The total cryptocurrency market capitalization has now fallen to less than 15% from its all-time high (ATH). Meanwhile, Tether (USDT), a representative stablecoin, showed signs of potential buying pressure in May.

These indications include Tether's continued issuance of new USDT and the significant drop in USDT dominance (USDT.D) during May.

USDT Trends Suggesting Potential Continuation of Crypto Bull Market

According to CoinMarketCap data, Tether's market capitalization has broken through and set a new all-time high of $151 billion.

Yesterday, Tether injected 1 billion USDT into the market. Tether issued a total of 2.5 billion USDT in May alone. Since the beginning of the year, USDT's market capitalization has increased by nearly 10%, rising by $13 billion.

"Over the past 20 days, $6 billion in cash has been injected into the market through newly issued USDT. Tether's current market capitalization is $150 billion," said analyst Axel Adler Jr.

Currently, USDT occupies a dominant position, accounting for 62.4% of the total stablecoin market. In particular, the total amount of USDT issued on the TRON network has exceeded $73 billion, surpassing Ethereum and emerging as the leading platform for USDT circulation.

The rise in USDT's market capitalization serves as a strong indicator of potential purchasing power. An increase in USDT's market capitalization means that there is a large amount of funds waiting to be invested in other cryptocurrency assets. This implies that the market can quickly recover due to incoming funds, even if cryptocurrency prices fall.

Another bullish signal is the decline in the USDT Dominance Index (USDT.D), which measures USDT's market share relative to the total cryptocurrency market capitalization.

According to TradingView data, USDT.D has fallen from 6% in April to 4.6% at the time of writing.

The decline in USDT.D suggests that investors are using USDT to purchase other cryptocurrency assets such as Ethereum (ETH) or altcoins. This behavior reflects a bullish market sentiment. Investors seem increasingly willing to take risks for higher returns rather than keeping funds in stablecoins as a safe haven.

Axel Adler Jr. added, "The decline in Bitcoin's dominance and the rise in Ethereum's market share indicate that part of the USDT flow is moving into altcoins."

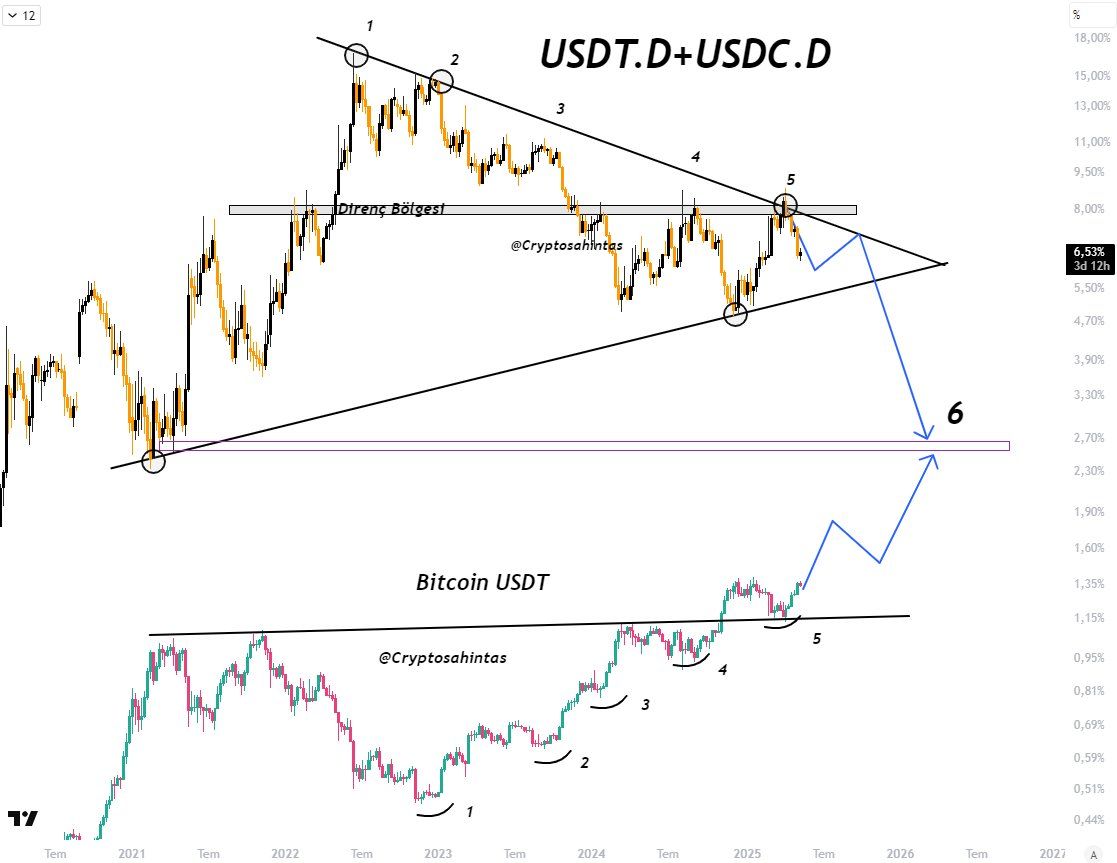

Additionally, analyst Cryptosahintas provided deeper insights by analyzing the USDC.D and USDT.D indices. He expects the combined ratio of these two indices to continue declining, which will further support Bitcoin's bullish momentum.

"Tether's dominance is gradually decreasing. I expect Bitcoin to continue its upward trend. Liquidity is slowly moving to more risky assets," Cryptosahintas predicted.

With Tether's market capitalization reaching an all-time high and USDT dominance showing a downward trend, the cryptocurrency market is displaying strong signals of the possibility of a new bull market.

However, historical data shows that its impact appears with a time lag. From January to April, Tether's market capitalization increased from $137 billion to $144 billion, but Bitcoin's price still fell from $110,000 to below $75,000. This delay complicates timing predictions and demonstrates the difficulties in interpreting market signals in real-time.