In the tumultuous waves of cryptocurrency, Trump's name once again becomes the global focus. This time, he is not making shocking statements as a president, but has sparked a heated discussion about Bit through his Trump Media and Technology Group (DJT). From the initial rumored $3 billion financing plan to the final confirmed $2.5 billion Bit vault strategy, DJT's moves resemble a carefully choreographed market drama, triggering stock price volatility and a brief surge in Bit prices. Behind this, Trump's wealth empire, policy trends, and institutional investors' quiet positioning are adding more drama and complexity to this adventure. Is this a far-sighted move towards "financial freedom" or a high-risk gamble?

From Rumor to Denial to Confirmation: A Psychological Market War

The story begins with an explosive rumor. According to the Financial Times, DJT planned to raise $3 billion through a hybrid of stock and convertible bond issuance to purchase Bit and other cryptocurrencies. This news was like a bombshell, quickly igniting market enthusiasm. Bit prices briefly broke through $110,500 after the news, creating a recent high, with investors seemingly anticipating another bold attempt by the former president in the crypto realm. However, DJT quickly denied the report, calling it "inaccurate", attempting to calm market volatility.

[The rest of the translation follows the same professional approach, maintaining the specified translations for specific terms]Trump's wealth structure reveals his preference for high-risk assets. From real estate to golf clubs, and now to Bit, his investment logic has always revolved around the possibility of high returns. This adventurous spirit is both the key to his success and a potential risk point. The short-term fluctuations in Bit price and DJT stock price remind us that the outcome of this bet remains undecided.

Dual Support from Policies and Institutions

DJT's Bit treasury plan is not an isolated event, but intertwined with broader policy and market trends. At the 2025 Bit Conference, US Senator Cynthia Lummis revealed that the Trump administration supports the "Bit Act", planning to purchase 1 million Bits within five years, funded by existing resources from the Federal Reserve system and Treasury. This policy signal undoubtedly endorses the legitimacy and strategic value of Bit. Lummis also mentioned that the Trump administration team is advancing legislation on digital asset issues such as stablecoins, market structure, and Bit strategic reserves, indicating the rapidly increasing importance of cryptocurrency at the policy level.

Meanwhile, institutional investors' actions further fuel the Bit craze. Global asset management giant BlackRock, with its $11.5 trillion in assets under management, has recently significantly increased its holdings of the spot Bit ETF (IBIT). Since its approval in January 2025, IBIT has attracted over $10 billion in funds, becoming one of the most popular Bit ETFs. BlackRock's managing director's public statement—"Bit's upside potential far exceeds gold"—not only ignited market enthusiasm but also provided a strong endorsement for Bit's long-term value.

BlackRock's increased holdings are not an isolated case. Market monitoring data shows that IBIT's capital inflows continue to rise, reflecting institutional investors' strong demand for cryptocurrency. This trend resonates with DJT's Bit treasury plan, jointly promoting Bit's mainstreaming. Imagine the market confidence when the world's largest asset management firm and a former president's business empire simultaneously bet on Bit? However, behind the confidence, risks still linger.

Game of Risks and Opportunities

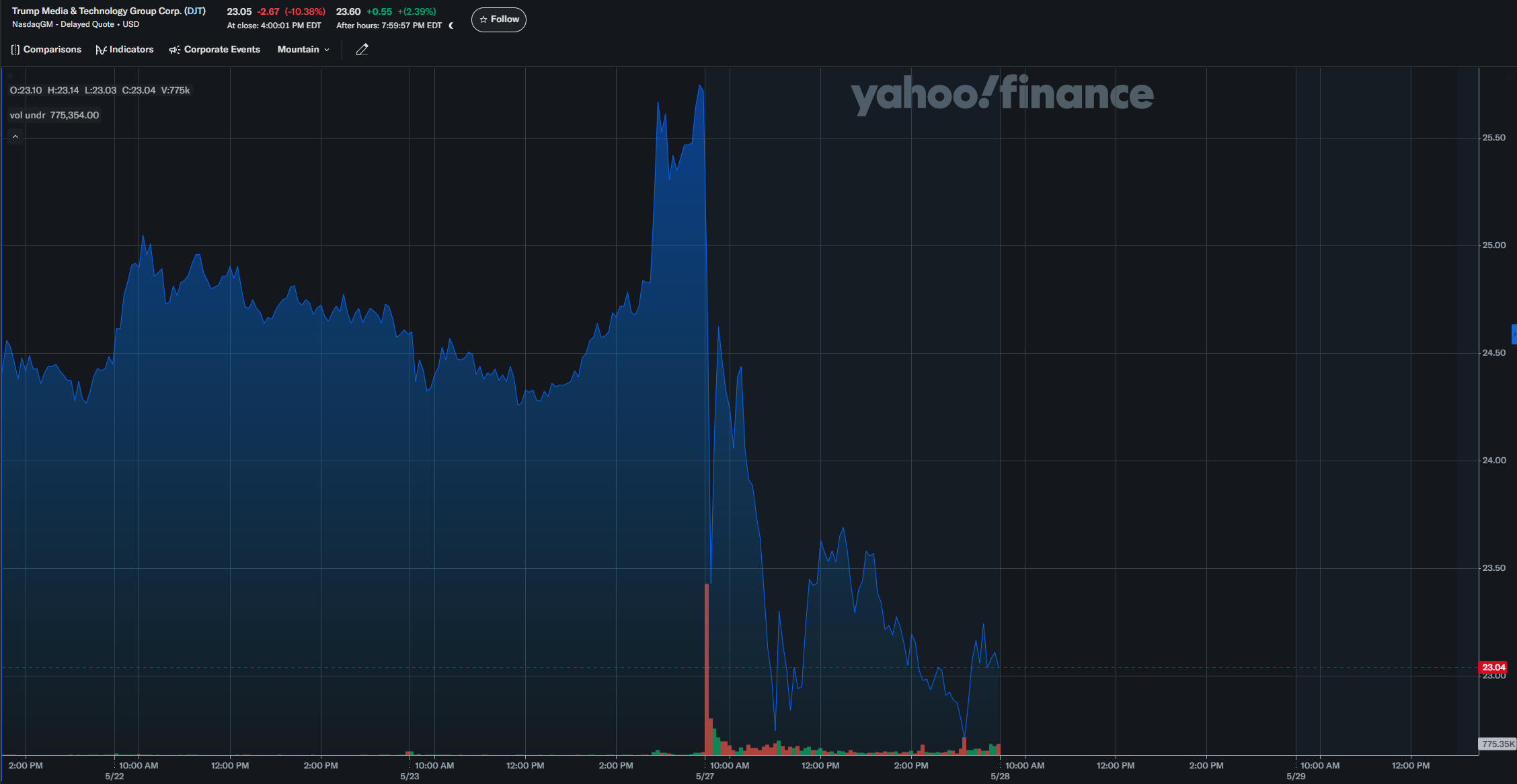

Bit's charm lies in its decentralized nature and long-term appreciation potential, but its volatility is equally daunting. DJT's $2.5 billion treasury plan, while demonstrating ambition, also comes with enormous market risks. Bit price briefly surged to $110,500 after the news was announced, then fell back to $109,000, showing the market's sensitivity to large capital inflows. DJT's stock price's dramatic fluctuation—rising before market opening and then dropping 12% shortly after—further reflects investors' uncertainty about this strategy.

From a macro perspective, Trump's "America First" stance and confrontational attitude towards traditional financial institutions may pose potential risks for DJT's future development. While Bit is viewed as the "ultimate tool of financial freedom", its price volatility and regulatory uncertainty could put pressure on DJT's balance sheet. Moreover, the implementation of the "Bit Act" still faces complex issues of legislation and funding sources, and policy uncertainty could further amplify market risks.

For ordinary investors, Trump's Bit gamble is both an opportunity and a warning. BlackRock's increased holdings and policy-level support indicate that Bit's long-term value is being recognized by the mainstream. However, short-term volatility and market uncertainty remind us to approach this crypto wave cautiously. DJT's $2.5 billion treasury plan may be just a microcosm of the cryptocurrency wave, and the real story is just beginning to unfold.

Conclusion: A Gambler's Game

From the $3 billion rumor to the confirmed $2.5 billion, from the stock price roller coaster to Bit's brief surge, Trump Media & Technology Group's Bit treasury plan is undoubtedly a highlight of the 2025 crypto market. This is not just a business adventure, but a game about financial freedom, policy direction, and market confidence. Trump's wealth empire provides the confidence for this adventure, with policy and institutional support adding to its aura, but the balance of risks and opportunities remains the biggest suspense of this bet.

On the cryptocurrency stage, Trump once again proves his presence. Is his choice a bold bet on the future or a high-risk gamble? Perhaps only time will provide the answer. For us observers, every twist of this adventure is worth holding our breath.