This week, the cryptocurrency market showed strength with Bitcoin (BTC) reaching an all-time high of $111,980. The investment trends and regulatory developments of U.S. states were notable, and the price surge of the Pi Network also drew attention.

The following is a summary of the most important developments in this week's cryptocurrency market.

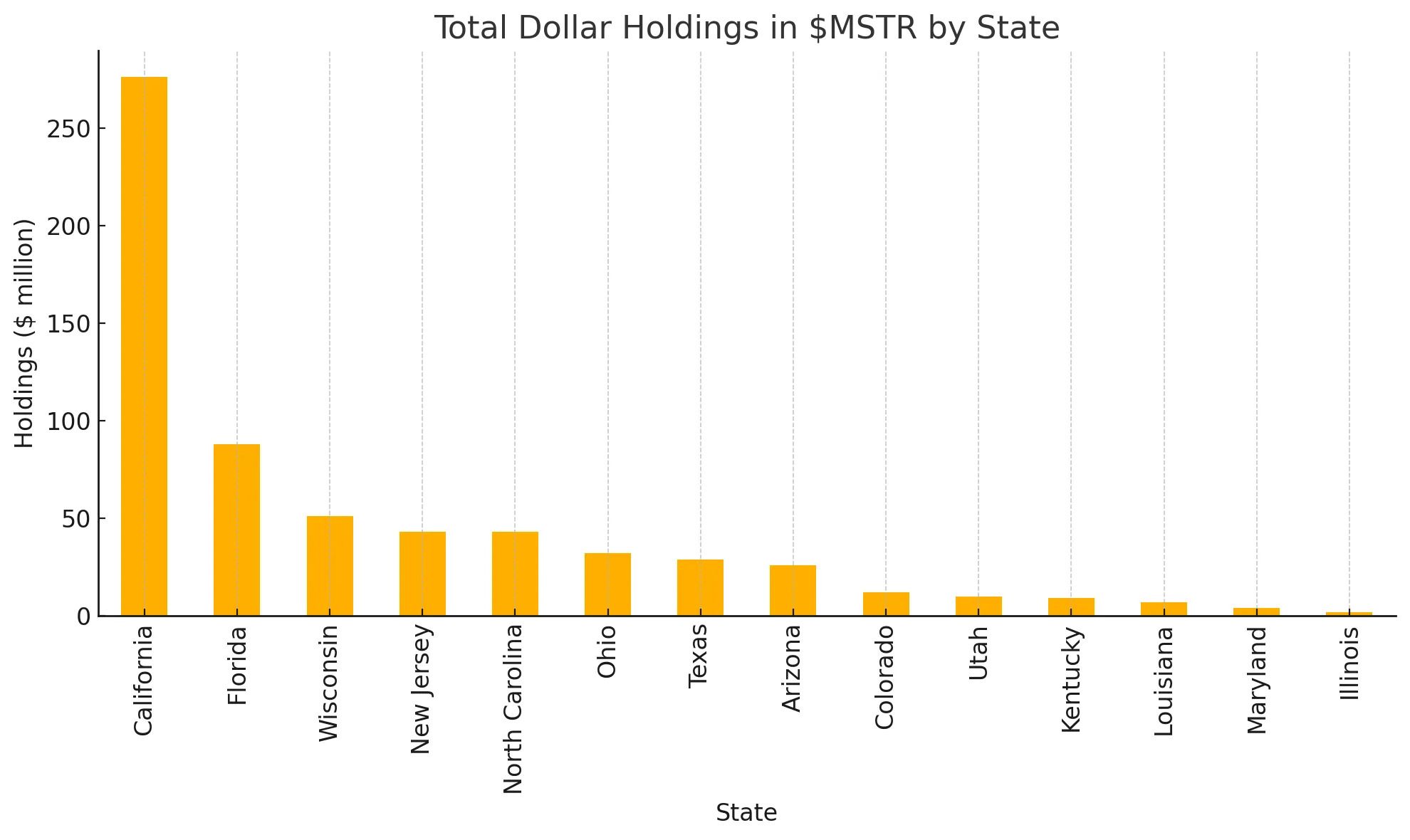

14 U.S. States Disclose $632 Million Stake in MSTR

One of the most notable developments this week was the revelation that U.S. states hold a strategic $632 million stake in MSTR stock. with BeInCrypto reported that holdings increased by an average of 42% in the first quarter of 2025.

"14 U.S. states reported $632 million MSTR exposure in the first quarter. There was a collective increase of $302 million in public retirement and financial funds over one quarter." – Founder of Bitcoin Law Julian Fahrer posted.

California led the way, holding $276 million in THROUGH state teacher and public retirement funds, followed by Florida, North Carolina, and New Jersey. Arizona also increased its MSTR holdings, despite the recent veto of the Bitcoin reserve bill.

Other states like Utah and Colorado significant growth in MSTR investments, the former seeing a 184% increase in holdings last quarter. Meanwhile, the Wisconsin Investment Board increased its MSTR position by 26% while selling its entire $300 million stake in BlackRock's Bitcoin ETF.

This shows that the strategic company, the largest corporate Bitcoin holder (576, Bbecome the preferred choice for states wanting to indirectly expose themselves to cryptocurrency while avoiding the complexity of direct ownership.

Pi Network Withdraws 86 Million Tokens from OKX

The Pi Network has been widely discussed since the launch of its Open Network in late February 2025. This week, Pi Coin (PI headlines with an of11% price increase.. BeInCrypto highlighted that the catalyst for this rise was a withdrawal of 86 million tokens from the OKX exchange.

This reduced the PI token balance balance on to 21 million. The massive movement suggested that investors were holding rather than selling, tokens. This is often a with a bullsignal related to confidence in future price increases.

"This is not just a withdrawal. It's a powerful move by the Pi community. Scarcity is beginning, and the market is feeling the heat!" – Pioneer >.

At the time of writing, it was0.79.

Along with poor price performance, the Pi Network has faced significant criticism for not being listed on major exchanges like Binance or Coinbase. Lack of recognition on price tracking platforms, token distribution, node centralization, and concerns about mobility issues were added to the list of problems.

Blum Co-Founder Vladimir Smerkis in2>Another cryptocurrency-related event this week involved the co of-the-based Blum. On May 18, theOskvoCourt arrested Vladimir Smerkis. He previously reported.

In response toAnced blum distanced smhis project involvement.

Kruger Expects Bitcoin to Reach $600,000 in October h2025>This week, Bitcoin drew attention with an impressive rally. BeInCrypto first reported that Bitcoin recovered its all-time high of $108,900 after four months. However, the rally did not stop there, and the price continued to rise further."We want to inform our community that Vladimir That Smerkhaserkhas stepped down from theO position and is no longer involved in project development or co-founder role." – Official statement from Blum posted.

Yesterday, BTC set a new record at $111,980. This record has not yet been broken. However, analysts becoming increasinglyly optimistic about Bitcoin's prospects future.

"Final Rally: Bitcoin to $600,000. Period: From Monday, July 21, 2025, for 90 days. Starting BTC: $150,000, Ending BTC: $600,000. Final Gold: $10,400. DXY: Collapse from 96 to 68. US 10-Year Yield: Surging to 9.2% before being 'frozen' by the Fed. SPX: 50% Collapse," – Kruger statement.

The anticipated catalysts for Bitcoin's $600,000 rise include failed US Treasury auctions, BRICS countries launching Bitcoin-based payment systems, countries converting reserves to Bitcoin, Treasury yield increases, US real estate collapse, tech companies adopting Bitcoin, potential US dollar restructuring at the October summit, and more.

Texas Bitcoin Reserve Bill Passes Key House Vote

Beyond price, Bitcoin has also been in the spotlight in the regulatory sector. This week, Texas Senate Bill 21 passed its second reading in the House with a 105-23 vote. Subsequently, it passed its third and final reading with a 101-42 vote.

This bill to create a state-level Bitcoin reserve now only requires Governor Abbott's signature. As BeInCrypto noted, Governor Abbott is crypto-friendly.

In fact, he posted an article about the Texas Strategic Bitcoin Reserve on his X account today, suggesting potential approval.

"Things are happening. Governor Greg Abbott will sign the Texas Bitcoin reserve into law. One of the wealthiest states will be buying Bitcoin. Get ready!!!" – Crypto commentator Kyle Chasse statement.

As the Texas Senate session ends on June 2, Governor Abbott must make a decision by then. If signed into law, Texas will become the second US state to establish its own Bitcoin reserve, following New Hampshire.