Meta Platforms, the parent company of Facebook and Instagram, overwhelmingly rejected a proposal to diversify corporate finances with Bitcoin.

This indicates that large tech companies are still maintaining a cautious attitude despite high interest in cryptocurrencies.

Meta Halts Bitcoin Financial Move

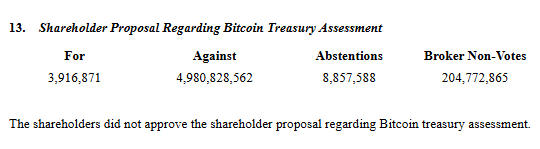

According to documents shared on X, the shareholder proposal received 3.9 million votes in favor and over 4.9 billion votes against. 8.9 million shares abstained, and 205 million shares were broker non-votes.

This vote was based on a proposal by Meta shareholder Ethan Peck earlier this year.

Peck urged Meta to convert some of its cash and bonds into Bitcoin, citing increasing institutional adoption and potential to outperform traditional financial instruments.

However, Meta's board had already rejected the proposal before the vote, stating they have strong financial management practices.

The board claimed there were no compelling reasons to consider Bitcoin, but did not completely exclude the concept of digital assets.

"We do not argue the merits of cryptocurrency investments compared to other assets, but believe the requested assessment is unnecessary given our existing corporate financial management processes," the Meta board stated.

Meta has not completely ruled out blockchain technology. The company is reportedly in early-stage discussions with cryptocurrency infrastructure companies about the possibility of integrating stablecoins to support global payments.

Meanwhile, this vote ended months of speculation that Meta would aggressively accumulate Bitcoin as a reserve asset.

The Facebook parent company's decision is also consistent with similar proposal rejections by Amazon and Microsoft.

Some speculation stemmed from Meta CEO Mark Zuckerberg's connection to cryptocurrency culture. One of his goats is named Bitcoin.

Notably, market analysts had suggested that Meta could lead a wave of new tech companies accepting digital assets.

"If Meta or Microsoft add BTC to their balance sheet, it would have a much bigger impact than smaller companies doing so. It's similar to how it felt real when Tom Hanks got COVID, even though cases were already increasing," explained Bloomberg ETF analyst Eric Balchunas.

As of May 2025, over 85 listed companies hold more than 804,000 BTC. Strategy leads with over 580,000 BTC.