Bitcoin shows undetermined price movements, leaving investors uncertain about market direction.

Despite this stagnation, historical investor behavior suggests potential for rise that cannot be predicted by price alone.

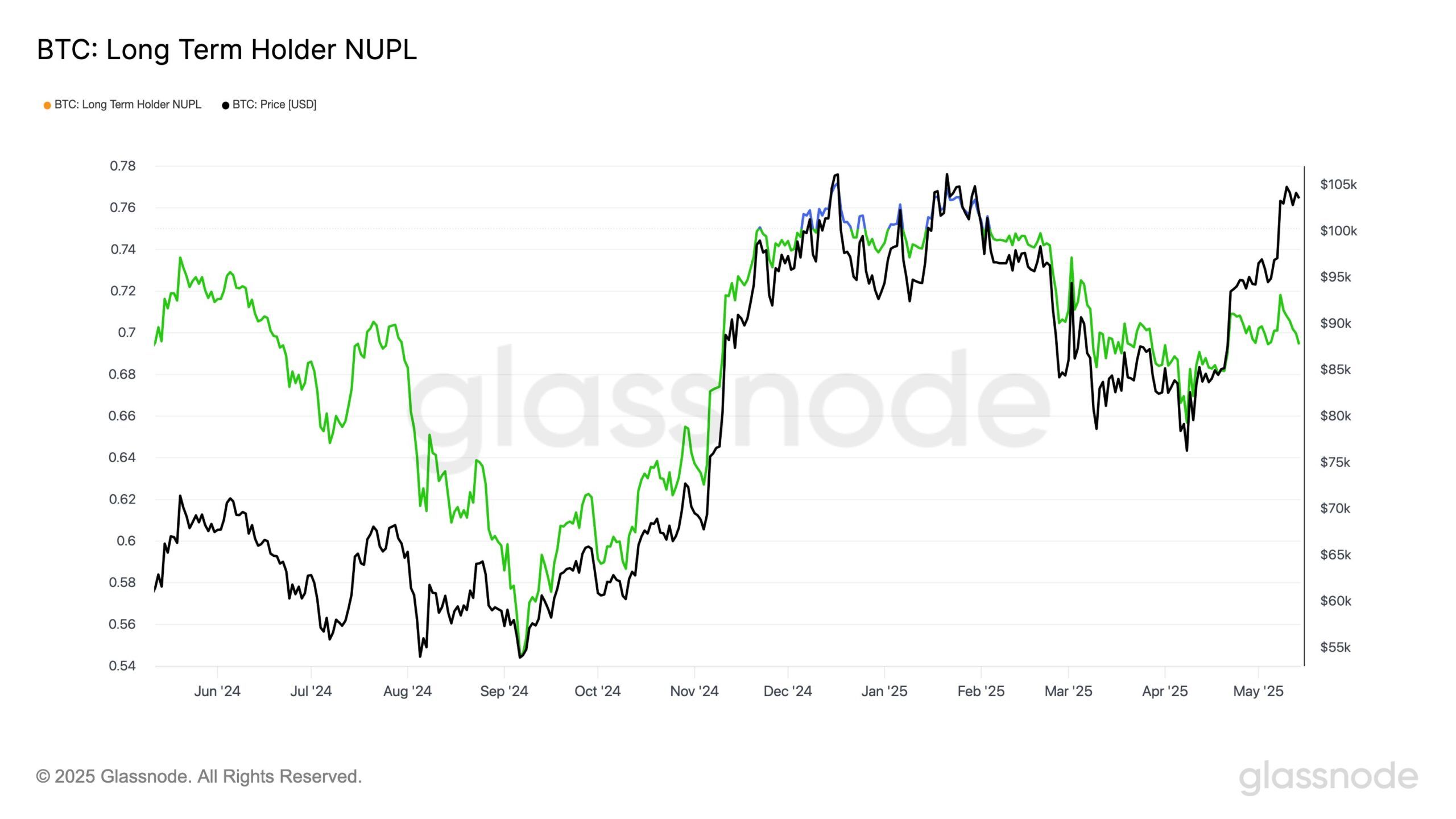

Long-Term Holders Consolidating Bitcoin's Bottom

Long-Term Holders (LTH) Net Unrealized Profit/Loss (NUPL) indicates that Bitcoin buyers from December 2024 are maturing into LTH after a 155-day holding period. This is positive for Bitcoin. Mature buyers tend to hold coins longer, reducing impulsive selling pressure.

As more investors become LTH, coins remain in strong hands, building resistance to price drops. This behavior supports Bitcoin's price stability and may promote potential gains as the market matures and short-term volatility decreases.

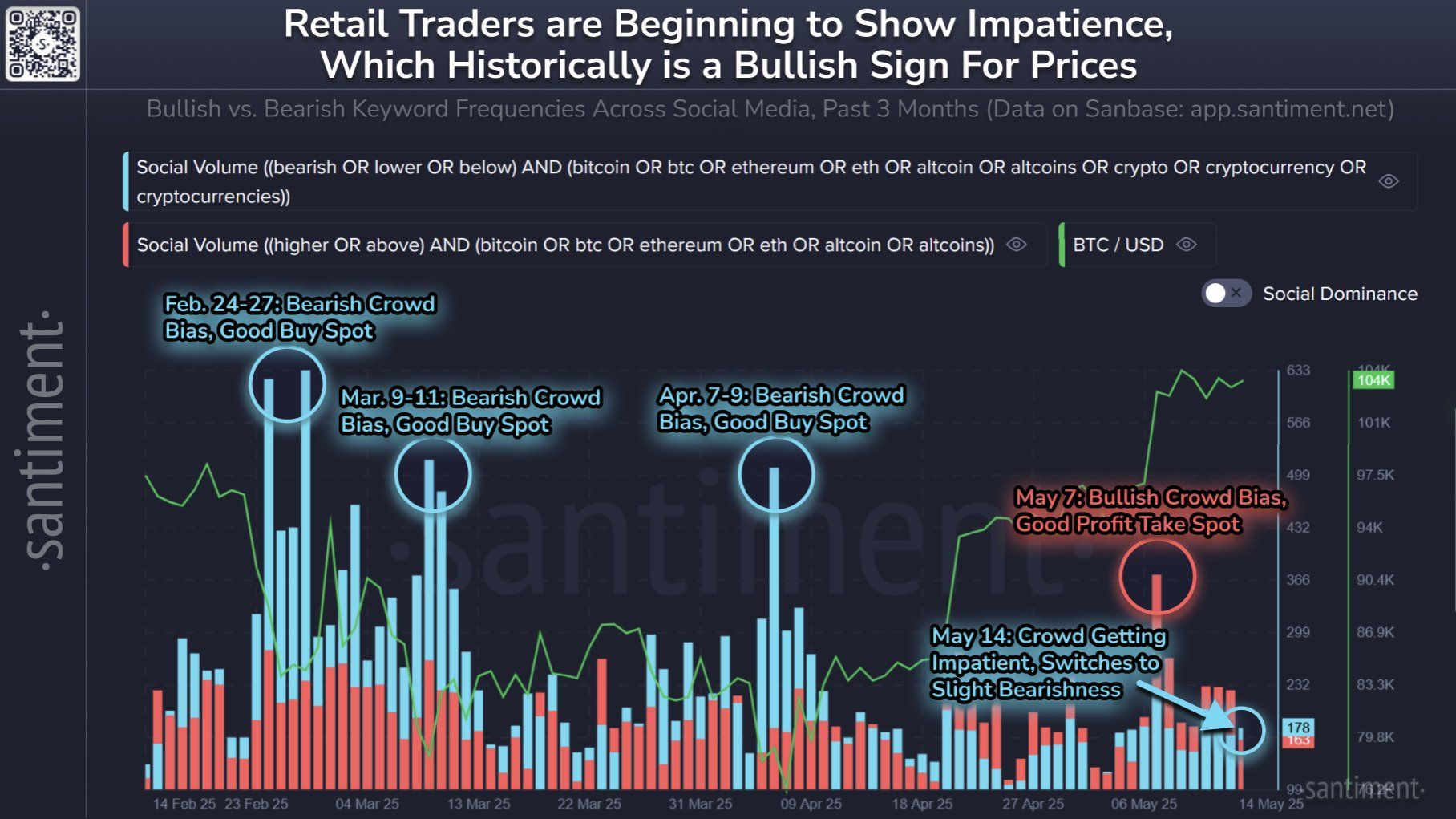

Bitcoin investors' sentiment often moves contrary to market performance. Historical data shows bearish sentiment typically signals buying opportunities, while excessive bullishness predicts selling. Over the past 48 hours, sentiment has shifted back to bearish.

Increased fear among retail investors can set the stage for market rise, as traders seek value during dips. This heightened anxiety contrasts with positive price fundamentals, suggesting potential breakout with renewed buying interest emerging cautiously.

BTC Price Needs to Break Key Barriers

Bitcoin is currently trading at $103,885, hovering between $105,000 and $102,734. To reach $110,000, Bitcoin needs to rise approximately 6%, which seems achievable given recent momentum.

Last week, Bitcoin surged 11% in just 5 days, showing strong potential for rise. Major resistance after $105,000 is at $106,265. Converting this to support could likely lead to a rise to $110,000 and confirm new all-time highs.

However, if Bitcoin continues to consolidate or correct, impatient investors might sell to avoid losses. This selling pressure could drive the price below $102,734, potentially dropping to $100,000 and invalidating the current bullish outlook.