The new U.S. Treasury Secretary is Bessent, who previously worked with George Soros and helped break several different sovereign currency pegging mechanisms. He clearly understands what needs to happen economically for the U.S. to succeed in facing all these challenges.

This is a photo of Bessent doing a sales presentation. I believe some of you have seen the movie 'Glengarry Glenn Ross' and that iconic scene where... I forgot the actor's name, he stands there telling salespeople ABC - Always Be Closing. So what is Scott Bessent's job? Every time you see him on TV, imagine him as a used car salesman pitching something to you. What is he selling? Bonds. His job is to sell bonds because his boss - the U.S. government - needs to finance itself.

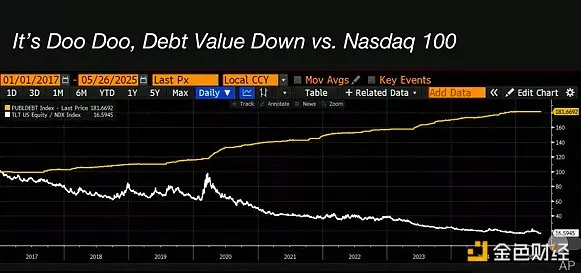

So why are bonds a bad investment? The yellow section here is a chart of total U.S. national debt starting from 2017. You can see it's benchmarked at 100, and the debt supply has risen about 80%. I then compared this index with TLT (ETF tracking long-term Treasury bonds) divided by the Nasdaq 100 index. So if the chart goes down, it means Nasdaq outperformed bonds. From 2017 to now, Nasdaq has outperformed bonds by about 80%. So yes, you might have made money from bond coupon yields, but if you had invested in the stock market, you would have earned 80% more.

Let's look at the same chart compared to gold. Similar situation. If you had bought gold instead of U.S. Treasury bonds, your performance would be about 80% better. Obviously, this isn't a gold or stock conference. We're talking about Bitcoin here. So how does it compare to Bitcoin? That's even more striking. By buying Bitcoin instead of bonds, your performance would also exceed bonds.

Therefore, although many investment professionals might stand up and say, you know, I think the bond market will perform well in the next year or two, and so on, that might be true. You might really make money by holding bonds, but you would make more money by holding something else. The goal of investing is to maximize your earnings in the current environment, and holding government bonds is not a good trade.

Now, this obviously comes back to my message that Bessent's job is very difficult, because as more and more investors read these charts and understand that if they continue to hold government bonds, their performance will be far inferior to what they could have earned for themselves and their clients, more government action will be needed to ensure the U.S. government can finance itself. So it's clear that after the Trump administration took office, they talked about the U.S. government having spending issues.

U.S. Debt Deficit and Inflation

This is a chart from the Peterson Institute. The U.S. fiscal year starts in October. We can see that as of this March, despite many efforts and rhetoric to control excessive U.S. government spending, our expenditure is already higher in fiscal year 2025 than in fiscal year 2024, which was already a record deficit year.

It's obviously been widely discussed in the media how certain people - we'll mention that person later - would control government spending by eliminating fraud and abuse. We discussed it for a while, and then the protagonist of this effort, that Doge "pioneer" Musk, disappeared. We haven't heard from him for a while because this is bad political maneuvering. Every dollar the government spends goes into someone else's pocket. If you stand up and say we're going to cut trillions of dollars in deficit, that would obviously negatively impact many people and businesses. We saw negative reactions from the media and individuals. Ultimately, I think politicians realized that hey, this isn't a good political strategy. Let's recall our "attack dog" and let him fade from public view to manage his private companies.

But this means that if they can't meaningfully reduce the deficit, how do you balance the books? Recently, Scott Bessent has been making media rounds, talking about how he's focused on growth. He's going all out pursuing growth. So what does this mean when you're facing massive deficits? It means you need nominal GDP growth rate to exceed your interest costs, which is very difficult unless you plan to increase credit in the economy.

Many of you here are Americans, or have spent a long time in North America. I've spent most of my adult life in Greater China. When you live in China, you understand that GDP or growth is merely the output of how much credit you're willing to inject into the economy. If we want to understand the Trump administration - I think any administration facing these mathematical facts - we must understand that this economy depends on credit. So if you're willing to inject more credit into the system, you can achieve any growth target you want. So if Bessent says they want 6% or 7% nominal GDP growth, fine, how much credit are you going to create? We want to know how much credit they plan to create, because this is ultimately why Bitcoin outperforms all other assets when priced in fiat currency.

So how do we go beyond the 7% persistent deficit? What can they do? Typically, authorities would blow another financial bubble. Perhaps that's Bitcoin and crypto. Politicians take a very loose stance saying: "Hey, we hope our crypto brothers and sisters become very wealthy, pay capital gains tax, you know, consume massively and boost economic performance." They can encourage the banking system to lend to the real economy, which I called "QE for poor people" in an article I wrote months ago. Basically, if the banking system isn't doing financial engineering but using its balance sheet to lend to ordinary companies, this would create jobs and economic growth.

Now, the problem with these two things is inflation. Inflation is necessary for balancing the balance sheet. I know this is an unpopular word in politics and economics, but inflation is necessary for the government to bear its massive debt. So we will face inflation, and obviously everyone here understands that Bitcoin is the best hedge against this. But we need to spread this message worldwide.

Bitcoin's Path to $1 Million

Finally, I want to talk about a few things. Bitcoin's path to $1 million, I believe, primarily has three aspects.

First is capital controls and tariffs. I recently wrote an article deeply exploring why I think tariffs are bad political tools because they encourage commodity inflation and empty shelves, which ordinary Americans don't like. But you can achieve the same economic rebalancing goals through capital controls. So we're starting to see some fringe economists - who will soon become mainstream - discussing how they can cancel certain tax benefits for foreigners investing in the U.S. and redistribute this income to voters or use it to buy specific-term government bonds.

The second thing is the Supplementary Leverage Ratio (SLR) exemption, which I'll elaborate on later. Scott Bessent has talked about this in multiple interviews, and he recently even strengthened his rhetoric in Bloomberg and Fox News interviews, discussing how he believes this ratio will be exempted this summer, just like large banks could leverage infinitely to buy government bonds during the COVID-19 pandemic.

Lastly, an increasingly interesting area is Fannie Mae and Freddie Mac, these government-sponsored enterprises (GSEs), which if allowed again, would be able to inject massive funds into the mortgage market.

Let's look at these "three horses". "Foreigners must pay" is a good political strategy. If you want to tell voters "I will give you something", if someone else pays, that's obviously the best. Politics around the world operates this way. As early as 1984, because the US government encountered another problem, the same problem: how do we get people to buy our debt? At that time, the yield of 30-year Treasury bonds was around 12%. They said: "Hey, why don't we exempt foreign bondholders from withholding tax?" Now, if you are an American, all interest you receive from holding government bonds is taxed at a specific rate, I think between 20% and 30%. And now, if you are a foreigner, you don't need to pay this tax.

So now there are discussions about canceling this exemption for several purposes. First, by essentially taxing income earned by foreigners, this can raise over one trillion dollars in ten years. Now, obviously, if you are taxed, you might not want to hold government bonds. So one idea is, can we set a very low tax rate for holding long-term government bonds - these are things Bernanke finds hard to sell - while imposing high taxes on government bonds (short-term bonds) - these are cash-like instruments you might hold in a money market account. Everyone wants this, everyone wants a high-yield cash account. So let's punish you for holding short-term bonds, but allow you to hold long-term bonds. This is a mild form of yield curve control. How do we get demand for long-term bonds from foreigners? Just change the tax rate.

Now, the ultimate question is who will replace foreigners as the marginal holders of debt. Obviously, this means they will print money to make up for the funds lost due to foreigners not investing in these debts.

Another thing: bank bond-buying frenzy. Supplementary Leverage Ratio (SLR), if you remember nothing else from this talk, please remember this. This is a way banks can buy bonds with unlimited leverage. There's something called Basel III, a very complex regulation developed after the global financial crisis, which did a wise thing. It said, hey banks, you don't have much capital, why don't we let you have more capital? So if I hold a bond, I must invest some of my own equity capital. This makes sense. This means US banks will face limits on the amount of US Treasury bonds they can buy. Remember, Bernanke needs to sell two trillion or more bonds each year, and he needs to ensure someone can buy these bonds. So if I cancel this exemption, it will allow commercial banks to buy government bonds with unlimited leverage. When they can do this, their profits will soar because the rates they pay on commercial deposits are very low. Obviously, a smiling Jaime Dimon very much wants this to happen. He has stated on multiple occasions that he thinks the banking system needs this exemption. As I always say, whatever Jamie Dimon wants, he gets.

Another thing, stablecoins are obviously a very hot topic recently. If you combine stablecoins or non-interest-bearing US dollar stablecoins issued by US banks in the market with SLR exemption, they basically become like Tether. They do not allow any fees to people investing in these stablecoins and using them for transfers, and then they can invest all this money into US Treasury bonds without capital requirements. This is essentially unlimited profit. So I expect that if this exemption passes - and I think it will - you will see large US banks working very consistently to issue "orange stablecoins" (referring to a stablecoin related to Bitcoin or a bank supporting Bitcoin), because this is a way for them to earn massive net interest income.

This is a post by Trump on "Truth Social" about Fannie Mae and Freddie Mac.

Basically, these are organizations that issued mortgages before the 2008 financial crisis. They were once very profitable. Now, what happens when you release Fannie Mae and Freddie Mac? Basically, you liberate them from government conservatorship. This deal has been discussed for nearly two years. If you bought at one dollar, these companies might now be trading at 11 dollars in the market. But by freeing them from conservatorship, they are allowed to use their equity capital, issue more debt with implicit government guarantees, and leverage it 33 times. Then they can buy up to 5 trillion dollars in mortgages. If you allow these two organizations to resume normal operations, this will be 5 trillion dollars of liquidity entering the market.

Simple Calculation

Where did I get the idea that Bitcoin might reach 1 million dollars?

- If we consider "quantitative easing for the poor" - banks providing more loans to the real economy - I estimate from now until 2028, there might be up to 3 trillion dollars in bank credit. The statistic to watch is the "Other Deposits and Liabilities" item on the Federal Reserve's weekly balance sheet, where we will see this happening.

- If banks are allowed to buy government bonds, an estimated 900 billion dollars of foreign demand might disappear. This must be compensated by commercial banks, which can now buy these bonds with unlimited leverage.

- Finally, releasing Fannie Mae and Freddie Mac will bring 5 trillion dollars of liquidity to the market.

- This will bring us close to printing 9 trillion dollars from now until 2028.

Let's put this in context. During the COVID-19 pandemic, the US stimulus package and all aid given to the financial sector totaled about 4 trillion dollars. From the low point in March 2020 to 70,000 dollars in November 2021, Bitcoin rose about 10 times.

Remember, price is determined by the margin. The marginal price is important, not the entire stock. So, if due to ETF demand we have a decrease in Bitcoin on trading platforms, and the money we print from now until 2028 is twice that of the COVID-19 period, then Bitcoin reaching 1 million dollars is very easy.