The market sentiment index based on Upbit, the most used platform by domestic individual investors, is maintaining a 'neutral' range. Considering the slowdown in trading volume and concentration in certain assets, the market still appears to be weighing its short-term direction.

According to Upbit Data Lab as of 3:45 PM, the 'Fear and Greed Index' based on Upbit remains at 'neutral (53)', the same as the previous day. Compared to 'neutral (57)' a week ago, the short-term optimistic sentiment has somewhat weakened.

This index is calculated based on Upbit's digital asset prices and trading volume, distinguishing market sentiment in 5 stages from 'extremely fearful' to 'extremely greedy'. It captures the domestic market sentiment by indirectly reflecting not only price movements but also investor emotions and participation intensity.

In terms of asset-specific sentiment indices, the assets with the highest 'fear' sentiment are ▲XEM (14) ▲PYTH (19) ▲STMX (22) ▲AERGO (22) ▲LAYER (23) in order. STMX saw a significant increase in fear sentiment, dropping 14 points compared to the previous day.

The assets with the strongest 'greed' sentiment are ▲SNT (97) ▲SAFE (94) ▲MASK (81) ▲VANA (74) ▲ICX (72) in order. SAFE showed strong buying sentiment, surging 20 points compared to the previous day.

'Fear' assets reflect a state of low investment interest, accompanied by price declines and decreased trading volume. Some may be interpreted as potential bottom-buying opportunities as they enter oversold zones. 'Greed' assets are characterized by strong upward trends and increased trading volume, which may require cautious assessment due to high expectations and potential overheating concerns.

The Upbit premium (based on USDT) recorded 1.55%. This means that the trading price on Upbit is on average 1.55% higher than the global average, indicating that buying sentiment still remains relatively dominant in the domestic market. However, it dropped by 0.28 percentage points compared to the previous day, showing some cooling of buying enthusiasm.

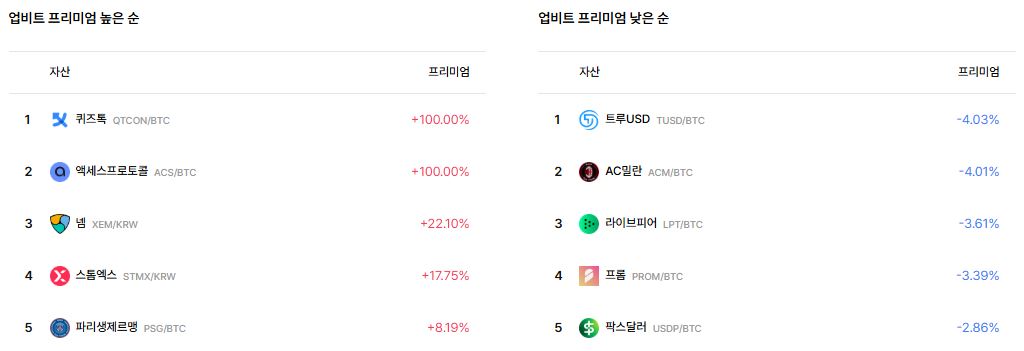

The assets with the highest premium today were ▲QTCON and ▲ACS, both recording 100% premium. This is interpreted as a result of concentrated demand for assets with limited circulation outside Upbit.

Among actively traded assets, ▲XEM (+22.10%) and ▲STMX (+17.75%) showed high premiums. Both assets are in the 'fear' sentiment index range, likely influenced by bottom-buying inflows. ▲PSG also drew attention, recording an 8.19% premium.

In contrast, ▲TUSD (–4.03%), ▲ACM (–4.01%), and ▲LPT (–3.61%) remained in the reverse premium zone, trading at prices lower than the global average.

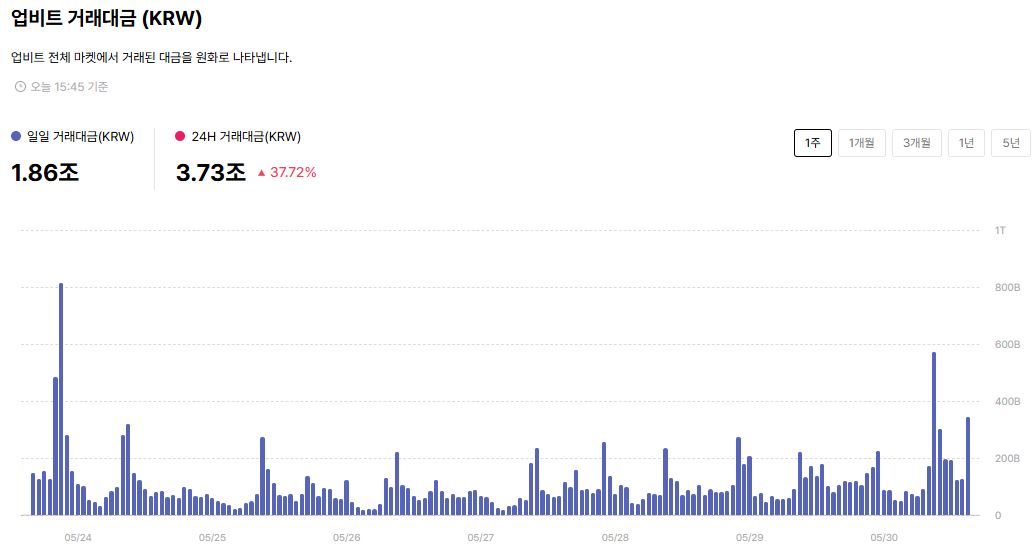

In terms of Upbit market trading volume in Korean won, the daily trading volume from midnight to 3:45 PM was 1.86 trillion won, with the cumulative trading volume over the past 24 hours at 3.73 trillion won. The 24-hour trading volume increased by 37.72% compared to the previous day.

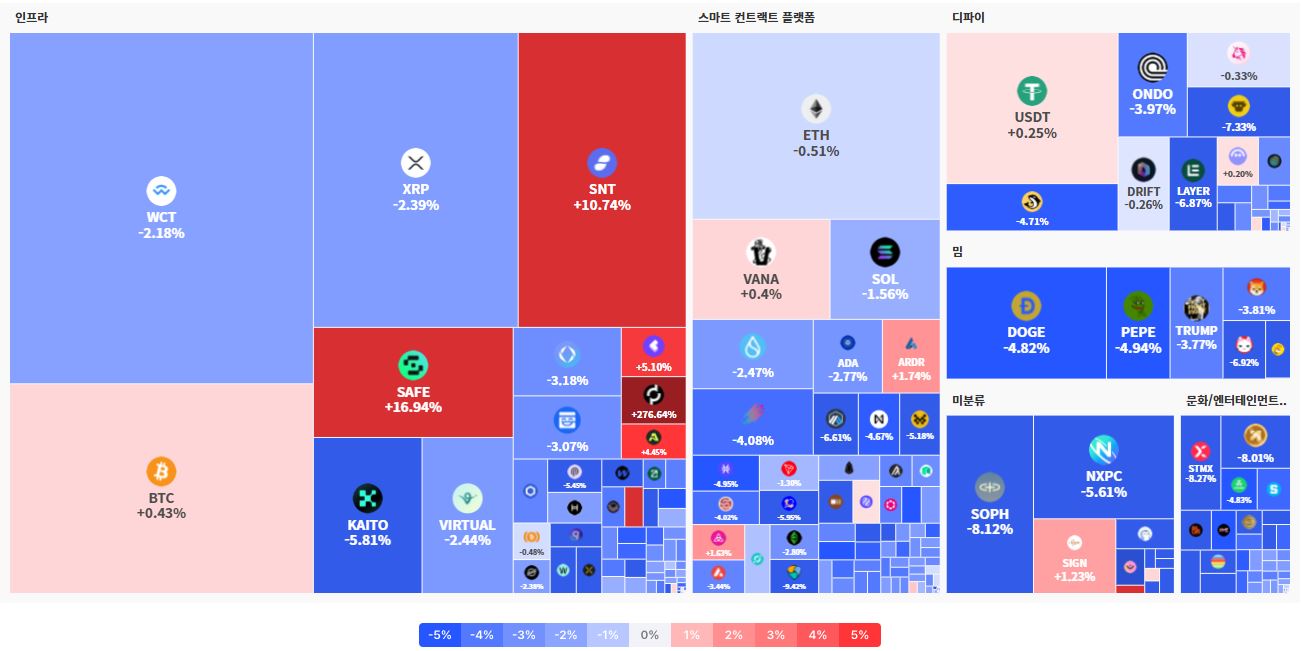

In terms of thematic trading flows, trading volume was concentrated in 'infrastructure' and 'smart contract platform' areas.

In the infrastructure theme, ▲WCT (–2.18%) and ▲SNT (+10.74%) had significant trading volumes. Particularly, SNT was ranked among the top 'extremely greedy' assets in Upbit's sentiment index, reflecting strong buying sentiment. ▲SAFE (+16.94%) also attracted investor attention with the highest rise in the infrastructure theme.

In the smart contract platform, ▲ETH (–0.51%) was actively traded as the central asset. ▲SOL (–1.56%) also showed adjustment, while ▲VANA (+0.4%) displayed a limited upward trend. The theme was generally weak, with only a few assets maintaining strong performance.

In the DeFi sector, ▲ONDO (–3.97%), ▲DRIFT (–0.26%), and ▲LAYER (–6.87%) mostly showed poor performance. In the meme theme, representative assets ▲Doge (–4.82%) and ▲Pepe (–4.94%) both saw reduced trading volumes, and ▲TRUMP (–3.77%) also experienced trading volume contraction.

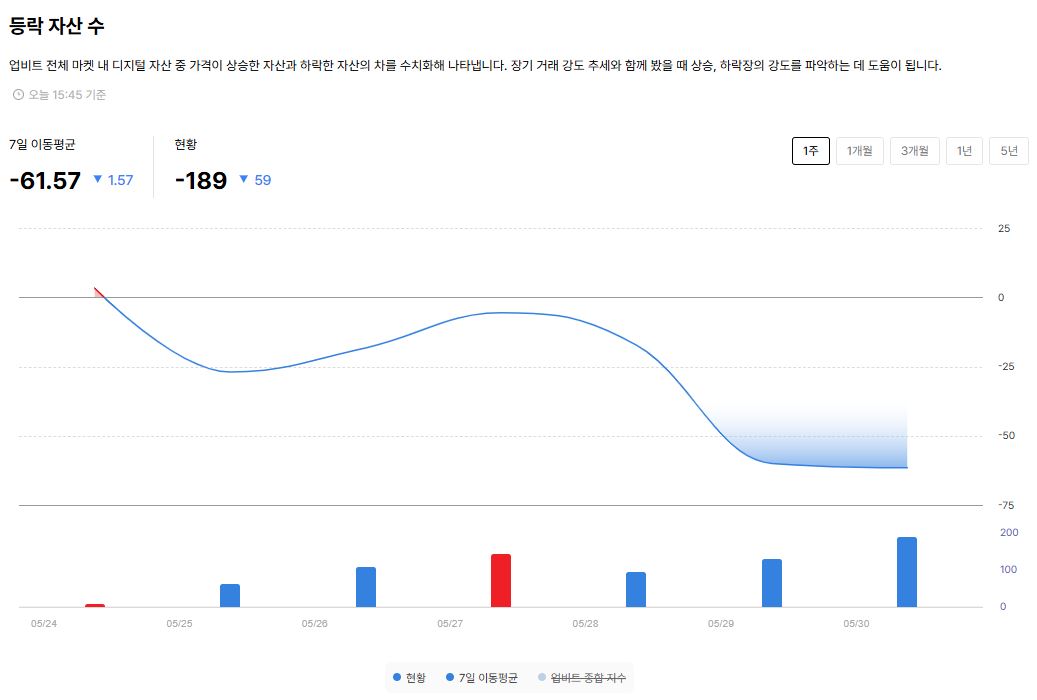

In the Upbit market, declining assets continue to overwhelm rising assets. The number of assets by change is –189, indicating 189 more declining assets than rising assets.

The 7-day moving average also recorded –61.57, clearly showing the dominance of declining assets over the past week. This suggests that despite short-term rebound attempts, investment sentiment improvement remains limited.

The 'Long-term Trading Intensity Trend' indicator, which compares the trading volume ratio of rising and declining assets in the Upbit market, was recorded at 0.08.

It dropped by 17.98% compared to the previous day, significantly below the baseline of 1. This means that trading is more concentrated in declining assets, suggesting a recent contraction in buying sentiment and overall deterioration of investment sentiment.

This indicator is a supplementary metric showing the concentration of trading on rising assets, with values closer to 1 indicating a strong bias towards rising assets.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, unauthorized reproduction and redistribution prohibited>