On May 30, the last day of the Bitcoin 2025 Conference, the market once again experienced a significant drop, fulfilling the conference's curse.

Bitcoin briefly fell below $105,000 this morning, reaching a low of $10.30. Ethereum also dropped from its high of $2,,788 to a low of $2,475. Thecoin saw a correction, with some altcoins like BERA hitting historical lows.

VX: TZ7971

In the macro market, crypto stocks COIN and MSTR both declined after hours. Regarding Federal Reserve rate cuts, opinions remain uncertain. Fed's Daley on Thursday that policymakers might still potentially cut rates twice this year, year rates should remain stable to ensure inflation reaches the s 2% target. Daley emphasized that long above the target and uncertain, inflation will remain a focus due to the market robust condition. Additionally, the U.S. Trade Court's Wednesday ruling blocking Trump's tariff measures was overturned by the appeals court on Thursday, highlighting, trade policy uncertainty that makes many businesses and the Fed uneasy.

Is this pullback a healthy short-term correction or the beginning of a prolonged consolidation?

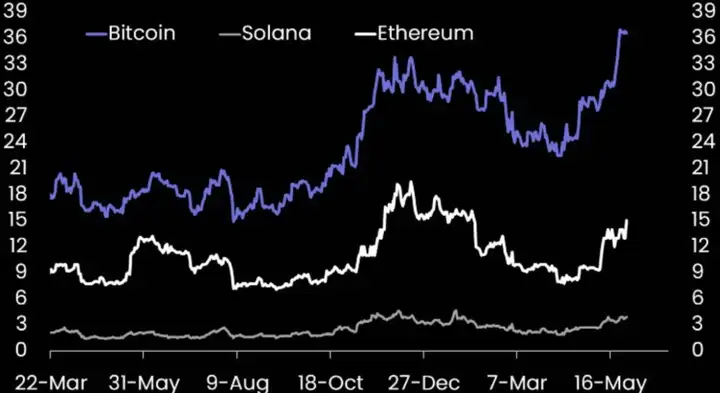

< h3>MinorBack Correction Doesn't Mean Market End, Risk Structure Remains SoundSince April's low point, futures open interest has significantly risen. Although Solana hasana has been relegated to second place due to the cooling of meme coins and Pump.fun, Bitcoin's open open interest has shown notable growth. This surge might reflect a shift in risk appetite,,, after recent reversals in'siff Bitcoin continues to play a dual role of "risk appetite" and "safe haven", increasingly aligning with the ""digital gold" narrative.

Open interest currently seems to be stabilizing, which might confirm traders are starting beginning to take take plan re-entry at lower levels.

Enters Consolid<3>After hitting a historical high in January, Bitcoin experienced a 32% correction but subsequently rebounded over 50%, creating a new peak of $111,880, and has now entered a healthy consolidation phase. Strong ETF capital inflows, spot market participation surge, and positive "realized net capital growth have driven structural buying in the market, rather than excessive speculation. macro risk appetite declining, such as as potential U.S. 50% tariffs on European imports, Bitcoin remains Bitcoin remains resil—showing no significant drop during deleveraging and profit-.

Thisience market attention to Bitcoin's evolinto a "macro-sensitive, belief belief-", with its trading behavior now more closely linked to global liquidity trends rather than retail sentiment.

Looking ahead, whether Bitcoin can maintain consolidation above short-term holder cost around $95,000) key.. In the past month, short-term holders have realized over $11.4 billion in profits, so some selling pressure might exist short-term, but structural demand demand demand. ETF buying strengthility, spot market premium premiums all market mat, and once macro environment clarifies, further increases might follow.