase Premium Indicator', which shows the price difference between Coinbase and Binance for Bitcoin, slightly decreased to 0.0188% on the 11th and 0.0086% on the 12th, but remains in the plus range, suggesting that the buying intensity in the US physical market is maintained at a certain level.

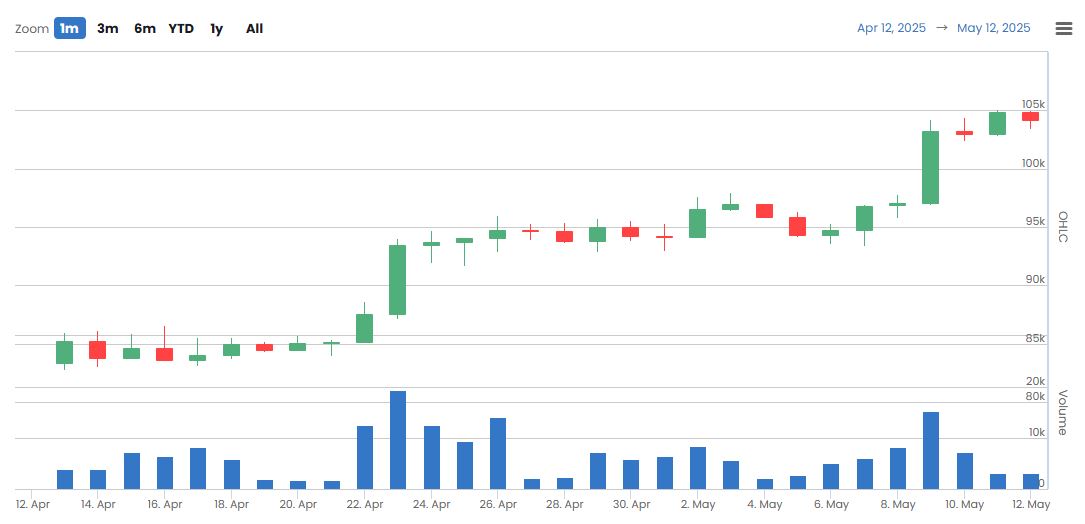

The BTC/USD trading volume in the OTC market 'Coinbase Prime' was approximately $1,090,810,000 over 24 hours.

The trading volume in Bitcoin terms surged from 3,055.18 BTC to 10,993.75 BTC. This is interpreted as an indicator showing that the large-scale physical buying by US institutional investors is expanding again.

As of 2:35 PM on the 13th, the Bitcoin price was $102,464, down 1.3% from the previous day, showing a breathing pattern. It remains above the psychological support line of $100,000, displaying adjustment pressure amid strong upper resistance.

For real-time news...Go to Token Post Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>