According to Jonny Garcia, the Institutional Growth and Capital Markets Management Director of the VeChain Foundation, Texas is highly likely to be the next state to establish a strategic Bitcoin reserve, following New Hampshire.

In an exclusive interview with BeInCrypto, Garcia explained that states with leadership supporting innovation are more likely to follow New Hampshire's example, while other states may observe the situation more cautiously.

States like Texas Likely to Follow New Hampshire's Bitcoin Holdings

The VeChain executive described the passage of New Hampshire's House Bill 302 as a 'groundbreaking moment' for digital assets. He stated that this development is raising the recognition of Bitcoin as a strategic financial tool.

This also establishes a foundation to encourage blockchain adoption by normalizing digital assets in public portfolios.

"Momentum is gathering at the state level since the presidential inauguration, and there is a change in the general perception of Bitcoin [and other cryptocurrency assets] among state representatives," Garcia told BeInCrypto.

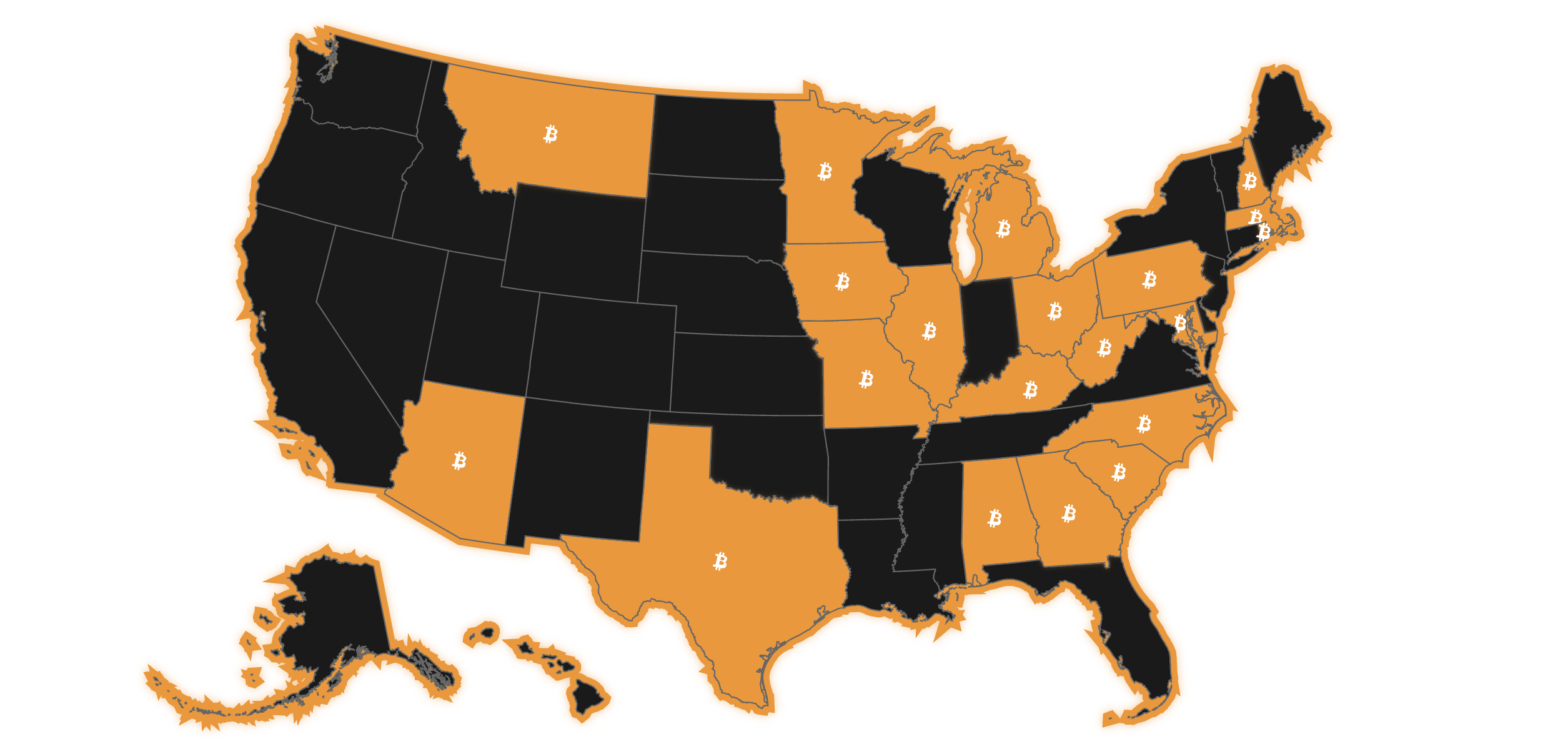

Importantly, he believes this movement could accelerate efforts for states considering related bills to not fall behind. According to the latest Bitcoin law data, 37 digital asset-related bills are active in 20 states as of May 2025.

However, Garcia emphasized that the success of such bills depends on various factors, including the state's political climate, economic priorities, and risk tolerance.

"States with leadership supporting innovation like Texas or Utah are more likely to quickly follow New Hampshire's precedent, while other states will observe the results of New Hampshire," he added.

This dynamic is already manifesting in practice. For example, on May 6th, New Hampshire's Republican Governor Kelly Ayotte signed HB302, allowing the state to allocate up to 5% of its funds to Bitcoin.

Nevertheless, Arizona's Democratic Governor Katie Hobbs rejected Senate Bills 1025, SB 1373, and SB 1024 due to concerns about Bitcoin's volatility. However, she signed HB 2749, which allows the state to claim abandoned digital assets without direct investment.

Now Texas is in the spotlight, with strong optimism that similar legislation will be enacted. Republican Governor Greg Abbott has expressed a positive outlook on this industry. The Texas legislative session ends on June 2nd, so a decision could come at any time.

This trend highlights a clear difference of opinion between Democrats and Republicans regarding digital asset reserve investments, which Garcia acknowledges.

"These differences are not new and stem from more deeply rooted perspectives like conservatives and progressives, or those who take risks versus those who prefer safety. Some may try to categorize these groups as Democrats and Republicans, but I think that's too simplistic," he said.

He acknowledged that bridging this gap is a significant challenge but can be overcome. The executive mentioned that collaboration can be promoted through education and a deep understanding of potential benefits and risks of technology.

According to Garcia, the focus should be on identifying shared goals such as utilizing blockchain to improve government operations' efficiency and transparency. This approach can lay the groundwork for bipartisan cooperation.

"The ultimate goal is to develop a thoughtful and balanced approach to digital assets that can benefit all Americans. This can be achieved by focusing the dialogue beyond partisan boundaries on long-term economic and technological implications," Garcia told BeInCrypto.

State Government Interest and Its Impact on Cryptocurrency Adoption

It remains uncertain whether Democrats and Republicans will fully agree on digital assets. Nevertheless, the introduction of bills and increased state-level discussions indicate growing interest and momentum.

Garcia said this change represents a fundamental shift in public finance recognizing blockchain assets as tools for innovation and resilience.

"This, combined with Bitcoin's strengths, has reignited discussions about 'digital gold' and can help restructure public finance by introducing diversified and censorship-resistant assets to traditional portfolios," he noted.

Additionally, Garcia explained three ways state-level interest could improve mainstream and corporate cryptocurrency accessibility and adoption.

- Normalize digital assets as a strategic asset class rather than a mere speculative asset. This encourages more institutional and corporate participation.

- This also helps policymakers and the public better understand the risks and benefits of digital assets, leading to clearer and better regulation.

- Helps build infrastructure such as regulated custody and on-chain auditability. This makes it easier for companies to adopt blockchain.

He also said that accessibility remains a challenge for mainstream adoption, but national-led initiatives can foster partnerships between public and private sectors. These collaborations can lead to the development of user-friendly wallets, custody services, and DeFi platforms, expanding accessibility for retail and institutional users.

"This aligns with VeChain's focus on scalable enterprise blockchain solutions, and we anticipate that national-level adoption will create a ripple effect accelerating public and private sector integration of digital assets." – Garcia

Balancing Opportunities and Risks of National Cryptocurrency Reserves

While benefits inspire optimism, reserves have several implications for taxpayers. Garcia explained that supporters believe national investment can increase long-term returns and diversify away from inflation-vulnerable assets, which can strengthen national finances and benefit taxpayers. However, he argued,

"Bitcoin has not yet reached a point of higher stability, and if it experiences a recession similar to previous cycles, this could significantly reduce interest in reserve setting and cost taxpayers."

Garcia warned that significant price drops could cause losses to national reserves. Therefore, if allocation is too large or poorly managed, it could threaten financial stability.

"Theoretically, this could lead to pressure for tax policy changes to offset such losses, but this will largely depend on the scale of investment and the overall financial health of the nation." – Garcia, mentioned to BeInCrypto

Garcia argued that public trust must be maintained by educating taxpayers about the benefits and risks. He emphasized that long-term impacts depend on responsible and strategic management of these reserves.

Beyond tax issues, Garcia outlined several challenges states might face when implementing cryptocurrency reserves.

"The volatility of digital assets remains the biggest challenge for states seeking to implement reserves, and managing this volatility within public financial structures will require careful consideration and potentially sophisticated risk management strategies." – Garcia

Garcia also mentioned that educating legislators and the public is crucial for broader acceptance. Many state officials lack expertise in digital asset management and will need education or experts. He emphasized that federal regulatory uncertainty adds complexity. Therefore, clear rules for custody and reporting are necessary.

According to Garcia, transparency and robust cybersecurity measures are other key elements essential to ensuring the long-term success of such initiatives.

The Path to National Strategic Bitcoin Reserves

Meanwhile, Garcia noted that concerns about taxes and market volatility are why Trump's Bitcoin reserve does not include provisions for national fund investment. Instead, it focuses on building reserves using confiscated assets.

However, national-level legislation aims to achieve this. The BITCOIN Act proposed by Senator Cynthia Lummis suggests establishing a strategic Bitcoin reserve.

The SBR includes acquiring 1 million Bitcoin over 5 years and holding it for at least 20 years. Garcia declared that direct Bitcoin investment will vary depending on political and economic factors.

"Allowing these purchases requires bipartisan support in both the House and Senate and presidential signature, but as the recent stagnation of the GENIUS Act shows, legislators are not on the same page." – Garcia, shared with BeInCrypto

Garcia believes that a clear regulatory framework for cryptocurrencies and plans to integrate Bitcoin into strategic reserves will eventually be enacted into law. However, the timeline and specific details of such bills remain 'difficult to predict'.