After announcing a temporary suspension of tariffs on China, President Trump suddenly posted on social media that EU trade negotiations had "no progress" and suggested "directly imposing a 50% tariff on the EU starting from June 1, 2025". Trump pointed out that the EU has "strong trade barriers, value-added tax, ridiculous corporate fines, non-monetary trade barriers, currency manipulation, and unfair and unreasonable lawsuits against US companies", believing these measures result in an "unacceptable" trade deficit of over $250 billion annually for the United States.

Just as the market was preparing for EU retaliation, Trump quickly changed his stance after speaking with the EU Commission President, announcing a postponement of the tariff implementation date to July 9. Now we are back to square one, and the US dollar is already facing greater pressure this week.

Simplifying the overall logic, if the US goal is to eliminate trade deficits with trading partners, it essentially requires the EU to pay around $200 billion annually as an "entry fee" to enter the US market, which is clearly an unacceptable cost for most people.

In fact, according to Citigroup's analysis, under game theory, the "Nash Equilibrium" result between the US and EU is likely to be mutual 50% tariffs.

For Japan, based on the same analysis, considering the extremely limited impact on its net exports, the "no agreement" state might actually be most beneficial. Ironically, reaching a "comprehensive agreement" with the US under current conditions could be the worst outcome, so future negotiations becoming deadlocked would not be surprising.

Of course, there are many dynamic factors that market and economic experts have not grasped (such as rare earth dependencies), similar to China's situation where the US ultimately seems to have made comprehensive concessions and accepted a less-than-ideal result. Like Japan, economists generally believe China is likely to reach a comprehensive agreement with the US, with the best approach being to delay negotiations to gain more US concessions, which are indeed happening.

For the global macro market, this is also the "optimal solution": the US withdraws policies that were pressuring global economic synchronization, with the US dollar becoming the main pressure point, and the strong performance of overseas stock markets partially offsetting the impact.

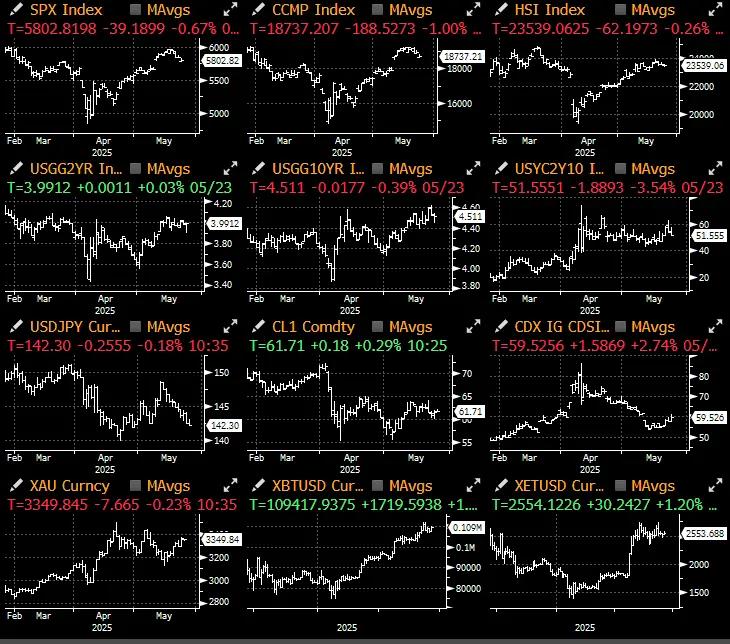

Returning to the market level, besides the US dollar, the biggest losers are global fixed-income assets. Recent credit rating downgrades, disappointing budget results, and a series of weak US debt auctions have pushed bond yields back to high points in the range.

The double hit of soaring bond yields and fiscal budget concerns caused SPX to underperform other global markets and macro asset classes, experiencing its largest weekly decline since early April (-1.6%), with selling pressure across all sectors.

The recent US stock pullback occurred when overall market sentiment had already rebounded to an overheated level, especially in US, Chinese, and European markets.

Although growth stocks and real estate are most sensitive to yields, as geopolitical and economic recession tail risks gradually dissipated over the past month, higher term premiums have also dragged down gold spot prices.

In the short term, we believe current market concerns about US budget and spending issues may be overly magnified, just like previous fears of economic recession. As government tariff measures are gradually implemented, expected future revenue should offset some short-term deficit pressures.

In contrast, cryptocurrencies have shown extreme resilience over the past two weeks, with BTC price performance exceeding US stocks and US bonds by around 15% in the past three weeks.

In terms of ETF fund flows, net inflows reached $2.75 billion in a single week, the third-highest in history, with ETH also attracting $248 million in net inflows.

The passage of the GENIUS stablecoin bill is widely seen as an important milestone in cryptocurrency industry development, though at the cost of strengthening institutional monitoring and regulatory intervention, gradually moving away from the initially emphasized decentralization spirit of cryptocurrencies.

BTC and ETH volatility skew has returned to a more normal level, tilting upward, with overall implied volatility also rebounding, indicating investors are no longer shorting rebounds but shifting towards layouts for more sustained upward breakthroughs.

Meanwhile, MicroStrategy announced launching a new $2.1 billion market-price preferred stock issuance plan to acquire more BTC. The current macro environment still provides tailwind, with momentum seemingly tilting towards cryptocurrencies. Recent price trends are structurally healthier, with high-chasing sentiment significantly weakened, which is conducive to continued upward breakthroughs and potentially creating new highs in the coming weeks.

Wish everyone good luck and successful trading!