Japan's government bond market is facing its worst liquidity crisis since the 2008 financial crisis, raising concerns about potential economic contagion that could spread to the global cryptocurrency market.

Analysts are issuing warnings as bond yields surge and long-standing financial structures crumble.

Japan Bond Market Crisis…Global Contagion Concerns

Japan's 30-year government bond yield rose 100bp to 3.20% in 45 days. Meanwhile, the 40-year bond, previously considered a 'safe' investment, has seen its value drop by over 20%, recording market losses exceeding $500 billion.

According to Finance Lancelot, bond market liquidity has deteriorated to levels seen during the Lehman Brothers collapse, suggesting a potential financial crisis.

"Japan's bond market liquidity has fallen to 2008 Lehman crisis levels. Are we about to experience another financial crisis?" Finance Lancelot wrote on X (Twitter).

The crisis stems from the Bank of Japan's (BOJ) recent policy shift. After years of aggressive bond purchases, the BOJ suddenly flooded the market, raising yields.

The central bank still holds $4.1 trillion in government bonds, representing 52% of total issuance. This has distorted market control, skewing prices and investor expectations.

Japan's total debt has increased to $7.8 trillion, with the debt-to-GDP ratio reaching a record 260%, more than double that of the United States.

The results were swift. Japan's real GDP decreased by 0.7% in Q1 2025, more than double the expected 0.3% decline.

Meanwhile, Consumer Price Index (CPI) inflation accelerated to 3.6% in April. However, real wages dropped by 2.1% year-on-year, deepening concerns about stagflation.

"Japan needs massive restructuring." The Kobeissi Letter warned, emphasizing the vulnerability of the country's economic model.

Bitcoin Emerges as Safe Asset Amid Yen Carry Trade Liquidation

As global investors digest these warning signals, attention is increasingly focused on the cryptocurrency market, particularly Bitcoin, which is emerging as a potential refuge from bond market volatility.

The yen carry trade, where investors borrow low-yield yen to invest in high-yield assets, is under threat.

According to Wolf Street, Japan's surging yields and economic weakness are pressuring these high-leverage positions.

"A big mess is coming home to roost." The media noted that the unraveling of this trade could trigger a global risk-off event.

These changes are already visible. As yields rise in Japan and the UK, demand for Bitcoin has surged in both regions.

"Is it a coincidence that Bitcoin exposure demand is spiking in the UK and Japan?" Analyst James Van Straten questioned.

Analysts noted that the 30-year UK government bond yield is approaching a 27-year high.

Kaue Oliveira, research head at BlockTrendsBR, pointed out an increasing positive correlation between bond volatility and Bitcoin flows. Andre Dragosch, European research head at Bit Wise, concurred.

"Many large investors are moving from bonds to Bitcoin." – Oliveira noted.

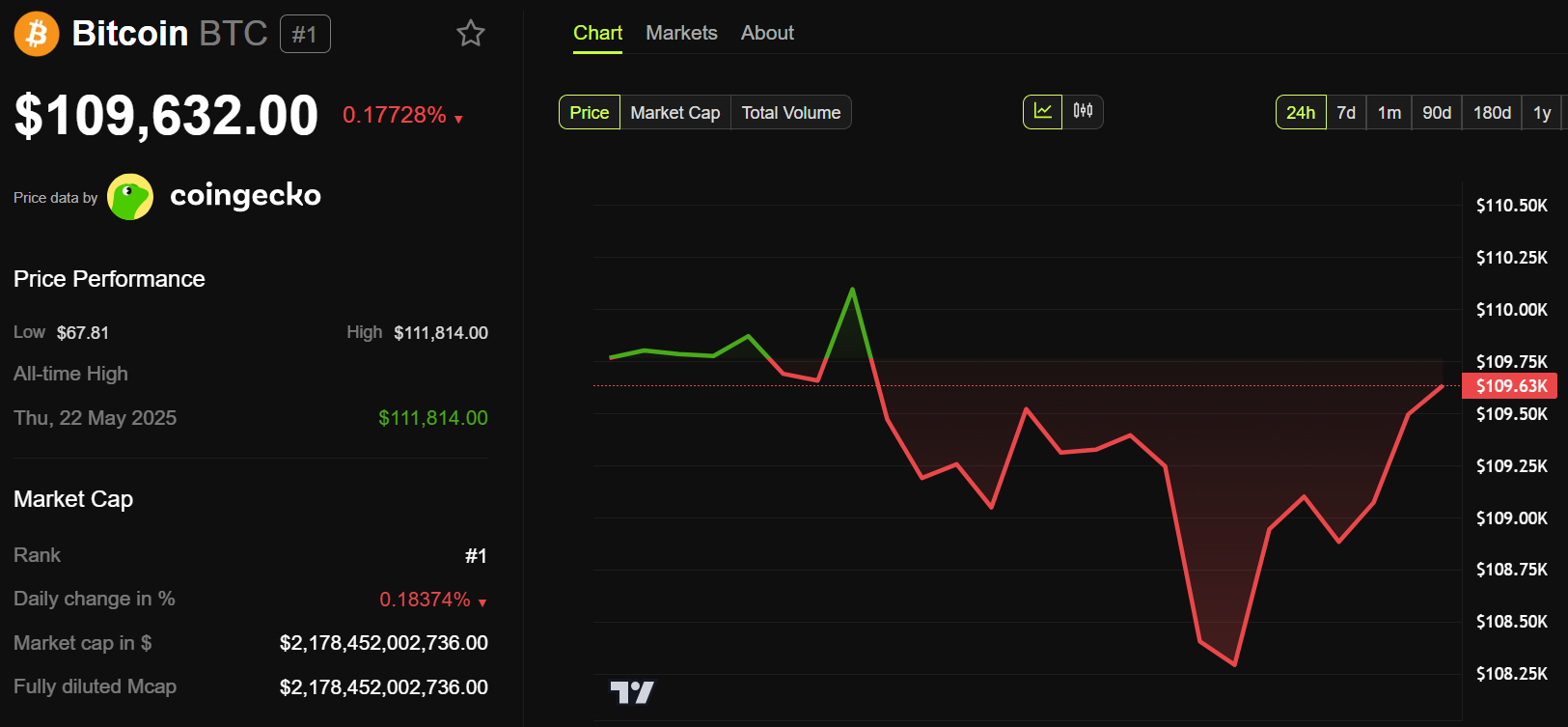

According to BeInCrypto data, Bitcoin is currently trading at $109,632, down 0.17% in the last 24 hours.

However, Bitcoin's role comes with its own risks. BeInCrypto recently reported on a yen carry trade analysis, warning that disorderly liquidation could pressure cryptocurrency assets, especially if global safe-asset preference triggers dollar strength and capital outflow from risk assets.

Long-term, Japan's debt crisis could reinforce Bitcoin as a hedge against monetary instability. As traditional 'safe' assets like long-term bonds waver, institutions are increasingly considering digital assets as a viable alternative.