Bitcoin exchange balances have decreased by over 100,000 BTC in a month, with investors maintaining a long-term holding tendency, leading to decreased liquidity and an expanding wait-and-see sentiment.

According to CoinGlass as of the 22nd, the total Bitcoin balance of major global exchanges is approximately 2,157,013.83 BTC.

A total of 3,503.63 BTC was net outflowed in a day, with 9,155.67 BTC net outflowed in the past week, and 107,728.56 BTC net outflowed in the past month, maintaining the long-term holding trend.

Coinbase Pro holds 671,199.87 BTC, the largest amount. While 855 BTC was net inflowed in a day, 1,269.88 BTC was outflowed on a weekly basis, and 49,633.7 BTC was outflowed on a monthly basis, still showing the largest outflow.

Binance holds 536,745.11 BTC, with 3,663.06 BTC net outflowed in a day. On a weekly basis, 1,683.54 BTC was outflowed, and on a monthly basis, 40,739.8 BTC was outflowed, continuing the medium to long-term outflow trend.

Bitfinex holds 398,798.62 BTC, with 13.75 BTC net inflowed in a day. However, 1,200.24 BTC was outflowed in the past week, while 3,500.45 BTC was net inflowed in the past month, showing some reverse flow.

Largest Daily Net Inflow ▲Binance(+3,663.06 BTC) ▲Coinbase Pro(+855 BTC) ▲Bybit(+368.49 BTC)

Largest Daily Net Outflow ▲Kraken(–1,130.63 BTC) ▲Gemini(–418.01 BTC) ▲Bitflyer(–154.23 BTC)

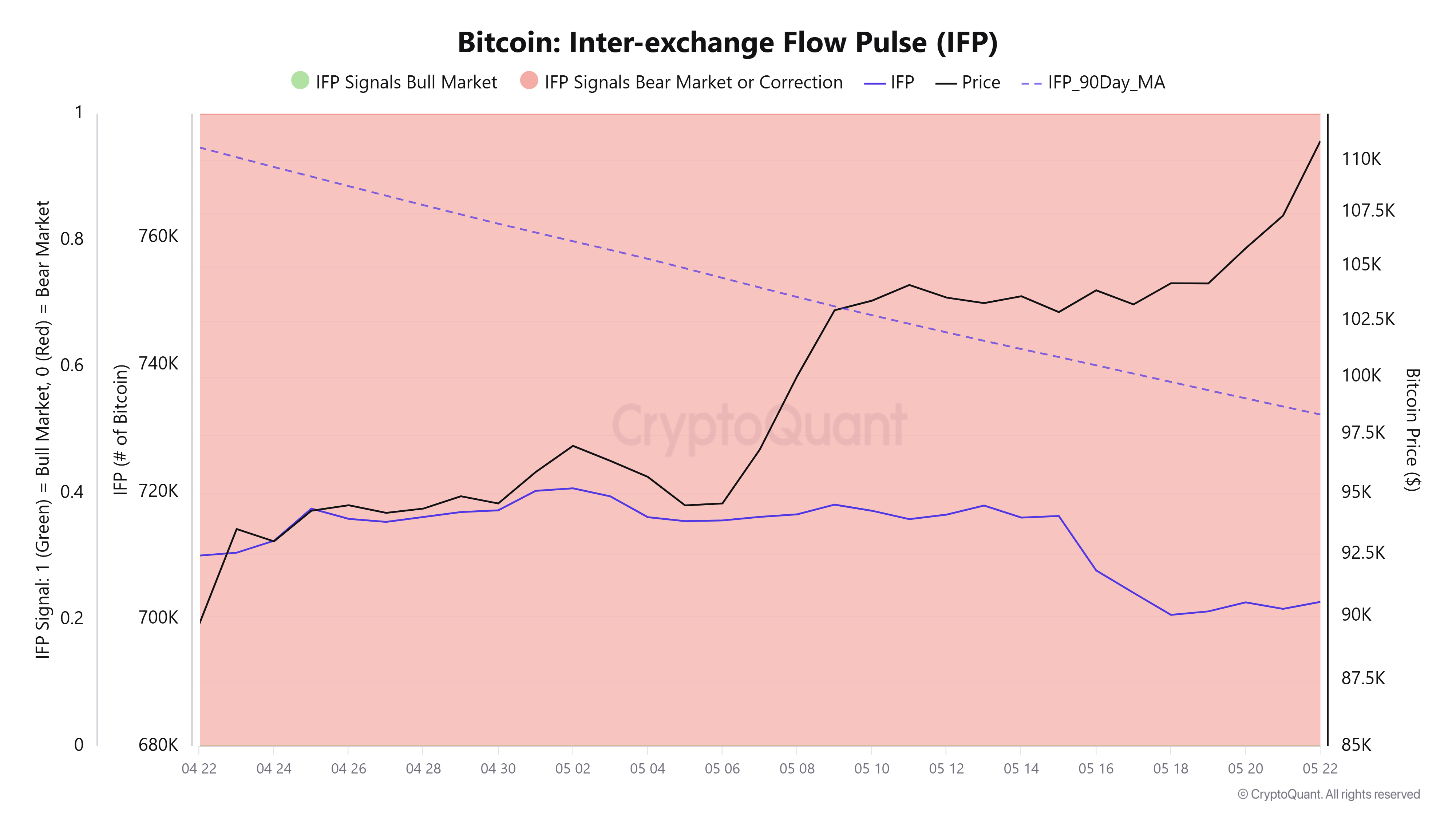

According to CryptoQuant, the IFP (Inter-exchange Flow Pulse) indicator as of the 22nd is 702,731 BTC, slightly increased from the previous day (701,625 BTC on the 21st). Despite Bitcoin remaining in the $10,000 range, the IFP is still below the 90-day average of 732,237 BTC.

The IFP is an indicator that indirectly shows investment sentiment through inter-exchange movement, and tends to coincide with a bullish market when it exceeds the average.

Although the figure has slightly improved from the previous day, the market's perceived buying sentiment has not yet spread. The limited movement between exchanges among holders can be interpreted as a reflection of a lack of short-term directional confidence or caution about potential sell-offs. Unlike past bullish markets, the current market is mixed with a wait-and-see attitude and cautious entry signals.

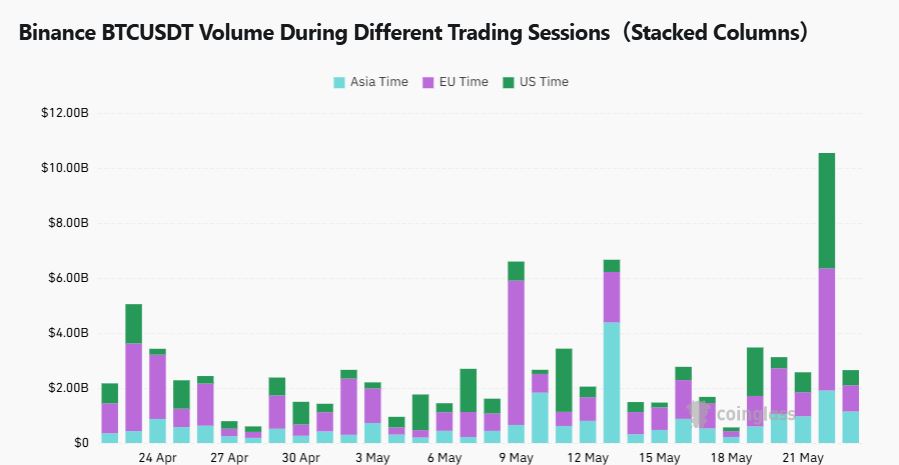

According to CoinGlass, the Binance BTCUSDT trading volume as of the 22nd was $1.14 billion in the Asian time zone, $952.41 million in the European time zone, and $553.38 million in the US time zone.

On the previous day, the 21st, it was $1.91 billion in Asia, $4.44 billion in Europe, and $4.2 billion in the US.

Overall, the trading volume across all time zones has significantly decreased within a day, making the short-term liquidity contraction trend clear. Particularly, the US time zone trading volume decreased by about 86.8% compared to the previous day, showing a sharp reversal of the North American-centered liquidity flow that was seen the day before. It is interpreted that trading momentum has decreased as the wait-and-see sentiment spreads rather than price adjustment.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>