Author: Arthur Hayes, founder of BitMEX; Translated by: AIMan@ Jinse Finance

It turns out that Lizzo, the fat-positive singer, has a lot in common with the economic imbalances of Pax Americana. Don’t get me wrong, it doesn’t matter whether you find plump human flesh aesthetically pleasing. However, the metabolic disorder caused by obesity is sometimes beautiful but always deadly. Similarly, the American economy works well for some, but ultimately, severe social disharmony leads to revolution.

It turns out that Lizzo, the fat-positive singer, has a lot in common with the economic imbalances of Pax Americana. Don’t get me wrong, it doesn’t matter whether you find plump human flesh aesthetically pleasing. However, the metabolic disorder caused by obesity is sometimes beautiful but always deadly. Similarly, the American economy works well for some, but ultimately, severe social disharmony leads to revolution.

Waistlines and economic conditions in the American Empire weren’t always so distorted. In the mid-20th century, Americans weren’t obese, and the economy wasn’t seriously out of balance. But over time, the problem spread.

The food system has been hijacked by Big Ag, which has created nutritional guidelines that have no nutritional value and peddles their processed, delicious, lab-made foods. As Americans have become fatter and more chronically ill, and the foods they eat lack nutrition, Big Pharma has stepped in to create a variety of drugs that only treat the symptoms and not the root causes of metabolic diseases such as diabetes. Unwilling to weaken the influence of the big corporations that control the food supply, pharmaceutical companies have begun to promote the "fat is right"/"big is beautiful" philosophy, telling obese people that it is not the fault of the corrupt system that feeds them shit, that they are glorious creatures who should be proud of their jelly rolls. The system worships stars like Lizzo, who is undoubtedly a talented singer, but she is also an artist who promotes a lifestyle that will inevitably lead to preventable, premature, painful, prescription drug-dependent death. Lizzo represents the obesity status quo, which is very profitable for a small group of corporate killers.

The US economy was hijacked by money printing. Before the creation of the Federal Reserve in 1913, credit expanded too quickly, far faster than it could support cash flows, and a financial panic ensued. Some bad businesses, some good, collapsed, and the economy restarted. Credit was destroyed, and the system began to recover. However, every credit bubble since the monster of Jekyll Island has been met with a flood of money printing, and the imbalances in the US economy have never really subsided since the Great Depression of the 1930s. This is the root cause of the imbalances in trade and financial capital under Pax Americana, not tariff rates. [1] The status quo has brought inequality, despair, and addiction to the common people without financial assets that benefit from the printed money gushing out of the imperial money spigot, but it has brought unprecedented wealth to the few masters of the universe who own stocks, bonds, and real estate.

All is not lost; getting better is possible; however, this can be achieved the hard way or the easy way.

For decades, pharmacological charlatans have been peddling miracle pills that melt fat away. Remember Fen-Phen? No drugs work; so there are only complicated, unpopular, expensive, and unprofitable solutions. Going to the gym, removing cheap processed calories from your diet, eating expensive fresh produce that’s grown or raised organically are all sophisticated ways to fight obesity. But even these methods aren’t effective enough, because once you put on the fat suit, your body adjusts your hunger and metabolism to ensure you stay fat. Some scientists say it can take up to seven years to change your body’s metabolism to make you thinner. Then, along came the Danish “easy button.”

GLP-1 agonists are a class of drugs used to treat diabetes that have been shown to reduce appetite and the intake of addictive substances such as alcohol and nicotine. Ozempic, Wegovy, Monjaro, etc. are popular drugs that can significantly reduce weight in the short term when taken. So far, these drugs have been proven to be safe enough that some people believe that a large proportion of people who were once obese will take them for life. Thanks to modern medicine, if you can afford it, you can easily get rid of obesity through injections or medications. Even Lizzo, who is chronically suicidal due to preventable metabolic diseases, finally decided to inject herself with this magical weight loss drug. So happy for you. However, she may not be invited to campaign for Kamala Harris in 2028...

There are painful solutions and painless solutions to the U.S. trade imbalance. For U.S. politicians, pursuing policies that cause pain or discomfort to middle-class voters is bound to lead to their own defeat. Previously, the Trump administration sought difficult and painful solutions. However, they soon discovered that middle-class voters have no appetite for high-priced American goods that may appear in a decade. They also cannot tolerate empty shelves between now and when American manufacturers can produce the large quantities of goods that China used to supply. This negative sentiment was conveyed to congressmen and senators, especially in Republican districts, and the Trump team eventually made concessions and now must find another way to achieve the same rebalancing. The rollback of the highest tariffs is underway, as evidenced by the recently announced reduction of tariffs between China and the United States to about 10% each within 90 days.

A successful general can abandon a flawed strategy and achieve victory.

Another politically acceptable and simple way to rebalance U.S. trade is to use various forms of capital controls to combat capital account surpluses. These capital controls would impose taxes on foreigners who buy and hold U.S. financial assets. If foreigners stop buying U.S. financial assets because of the high tax rates, they must also stop selling cheap goods to the U.S. If foreigners sell cheap goods and buy assets, then the tax revenue can be passed on to the median voter in the form of stimulus checks or lower income taxes. Trump can then claim that he hit those evil foreigners and brought lower taxes to the American public. This strategy won the midterms and the presidential election and achieves the same goal: reducing the influx of cheap foreign goods into the U.S. consumer market and promoting the reshoring of manufacturing capacity.

The ultimate consequence of Trump’s shift from “hard” to “easy” on US trade is that foreign capital will slowly, then suddenly, flee US stocks, bonds and real estate. The dollar will then depreciate relative to the currencies of surplus countries. The problem facing the US, and especially US Treasury Secretary Bessent (BBC – Big Bessent Cock), is who will finance the growing US national debt if foreigners turn from net buyers to sellers. The problem facing governments and companies in surplus countries is how to “save” their surpluses if they continue to run surpluses. The answer to the former is to print money, the answer to the latter is to buy gold and Bitcoin.

The core of this article will focus on the mathematical identities of trade, how capital controls work (i.e. the “boiling frog theory”), how these taxes affect capital flows from surplus countries, how Bessant prints money overtly and covertly to fund the U.S. Treasury market, and ultimately why Bitcoin will be the best performing asset during the global monetary transition.

Trade accounting identities and geopolitical issues

Let's use this ironic example to illustrate the relationship between the trade and capital accounts, just for fun.

In 2025, Trump’s election reaffirms little boys’ right to play with action figures. Mattel reintroduces the He-Man action figure, complete with a plastic AR-15 rifle. Toxic masculinity is back, baby… and the face of this toy is Andrew Tate! Mattel needs to produce a million quickly and at the lowest price possible. Lacking a manufacturing base in the U.S., Mattel must source these figures from Chinese factories.

Mr. Zhou owned a manufacturing company in Guangdong Province that specialized in producing cheap plastic dolls. Mr. Zhou agreed to Mattel's terms, one of which was to pay in U.S. dollars. Mattel wired the money to Mr. Zhou, and the dolls arrived within a month. Wow, that was fast.

Zhou's profit margin was 1%. The Chinese market was extremely competitive. Because his trading volume was so large, his total profit from orders from Mattel and other similar companies was as high as $1 billion.

Zhou had to decide what to do with his dollars. He didn't want to convert them into renminbi to take back to China, because the renminbi had no productive use given the low interest rates on government and corporate bonds. Also, bank deposits paid almost zero interest.

Zhou didn’t like all this anti-China talk because he didn’t feel welcome the last time he came to the U.S. His daughter, who attends UCLA, gets a lot of flak for riding in the latest Phantom convertible while ordinary Americans ride the Los Angeles subway, ahem, I mean Uber, to class. So even though U.S. Treasury yields are among the highest in the world, he’d rather not buy them if he can help it. Zhou did have a good opinion of Japan, and its long-term yields were much higher than they used to be. He asked his banker to help him buy Japanese government bonds. The banker told him that the Japanese government didn’t want foreigners buying a lot of its bonds because that would push up the yen, and the government wanted to keep its exports competitive. If Zhou sold dollars for yen and used the yen to buy Japanese government bonds, the yen would appreciate.

The Japanese government bond market was one of the few large enough to absorb its surplus, and Japan didn't want foreigners pushing up its currency. Zhou accepted reality and reluctantly bought U.S. Treasuries with his dollar export earnings.

What impact does this have on the U.S. trade and capital accounts?

US Trade Account:

$1 billion deficit

Mr. Zhou's bank account:

$1 billion in cash

Buy

$1 billion in national debt

Because these surpluses don’t go back to China, Japan, or anywhere else, but are recycled into US Treasuries:

U.S. Capital Account:

$1 billion surplus

The moral of the story is that a trade account deficit creates a capital account surplus if no other country is willing to let its currency appreciate. This is what is happening right now: no market other than the United States is large enough or willing to absorb global trade imbalances. This is why the dollar remains strong despite the fact that the United States issues trillions of dollars in debt every year to finance its government. By the way, many years ago, China asked Japan if it could buy Japanese government bonds. Japan said, “No, not unless you let us buy Chinese government bonds (CGBs).” China said, “No, you can’t buy CGBs.” So both countries continue to park their excess capital in U.S. financial assets. Unless China, Japan, or the European Union are willing to open their capital accounts and their financial markets are large enough to absorb the surplus countries’ gains, any talk of the renminbi, yen, or euro replacing the dollar as the global reserve currency in the current global trade landscape is nonsense.

Next, Trump has decreed that the U.S. must restore manufacturing and reduce the trade deficit. Currently, his tool of choice is tariffs. Let’s look at why tariffs won’t work from a political perspective.

Mattel sells cheap dolls to little boys. Most little boys have parents who are dirt poor. Most American families don’t have $1,000 in emergency savings. So if a He-Man doll costs $20 instead of $10, little Johnny is left playing with shit. In a no-tariff system, Mattel could sell the doll for $10 because it’s made cheaply in China. But now Trump is slapping a 100% tariff on Chinese goods. Zhou can’t afford the tariff costs, so he passes the expense on to Mattel. Mattel passes the cost on to consumers because its profit margin is only 10%. Chinese goods may be cheap, but it’s expensive to market the toys through TikTok, Instagram, and Google AdWords because the conversion rate is so low.

The price of the doll has gone up to $20. This is too expensive for most families, and they choose not to buy it. Johnny is a willful little guy who doesn’t understand why Mommy and Daddy won’t buy him his favorite gun-wielding doll. Mommy and Daddy work their asses off driving Ubers and delivering DoorDash, they barely make ends meet, and now their little guy is throwing a tantrum over Trump’s decision to raise the price of toys. Will Mommy and Daddy vote Republican or Democrat in the next election? … Before the election, they will diagnose their kid with ADHD and fill him with prescription drugs to shut him up. The new Democratic platform is based on restoring “free trade” policies to make toys and other goods affordable again, which allows China to dump cheap goods into the American market. The Democrats say that all the smart economists with degrees agree that “free trade” has brought cheap goods to the United States and maintained this country’s way of life; the subtext is that Trump and his advisors are a bunch of stupid, uneducated idiots. If this is the case, I think the Democrats will make a comeback in the 2026 midterm elections.

Could Mr. Zhou avoid paying the tariffs by moving production of the dolls outside of China to a country with lower tariffs? Of course he could.

Mr. Zhou has become very wealthy since the early 2000s, and he began to invest in factories in Mexico, Vietnam, Thailand, etc. Mr. Zhou began to produce He-Man dolls in these places and then shipped them to the United States. After the actual tariff was reduced, he could sell a doll for $12 instead of $20. Mom and dad can spend an extra $2 to shut up their children and prevent them from getting prescription drugs too early.

Because Trump is proposing not uniform tariffs for all markets, but piecemeal bilateral deals, savvy manufacturers like Mr. Zhou are able to find a way into the United States with lower tariffs than a blanket imposition on China. The Trump team realizes this, but is reluctant to impose blanket tariffs on allies’ economies because of geopolitical considerations, such as whether a country has U.S. military bases, sells key goods to the United States, or sends young men to fight alongside the United States, or they decide not to work with the U.S. “world police” team anymore. Without uniform tariffs, there will always be one or more countries that act as transshipment arbitrage points. It is this arbitrage mechanism that allows China to obtain advanced semiconductors and artificial intelligence chips from TSMC and Nvidia, for example, and these arbitrage mechanisms will also exempt Chinese goods or ultimately Chinese-owned manufacturing from the high tariffs imposed on goods shipped directly from China to the United States.

Ultimately, tariffs will not achieve their goal of significantly reducing the U.S. trade deficit. The American public will not sit around and wait five or ten years for manufacturing output to repatriate to the United States, allowing cheap, plentiful goods to return to the market. Moreover, let’s assume that the trade deficit does not shrink significantly over the next twelve months. In that case, Trump’s policies look foolish in imposing commodity inflation on poor citizens without any discernible benefit to the United States.

To reiterate, the problem is not the tariffs themselves; it’s that for tariffs to really work, every country has to face the same rate. There should be no trade-offs. There is only one tariff rate; accept it. Obviously, this doesn’t work when the surplus countries are not just the “evil” Korean peninsula, but staunch allies like Japan and Germany. It’s simply ridiculous to expect Japan to continue to suppress China and Russia from a naval perspective, station tens of thousands of filthy “foreign” American troops at some 120 military bases, and have its manufacturing industry killed by tariffs.

That is why the 90-day suspension will become permanent.

Tax me, baby

If addressing the trade account deficit is problematic for both domestic political and geopolitical reasons, what about focusing on the capital account surplus? Is there a way to stop people from accumulating US financial assets? The answer is yes , and for the wealthy, who have been educated in the glory of the free market, the method is dirty and mean… It’s called capital controls . Specifically, I don’t mean that the United States prohibits or severely restricts foreigners from holding financial assets like most countries in the world do, but I mean that foreigners will be taxed on assets held by foreigners . Foreigners will be allowed to hold US financial assets of any size, but their value will continue to be taxed at a certain rate. These tax revenues will flow back to the American civilians in the form of lower income taxes and other government subsidies to ensure their livelihood. The result is that foreigners continue to have a surplus from selling goods to the United States and face the risk of being taxed on their gains, and they will reduce their exports to the United States to avoid paying taxes, or buy other stateless financial assets such as gold or Bitcoin.

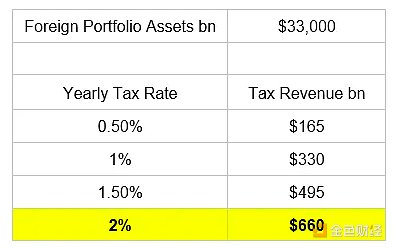

There are various ways to tax foreign capital, but for simplicity and to illustrate the tax impact, assume that the value of all foreign capital is taxed at 2% per year. I am primarily focused on foreign portfolio assets, meaning liquid stocks, bonds, and real estate. I am not referring to illiquid property, plant, and equipment, such as a plant owned by a foreign automaker in Ohio.

Let’s analyze what the annual return on taxing foreign portfolio assets would be, assuming constant prices and no capital withdrawals due to taxes.

I emphasize the last line because the bottom 90% of Americans pay about $600 billion in income taxes in 2022. So Trump could exempt the vast majority of his constituents from income taxes by imposing a 2% foreign capital tax on stocks, bonds, and real estate. This is a winning political strategy in my opinion.

Let us examine the effectiveness of this policy compared with the use of tariffs in two ways.

Taxation Capacity:

The U.S. Treasury has complete control over the banking system and financial markets. They may not know exactly who owns what, but they know whether the entities are U.S. or foreign. Therefore, it is easy for financial institutions or municipalities to impose this tax on non-U.S. entities that own stocks, bonds, and real estate.

With tariffs, it's hard to know exactly where each item came from, and how its value was added throughout the supply chain. That's why it's so easy to cheat.

Same tax rate for everyone:

The tax is designed to help eliminate net capital account surpluses. There is only one tax rate. If foreigners don't want to pay the tax, they shouldn't buy U.S. financial assets. They can reinvest their export earnings at home. It won't necessarily stop exporters from selling cheap goods to the U.S., so the impact on merchandise trade volumes won't be immediately apparent.

Capital controls raise revenue that can be used to reduce income taxes, which is great, but will it help bring manufacturing back to the United States?

Suppose exporters are unwilling to pay 2% per year to hold U.S. financial assets. Given their net expected return after tax, they see better investment opportunities at home. They sell their assets for dollars, which they then sell back for their own currencies. The net result is a depreciation of the dollar and an appreciation of the currencies of the surplus countries. Eventually, the dollar will depreciate over many years, while the currencies of the surplus countries, such as the yen, will appreciate substantially. At that point, even without the tariffs, the price of goods produced in Japan sold to the U.S. will be substantially higher in dollar terms. That's the point.

Over time, American-made goods get cheaper, and foreign goods get more expensive. This process may take decades. But it doesn't matter, because American voters benefit either way. Either foreign capital stays, pays taxes, and the revenue is used to exempt the vast majority of voters from income taxes; or foreign capital leaves, American manufacturing grows, hiring more people at higher wages, and the vast majority of voters get better-paying jobs. But in either case, the shelves will not be immediately empty, and commodity prices will not soar.

Four characters hold this view

I'm a global macro DJ. I take inspiration from others and then mix it with my own language and style. The standard kick, snare, clap and irregular cymbals, with some syncopation and swing to create a groove, are present in every House music. My drum beats jump with the press of the Brrr button. Hopefully I can layer an interesting bassline, harmony and special effects, and finally present a wonderful Solomun-style breakdown, embellished with my written prose and some mesmerizing drops.

I say this to emphasize that the idea of using capital controls rather than tariffs to reduce U.S. trade and capital account imbalances is not new, nor is it my own. During the Bretton Woods negotiations over the new structure of the post-World War II global economy, economist Maynard Keynes advocated imposing “user fees” on surplus countries’ capital that was recycled into deficit countries’ capital markets as a way to balance trade and capital flows. More recently, Stephen Miran, in an article he wrote while at Hudson’s Bay Capital entitled “ A User’s Guide to Restructuring the Global Trading System, ” has written about the possibility of imposing certain types of fees on foreign holdings of and trading in U.S. financial assets as a way of forcing a rebalancing of capital flows. [2] Another very influential macro analyst (who requested anonymity) has published a number of articles in the past 12 months on why he believes capital controls are necessary and that those who want to be allies of the United States will and must pay for them. Michel Pettis speculated in a recent webinar that tariffs would not materially reduce the U.S. trade deficit and capital account surplus relative to the world, concluding that capital controls are coming as governments realize that they are the only way to really change capital flows in a meaningful way.

I name all of these people to demonstrate that the financial intelligentsia, from which Bessant et al. draw, advocates capital controls, not tariffs. The benefit to us investors is watching in real time how the hard-line tariff camp, led by Commerce Secretary Howard Lutnick (who is currently Trump’s eyes and ears), advocates for measures to reduce U.S. trade imbalances. The internal fighting seemed to be over, thanks to the hastily implemented tariff pivot following the financial market crash in early April. Now, the capital controls lobby, led by Bessant, is preparing to strike.

The picture I paint of the effectiveness of capital controls is just as rosy as the picture our favorite fake vegetarian scammer white boy Sam Bankman-Fried paints of FTX/Alameda’s financial situation to a gullible crowd of investors. Imposing capital controls in the financial markets of the American Empire could lead to dire consequences. My predictions of how the financial elites and policymakers will respond to the consequences of capital controls lead me to believe that Bitcoin’s fiat price appreciation will accelerate from now on. This is the crux of my boiling frog theory. Capital controls will be implemented gradually due to their negative impact on US financial assets. Slowly, global financial markets will accept US capital controls as the norm, not some heresy. Just like the frog in the warm water does not know that it is about to be boiled alive as the water temperature slowly rises.

Not a real crash

Foreigners who earned dollars by selling junk to Americans had no choice but to reinvest those dollars into U.S. stocks, bonds, and real estate. Here are a few charts showing how U.S. financial markets outperformed as foreign capital poured in.

The chart below is the basis for all my analysis . If you are a reserve currency issuer that has to open its capital account, then a trade deficit will lead to a capital account surplus.

For the following three charts, I used the period from 2002 to early 2025 because China joined the World Trade Organization in 2002 and early January 2025 was the peak of “Trump will fix the world” optimism in the US market.

Since 2022, the MSCI USA Index (white) has outperformed the MSCI World Index (gold) by 148%: US stock market exceptionalism.

Total US marketable Treasuries (gold) rose 1,000%, but 10-year US Treasury yields fell slightly: the US bond market was the exception.

The US working-age population (gold) aged 15 to 64 grew by only 14%, but the Cash-Shiller National Home Price Index (white) rose by 177%: the US housing market was the exception. This is quite shocking, as the dataset includes the 2008 global financial crisis.

If foreign capital is taxed and they don’t think it’s worthwhile to invest in the U.S., then the math says that stock, bond, and real estate prices must fall. That creates a lot of problems. If the stock market falls, capital gains taxes will fall, and those taxes are the drivers of marginal government revenue. If bond prices fall and yields rise, the government’s interest payments will rise because it must continue to issue new debt to finance its massive deficits and roll over $36 trillion in existing debt. If house prices fall, middle-class Americans and wealthy baby boomers who own most of the real estate will find their net worth plummeting just when they need that wealth to support their decades of retirement. These people will vote out the ruling Republican Party in the November 2026 midterm elections.

Pax Americana depends on foreign capital, and if that capital leaves—and it will, given capital controls—it will be bad news for the economy. What can politicians, the Fed, and the Treasury do to replace foreign capital and maintain financial market stability?

Remember that 4/4 bass drum, that "Brrr" button. You all know the answer. It's the same answer as always. If foreigners don't provide dollars, the government will use the printing press.

Here are the policies the Fed, Treasury and Republican lawmakers will enact to replace foreign capital:

Fed:

- Ending quantitative tightening (QT) on mortgage-backed securities (MBS) and Treasury bonds.

- Restart quantitative easing (QE) policy for MBS and Treasury bonds.

- Exempt MBS and Treasuries from the supplementary leverage ratio (SLR).

Ministry of Finance:

- Increase the amount of government bond repurchases every quarter.

- Continue to issue a large number of notes (with a maturity of less than 1 year) rather than bonds (with a maturity of more than 10 years).

Republican Congressmen:

- Closing the escrow for Fannie Mae and Freddie Mac.

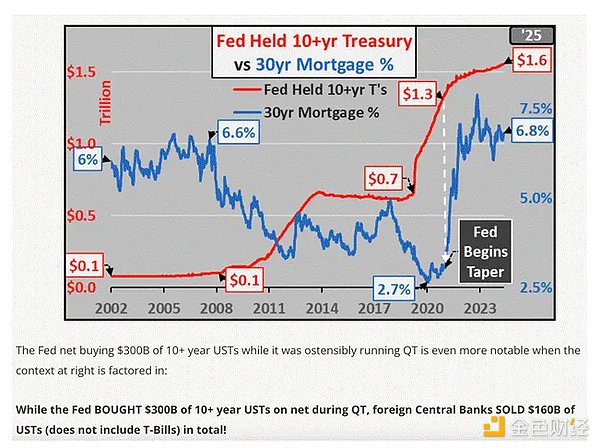

It’s not hard to imagine the Treasury and Republican lawmakers following Trump’s orders, but why should the Fed do what Trump wants? The answer is that’s the wrong question. The Fed is already doing what Trump and Bessant want behind the scenes. Check out this beautiful picture flagged by Luke Gromen:

The Fed is shrinking its balance sheet. However, the Fed has the power to decide how to shrink it, especially given that the policy mandate is a net reduction, not an even reduction across all maturities. Yellen, and now Bessant, need to finance the government’s massive “stinking shitty debt.” Foreign investors and the U.S. private sector are keen to buy Treasuries because they are short-term and they pay a yield. This means they are a high-yielding cash alternative and preferable to low-yielding bank deposits. But no one wants long-term Treasuries, meaning 10-year and above. The Fed has done Yellen and now Bessant two big favors by implementing 10-year Treasury QE in order to help them finance the government. It is highly dishonest for Powell to say that government deficits are a problem while continuing to accommodate said spending by allowing yields to remain politically acceptably low, as the Fed is driving down the 10-year yield by printing money.

Given that Powell is already implementing stealth Treasury QE, he will also agree to Bessant and JPMorgan CEO Jamie Dimon’s demands for strong commercial banks to stop QT, resume QE, and grant unilateral loan forgiveness. I don’t care how stubborn he is at his press conferences against Trump’s calls for looser monetary policy. Powell’s butt is firmly in the “turtle” chair, and he’s not leaving. Now, pass the lube.

These measures will provide money printing through multiple channels to compensate for the outflow of foreign capital due to capital controls and rising stock, bond and real estate prices , as follows:

Treasury prices will rise and yields will plummet. The Fed will buy Treasurys as part of its quantitative easing policy. Banks will buy Treasurys because they have unlimited leverage and they will buy before the Fed does.

Stock markets will rise overall as future earnings are discounted at a lower rate; some sectors will benefit more than others. Manufacturing companies will benefit the most as credit costs fall and credit availability increases. This is a direct result of lower government bond yields and banks having more balance sheets available to lend to the real economy.

Home prices will rise as mortgage rates fall. The Fed's quantitative easing purchases of MBS will lower mortgage rates. Available credit will increase as Fannie Mae and Freddie Mac quickly return to the loan underwriting business, using the implicit government guarantees they hold.

Don’t expect these policies to happen overnight. It’s a multi-year process, but it has to happen; otherwise, U.S. financial markets will collapse. Given that politicians can’t even handle the financial woes a week after Liberation Day, they will always hit the “Brr” button one way or another.

Will foreign capital leave?

Before concluding my Bitcoin price prediction, the first question I want to ask is whether foreign capital will withdraw. If so, are there any signs today that confirm this statement?

My hypothesis is consistent with that of many other analysts: the rapid appreciation of the currencies of certain Asian exporters (such as Taiwan and South Korea) over the past few weeks is a harbinger of a reversal in capital flows. This, therefore, lends credence to the idea that capital controls are coming, and that prescient market participants are moving out ahead of time. Moreover, as this carry trade is unwound, finance ministers responsible for setting monetary policy are allowing their currencies to appreciate.

Private capital such as Asian companies, insurance companies and pension funds have also followed suit. Since Asian exporters devalued their currencies and implemented policies to manipulate their currencies against the US dollar after the Asian financial crisis of 1997-1998, Asian private capital has been taking the following actions:

Capital earned abroad stays abroad

Domestic capital is transferred overseas, mainly to earn higher interest rates in the U.S. financial market

Essentially, this is a giant carry trade. Eventually, either capital must be repatriated to local shareholders in Asian local currencies, or Asian local currency debt must be repaid. Therefore, Asian private capital is short its local currency. In some cases, it borrows domestically because interest rates are very low as central banks create large amounts of local currency bank deposits to keep their currencies weak. Asian private capital is long yielding US dollar assets such as stocks, bonds and real estate. They do not hedge their long and short US dollar positions because state-sponsored policies manipulate local currencies to depreciate.

If the yield gap between U.S. and domestic financial assets narrows, and/or Asian currencies begin to appreciate against the dollar, this carry trade will be unwound.

Capital controls have reduced the net rate of return on U.S. financial assets. If the net rate of return falls, or if the market expects this trend to continue due to rising taxes on foreign capital, then Asian private sector capital will begin to unwind carry trades. They will sell stocks, bonds, and real estate, and then convert dollars into Asian local currencies. This will, to some extent, lead to a decline in the prices of certain U.S. financial assets and a strengthening of Asian currencies against the dollar.

The first and most critical battleground in U.S. asset markets will be in the U.S. Treasury market, especially in bonds with maturities of 10 years and above. This market is most vulnerable to foreign selling because no one wants to hold such a mess. The corresponding battle in currency markets will focus on the currencies of certain Asian exporters.

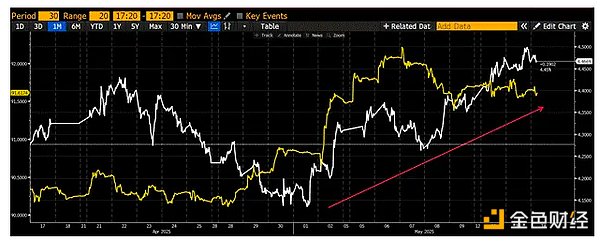

The Taiwan dollar (TWD) and the South Korean won (KRW) have strengthened significantly against the U.S. dollar in the past few weeks, and we have a glimpse of where they are headed. The reason these two countries are bellwethers is that both countries deliberately undervalue their currencies in order to export more goods to the United States. Moreover, both countries, as nation states, rely on the U.S. security umbrella for their survival. As I will show, both countries’ treasuries have allowed their currencies to appreciate and have not intervened. They have done so because Trump’s message to his allies is that you have to pay. And Taiwan and South Korea have no choice if they want U.S. military support.

Korean Won USDKRW (Gold) vs. Taiwan Dollar (USDTWD) KRW and TWD strengthen against the USD when prices fall.

There are many sovereign and private pools of foreign capital engaging in similar carry trades. If Asian private capital flows reverse, then these too must leave. So even before there is a coherent plan for the size and scope of U.S. capital controls, foreign investors holding U.S. assets and local currency liabilities will have to start selling their stocks, bonds, and real estate and buying back their local currency.

What will eventually force the Fed, Treasury, and politicians to implement some or all of the aforementioned money printing measures is the slow but inexorable rise in the 10-year Treasury yield. As capital repatriation gains momentum, yields will rise. Due to the massive leverage embedded in the financial system, the 10-year Treasury bond has a financial dysfunction yield strike price between 4.5% and 5%. As yields rise, bond market volatility will rise, which we can observe through the MOVE index. Remember, when this index breaks above 140, policy action will be immediate and imperative. Therefore, even if rising yields hinder the stock market rebound, it will eventually accelerate money printing, and Bitcoin will benefit from this.

Bloomberg Asian Dollar Index (gold) versus the US 10-year Treasury yield (white). When the US dollar index rises, Asian local currencies strengthen and we see a corresponding rise in 10-year Treasury yields.

lifeboat

As Sino-US relations slowly progress, global financial markets will fall into Balkanization. State-first monetary policy will inevitably lead to capital controls, and this policy prescription will be implemented everywhere, including the United States. No matter who you are, your funds cannot be invested in the highest-yielding and lowest-risk assets in the world in the fiat financial system. In the past, gold was the only liquidity link connecting different financial systems, but now, Satoshi Nakamoto has given believers Bitcoin!

As long as you have an internet connection, you can exchange fiat for Bitcoin. Even if centralized exchanges are banned, or banks are prohibited from processing Bitcoin transactions, you can still exchange fiat for Bitcoin. I’m confident of this because that’s what China does. China has effectively banned centralized exchanges from operating central limit spot order books since 2017. However, if individuals want to send fiat to each other within the banking system and exchange Bitcoin outside of it, the state is powerless. The over-the-counter (OTC) Bitcoin market remains extremely liquid in mainland China. Even China has not banned private ownership of Bitcoin because it knows that doing so is counterproductive and impossible. For all you poor Europeans out there, don’t expect the European Central Bank (ECB) to learn this lesson without a fight. So get your money out now! Listen to my talk at the Crypto Finance Conference earlier this year on why the EU is implementing capital controls.

The big question is whether Team Trump will try to sink the twin lifeboats of global capital, gold and Bitcoin. I think not, because he and his lieutenants believe that the post-1971 structure of US Treasuries as global reserve assets has not benefited the American people who put them in power. They believe that the financialization of the US has led to a decline in military preparedness, manufacturing prowess, and social harmony. To correct this, gold and/or Bitcoin will be promoted as neutral global reserve assets. Sovereign imbalances will be remedied through gold, and private imbalances will be remedied through Bitcoin.

We know that Team Trump is positive about gold because it was exempted from tariffs in the first place. We also know that Team Trump is positive about Bitcoin because of the series of reforms initiated by various regulators. I think these reforms may not be necessary for Bitcoin to truly expand fairly in Pax Americana, but it is undeniable that the withdrawal of the DOGE hit squad is not a big step in the right direction.

Given that we know that foreign portfolio assets total $33 trillion, it becomes a mental exercise to determine how much capital will flow out of the U.S. and into Bitcoin. As for what percentage of assets will flow into Bitcoin, it depends on how quickly you want to end it.

What if 10% of these assets ($3.3 trillion) flowed into Bitcoin over the next few years? At current market prices, exchanges hold about $300 billion in Bitcoin. If 10x as much money tried to flood the market, the price would rise much more than 10x. This is because the final price is determined on a margin basis. Of course, if the price soared to $1 million, long-term holders would proactively sell their Bitcoin for fiat, but as these portfolio assets shifted to Bitcoin, an epic short squeeze would ensue .

What makes Bitcoin a superior tool for moving capital around the global financial Balkans is that it is a digital bearer asset. No intermediaries are needed to store and transfer wealth. Gold, despite its 10,000-year-old history as stateless capital, can only circulate in paper digital form. This means you must trust a financial intermediary to hold your physical gold, and you trade a digital receipt. These intermediaries will be subject to financial regulations designed to keep capital domestically so that it can be taxed to pay for national priority industrial policies. Therefore, unless you are a state or quasi-state actor, gold as a physical bearer asset does not circulate fast enough to play a role in the global digital economy. Bitcoin is the perfect and only lifeboat for global capital that must leave the United States and elsewhere.

Additional bullish firepower will come from the US actually defaulting on its massive treasury bonds . A $1,000 face value bond will receive $1,000 when it matures, meaning nominally you will get your principal back. But that $1,000 will buy fewer units of energy in the future. The US started defaulting heavily on the actual value of its treasury bonds after the 2008 global financial crisis, when they decided to print money to get out of trouble. But the pace of defaults has accelerated after the COVID-19 pandemic. This trend will accelerate again as the Trump team stimulates the US economic recovery by devaluing treasuries against hard currencies such as gold and Bitcoin. This is the real point of the Liberation Day tariff farce. As companies rebuild better at home, nominal growth rates will soar; however, high single-digit nominal GDP growth rates will not be matched by high single-digit yields on treasuries and/or bank deposits. This inflation will be reflected in the price of gold and Bitcoin in the future, just as it has in the past .

Here is a chart of the long-term US Treasury bond ETF TLT US (gold) in terms of gold versus the same ETF in terms of Bitcoin (red), with the index at 100 starting in 2009. As you can see, US Treasuries have lost 64% and 84% of their value relative to gold and Bitcoin, respectively, from 2021 to date.

The return of foreign capital and the devaluation of the massive U.S. Treasury debt will be two catalysts that will push the price of Bitcoin to $1 million sometime in 2028. I say 2028 because the next U.S. presidential election will be held by then, and no one knows which politician will win and what policies will be enacted. Perhaps, under the protection of some kind of gods, the American public is ready to accept the monetary hangover from the profligacy of the last century and eradicate the corrupt credit that is destroying society. Maybe, I dare not jump to conclusions, but it is just a maybe. Therefore, now is a good time to take advantage of the "Sun King" (i.e. Trump)'s favor on Bitcoin and take advantage of it.

Trading strategies

From a macro perspective, I have done my job as Maelstrom’s CIO. I reduced risk and increased fiat circulation in late January. Then, fiat gradually flowed back into the market from late March to early April. We long crypto during the week-long financial market crash on “Liberation Day.” Now it’s time to determine which high-quality shit coin can outperform Bitcoin in the next bull run.

I believe this time the market will reward those “shit coin” that actually buy products or services with real money, and the protocols will return some of the profits to token holders. Two projects stood out and Maelstrom bought them at the low point: PENDLE and ETHFI. Pendle will have a cryptocurrency fixed income trading business, which in my opinion is the largest untapped opportunity in the cryptocurrency capital markets. Ether.fi will become the “American Express” of the cryptocurrency space, a prototype cryptocurrency financial institution serving wealthy holders. I will comment further on these “shit coin” in the following articles.

My belief that Bitcoin will go to $1 million does not mean there are no opportunities for tactical short positions. Capital controls and money printing are coming, but the road from now to the future is bumpy. Team Trump is not all for capital controls, so those who think Trump should take the empire in a different direction are expected to come back. Trump has no fixed ideology; he will work with restrictions and zigzag his way toward that goal. Therefore, the trend is your friend until it is no longer your friend.

[1] Daniel Oliver has written an excellent article explaining why excess credit is the cause of trade imbalances and tariffs are a red herring.

[2] Milan is currently the Chairman of the White House Council of Economic Advisers.