The global Bitcoin market continues to see exchange outflows. While trading volume recovered during the US time zone, prices remain within a box range.

As of the 30th, according to CoinGlass, the total Bitcoin balance of major global exchanges is approximately 2,164,361.03 BTC.

Over the past 24 hours, a net outflow of -10,409.82 BTC was recorded. In the past week, there was a net inflow of +7,219.19 BTC, while in the past month, a net outflow of -42,974.83 BTC was observed.

Coinbase Pro holds 654,639.69 BTC, still maintaining the largest Bitcoin balance. It experienced a daily net outflow of -8,607.00 BTC, with weekly outflows of -16,533.11 BTC and monthly outflows of -47,999.34 BTC, indicating a continued long-term outflow trend.

Binance currently holds 564,024.14 BTC, with a daily net inflow of +405.51 BTC, weekly inflow of +27,193.36 BTC, and monthly inflow of +18,767.78 BTC, showing a clear short-term buying trend.

Bitfinex holds 396,393.48 BTC, with a daily net inflow of +788.49 BTC. While experiencing a weekly net outflow of -2,322.01 BTC, it saw a monthly net inflow of +2,882.79 BTC, indicating a change in direction.

Largest Daily Net Inflows ▲Bitfinex (+788.49 BTC) ▲OKX (+711.24 BTC) ▲Binance (+405.51 BTC)

Largest Daily Net Outflows ▲Coinbase Pro (-8,607.00 BTC) ▲Kraken (-3,787.62 BTC) ▲Gemini (-490.91 BTC)

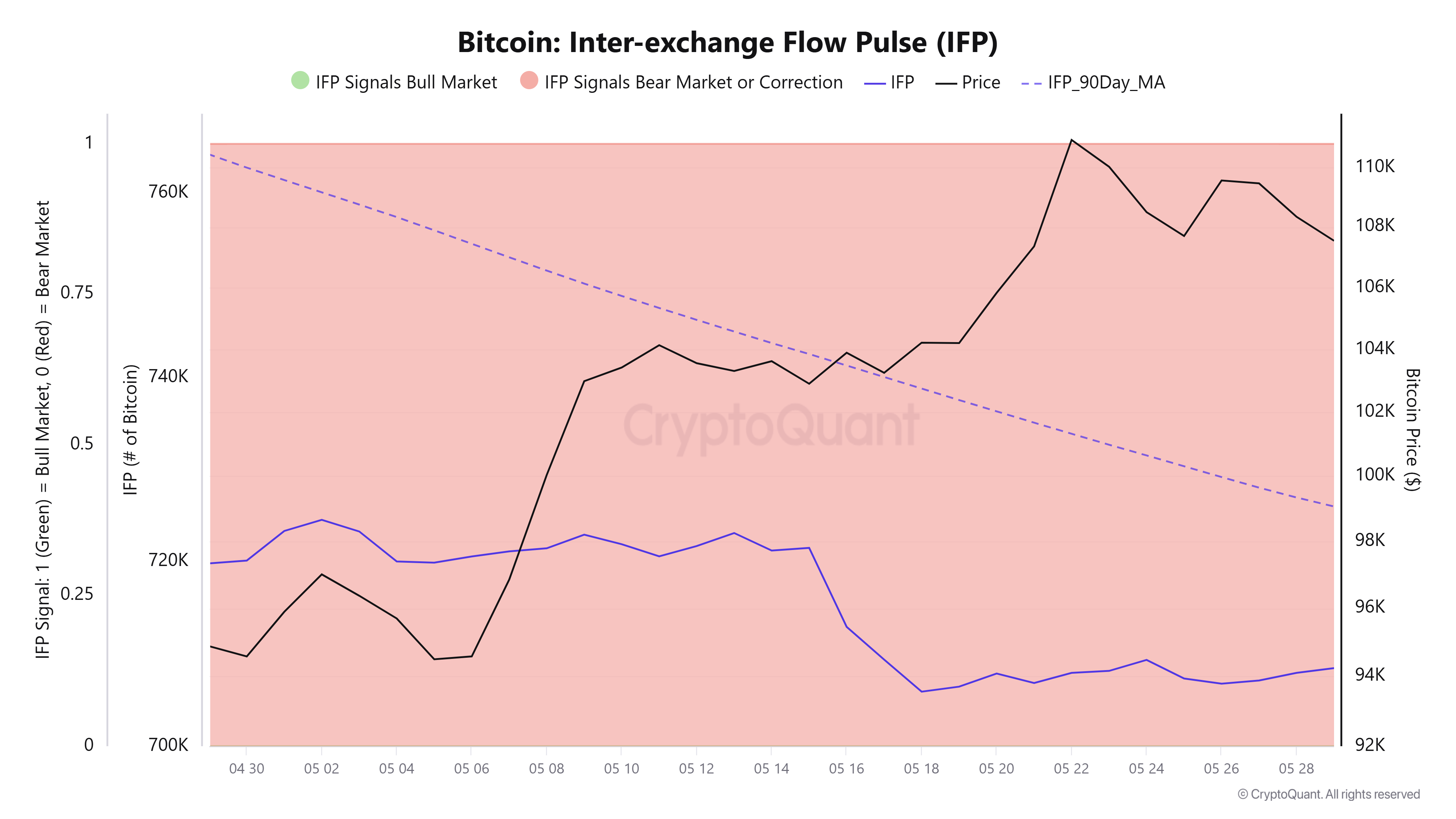

According to CryptoQuant, the IFP (Inter-exchange Flow Pulse) indicator was 708,479.3 BTC as of the 29th, slightly increasing from the previous day's 707,966 BTC.

The IFP was below the 90-day average of 726,029.7 BTC, indicating that inter-exchange liquidity remains below average. The 'Bear Market or Correction' signal was maintained from the previous day.

The IFP is a representative liquidity indicator that assesses market vitality through Bitcoin movement between exchanges. Generally, when above average, it signifies active buying movements that form the basis of a bull market, while below average suggests a more cautious sentiment.

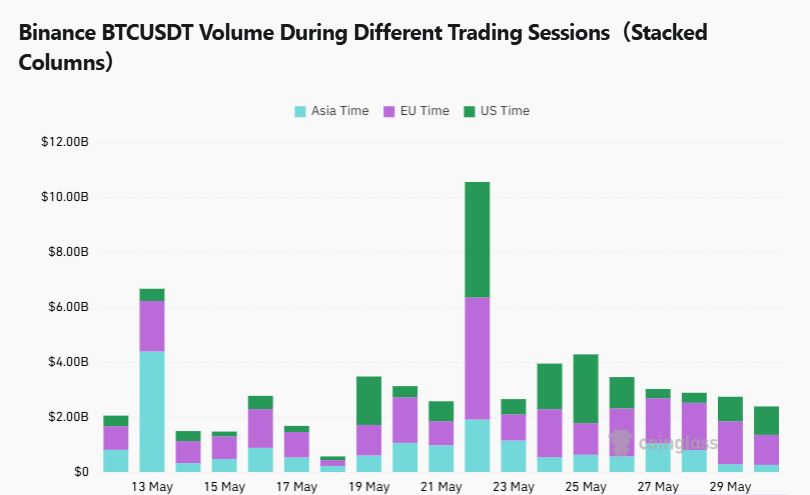

According to CoinGlass, the Binance BTCUSDT trading volume on the 29th was $258.37 million in the Asian time zone, $1.09 billion in the European time zone, and $1.03 billion in the US time zone.

Compared to the previous day (28th), Asian volume decreased by -8.7%, European volume significantly dropped by -30.1%, while US volume rebounded relatively strongly by +15.4%. The European time zone saw a significant reduction in its previously strong trading dominance, transitioning to an adjustment phase.

Prices continue to fluctuate within a box range without showing a clear movement, resulting in overall trading activity remaining at a relatively low level.

Meanwhile, the US time zone showed a notable increase in trading volume compared to the previous day (893.27 million), indicating some revival of buying demand. In contrast, the Asian market continues to maintain a wait-and-see approach, with accumulated short-term buying fatigue.

The European time zone entered a temporary consolidation phase with significantly reduced liquidity. However, given its recent strength, it's worth noting the potential for trading leadership to be distributed to other regions.

Get news in real-time...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, unauthorized reproduction and redistribution prohibited>