After Bitcoin recorded a new all-time high in May, the major altcoin Ethereum reached its highest level in months at $2,789 on May 29 with increased trading activity.

However, as the market cooled down over the past two weeks, ETH's price movement has entered a consolidation within a narrow range. Nevertheless, market analysts are generally positive about ETH's outlook in June.

Ethereum Outlook Strengthens... Institutional ETF Inflows Surge

In an exclusive interview with Beincrypto, Wanchain CEO Temujin Louie said that Ethereum's prospects are "increasingly positive". This is attributed to the continued inflow of Ethereum ETFs and the recovery of network stability.

"Continued investment in Ethereum ETFs indicates that institutional interest remains strong and reinforces ETH's credibility as a long-term asset. Ethereum's recent Petra upgrade was also a great success, and internal disputes within the Ethereum Foundation have subsided. Investor confidence in Ethereum as a network and ETH as an asset is being restored," Louie mentioned.

Additionally, Chronos Research analyst Dominic John confirmed this optimism by emphasizing the impact of ETF inflows on the coin's price movements.

"ETH ETFs have significantly influenced recent price movements, indicating increased institutional interest that increases market liquidity while mitigating volatility. This wave of demand, combined with strong fundamental factors like stablecoin strength and robust on-chain signals, is limiting supply and supporting continued interest."

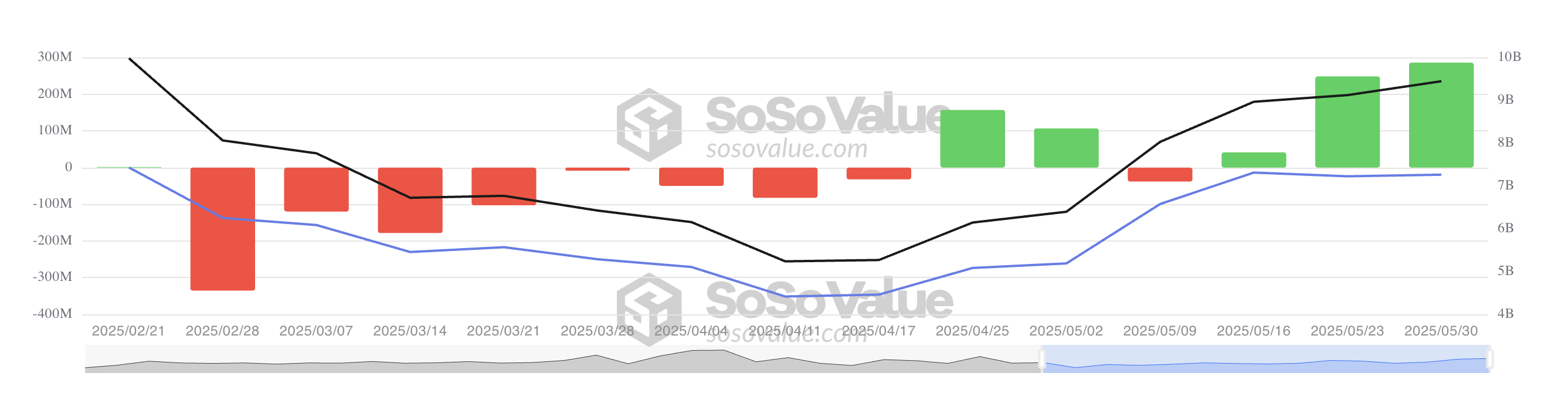

According to SosoValue, ETH-based ETFs have seen increased weekly inflows since May 16. This week, net inflows into these investment vehicles reached $286 million, highlighting growing confidence among institutional investors.

If this trend continues, it could create upward pressure on ETH's price, potentially breaking out of its narrow range in June.

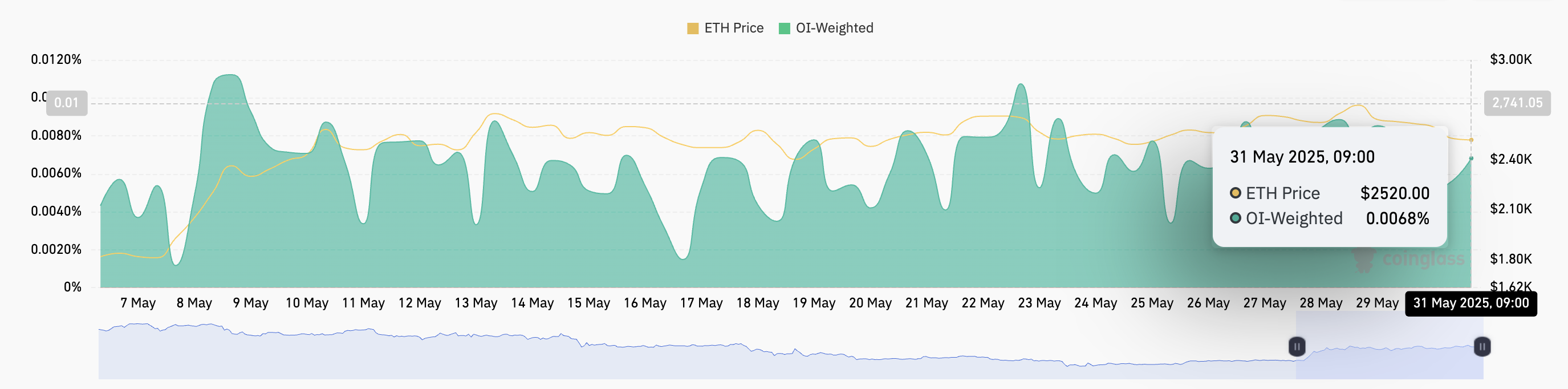

Furthermore, ETH's continued positive funding rate further supports this optimistic outlook. Currently, ETH's funding rate is 0.0068%, reflecting traders' willingness to pay a premium to maintain long positions.

The funding rate is used to ensure contract prices in perpetual futures contracts align with the underlying asset's spot price. When an asset's funding rate is positive, long position holders pay short position holders, indicating positive market sentiment and more market participants betting on price increases.

ETH's continued positive funding rate coincides with significant institutional inflows into ETH-based ETFs, adding another layer confirming market participants are positioning for potential additional gains in June.

Potential Pitfalls

Despite the positive outlook for ETH in June, these analysts warn that broader macroeconomic conditions could still pose risks to the asset's short-term performance.

Louie emphasized that while ETH's fundamentals are strong, major altcoins remain "vulnerable to macroeconomic conditions".

"Despite the current positive momentum, the entire cryptocurrency market remains speculative and can rapidly react to inflation data, interest rate expectations, Federal Reserve policy changes, and other external factors. While Ethereum's fundamentals are strong, short-term price trends can quickly reverse due to unfavorable macroeconomic trends," he said.

John also added that the upcoming June 17 FOMC meeting is noteworthy.

"Broader macroeconomic trends, especially inflation data and the Federal Reserve's interest rate policy, play a crucial role in price movements. A dovish shift, combined with continued ETF inflows, could reinforce ETH's breakout. However, a hawkish stance could inject new volatility, while fundamental strengths like stablecoin dominance, staking yields, and Layer 2 growth continue to signal the ecosystem's strength," he explained.

As ETH enters June with an optimistic outlook, investors should carefully observe macroeconomic signals, which are likely to shape ETH's price path in the coming weeks.