The options market has issued a warning signal: Bitcoin's implied volatility skew - the difference in implied volatility between call and put options - has dropped to nearly -10%, indicating that the market is pricing call options far higher than put options. In other words, traders are actively chasing upward momentum rather than hedging against downside risks. In our experience, such extreme skew levels often reflect a market at an extremely optimistic top, which is a typical contrarian signal.

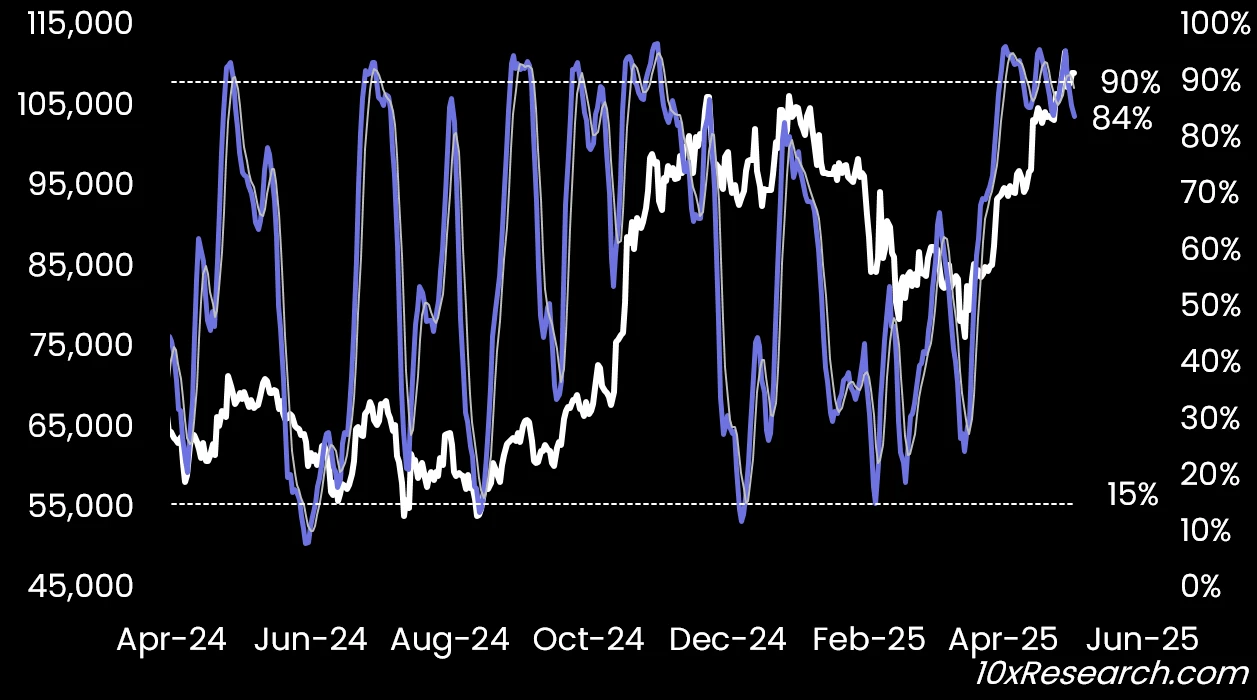

Our multiple technical reversal indicators (such as Relative Strength Index RSI and Stochastic Oscillator) are currently showing overbought signs and beginning to reverse downward, forming a divergence with Bitcoin's price. The current gap between Bitcoin's price and our trend signals has reached $20,000, and this gap is narrowing, indicating weakening market momentum. We maintained a bullish view since mid-April (which was a contrarian view at the time), but now believe it is wiser to reduce risk exposure and wait for a more favorable re-entry opportunity.

Chart description: Bitcoin (left axis) and Stochastic Oscillator (right axis) - Divergence is expanding

While the past six weeks' gains are indeed impressive, the core of trading is risk-adjusted return management, not blindly chasing trends. At the current overvalued levels, the last batch of Japanese retail investors buying Metaplanet may bear a heavy cost.

Conclusion:

Now is the time to lock in partial profits. We recommended buying a put spread on MicroStrategy last Friday, and the stock has since dropped 7.5%, with the strategy achieving a 66% return. Next, Metaplanet appears to be the potential target for valuation correction in the coming months. Shorting it against Bitcoin is an effective way to express this judgment.

From a broader market perspective, as June approaches and the traditionally low-volume summer period arrives, we believe Bitcoin itself may enter a period of consolidation. At this stage, the focus should be on profit-taking and risk control, rather than blindly chasing highs.