Bitcoin (BTC) has just experienced a turbulent week, plummeting from a local peak of $110,000 to $103,000. As of the time of writing, the token is trading at around $103,707, down 3.88% over the past seven days.

VX:TZ7971

The biggest question now is: Has the market entered a deep adjustment phase?

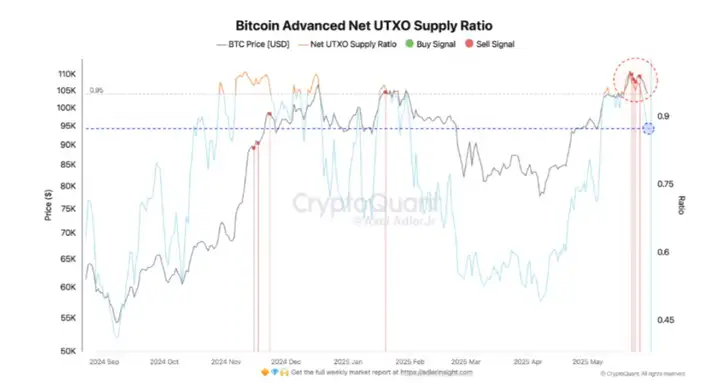

Four Consecutive Sell Signals

Bitcoin's net UTXO supply rate has just issued four consecutive sell signals - a signal that cannot be ignored. Meanwhile, the UTXO Ratio index is also plummeting. When these two indicators weaken simultaneously, the market is typically considered overheated.

In this context, investor profit-taking activities have significantly increased, while demand shows signs of decline relative to existing supply.

The simultaneous presence of these two factors indicates that the majority of BTC is in an unrealized profit state. This not only reduces the incentive for long-term holding (HODL) but also increasingly drives the trend of profit-taking.

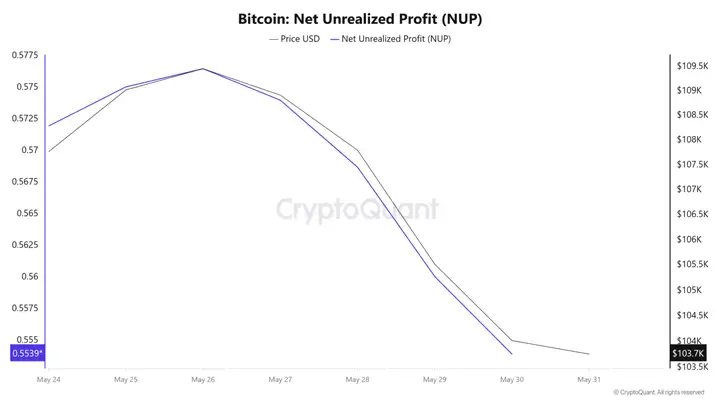

Specifically, Bitcoin's net unrealized profit index has dropped to 0.553, its lowest level in recent weeks.

This decline indicates that the profit margins for most investors are shrinking. This is a warning signal suggesting that the market's growth momentum is visibly weakening.

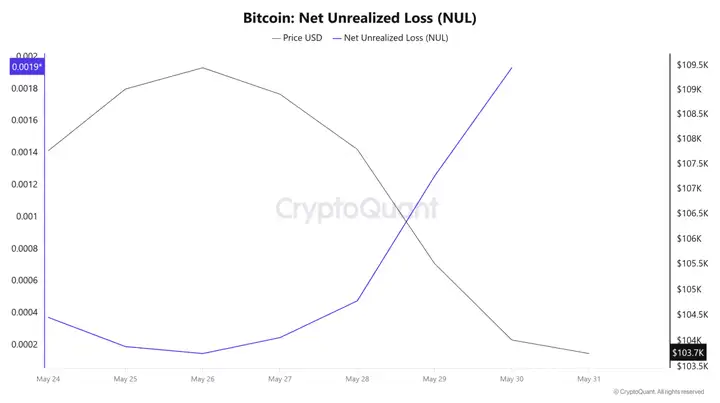

In fact, investors who purchased BTC between $104,000 and $112,000 are now in a loss-making position.

These two scenarios could lead to market capitulation, where investors panic sell, resulting in deeper declines. Under the current circumstances, the market needs a powerful "reset".

This "reset" opens up many potential scenarios for Bitcoin's price trend in the near future.

In the short term, given the current market conditions, BTC may fluctuate in the accumulation zone between $95,000 and $105,000 until the net UTXO supply ratio stabilizes around 0.85 - 0.9, indicating that selling pressure has cooled after a series of strong distribution signals.

However, BTC could also further retrace, falling back to the $92,000 area to completely clear the current overbought state.

Regardless of the situation, it's worth noting that Bitcoin's price still risks falling below the $100,000 mark before the market finds a sustainable balance.

Increasing Selling Pressure - Can $101,000 Hold?

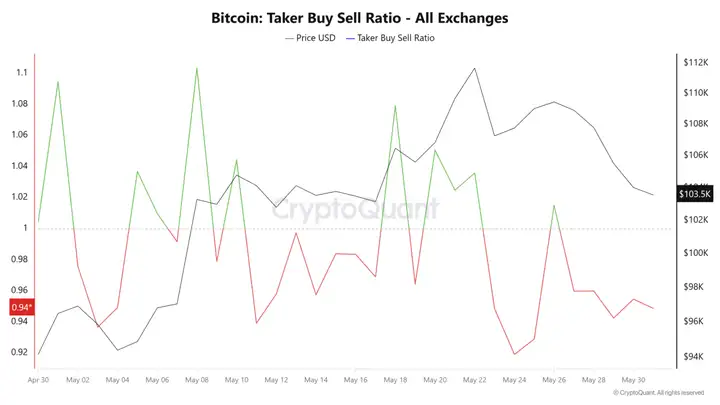

Notably, with unfavorable profit indicators, the buy-sell ratio of order takers has been negative for four consecutive days. This clearly reflects the market's pessimistic sentiment, with selling pressure visibly dominating.

If this negative trend continues, BTC may fall back to the support level of $101,488. If this price range cannot be maintained, breaking below the psychological threshold of $100,000 becomes inevitable. In this case, the next support area would be around $98,890.