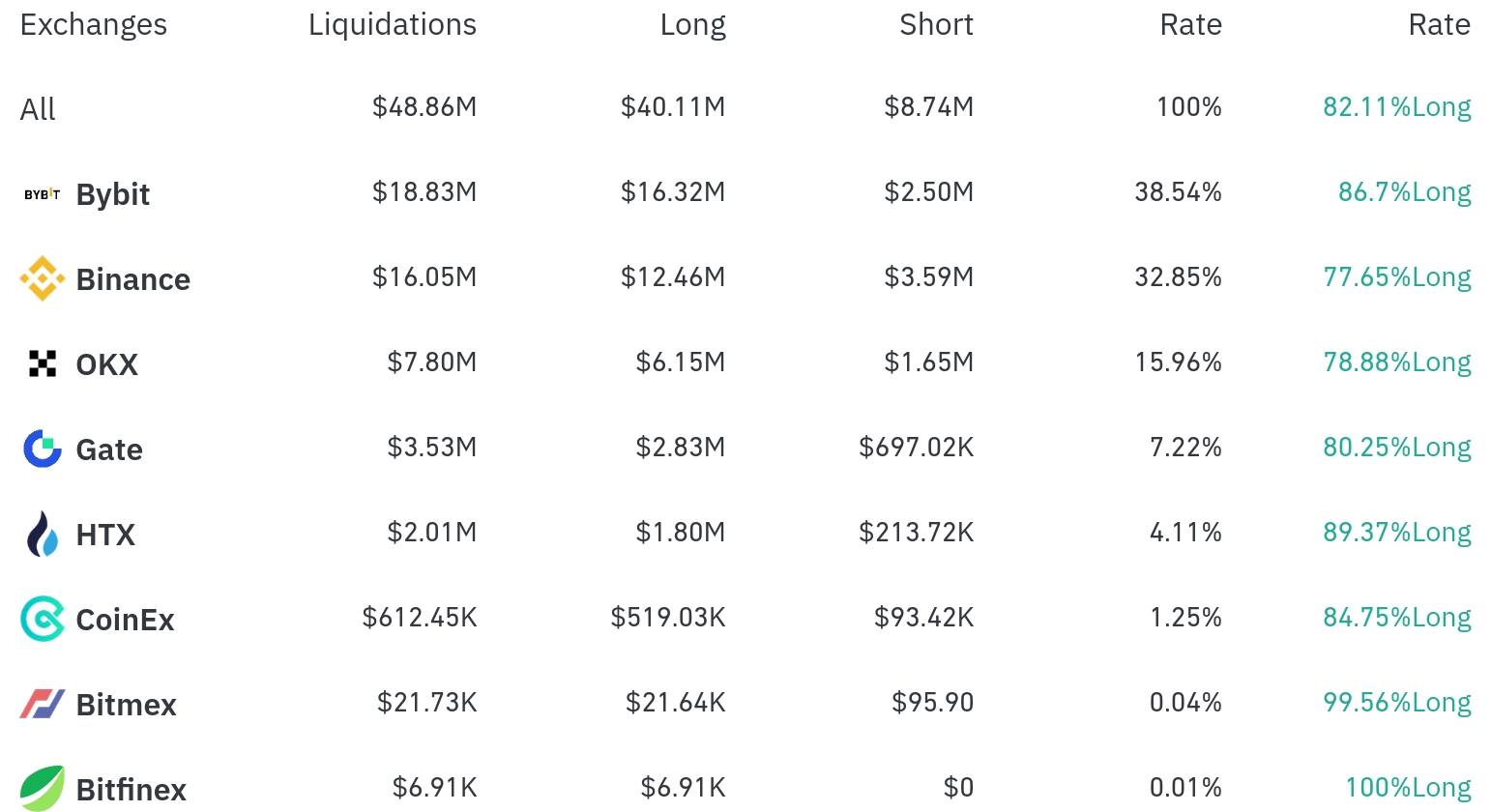

In the past 24 hours, a large-scale position liquidation occurred in the cryptocurrency market. According to the currently aggregated data, long positions dominated, and significant liquidations were made across the market.

Over the past 4 hours, Bybit had the most position liquidations, with a total of $18.83 million (38.54%) liquidated. Among these, long positions accounted for $16.32 million, or 86.7%.

Binance was the second-highest exchange with liquidations, with $16.05 million (32.85%) of positions liquidated, of which long positions comprised $12.46 million (77.65%).

OKX saw approximately $7.8 million (15.96%) in liquidations, with a long position ratio of 78.88%. Following that, Gate recorded $3.53 million (7.22%), and HTX recorded $2.01 million (4.11%) in liquidations.

Notably, on BitMEX, 99.56% of liquidated positions were long positions, with almost all liquidations concentrated on long positions.

By coin, Bitcoin (BTC) had the most liquidated positions. Approximately $53.65 million in Bitcoin positions were liquidated over 24 hours, with up to $9.95 million in long positions and $830,000 in short positions liquidated over 4 hours. The current Bitcoin price is $107,239, down 2.06% over 24 hours.

Ethereum (ETH) saw about $50.44 million in positions liquidated over 24 hours, with $5.76 million in long positions and $2.8 million in short positions liquidated over 4 hours. The current Ethereum price is $2,631, down 1.36% over 24 hours.

Solana (SOL) had approximately $9.4 million liquidated over 24 hours, with its current price at $170.51, down 4.20% over 24 hours.

Among other major altcoins, XRP ($9.34 million) and TRB ($5.75 million) saw significant liquidations.

Particularly, the HYPE Token experienced a substantial liquidation of around $1.2 million along with a significant 9.18% price drop over 24 hours, and the FARTCO Token saw a considerable liquidation of $3.37 million with an 8.51% price decline.

The TRUMP Token saw approximately $1.68 million in liquidations over 24 hours, accompanied by a 4.46% price drop. This is analyzed as a market response related to recent US election news.

Doge saw $5.6 million in liquidations over 24 hours with a 3.83% price drop, with about $750,000 in long positions liquidated over 4 hours.

This large-scale liquidation occurred alongside a weak trend in the cryptocurrency market, bringing significant losses particularly to investors holding long positions. With continued market volatility, investor caution is necessary.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>