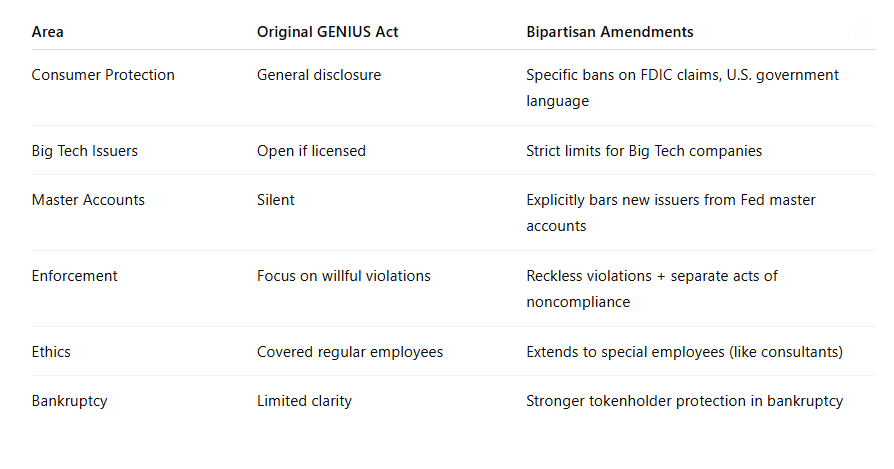

After the GENIUS bill failed in the Senate last week, legislators added several bipartisan amendments. This represents a significant concession to the anti-cryptocurrency camp, including several important restrictions.

In particular, it prohibits large tech companies from issuing or holding stablecoins. These amendments aim to increase stablecoin transparency and enable enforcement actions against non-compliant companies.

Will the GENIUS Bill Pass with New Amendments?

Stablecoin regulation is a priority for U.S. cryptocurrency regulation, and the GENIUS bill is currently the industry's biggest hope for passing it.

Although it seemed highly likely to succeed last week, it failed in the Senate due to strong opposition from Democrats and Republican defections. However, rumors suggest the GENIUS bill might pass through new bipartisan amendments.

Generally, the GENIUS bill amendments are proceeding in a direction that addresses the causes of last week's failure. This includes clearly specifying the lack of FDIC or federal affiliation to limit potential fraud.

However, one particularly notable aspect could have a significant impact:

"Prohibits non-financial publicly traded companies from issuing stablecoins unless they meet strict standards regarding financial risks, consumer data privacy, and fair business practices. This prevents companies like Meta, Amazon, Google, and Microsoft from issuing stablecoins and maintains the separation of banking and commerce," reads one version.

Reports indicate these GENIUS bill amendments came from two Senate sources. However, other versions are also circulating, suggesting large tech companies might be prohibited from holding stablecoins in any manner.

Since the bill's language is not yet finalized, it's impossible to know which version is accurate.

Here's a preview of how the GENIUS Act might — final text pending — limit major tech companies from owning stablecoins.

— Brendan Pedersen (@BrendanPedersen) May 15, 2025

Tech companies would be prohibited from issuing stablecoins "unless they can meet strict criteria regarding financial risk" https://t.co/Lh2h4ZoxO8 pic.twitter.com/Wp0UtwbsIA

Specific Amendments and Objectives

Skeptical legislators have sufficient reasons to make this their top regulatory priority. Stablecoins have garnered significant attention. Aside from stablecoins having substantial use cases in everyday criminal activities, these GENIUS bill amendments seem tailored to recent specific incidents.

For example, consider the requirement that stablecoins cannot directly use U.S.-themed branding. Trump's USD1 caused enormous controversy and has no direct government association.

The GENIUS bill amendments aim to prohibit large tech companies from launching stablecoins, just a week after Meta proposed using them.

Most importantly, the GENIUS bill amendments explicitly intend to "maintain the separation of banking and commerce". Tether has invested enormous resources in new U.S. stablecoin opportunities, spending $65 billion on U.S. Treasury bonds in three months.

Large tech companies have sufficient cash, so strict guardrails are necessary. Other GENIUS bill amendments detail some guardrails, such as relaxing enforcement action requirements for stablecoin issuers.

These measures are also placed under the Treasury's jurisdiction, with other regulatory agencies like SEC and CFTC weakened.

Additionally, it specifically mentions Elon Musk as a federal employee with strong conflicts of interest, among others.

Again, these amendments are not yet finalized, so it's not even clear if the GENIUS bill will pass. However, in any case, these proposals represent a significant victory for the cryptocurrency skeptics in Congress.