Author : Song Jiaji, Ren Heyi, Jishi Communication

summary

Stablecoins refer to cryptocurrencies whose value is anchored to various fiat currencies. As assets on the blockchain, stablecoins have the advantage of being deeply integrated with cryptocurrency projects (such as DeFi) at the blockchain infrastructure level and having very good network scalability. As traditional financial institutions in the United States, Hong Kong, China and other places have made efforts in the RWA field, the exploration and in-depth application of stablecoins in the traditional payment market have been promoted.

Stablecoins, to some extent, serve as a "pricing tool" in the cryptocurrency market, which is a supplement or even a substitute for traditional fiat currency transactions. Shortly after the birth of stablecoins, the most important trading pairs in the cryptocurrency market were stablecoin trading pairs. Therefore, stablecoins serve as "fiat currencies" in terms of trading tools and value circulation. In mainstream exchanges (including DEX decentralized exchanges), Bitcoin spot and futures trading pairs are mainly stablecoins such as USDT, especially futures contracts with larger trading volumes. The forward contracts of mainstream exchanges (futures contracts with USD stablecoins as margin) are almost all USDT trading pairs.

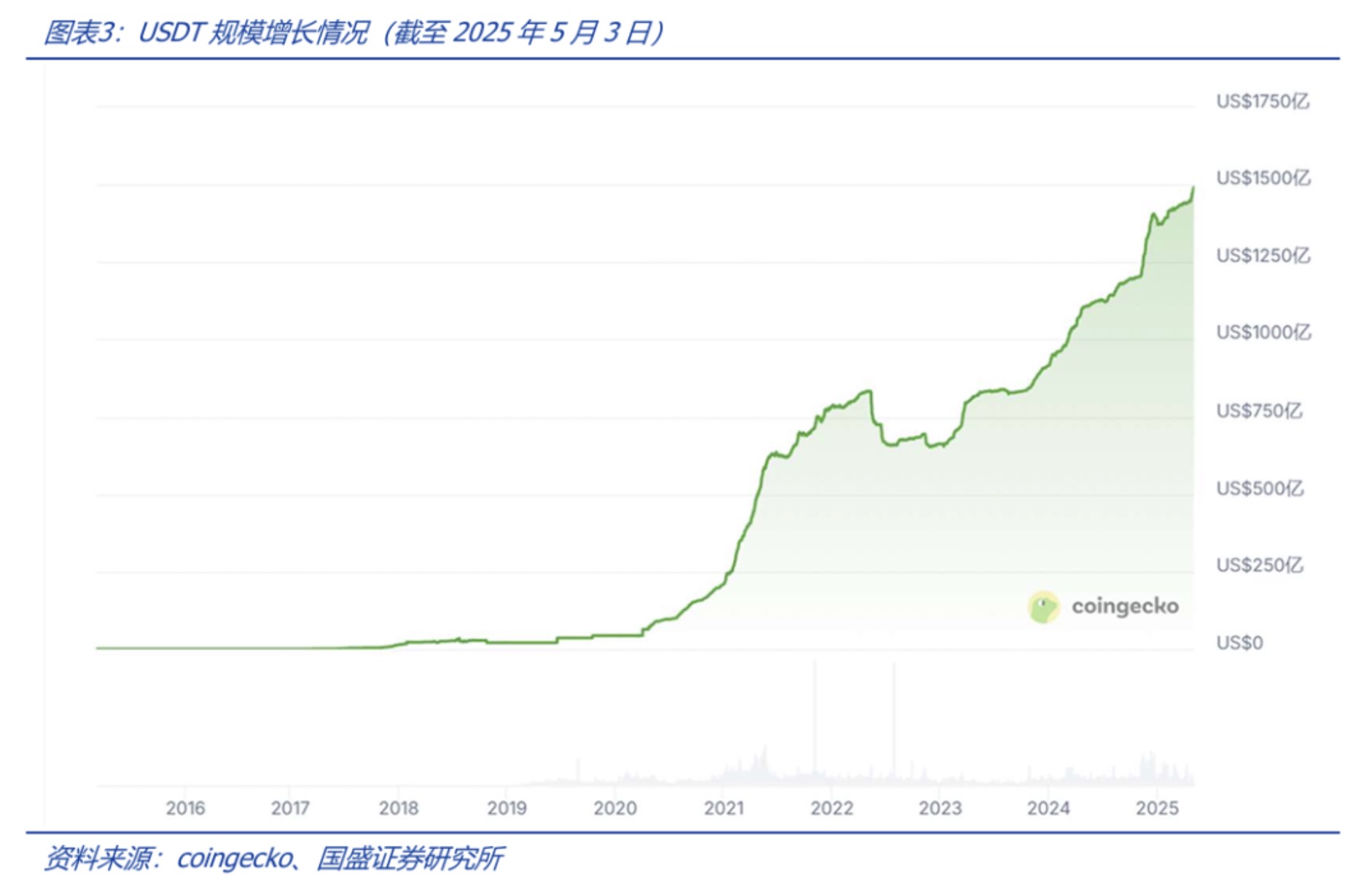

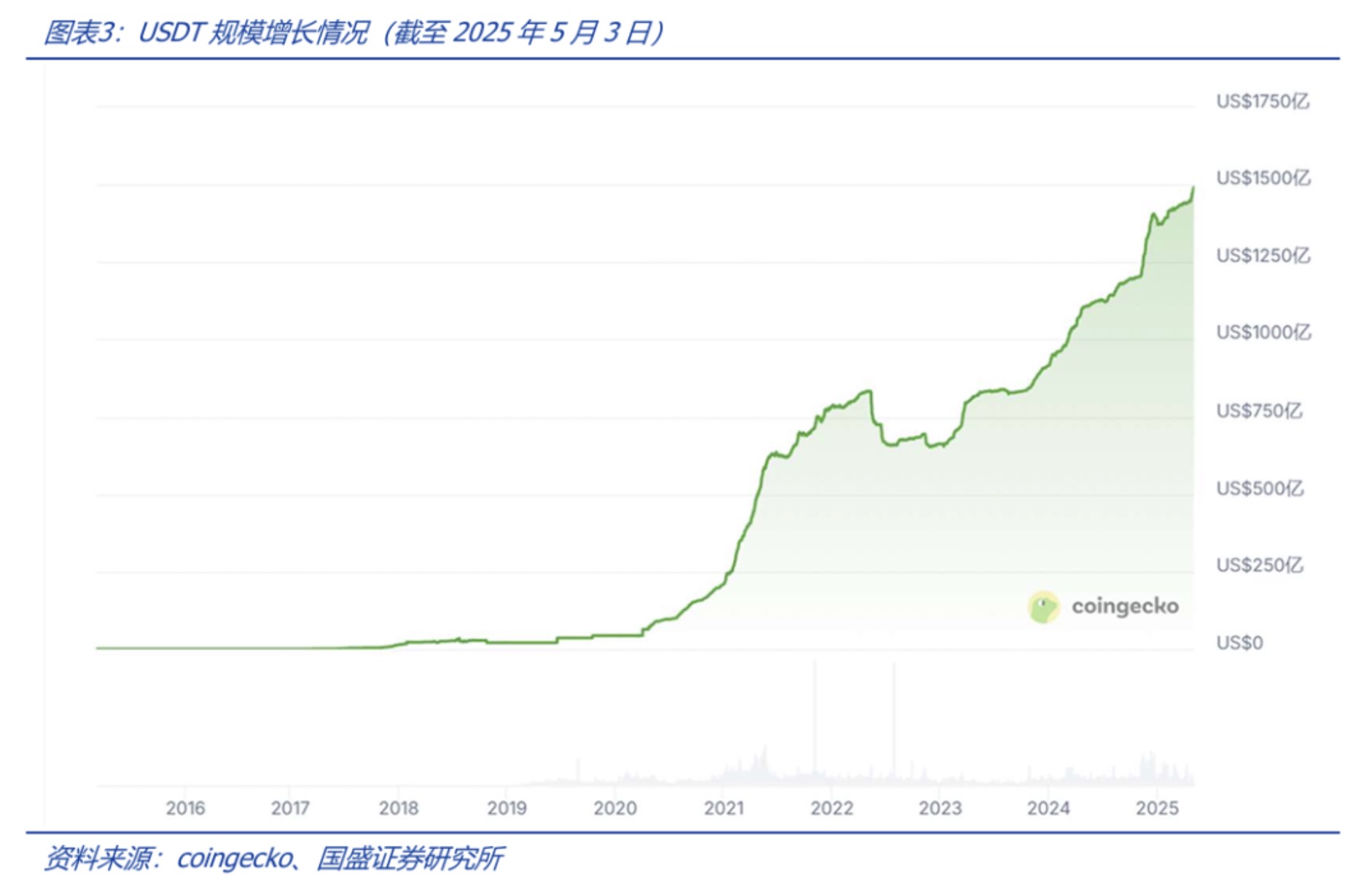

USDT is one of the earliest stablecoins issued. It is issued by Tether with sufficient reserve assets anchored to the US dollar and is currently the most widely used stablecoin. USDT was launched by Tether in 2014, with 1 USDT anchored to 1 US dollar. USDT became one of the earliest stablecoins listed on centralized exchanges, and has since gradually become the most widely used stablecoin product in the market, mainly used for cryptocurrency spot and futures trading pairs. USDT is a stablecoin backed by US dollar assets. The company claims that each token is backed by 1 US dollar in assets. Tether provides an auditable balance sheet, which mainly includes traditional financial assets such as cash. Since the launch of USDT, its scale has continued to maintain a relatively fast growth rate, which reflects the market's underlying actual demand for stablecoins. The emergence of stablecoins can be said to be "inevitable."

There are currently three ways to achieve this credit transfer: issuing stablecoins with sufficient reserve assets by centralized institutions, issuing stablecoins based on blockchain smart contracts and pledged crypto assets, and algorithmic stablecoins. For stablecoins, stablecoins issued by centralized institutions such as USDT are in a dominant position; the mechanisms of the second type of over-collateralization and the third round of algorithmic stablecoins are not intuitive to a certain extent, and users often cannot directly feel the intrinsic value anchoring logic of their stablecoin products, especially when the price of cryptocurrencies fluctuates violently, and users cannot directly anticipate the results of the liquidation mechanism. These factors have restricted the development of the latter two.

RWA has become an important engine to promote the development of the cryptocurrency market. Traditional financial institutions are also actively adopting stablecoins to promote stablecoins in the traditional payment market. Taking the tokenized U.S. Treasury market as an example, the main fund BUIDL was jointly launched by BlackRock and Securitize, and BENJI was launched by Franklin Templeton. It can be seen that traditional financial institutions embracing RWA has gradually become a trend.

Stablecoin regulation is gradually being promoted. Currently, stablecoins are being developed first and then adjusted to the regulations. Although they have also experienced doubts during their development, with BTC entering the mainstream capital market, the development of stablecoins is expected to accelerate.

Risk warning: Blockchain technology research and development is not as good as expected; regulatory policy uncertainty; Web3.0 business model implementation is not as good as expected.

1. Core Viewpoint

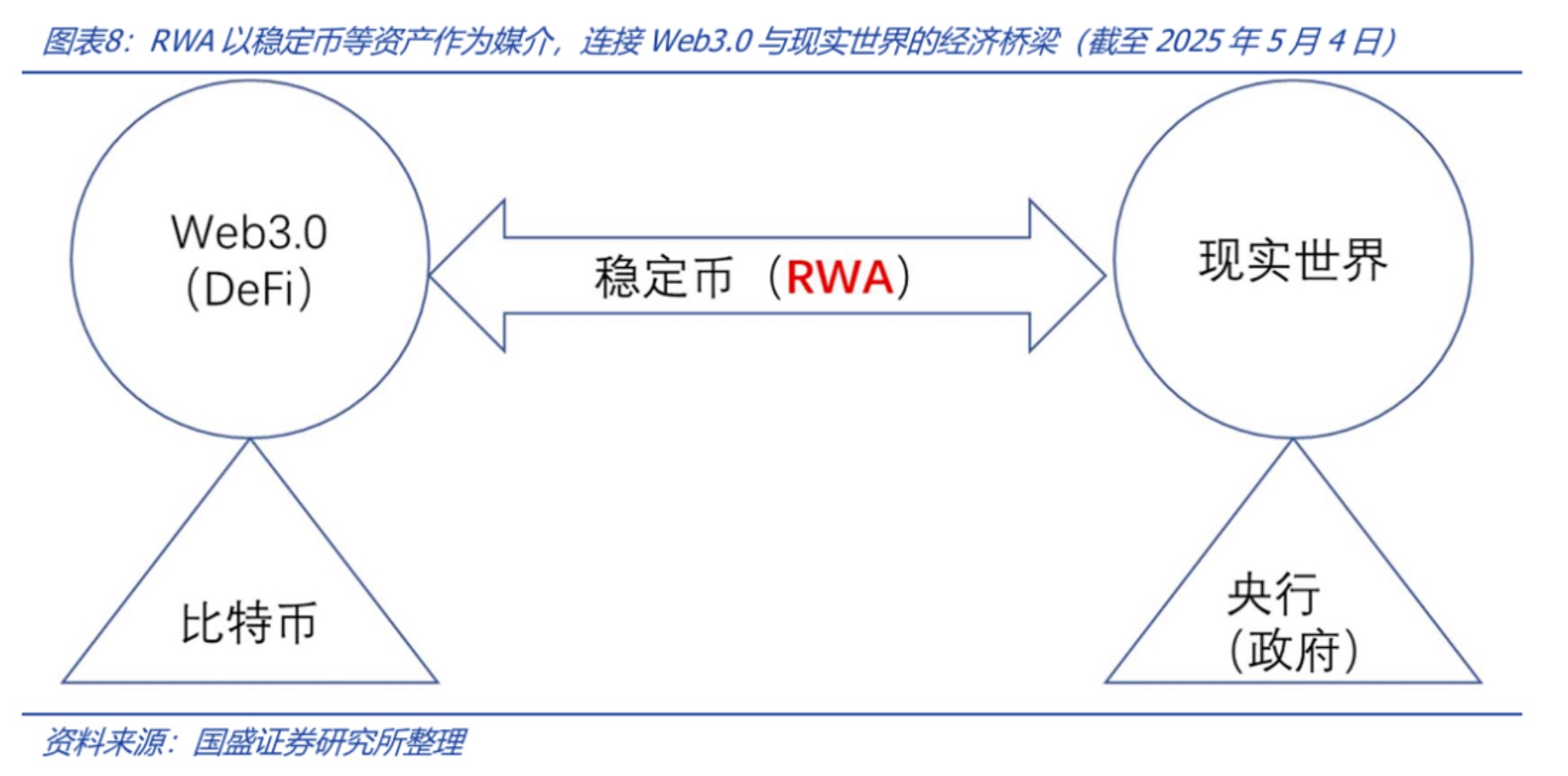

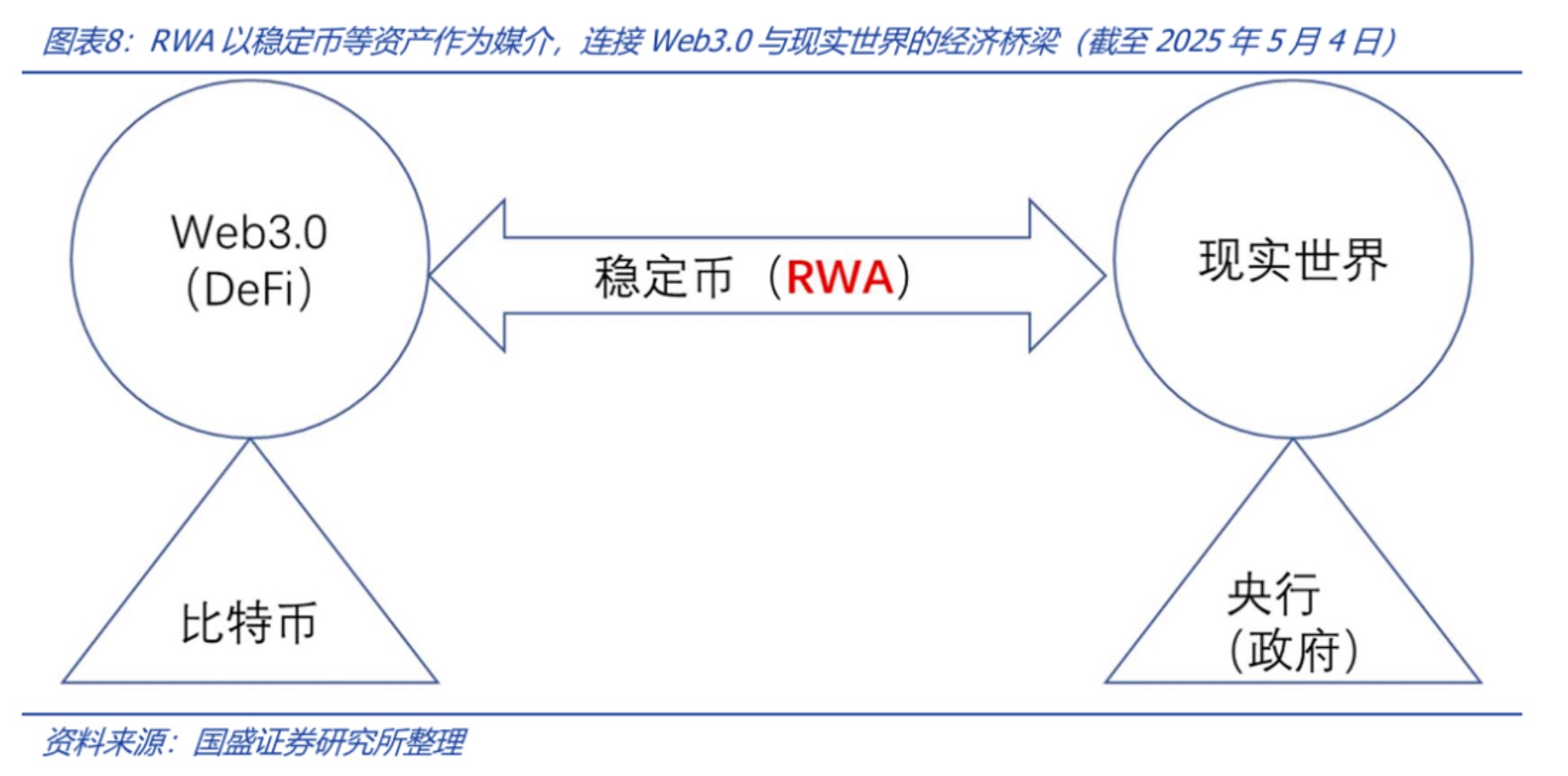

Stablecoins were born in the "grassroots" world of Web3.0. In the early days, they were used as a legal currency pricing tool for trading cryptocurrencies. As the cryptocurrency market grows and develops, stablecoins have become an indispensable basic tool for exchanges, DeFi, and RWA ecosystems. A key to the success of stablecoins is the ability to gain market trust, which involves the credit transmission mechanism of stablecoins. Stablecoins are not only a rigid demand in the Web3.0 world, but also a bridge between it and the real economic world. Today, when stablecoins are popular, traditional financial institutions have also begun to accelerate the adoption of stablecoins and embrace crypto assets. Stablecoins connect two worlds.

This article analyzes the birth, development, current status and mechanism of stablecoins, and looks forward to the current development opportunities of stablecoins.

2. The necessity of stablecoins: a bridge between traditional finance and Web3.0

2.1 The underlying demand for stablecoins: on-chain “fiat currency” tools

The so-called stablecoin refers to a cryptocurrency whose value is anchored to various fiat currencies (or a basket of currencies). Intuitively speaking, a stablecoin maps the value of real-world fiat currencies to account numbers on the blockchain (i.e., cryptocurrencies). In this sense, a stablecoin is a typical RWA (Real World Assets, tokenization of real-world assets). As an asset on the blockchain, the advantage of a stablecoin is that it can be deeply integrated with cryptocurrency projects (such as DeFi) at the blockchain infrastructure level - such as on-chain exchange with other cryptocurrency assets on the chain or combined staking and other DeFi operations. Traditional fiat currencies are not on the blockchain and cannot obtain on-chain scalability.

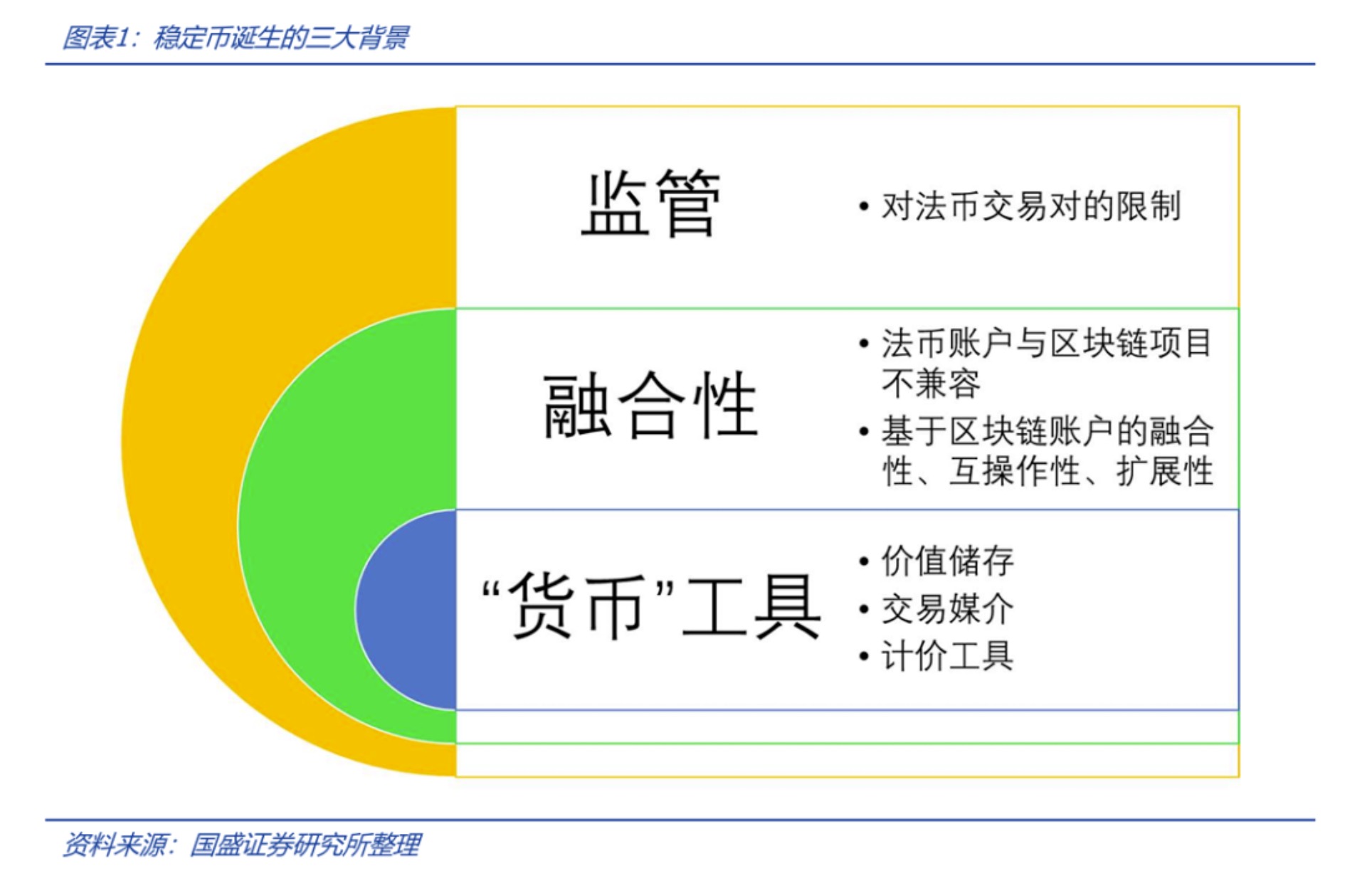

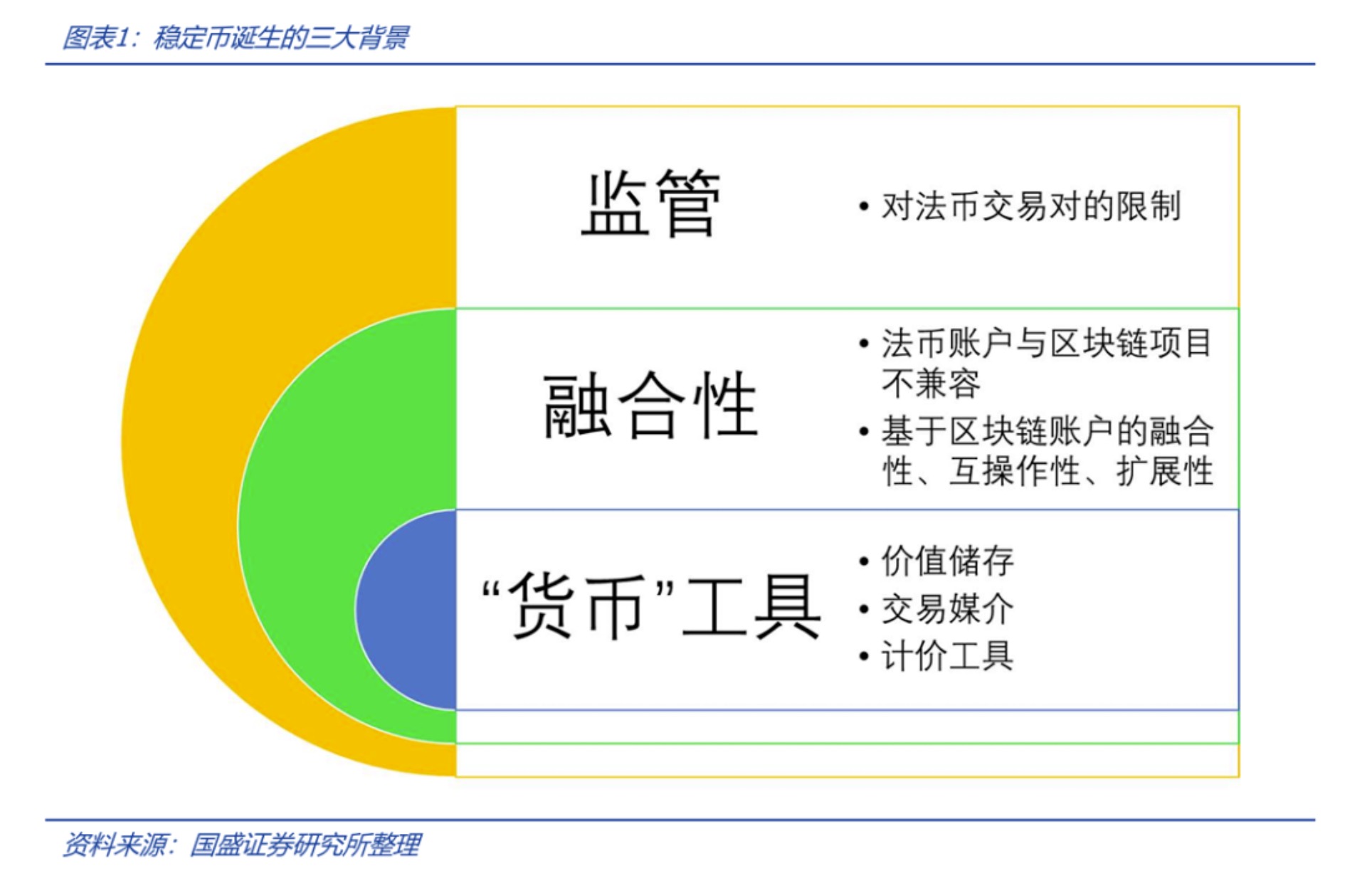

In the early days of the cryptocurrency market, users mainly traded Bitcoin and fiat currencies in centralized exchanges (CEX) or OTC markets. Bitcoin is an asset stored on the blockchain, while fiat currencies rely on traditional bank accounts. This transaction actually involves two completely isolated trading operations between Bitcoin blockchain accounts and bank fiat currency accounts. This is similar to the stock market, where stock registration systems and bank fiat currency accounts must be settled separately. In the early days of cryptocurrency development, as countries increasingly tightened their supervision of exchanges, bank fiat currency accounts were more susceptible to regulatory restrictions. Under the special background conditions in the early days, the demand for stablecoins anchored to the value of fiat currencies gradually emerged. Stablecoins formed trading pairs for Bitcoin (or other cryptocurrency assets) to trade in currencies, which was separated from the traditional financial account system. More importantly, cryptocurrencies are assets based on blockchain accounts. If the trading pairs they are denominated in are also based on currencies of blockchain accounts, then the integration and interoperability between ledgers become possible. However, traditional fiat currencies are not on the blockchain.

In other words, cryptocurrency assets such as Bitcoin are not interoperable with fiat currency accounts, and smart contracts cannot operate on fiat currency accounts, which is not conducive to the scalability of the network. Therefore, based on the needs of integration and interoperability, the market requires all assets to be expressed as numbers in blockchain accounts on the chain. In addition, due to the high volatility of cryptocurrency, it cannot meet the three characteristics of currency: value storage, transaction medium, and pricing tool. It is difficult for users to retain and exit their investments in the crypto world, which has stimulated the demand for low-volatility stable currencies.

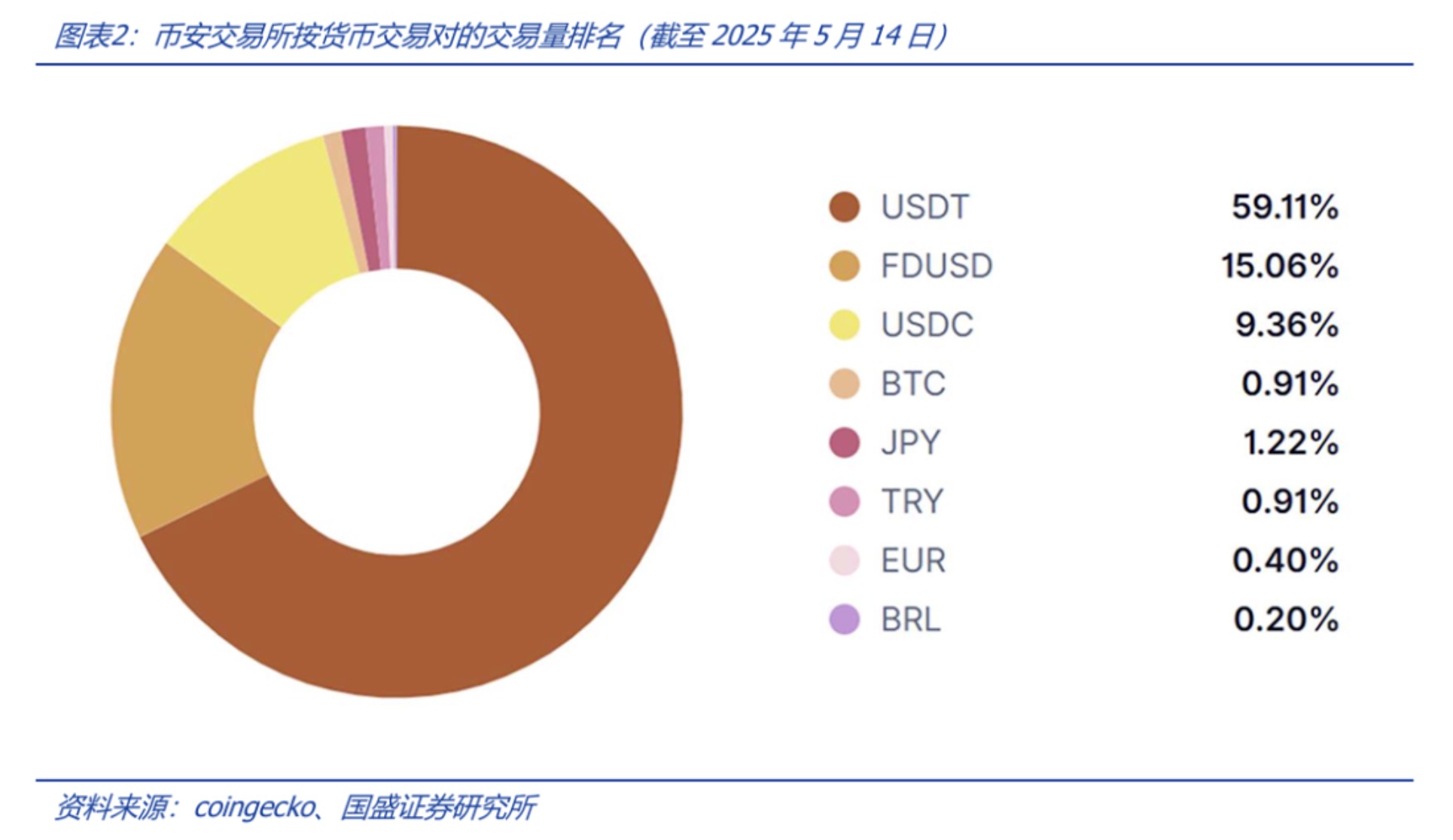

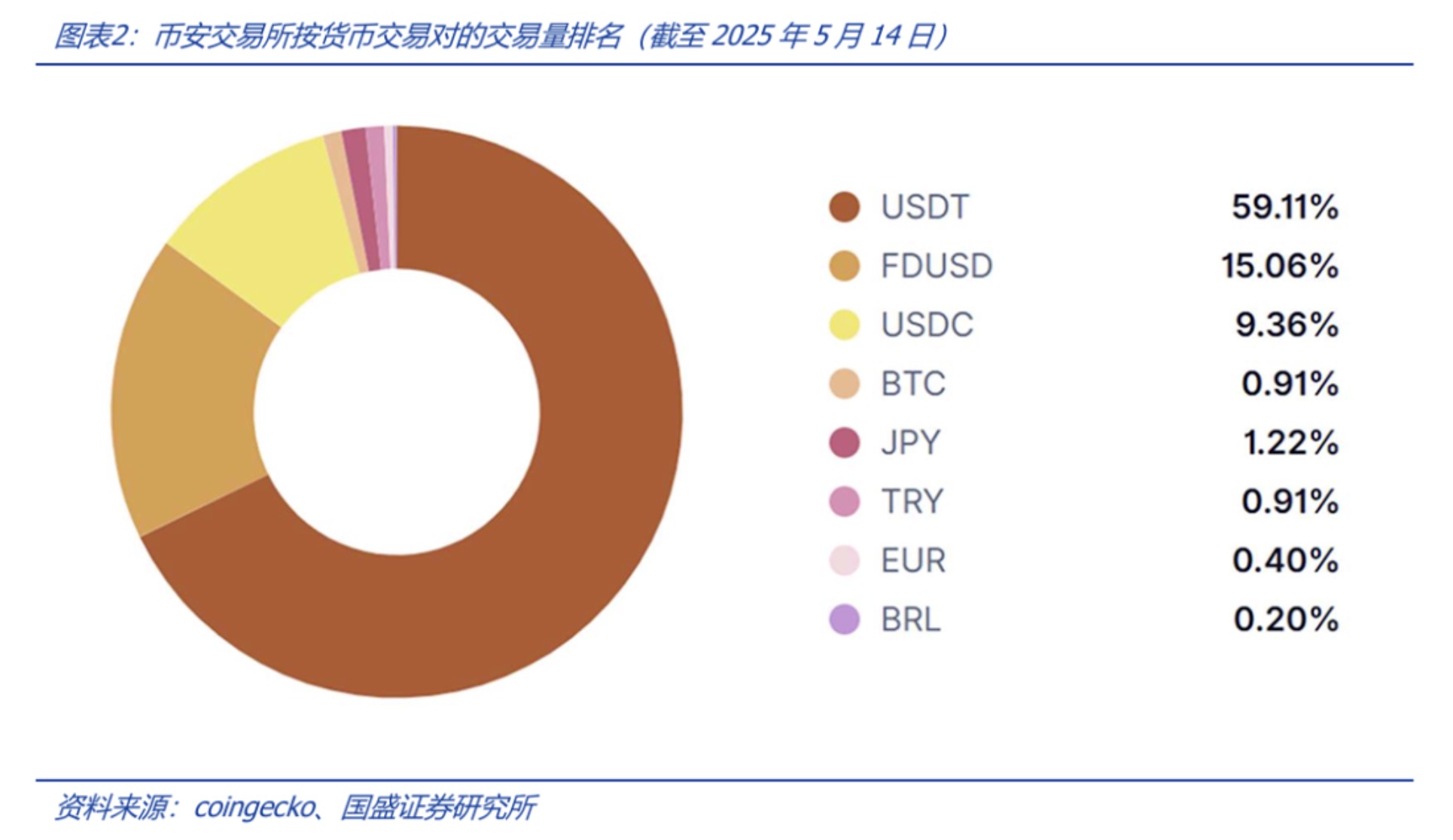

Stablecoins, to some extent, serve as a "pricing tool" in the cryptocurrency market, which is a supplement or even a substitute for traditional fiat currency transactions. Shortly after the birth of stablecoins, the most important trading pairs in the cryptocurrency market were stablecoin trading pairs. Therefore, stablecoins serve as "fiat currencies" in terms of trading tools and value circulation. As shown in Figure 2, on mainstream exchanges like Binance, Bitcoin spot and futures trading pairs are mainly based on various stablecoins such as USDT, especially futures contracts with larger trading volumes. Forward contracts on mainstream exchanges (futures contracts with USD stablecoins as margin, such as perpetual futures contracts) are almost all USDT trading pairs.

Tether USD (USDT) is one of the earliest stablecoins issued. It was launched by Tether in 2014, with 1 USDT anchored to 1 US dollar. USDT became one of the earliest stablecoins listed on centralized exchanges, and has since gradually become the most widely used stablecoin product in the market, mainly used for cryptocurrency spot and futures trading pairs. USDT is a stablecoin backed by US dollar assets. The company claims that each token is backed by 1 US dollar in assets. Tether provides an auditable balance sheet, which mainly consists of traditional financial assets such as cash. Other stablecoin projects issued in the same period include BitUSD and NuBits. Since the launch of USDT, its scale has continued to maintain a relatively fast growth rate, which reflects the market's underlying actual demand for stablecoins. The emergence of stablecoins can be said to be "inevitable."

Since USDT meets the actual needs of the market, since 2017, as mainstream cryptocurrency trading platforms have launched USDT trading pairs (spot and futures contracts), stablecoins have been favored by the cryptocurrency market. Whether various early stablecoins can effectively anchor the corresponding fiat currency value has become the most worrying issue in the market. Since companies like Tether failed to provide convincing and compliantly audited balance sheets in the early days, the market has always questioned their credit. In order to solve the problem of USDT's transitional reliance on the credit of centralized institutions such as companies, MakerDAO issued a decentralized, multi-asset collateralized stablecoin DAI based on smart contracts in 2017. The crypto assets managed by smart contracts behind it are over-collateralized, and the exchange rate between its price and the US dollar is stabilized by the smart contract system, allowing users to mint without permission. As of May 3, 2025, the issuance scale of DAI exceeds US$4.1 billion, ranking fifth among various stablecoins (the new stablecoin USDS issued by MakerDAO is not counted here).

The emergence of DAI is a milestone event. Decentralized stablecoins are not only different from products endorsed by centralized institutions (such as USDT) in terms of credit transmission, but they are also native products of the DeFi system - DAI itself is a RWA product pledged by DeFi. Therefore, decentralized stablecoins such as DAI are not only used in centralized exchanges, but also an indispensable link in the RWA ecosystem - a part of the so-called "Lego puzzle".

With the widespread and in-depth application of stablecoins, centralized exchanges have begun to develop their own stablecoin products, such as USDC issued by Coinbase and BUSD led by exchange giant Binance.

Since 2019, with the development of DeFi projects, stablecoins have been widely used in DeFi systems (lending markets, decentralized exchange markets). In pursuit of greater decentralization and integration with DeFi infrastructure, algorithmic stablecoins based on smart contract algorithms to adjust currency value stability have begun to be active in the market. Based on DAI, this uses the algorithmic mechanism of smart contracts to achieve credit transfer between stablecoins and legal tender. Currently, the main products include USDe, etc.

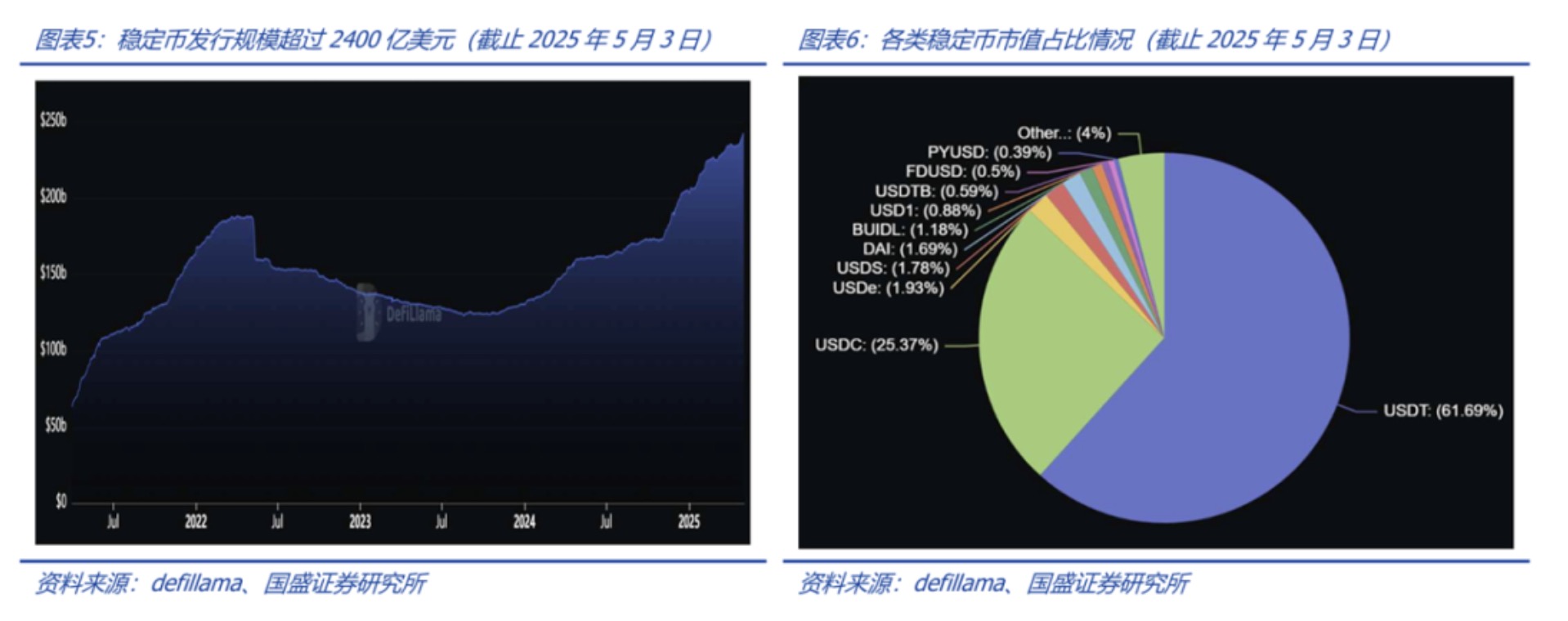

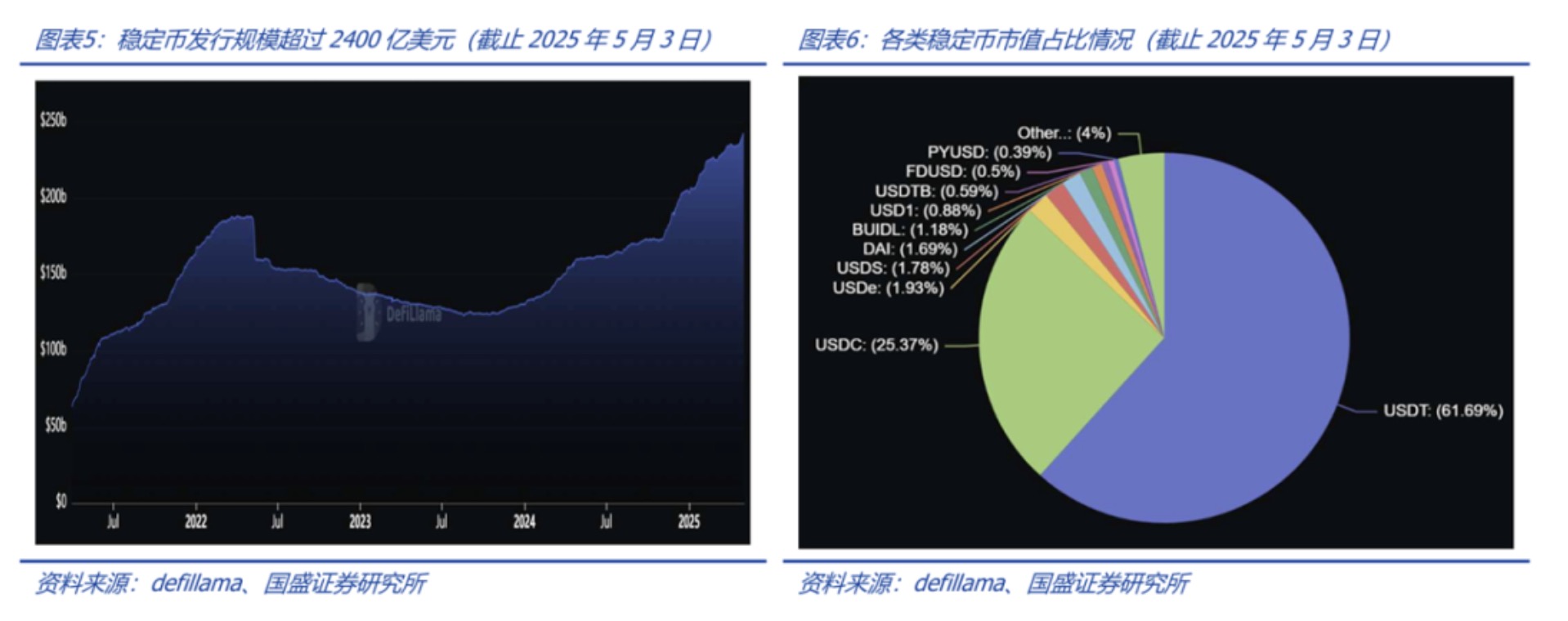

Although the cryptocurrency industry pursues sufficient decentralization, the stablecoin market (mainly US dollar stablecoins) is still dominated by stablecoins such as USDT and USDC, which are issued based on the collateral/reserve assets of central institutions, and they occupy an absolute monopoly. As shown in Figure 4, as of May 3, 2025, the scale of USDT, which ranks first, exceeds 149 billion US dollars, the scale of USDC, which ranks second, exceeds 610 US dollars, and the scale of USDDe, which ranks third, is less than 5 billion US dollars. USDT and UDSC, two centralized stablecoins, are in an absolute dominant position. The blockchain smart contract algorithm stablecoin USDDe ranks third, with a scale of about 4.7 billion US dollars. The stablecoins issued based on blockchain smart contract collateral assets, USDS and DAI, are ranked fourth and fifth, with a scale of about 4.3 billion US dollars and 4.1 billion US dollars respectively.

At present, the main use of stablecoins is in the cryptocurrency market, because the mainstream pricing method in the cryptocurrency market is to price stablecoins. With the bull market in the cryptocurrency market over the past year, the issuance scale of stablecoins (mainly US dollar stablecoins) has grown rapidly. As shown in Figures 5 and 6, the issuance scale will exceed US$240 billion as of May 3, 2025; currently, USDT and USDC account for 61.69% and 25.37% of the scale respectively. One point worth noting here is that decentralized stablecoins have not shown enough advantages. From the perspective of practical application, stablecoins such as USDT and USDC, which are in the mode of reserving traditional financial assets, have become the absolute leaders. There are many influencing factors. The rapid development of RWA is related to the adoption of USDT and USDC, which will be further analyzed later.

2.2 Not only a pricing tool, but also a bridge between Web3.0 and traditional financial markets

In the DeFi lending market, stablecoin assets such as USDT are commonly used as collateral/loan assets. They not only serve as deposits and savings, but also exist as a crypto asset - they can be used to mortgage crypto assets such as Bitcoin/ETH to borrow stablecoins, and they can also be used as collateral to borrow other crypto assets. For example, the AAVE project, which ranks first in DeFi locked assets, has three of the top six market-scale projects in its lending market for US dollar stablecoin lending, with USDT, USDC, and DAI ranking second, third, and sixth respectively.

Whether in the trading market or the DeFi lending market, stablecoins are similar to currencies or notes issued by private institutions to some extent. Due to the characteristics of blockchain infrastructure, stablecoins have different potential from traditional financial markets in terms of clearing speed, integration and scalability. For example, stablecoins can be quickly and seamlessly switched between DeFi projects (such as exchanges, lending markets, leveraged products, etc.) with just a few clicks on mobile phones and other terminals, while fiat currencies cannot circulate so quickly in traditional financial markets.

The integration of the Web3.0 world represented by cryptocurrency and the real economic world is an inevitable trend, and RWA is an important driving force in this integration process - because RWA more directly maps the display world assets to the blockchain. From a broad perspective, stablecoins are the most basic RWA products, anchoring fiat currencies such as the US dollar to the blockchain. For users of traditional financial markets, stablecoins and RWA are the bridges to the cryptocurrency market. For traditional financial institutions that want to enter the Web3.0 world, stablecoins are an important position. With stablecoins, they can freely roam in the Web3.0 world to convert asset allocation. In turn, investors holding cryptocurrency assets can convert stablecoins into traditional financial assets or purchase goods and return to the traditional financial market. On April 28, 2025, payment giant Mastercard announced that Mastercard allows customers to consume in stablecoins and allows merchants to settle in stablecoins. The use of stablecoins began to spread in reverse to the traditional economic society.

2.3 Three modes of stablecoin credit transmission

The numbers in bank accounts represent the fiat currency deposits of users, which is ensured by the rules of traditional economic society. Stablecoins attempt to transfer the value of fiat currency to the numbers in on-chain accounts, and the credit transfer in between needs to be different from the bank's method, which is a very critical core issue of stablecoin credit. In general, there are currently three ways to achieve this credit transfer: issuing stablecoins with sufficient reserve assets by centralized institutions, issuing stablecoins based on blockchain smart contracts and mortgaging crypto assets, and algorithmic stablecoins.

For stablecoins, stablecoins issued by centralized institutions such as USDT are in a dominant position; this type of product model has simple logic, and with the help of the credit transmission model of the traditional economic market, it is easy for users to understand and operate. It is the most reasonable choice in the early development stage of the stablecoin field. The mechanisms of the second type of over-collateralization and the third round of algorithmic stablecoins are not intuitive to a certain extent. Users often cannot directly feel the intrinsic value anchoring logic of their stablecoin products (that is, primary users cannot accept their logic well), especially when the price of cryptocurrencies fluctuates violently, users cannot intuitively anticipate the results of the liquidation mechanism - during the period of violent fluctuations in the price of encrypted assets, the liquidation mechanism will lead to some irrational results in the market. These factors have restricted the development of the latter two.

2.3.1. Relying on the traditional economic market to transfer credit: USDT

Centralized institutions issue stablecoins with sufficient reserve assets, and credit transmission relies entirely on the traditional economic market. As the simplest stablecoin model, a centralized institution reserves sufficient assets and issues a corresponding number of stablecoins on the blockchain (the issuing institution bears the responsibility for the issuance and redemption of stablecoins), which anchors the stablecoin to the legal currency 1:1, that is, the centralized institution is the credit endorsement subject. It is necessary to rely on an effective audit of the issuer's balance sheet. Usually, these assets are mainly treasury bonds, cash, etc. in the traditional market, and a small part can also be cryptocurrencies such as Bitcoin. Through one-to-one mortgage custody, this model ensures that users can redeem equivalent collateral from the issuer, ensuring the price stability of stablecoins. However, this model is also very dependent on the safe custody of collateral, which involves many details such as the compliance of the project party, the compliance of the custodian, and the liquidity of the collateral. Usually, whether the issuing institution can provide a compliant and effective audit report is the most concerned.

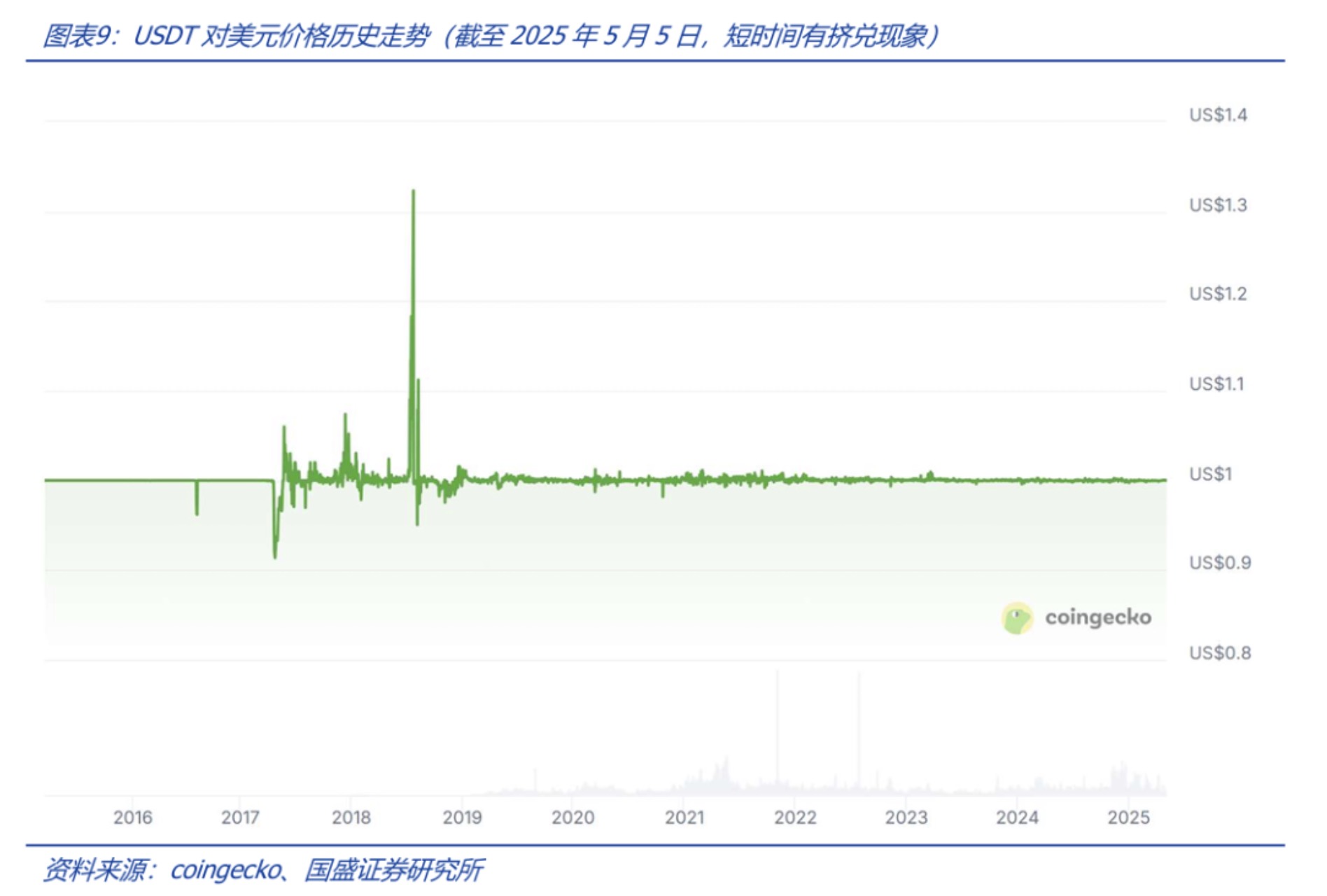

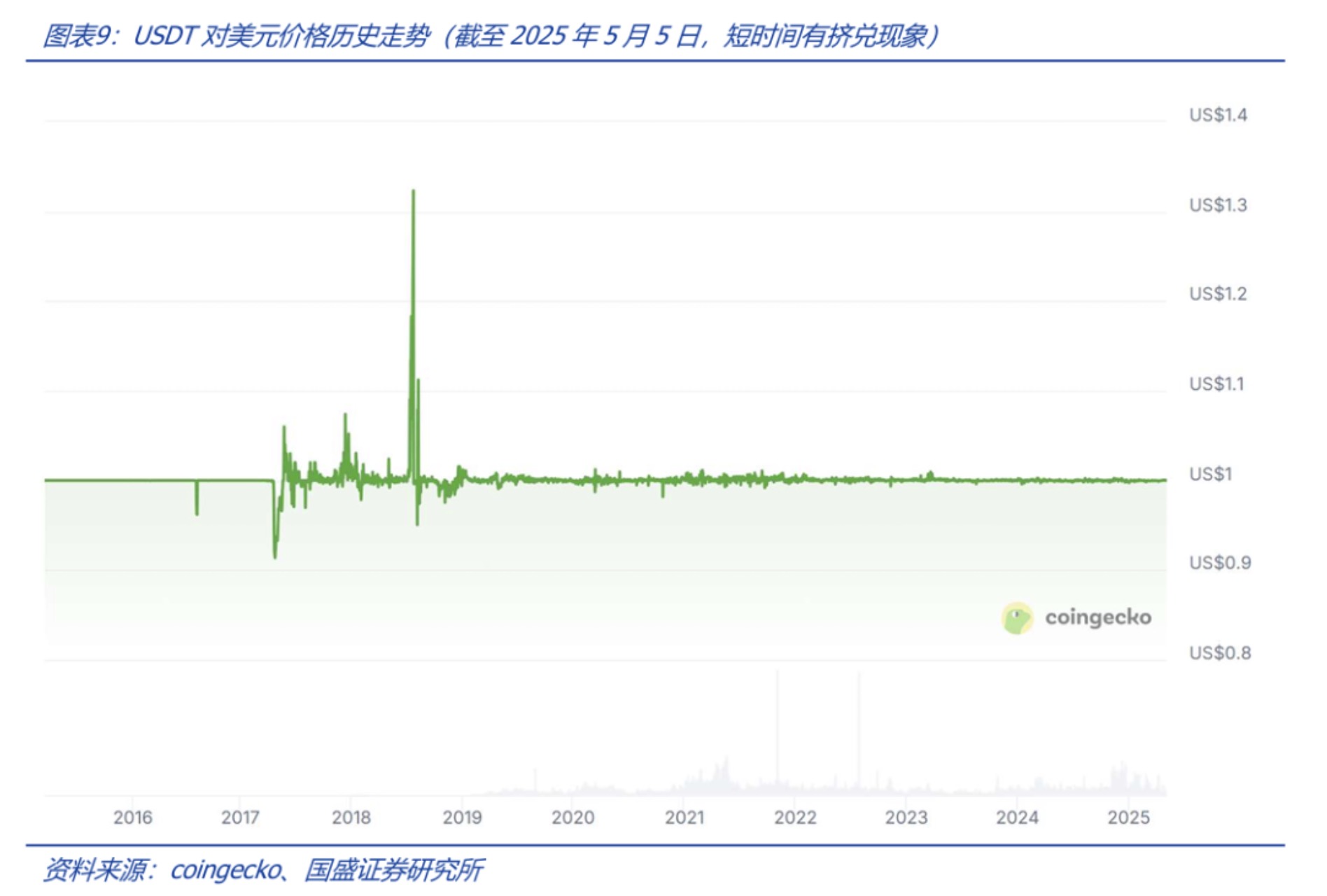

USDT's early project establishment also gave the project sufficient first-mover advantage. It is currently a stablecoin product with more than 60% of the circulation in the market. To ensure the wide application of the product, USDT is issued on multiple blockchains including Omni, Ethereum, Tron, Solana, etc. In the early stages of scale development, factors such as liquidity and market doubts about its balance sheet, coupled with market fluctuations, caused USDT to occasionally depeg (sometimes with a premium) in the early stages. However, these special cases are temporary, and USDT's anchoring to the US dollar is generally successful. We believe that there is no lack of strong market demand factors. After all, USDT is a rigid product for the cryptocurrency market.

In response to the market's doubts about its reserve assets and ability to pay, Tether has now released a complete and effective audit report. According to the audit report of an independent agency, the total assets of Tether's USDT issuance department on March 31, 2025 were approximately US$149.3 billion, which is consistent with the scale of USDT it issued. A careful examination of the balance sheet shows that 81.49% of the reserve assets are cash, cash equivalents and other short-term deposit items, mainly U.S. Treasury bonds, which ensures the soundness of its assets and liabilities and fully considers liquidity measures to deal with redemptions. Interestingly, there are also $7.66 million in Bitcoin reserves in its assets. Although the amount is not large, it fully echoes the fact that Bitcoin (and then extended to other cryptocurrencies) can be used as a reserve asset for issuing stablecoins. In short, the composition of USDT reserves is diverse, taking into account both liquidity and the diversity of configuration.

As the issuer of USDT, Tether achieved a total profit of more than 13 billion US dollars in 2024, while the actual company has only about 150 employees. Under the Fed's interest rate hike cycle, U.S. Treasury bonds contributed to Tether's core profits. Of course, there will be a certain fee for the redemption of USDT. As a compliant company responsible for issuing and redeeming stablecoins, Tether's model is currently the most sought-after in the market. We believe that USDT entered the market at an early stage and firmly occupied the first-mover advantage in both the centralized exchange (CEX) and DeFi eras. At the same time, relying on companies with credit endorsements provided by public audits in traditional society to issue stablecoins is also an important reason for being accepted by both traditional financial markets and Web3.0 markets.

2.3.2. Stablecoins issued by decentralized collateral assets can also gain market trust

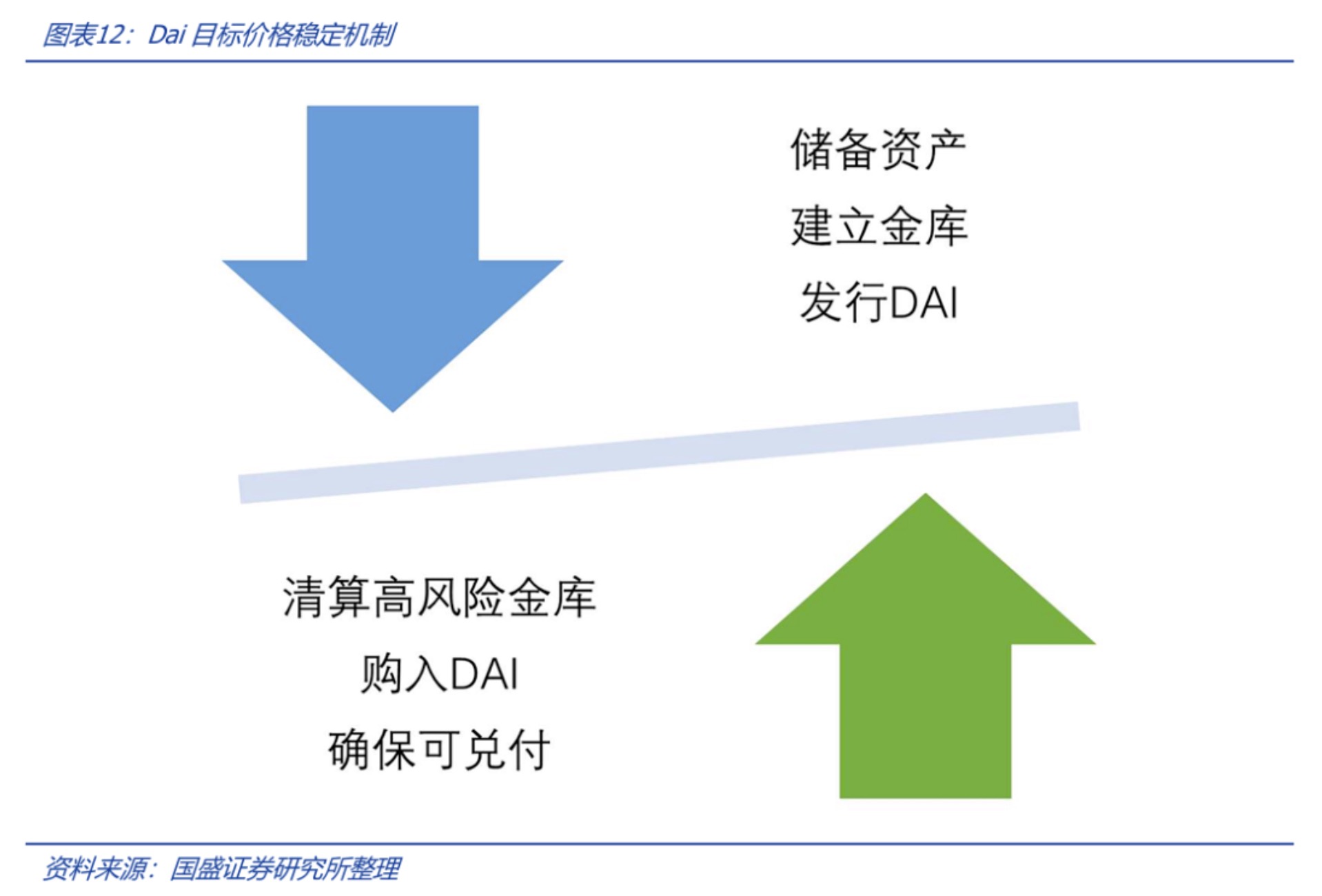

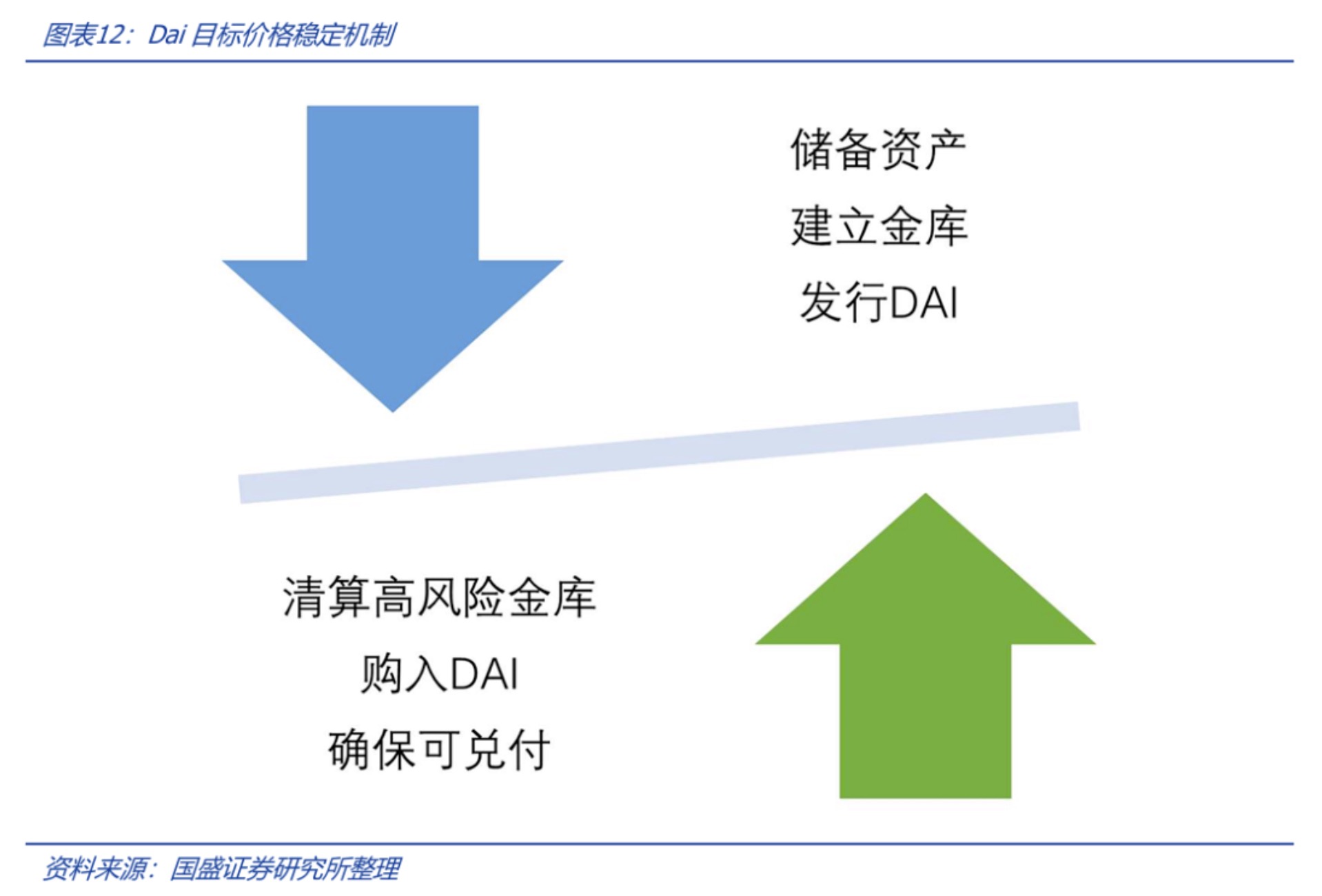

Based on the blockchain smart contract to pledge crypto assets, the issuance of stablecoins under excess reserves can also gain market trust. Crypto assets are pledged to smart contracts, which lock the crypto assets on the chain and issue a certain number of stablecoins. Since the crypto assets on the chain do not naturally maintain price stability against the US dollar, there is a risk of price fluctuations in the pledged assets. In order to achieve stable prices and redemption of stablecoins, this type of stablecoin uses an over-collateralized model to achieve credit transfer - that is, the value of the pledged crypto assets exceeds the amount of the issued stablecoins, and when the market fluctuates (especially when the price of the pledged assets falls), the blockchain smart contract liquidates the pledged assets (and purchases stablecoins at the same time) to ensure the redemption ability of the stablecoins. The difference between this model and the first model is that it does not rely on the credit of centralized institutions. The largest and most typical examples of this model are USDe and DAI - USDe is issued on the basis of DAI and based on the new Sky protocol, and can be considered an upgraded version of DAI (the two can be freely exchanged at an unlimited 1:1). In 2024, MakerDAO changed its name to Sky Ecosystem and launched a stablecoin product called USDS. All crypto assets that can be collateralized can generate DAI under the control of the Sky protocol through a smart contract called Maker Vault. The price drop of the collateral will lead to the risk of insufficient collateral value. The protocol will sell the collateral (i.e. buy DAI) according to the set parameters to support the value of DAI anchored to the US dollar at a 1:1 ratio.

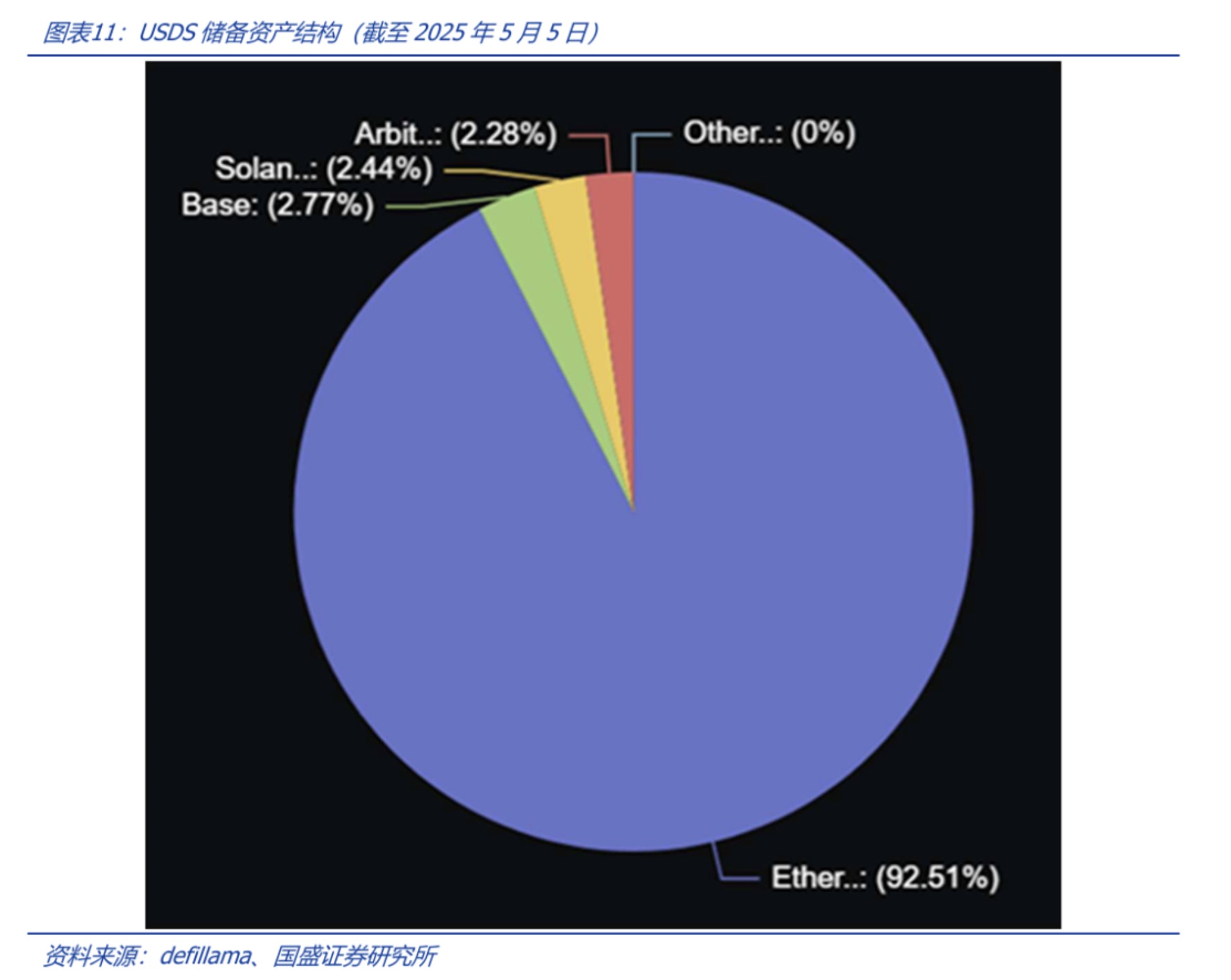

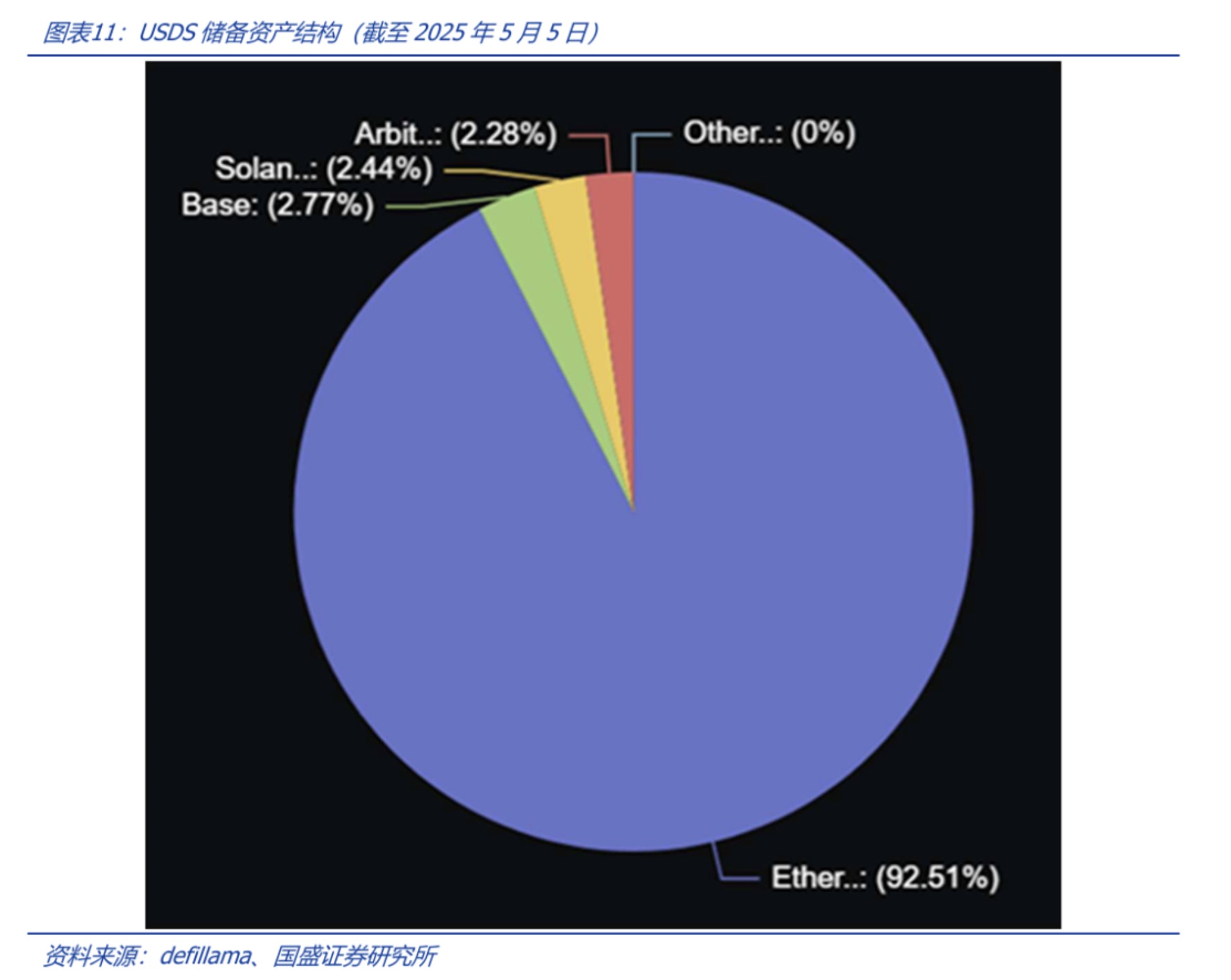

From the perspective of the composition of collateral assets, as of May 5, 2025, the main collateral of USDS is ETH tokens, accounting for more than 92%.

How to ensure the stability of DAI? In other words, ensuring that DAI holders can redeem is the core of DAI's stable anchoring. The DAI issuer interacts with the Sky Protocol Vault contract on the chain and deposits enough collateralized crypto assets into the vault (the asset value is greater than the DAI issuance amount to ensure that DAI can be redeemed). Under market fluctuations, if the price of the collateralized crypto assets falls, there is a risk that the collateral assets cannot be redeemed for the redemption of the issued DAI. The vault liquidates and auctions the collateralized assets according to the agreement of the contract procedure, and the liquidation is carried out by redeeming DAI. This mechanism is similar to the margin mechanism of futures contracts. When the margin is insufficient, the open positions will be liquidated in advance. The Sky protocol has designed a corresponding auction price mechanism to ensure that the value of the vault's collateralized assets can redeem the DAI circulating in the market, which is to ensure the "stability" of the DAI price.

2.3.3. Algorithmic stablecoin: full trust in blockchain algorithms, currently small in scale

The above two stablecoin models are to issue corresponding stablecoins by pledging assets. USDT is a company's fully auditable asset reserve, while USDS/DAI realizes the asset mortgage and redemption mechanism through blockchain smart contracts. The latter's liquidation mechanism pricing and treasury governance are not completely decentralized. Driven by the demand of decentralized financial native users for fully decentralized stablecoins, a mechanism that completely relies on algorithmic mechanisms to achieve stablecoin value anchoring has emerged, that is, products that maintain stablecoin prices in the trading market through algorithms have emerged one after another. This price stabilization mechanism of algorithmic stablecoins is generally similar to the market arbitrage/hedging mechanism under algorithmic control. In theory, it ensures that stablecoins remain anchored, but the practice is still in its early stages, and it is not uncommon for them to deviate from the anchored price level. The scale of algorithmic stablecoins is still relatively small. Compared with the second category, algorithmic stablecoins rely entirely on decentralized smart contract algorithms and basically do not require human intervention. As an innovative track, algorithmic stablecoins have historically had several different arbitrage/hedging mechanisms, but overall there are not many projects that have been successfully run for a long time.

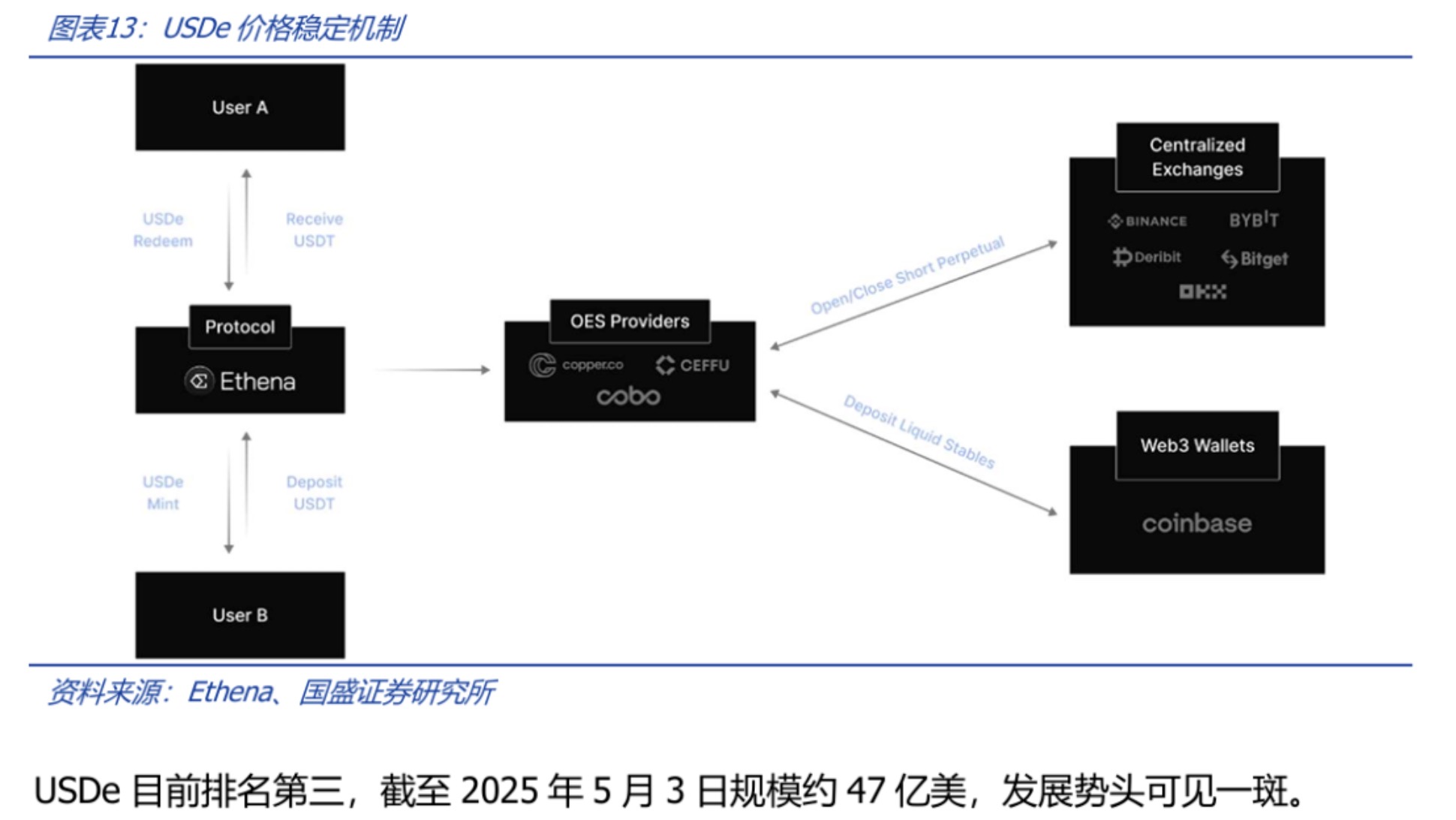

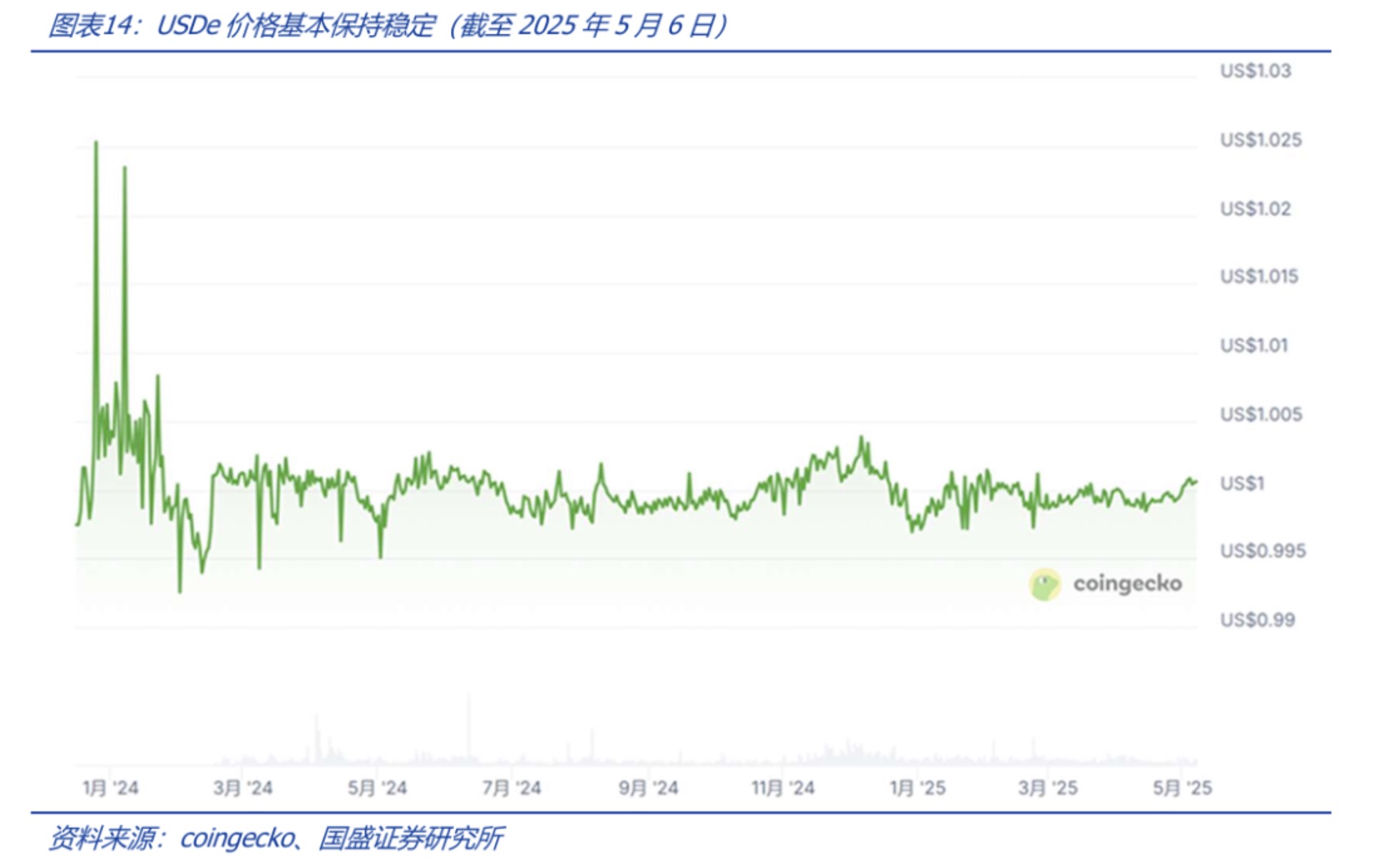

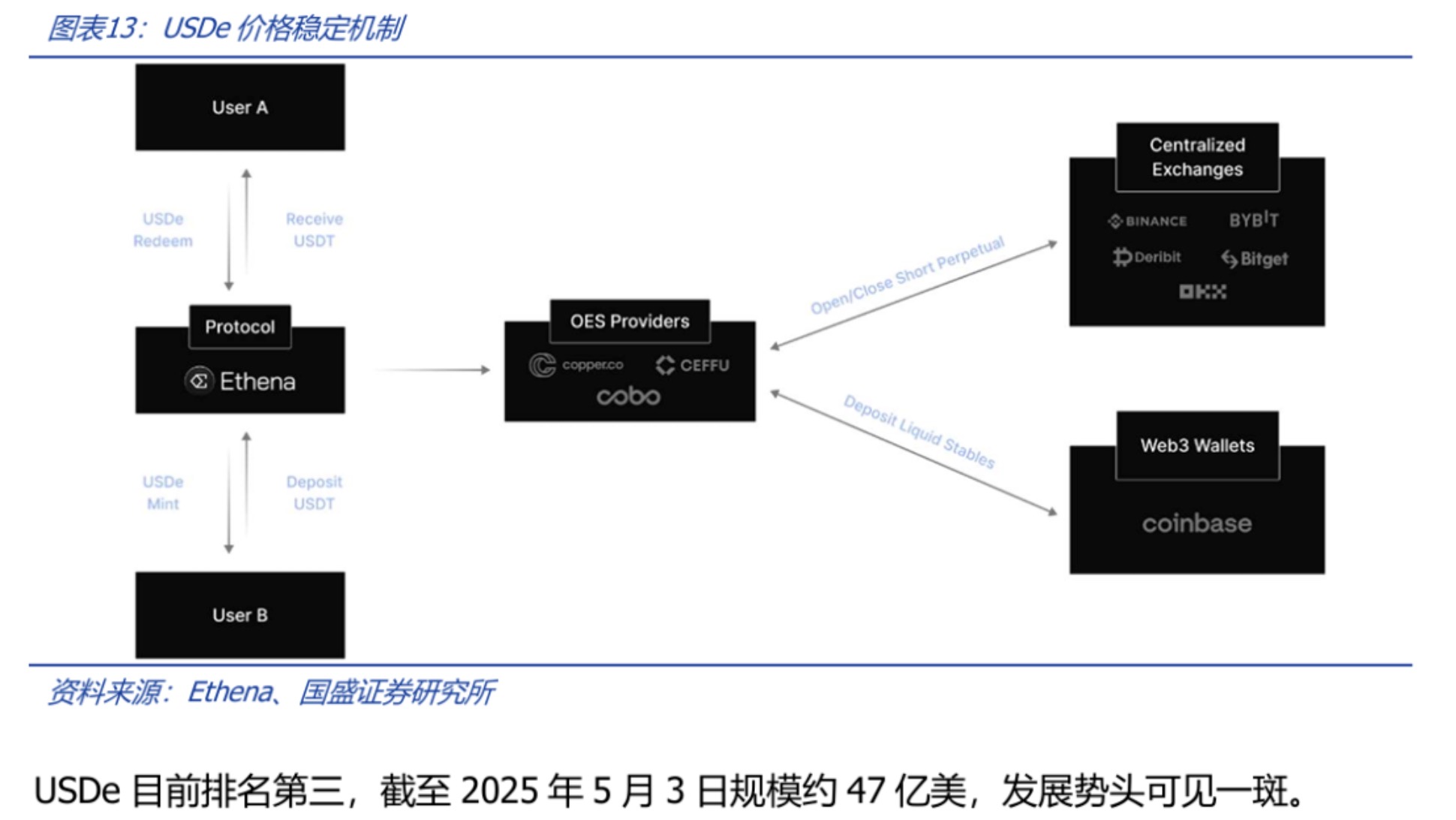

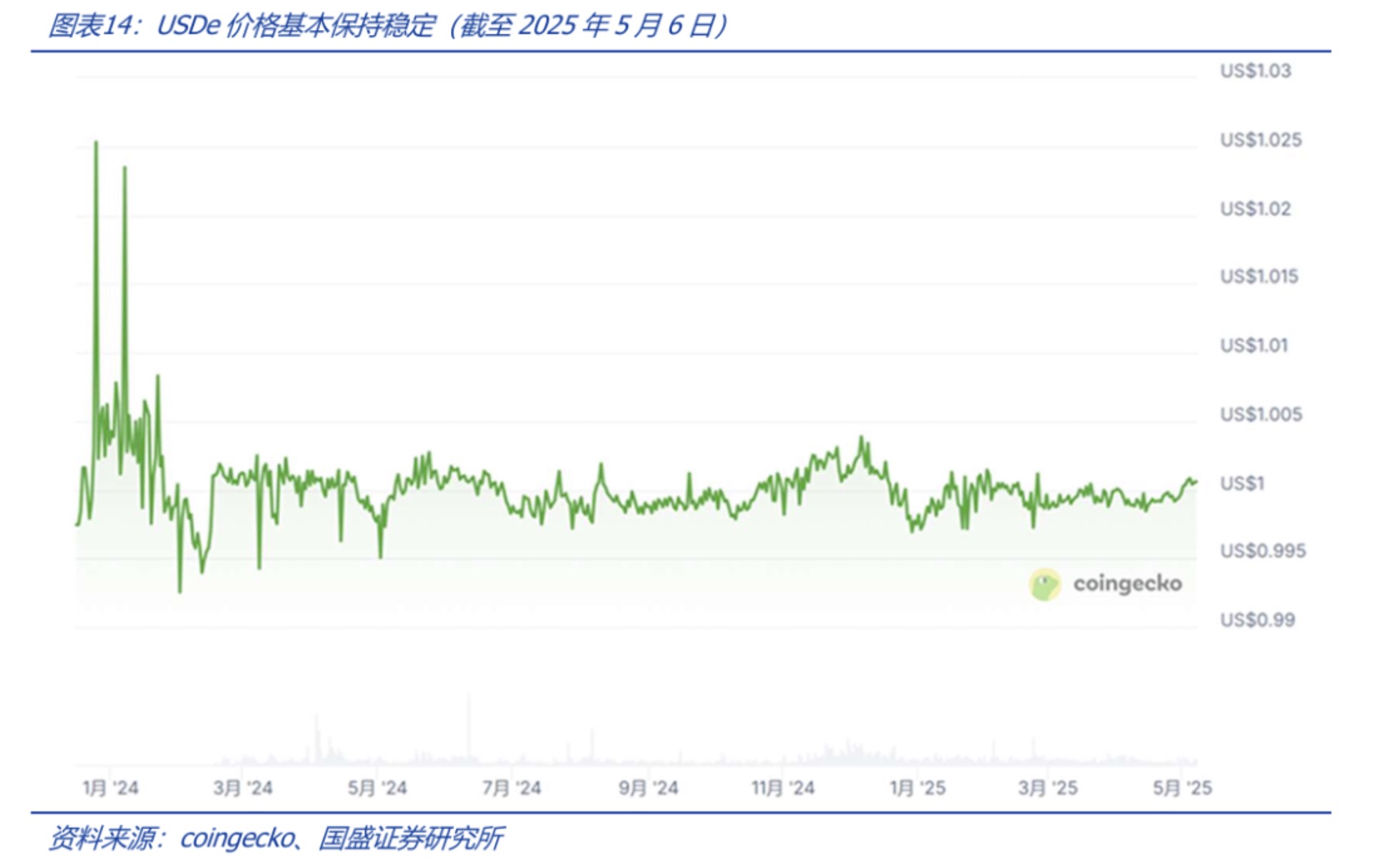

The representative of algorithmic stablecoins is currently the third largest USDe, issued by the Ethena protocol. Generally speaking, whitelisted users deposit crypto assets such as BTC, ETH, USDT or USDC into the Ethena protocol to mint stablecoins of equal value, and the protocol establishes short positions on CEX exchanges to hedge against price fluctuations of its reserve assets and maintain the value of the issued stablecoins. This method is similar to the hedging mechanism in commodity futures, which is an automatically executed neutral hedging strategy that is completely controlled by algorithms.

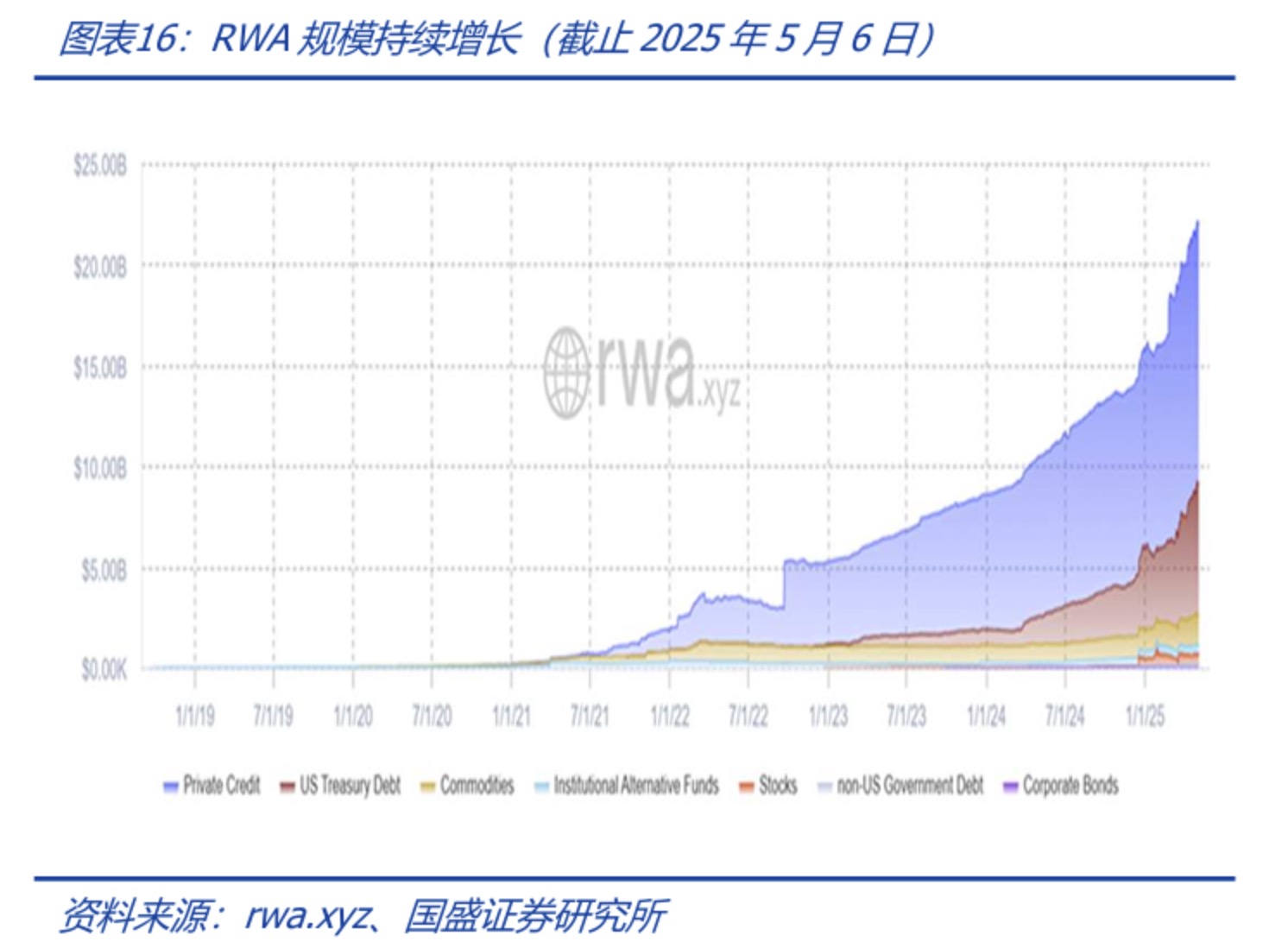

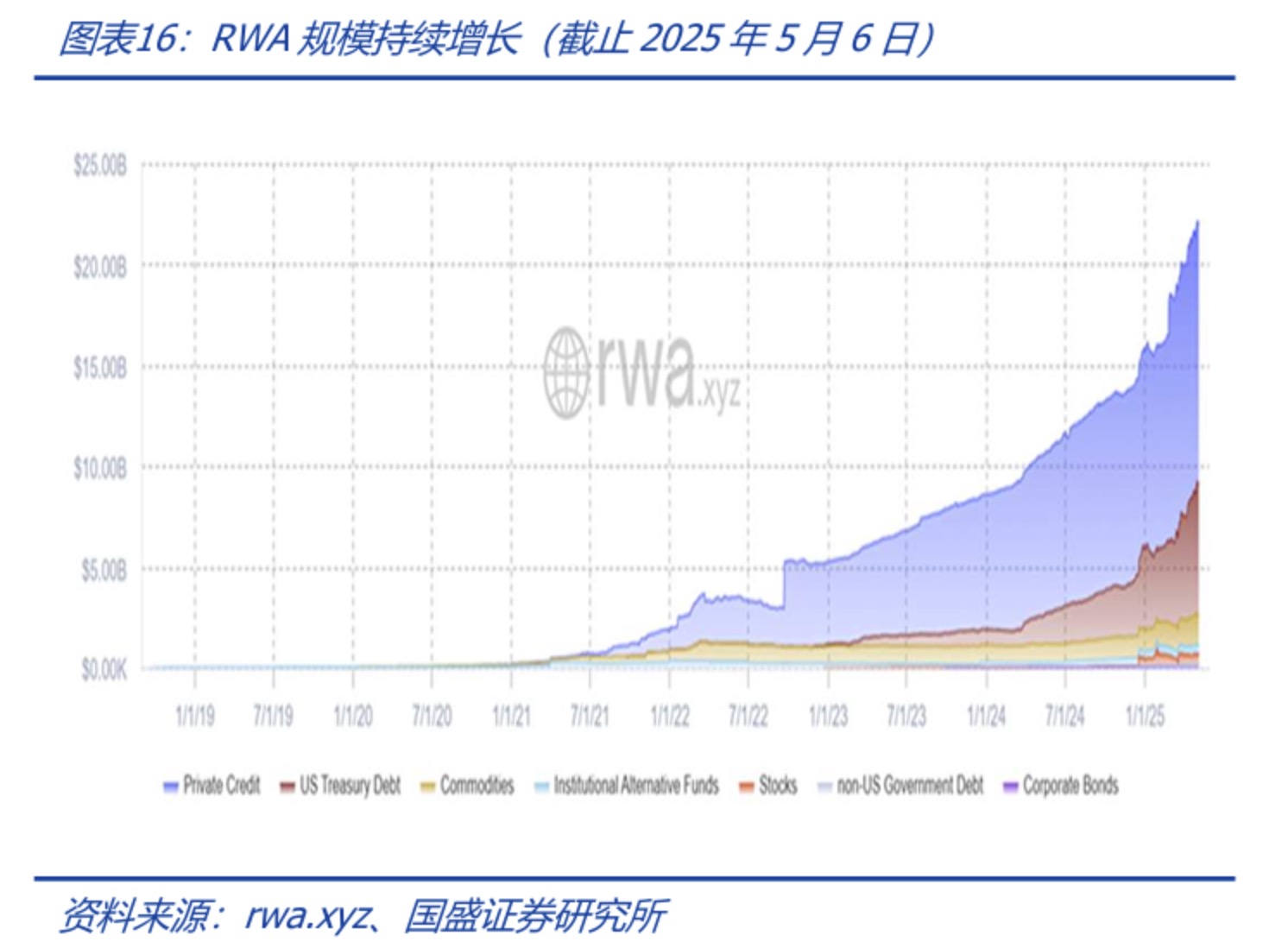

3. RWA: An important application area of stablecoins

Since the beginning of this year, the price of Bitcoin has fallen to a certain extent, driving the cryptocurrency market downward, while the RWA market has maintained a good upward trend. According to rwa.xyz data, as of May 6, the scale of RWA has exceeded US$22 billion, and it has shown a trend of continuous growth since the beginning of this year. From the perspective of scale growth, it does not seem to be affected by the decline in Bitcoin prices. From the perspective of RWA composition, private credit and US Treasury tokenization have contributed to a large scale and growth.

RWA has become an important engine to promote the development of the cryptocurrency market, which is inseparable from the active participation of traditional financial institutions. Taking the tokenized U.S. Treasury market as an example, the main fund BUIDL was jointly launched by BlackRock and Securitize, and BENJI was launched by Franklin Templeton. It can be seen that traditional financial institutions embracing RWA has gradually become a trend.

As a track with certain growth potential, RWA's demand for stablecoins is also obvious. RWA puts real-world assets on the chain, and USDT is the bridge between the real world and the Web3.0 world.

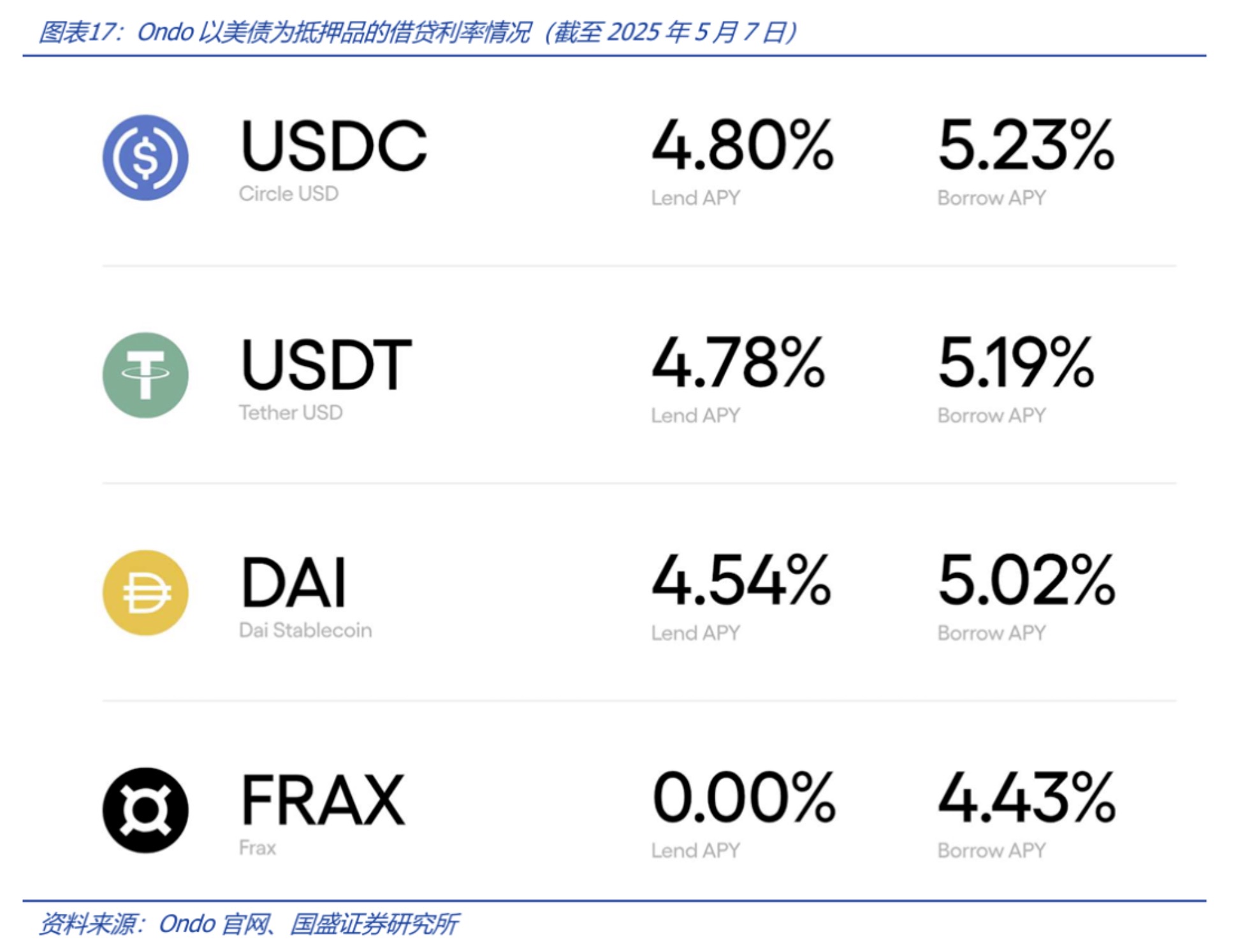

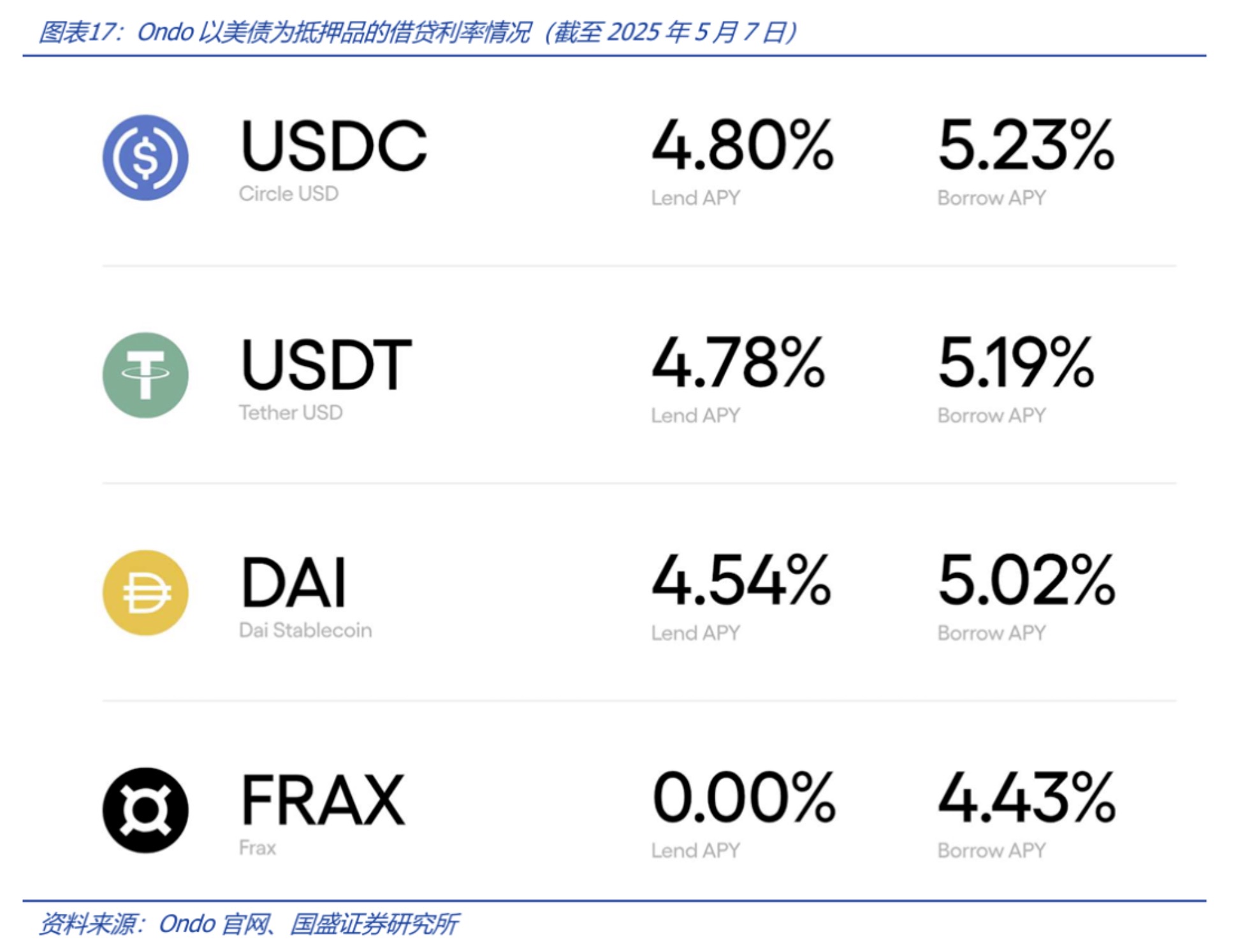

3.1 The institutionalization trend of RWA highlights the important role of stability

Although RWA was born in the wild world of Web3.0, it has now shown a certain "institutionalization" trend - especially the Bitcoin ETF has strengthened the recognition of Web3.0 by traditional financial institutions and markets, and this trend is natural. Take Ondo as an example, it is a US blockchain technology company whose mission is to accelerate the Web3.0 process of the traditional wealth world by building platforms, assets and infrastructure that bring financial markets to the chain. Recently, the company announced the launch of a new technology program, Ondo Nexus, which aims to provide real-time liquidity for third-party issuers of tokenized U.S. Treasury bonds. In other words, Ondo Nexus provides redemption and exchange services for tokenized treasury bonds, enhancing the liquidity and practicality of tokenized treasury bonds, while building infrastructure for a wider range of RWA asset classes. Its customers include Franklin Templeton, WisdomTree, Wellington Management and Fundbridge Capital, while leveraging the 7×24-hour all-weather liquidity provided by existing relationships with companies such as BlackRock and PayPal. In addition, on February 12, the company announced a strategic partnership with World Liberty Financial (WLFI), which is supported by Donald Trump Jr. (son of US President Trump), to introduce traditional finance onto the chain by promoting the development of RWA. RWA has accelerated into the "institutionalization" era.

With Ondo Nexus, investors in the tokenized treasury bonds of partner issuers will be able to seamlessly redeem their RWA assets in a variety of stablecoins, thereby enhancing the liquidity and utility of the entire ecosystem, improving the investability of the RWA space, and increasing confidence in the liquidity of on-chain assets. In 2024, the total locked value (TVL) of RWA assets in the company's tokenized treasury bond category exceeded US$3 billion, achieving good results.

With the support of traditional financial institutions, Ondo has obtained good liquidity support, which plays a vital role in attracting customers from traditional financial markets. After all, many of these customers’ assets are not on the chain.

4. The traditional payment market is developing stablecoins: payment and interest-bearing

As a bridge between Web3.0 and the real world, stablecoins have a two-way role. Not only are real-world assets on the chain through stablecoins, but the application of stablecoins is also penetrating into the real-world market. We can expect that the application of stablecoins in cross-border payments will be worth looking forward to. At the same time, as an asset similar to shadow "legal currency", if users can generate interest when holding stablecoins, it will be another important breakthrough.

It is not new that traditional payment institutions such as Mastercard support the use of stablecoins. This is an active bid by traditional financial institutions for Web3.0 financial traffic. Since the DeFi system provides an interest-bearing method for crypto assets, this is an advantage for on-chain assets. In terms of interest-bearing, traditional financial institutions are also seeking higher attractiveness. Payment giant PayPal is stepping up its efforts to develop its stablecoin PYUSD market. Recently, the company is preparing to start offering 3.7% interest on balances to US users holding PYUSD. The plan will be launched this summer, and users will earn interest while storing PYUSD in PayPal and Venmo wallets. PYUSD can be used through PayPal Checkout, transferred to other users, or exchanged for traditional US dollars.

As early as September 2024, Paypal officially announced that it would allow payment partners to use PayPal USD (PYUSD) to settle cross-border remittances through Xoom, allowing them to take full advantage of the cost and speed advantages of blockchain technology; in April of that year, the company allowed its US Xoom users to use PYUSD to transfer money to overseas relatives and friends without paying transaction fees. Xoom is a service under PayPal. As a pioneer in the field of digital remittances, it provides fast and convenient remittances, bill payments and mobile phone recharge services to relatives and friends in about 160 countries around the world.

In other words, stablecoins are beginning to be adopted by the traditional payment market, and generating interest is an important means of potentially attracting customers.

On May 7, 2025, Futu International Securities announced that it would officially launch crypto asset recharge services such as BTC, ETH, and USDT, providing users with Crypto+TradFi (traditional finance) asset allocation services. Recently, three years after abandoning the Libra/Diem project, Meta is in contact with a number of crypto companies to discuss the application of stablecoins, exploring cross-border payments to creators through stablecoins to reduce costs. It is a general trend for traditional financial/Internet institutions to begin to deploy crypto asset services and share Web3.0 financial traffic.

Of course, cryptocurrency project parties are also actively expanding into traditional financial markets. On April 1, local time in the United States, Circle, the issuer of stablecoin USDC, submitted an S-1 form to the U.S. Securities and Exchange Commission, applying for listing on the New York Stock Exchange with the stock code CRCL. Circle reported that by the end of 2024, its stablecoin-related business revenue was US$1.7 billion, accounting for 99.1% of total revenue. Circle is expected to become the first listed stablecoin issuer in the U.S. market. If Circle is successfully listed this time, it will further promote the development of the U.S. stablecoin market, and at the same time accelerate the acceptance of stablecoins by traditional financial users, especially institutional users-after all, the traditional users of stablecoins are still from the cryptocurrency market.

5. How should stablecoins be regulated?

Cryptocurrency was born in the wild. As a brand new thing, its development process has been accompanied by a game with supervision. Taking the US market as an example, the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), the Financial Crimes Enforcement Network (FinCEN) responsible for anti-money laundering (AML), terrorist financing (CFT) and the Office of the Comptroller of the Currency (OCC) (responsible for supervision related to national banking business) and other regulatory departments have the willingness and cases to regulate cryptocurrencies. In fact, as a new thing, cryptocurrency has also largely touched the regulatory scope of the above departments, and various regulatory departments are also striving to strengthen the dominant power of cryptocurrency supervision. However, there are currently no mature regulatory laws and regulations. All departments are implementing supervision according to existing laws and regulations or their own understanding. In the process of development, cryptocurrency projects often face regulatory intervention and legal proceedings from regulators. Take Tether, the issuer of USDT, as an example. In the early days, it faced accusations from the New York Attorney General's Office that it had problems such as opaque operations and deceiving investors. After a 22-month investigation, the New York Attorney General's Office announced in February 2021 that it had reached a settlement agreement with Tether, and Tether paid a fine of $18.5 million and was banned from providing related products and services to New York citizens. There are many similar accusations from regulators against cryptocurrency projects or platforms. This is the current reality facing cryptocurrency regulation - the lack of a sufficiently complete legal framework has caused cryptocurrencies to wander in a gray area.

Since the Bitcoin spot ETF was approved for listing in the United States, the cryptocurrency market has not only achieved great development in terms of market size, but also gained more positive attitudes in terms of regulation. The United States is a representative example, and the regulatory attitude towards cryptocurrencies is generally positive. The White House held the first cryptocurrency summit on March 7, and many industry professionals including Coinbase CEO and MicroStrategy (MSTR) founder were invited to participate. President Trump stated at the summit that the U.S. federal government will support the development of cryptocurrencies represented by Bitcoin and the digital asset market, and he supports Congress to pass legislation to provide regulatory certainty for the cryptocurrency and digital asset markets.

For the regulation of stablecoins in the United States, the most important thing at present is the GENIUS Act, which requires that stablecoins must be backed by liquid assets such as US dollars and short-term treasury bonds, which involves establishing a legal framework for the issuance of stablecoins in the United States. The U.S. Senate held a key vote on the GENIUS Stablecoin Act on May 8, local time, but unfortunately the bill failed to pass in the end. From the perspective of USDT, the most popular stablecoin, its reserve assets are mainly US dollars and treasury bonds, which is closer to the requirements of the bill, but for two major categories of stablecoins such as DAI and USDe, there is still a very large gap with the requirements of the GENIUS Act. In response, before this, the U.S. Securities and Exchange Commission (SEC) issued an announcement guidance on April 4, local time, stating that stablecoins that meet certain conditions are identified as "non-securities" under the new guidance and are exempted from transaction reporting requirements. The SEC defines this type of "compliant stablecoin" as: a token that is fully supported by fiat currency reserves or short-term, low-risk, high-liquidity instruments and can be redeemed for US dollars at a 1:1 ratio. This definition explicitly excludes algorithmic stablecoins that maintain their dollar peg through algorithms or automated trading strategies, leaving the regulatory status of algorithmic stablecoins, synthetic dollar assets (RWA) and interest-bearing fiat currency tokens uncertain.

At present, although stablecoins are gaining ground in the market, they still lack a complete and clear legal framework to support them. This is a microcosm of the current state of cryptocurrency regulation - as a financial or technological innovation different from any previous one, the regulatory challenges it faces are also unprecedented.

From a practical perspective, stablecoins are the "simplest" cryptocurrency. Considering the relationship with legal currency, stablecoins can penetrate into the payment field and are the cryptocurrency that regulators pay the most attention to. Not only is the United States concerned about regulation, but other regions such as Hong Kong are also accelerating the regulation of stablecoins. On February 27 this year, the relevant bill committee of the Legislative Council of Hong Kong, China, was reviewing the "Stablecoin Bill". Ho Hong-che, director (digital finance) of the Hong Kong Monetary Authority, said that he expects the Legislative Council to pass the draft this year, after which the Hong Kong Monetary Authority will issue regulatory guidelines to explain how regulators interpret the law, including the details of the issuer's business operations, and will implement the system in a timely manner to open interested participants to apply for licenses. On April 22, Shen Jianguang, vice president and chief economist of JD Group, said that JD has now entered the "sandbox" testing phase for the issuance of stablecoins in Hong Kong, China. This is also a positive response to regulation by companies in Hong Kong, indicating that the Hong Kong market has certain demand expectations for stability.

In short, the current status of stablecoins is that they are in the stage of application first and then adjustment with regulation. In any case, the application demand and business logic of stablecoins are basically mature. The regulatory policies of the United States and Hong Kong authorities will only play a regulatory role in the development of stablecoins, and provide a clearer business development logic for traditional financial institutions.

6. Risk Warning

Blockchain technology development is not as good as expected: The blockchain-related technologies and projects underlying Bitcoin are in the early stages of development, and there is a risk that technology development will not be as good as expected.

Uncertainty of regulatory policies: The actual operation of blockchain and Web3.0 projects involves a number of financial, network and other regulatory policies. Currently, the regulatory policies of various countries are still in the research and exploration stage, and there is no mature regulatory model, so the industry faces the risk of uncertainty in regulatory policies.

Web3.0 business model implementation is not as expected: Web3.0-related infrastructure and projects are in the early stages of development, and there is a risk that the business model implementation will not be as expected.

summary

Stablecoins refer to cryptocurrencies whose value is anchored to various fiat currencies. As assets on the blockchain, stablecoins have the advantage of being deeply integrated with cryptocurrency projects (such as DeFi) at the blockchain infrastructure level and having very good network scalability. As traditional financial institutions in the United States, Hong Kong, China and other places have made efforts in the RWA field, the exploration and in-depth application of stablecoins in the traditional payment market have been promoted.

Stablecoins, to some extent, serve as a "pricing tool" in the cryptocurrency market, which is a supplement or even a substitute for traditional fiat currency transactions. Shortly after the birth of stablecoins, the most important trading pairs in the cryptocurrency market were stablecoin trading pairs. Therefore, stablecoins serve as "fiat currencies" in terms of trading tools and value circulation. In mainstream exchanges (including DEX decentralized exchanges), Bitcoin spot and futures trading pairs are mainly stablecoins such as USDT, especially futures contracts with larger trading volumes. The forward contracts of mainstream exchanges (futures contracts with USD stablecoins as margin) are almost all USDT trading pairs.

USDT is one of the earliest stablecoins issued. It is issued by Tether with sufficient reserve assets anchored to the US dollar and is currently the most widely used stablecoin. USDT was launched by Tether in 2014, with 1 USDT anchored to 1 US dollar. USDT became one of the earliest stablecoins listed on centralized exchanges, and has since gradually become the most widely used stablecoin product in the market, mainly used for cryptocurrency spot and futures trading pairs. USDT is a stablecoin backed by US dollar assets. The company claims that each token is backed by 1 US dollar in assets. Tether provides an auditable balance sheet, which mainly includes traditional financial assets such as cash. Since the launch of USDT, its scale has continued to maintain a relatively fast growth rate, which reflects the market's underlying actual demand for stablecoins. The emergence of stablecoins can be said to be "inevitable."

There are currently three ways to achieve this credit transfer: issuing stablecoins with sufficient reserve assets by centralized institutions, issuing stablecoins based on blockchain smart contracts and pledged crypto assets, and algorithmic stablecoins. For stablecoins, stablecoins issued by centralized institutions such as USDT are in a dominant position; the mechanisms of the second type of over-collateralization and the third round of algorithmic stablecoins are not intuitive to a certain extent, and users often cannot directly feel the intrinsic value anchoring logic of their stablecoin products, especially when the price of cryptocurrencies fluctuates violently, and users cannot directly anticipate the results of the liquidation mechanism. These factors have restricted the development of the latter two.

RWA has become an important engine to promote the development of the cryptocurrency market. Traditional financial institutions are also actively adopting stablecoins to promote stablecoins in the traditional payment market. Taking the tokenized U.S. Treasury market as an example, the main fund BUIDL was jointly launched by BlackRock and Securitize, and BENJI was launched by Franklin Templeton. It can be seen that traditional financial institutions embracing RWA has gradually become a trend.

Stablecoin regulation is gradually being promoted. Currently, stablecoins are being developed first and then adjusted to the regulations. Although they have also experienced doubts during their development, with BTC entering the mainstream capital market, the development of stablecoins is expected to accelerate.

Risk warning: Blockchain technology research and development is not as good as expected; regulatory policy uncertainty; Web3.0 business model implementation is not as good as expected.

1. Core Viewpoint

Stablecoins were born in the "grassroots" world of Web3.0. In the early days, they were used as a legal currency pricing tool for trading cryptocurrencies. As the cryptocurrency market grows and develops, stablecoins have become an indispensable basic tool for exchanges, DeFi, and RWA ecosystems. A key to the success of stablecoins is the ability to gain market trust, which involves the credit transmission mechanism of stablecoins. Stablecoins are not only a rigid demand in the Web3.0 world, but also a bridge between it and the real economic world. Today, when stablecoins are popular, traditional financial institutions have also begun to accelerate the adoption of stablecoins and embrace crypto assets. Stablecoins connect two worlds.

This article analyzes the birth, development, current status and mechanism of stablecoins, and looks forward to the current development opportunities of stablecoins.

2. The necessity of stablecoins: a bridge between traditional finance and Web3.0

2.1 The underlying demand for stablecoins: on-chain “fiat currency” tools

The so-called stablecoin refers to a cryptocurrency whose value is anchored to various fiat currencies (or a basket of currencies). Intuitively speaking, a stablecoin maps the value of real-world fiat currencies to account numbers on the blockchain (i.e., cryptocurrencies). In this sense, a stablecoin is a typical RWA (Real World Assets, tokenization of real-world assets). As an asset on the blockchain, the advantage of a stablecoin is that it can be deeply integrated with cryptocurrency projects (such as DeFi) at the blockchain infrastructure level - such as on-chain exchange with other cryptocurrency assets on the chain or combined staking and other DeFi operations. Traditional fiat currencies are not on the blockchain and cannot obtain on-chain scalability.

In the early days of the cryptocurrency market, users mainly traded Bitcoin and fiat currencies in centralized exchanges (CEX) or OTC markets. Bitcoin is an asset stored on the blockchain, while fiat currencies rely on traditional bank accounts. This transaction actually involves two completely isolated trading operations between Bitcoin blockchain accounts and bank fiat currency accounts. This is similar to the stock market, where stock registration systems and bank fiat currency accounts must be settled separately. In the early days of cryptocurrency development, as countries increasingly tightened their supervision of exchanges, bank fiat currency accounts were more susceptible to regulatory restrictions. Under the special background conditions in the early days, the demand for stablecoins anchored to the value of fiat currencies gradually emerged. Stablecoins formed trading pairs for Bitcoin (or other cryptocurrency assets) to trade in currencies, which was separated from the traditional financial account system. More importantly, cryptocurrencies are assets based on blockchain accounts. If the trading pairs they are denominated in are also based on currencies of blockchain accounts, then the integration and interoperability between ledgers become possible. However, traditional fiat currencies are not on the blockchain.

In other words, cryptocurrency assets such as Bitcoin are not interoperable with fiat currency accounts, and smart contracts cannot operate on fiat currency accounts, which is not conducive to the scalability of the network. Therefore, based on the needs of integration and interoperability, the market requires all assets to be expressed as numbers in blockchain accounts on the chain. In addition, due to the high volatility of cryptocurrency, it cannot meet the three characteristics of currency: value storage, transaction medium, and pricing tool. It is difficult for users to retain and exit their investments in the crypto world, which has stimulated the demand for low-volatility stable currencies.

Stablecoins, to some extent, serve as a "pricing tool" in the cryptocurrency market, which is a supplement or even a substitute for traditional fiat currency transactions. Shortly after the birth of stablecoins, the most important trading pairs in the cryptocurrency market were stablecoin trading pairs. Therefore, stablecoins serve as "fiat currencies" in terms of trading tools and value circulation. As shown in Figure 2, on mainstream exchanges like Binance, Bitcoin spot and futures trading pairs are mainly based on various stablecoins such as USDT, especially futures contracts with larger trading volumes. Forward contracts on mainstream exchanges (futures contracts with USD stablecoins as margin, such as perpetual futures contracts) are almost all USDT trading pairs.

Tether USD (USDT) is one of the earliest stablecoins issued. It was launched by Tether in 2014, with 1 USDT anchored to 1 US dollar. USDT became one of the earliest stablecoins listed on centralized exchanges, and has since gradually become the most widely used stablecoin product in the market, mainly used for cryptocurrency spot and futures trading pairs. USDT is a stablecoin backed by US dollar assets. The company claims that each token is backed by 1 US dollar in assets. Tether provides an auditable balance sheet, which mainly consists of traditional financial assets such as cash. Other stablecoin projects issued in the same period include BitUSD and NuBits. Since the launch of USDT, its scale has continued to maintain a relatively fast growth rate, which reflects the market's underlying actual demand for stablecoins. The emergence of stablecoins can be said to be "inevitable."

Since USDT meets the actual needs of the market, since 2017, as mainstream cryptocurrency trading platforms have launched USDT trading pairs (spot and futures contracts), stablecoins have been favored by the cryptocurrency market. Whether various early stablecoins can effectively anchor the corresponding fiat currency value has become the most worrying issue in the market. Since companies like Tether failed to provide convincing and compliantly audited balance sheets in the early days, the market has always questioned their credit. In order to solve the problem of USDT's transitional reliance on the credit of centralized institutions such as companies, MakerDAO issued a decentralized, multi-asset collateralized stablecoin DAI based on smart contracts in 2017. The crypto assets managed by smart contracts behind it are over-collateralized, and the exchange rate between its price and the US dollar is stabilized by the smart contract system, allowing users to mint without permission. As of May 3, 2025, the issuance scale of DAI exceeds US$4.1 billion, ranking fifth among various stablecoins (the new stablecoin USDS issued by MakerDAO is not counted here).

The emergence of DAI is a milestone event. Decentralized stablecoins are not only different from products endorsed by centralized institutions (such as USDT) in terms of credit transmission, but they are also native products of the DeFi system - DAI itself is a RWA product pledged by DeFi. Therefore, decentralized stablecoins such as DAI are not only used in centralized exchanges, but also an indispensable link in the RWA ecosystem - a part of the so-called "Lego puzzle".

With the widespread and in-depth application of stablecoins, centralized exchanges have begun to develop their own stablecoin products, such as USDC issued by Coinbase and BUSD led by exchange giant Binance.

Since 2019, with the development of DeFi projects, stablecoins have been widely used in DeFi systems (lending markets, decentralized exchange markets). In pursuit of greater decentralization and integration with DeFi infrastructure, algorithmic stablecoins based on smart contract algorithms to adjust currency value stability have begun to be active in the market. Based on DAI, this uses the algorithmic mechanism of smart contracts to achieve credit transfer between stablecoins and legal tender. Currently, the main products include USDe, etc.

Although the cryptocurrency industry pursues sufficient decentralization, the stablecoin market (mainly US dollar stablecoins) is still dominated by stablecoins such as USDT and USDC, which are issued based on the collateral/reserve assets of central institutions, and they occupy an absolute monopoly. As shown in Figure 4, as of May 3, 2025, the scale of USDT, which ranks first, exceeds 149 billion US dollars, the scale of USDC, which ranks second, exceeds 610 US dollars, and the scale of USDDe, which ranks third, is less than 5 billion US dollars. USDT and UDSC, two centralized stablecoins, are in an absolute dominant position. The blockchain smart contract algorithm stablecoin USDDe ranks third, with a scale of about 4.7 billion US dollars. The stablecoins issued based on blockchain smart contract collateral assets, USDS and DAI, are ranked fourth and fifth, with a scale of about 4.3 billion US dollars and 4.1 billion US dollars respectively.

At present, the main use of stablecoins is in the cryptocurrency market, because the mainstream pricing method in the cryptocurrency market is to price stablecoins. With the bull market in the cryptocurrency market over the past year, the issuance scale of stablecoins (mainly US dollar stablecoins) has grown rapidly. As shown in Figures 5 and 6, the issuance scale will exceed US$240 billion as of May 3, 2025; currently, USDT and USDC account for 61.69% and 25.37% of the scale respectively. One point worth noting here is that decentralized stablecoins have not shown enough advantages. From the perspective of practical application, stablecoins such as USDT and USDC, which are in the mode of reserving traditional financial assets, have become the absolute leaders. There are many influencing factors. The rapid development of RWA is related to the adoption of USDT and USDC, which will be further analyzed later.

2.2 Not only a pricing tool, but also a bridge between Web3.0 and traditional financial markets

In the DeFi lending market, stablecoin assets such as USDT are commonly used as collateral/loan assets. They not only serve as deposits and savings, but also exist as a crypto asset - they can be used to mortgage crypto assets such as Bitcoin/ETH to borrow stablecoins, and they can also be used as collateral to borrow other crypto assets. For example, the AAVE project, which ranks first in DeFi locked assets, has three of the top six market-scale projects in its lending market for US dollar stablecoin lending, with USDT, USDC, and DAI ranking second, third, and sixth respectively.

Whether in the trading market or the DeFi lending market, stablecoins are similar to currencies or notes issued by private institutions to some extent. Due to the characteristics of blockchain infrastructure, stablecoins have different potential from traditional financial markets in terms of clearing speed, integration and scalability. For example, stablecoins can be quickly and seamlessly switched between DeFi projects (such as exchanges, lending markets, leveraged products, etc.) with just a few clicks on mobile phones and other terminals, while fiat currencies cannot circulate so quickly in traditional financial markets.

The integration of the Web3.0 world represented by cryptocurrency and the real economic world is an inevitable trend, and RWA is an important driving force in this integration process - because RWA more directly maps the display world assets to the blockchain. From a broad perspective, stablecoins are the most basic RWA products, anchoring fiat currencies such as the US dollar to the blockchain. For users of traditional financial markets, stablecoins and RWA are the bridges to the cryptocurrency market. For traditional financial institutions that want to enter the Web3.0 world, stablecoins are an important position. With stablecoins, they can freely roam in the Web3.0 world to convert asset allocation. In turn, investors holding cryptocurrency assets can convert stablecoins into traditional financial assets or purchase goods and return to the traditional financial market. On April 28, 2025, payment giant Mastercard announced that Mastercard allows customers to consume in stablecoins and allows merchants to settle in stablecoins. The use of stablecoins began to spread in reverse to the traditional economic society.

2.3 Three modes of stablecoin credit transmission

The numbers in bank accounts represent the fiat currency deposits of users, which is ensured by the rules of traditional economic society. Stablecoins attempt to transfer the value of fiat currency to the numbers in on-chain accounts, and the credit transfer in between needs to be different from the bank's method, which is a very critical core issue of stablecoin credit. In general, there are currently three ways to achieve this credit transfer: issuing stablecoins with sufficient reserve assets by centralized institutions, issuing stablecoins based on blockchain smart contracts and mortgaging crypto assets, and algorithmic stablecoins.

For stablecoins, stablecoins issued by centralized institutions such as USDT are in a dominant position; this type of product model has simple logic, and with the help of the credit transmission model of the traditional economic market, it is easy for users to understand and operate. It is the most reasonable choice in the early development stage of the stablecoin field. The mechanisms of the second type of over-collateralization and the third round of algorithmic stablecoins are not intuitive to a certain extent. Users often cannot directly feel the intrinsic value anchoring logic of their stablecoin products (that is, primary users cannot accept their logic well), especially when the price of cryptocurrencies fluctuates violently, users cannot intuitively anticipate the results of the liquidation mechanism - during the period of violent fluctuations in the price of encrypted assets, the liquidation mechanism will lead to some irrational results in the market. These factors have restricted the development of the latter two.

2.3.1. Relying on the traditional economic market to transfer credit: USDT

Centralized institutions issue stablecoins with sufficient reserve assets, and credit transmission relies entirely on the traditional economic market. As the simplest stablecoin model, a centralized institution reserves sufficient assets and issues a corresponding number of stablecoins on the blockchain (the issuing institution bears the responsibility for the issuance and redemption of stablecoins), which anchors the stablecoin to the legal currency 1:1, that is, the centralized institution is the credit endorsement subject. It is necessary to rely on an effective audit of the issuer's balance sheet. Usually, these assets are mainly treasury bonds, cash, etc. in the traditional market, and a small part can also be cryptocurrencies such as Bitcoin. Through one-to-one mortgage custody, this model ensures that users can redeem equivalent collateral from the issuer, ensuring the price stability of stablecoins. However, this model is also very dependent on the safe custody of collateral, which involves many details such as the compliance of the project party, the compliance of the custodian, and the liquidity of the collateral. Usually, whether the issuing institution can provide a compliant and effective audit report is the most concerned.

USDT's early project establishment also gave the project sufficient first-mover advantage. It is currently a stablecoin product with more than 60% of the circulation in the market. To ensure the wide application of the product, USDT is issued on multiple blockchains including Omni, Ethereum, Tron, Solana, etc. In the early stages of scale development, factors such as liquidity and market doubts about its balance sheet, coupled with market fluctuations, caused USDT to occasionally depeg (sometimes with a premium) in the early stages. However, these special cases are temporary, and USDT's anchoring to the US dollar is generally successful. We believe that there is no lack of strong market demand factors. After all, USDT is a rigid product for the cryptocurrency market.

In response to the market's doubts about its reserve assets and ability to pay, Tether has now released a complete and effective audit report. According to the audit report of an independent agency, the total assets of Tether's USDT issuance department on March 31, 2025 were approximately US$149.3 billion, which is consistent with the scale of USDT it issued. A careful examination of the balance sheet shows that 81.49% of the reserve assets are cash, cash equivalents and other short-term deposit items, mainly U.S. Treasury bonds, which ensures the soundness of its assets and liabilities and fully considers liquidity measures to deal with redemptions. Interestingly, there are also $7.66 million in Bitcoin reserves in its assets. Although the amount is not large, it fully echoes the fact that Bitcoin (and then extended to other cryptocurrencies) can be used as a reserve asset for issuing stablecoins. In short, the composition of USDT reserves is diverse, taking into account both liquidity and the diversity of configuration.

As the issuer of USDT, Tether achieved a total profit of more than 13 billion US dollars in 2024, while the actual company has only about 150 employees. Under the Fed's interest rate hike cycle, U.S. Treasury bonds contributed to Tether's core profits. Of course, there will be a certain fee for the redemption of USDT. As a compliant company responsible for issuing and redeeming stablecoins, Tether's model is currently the most sought-after in the market. We believe that USDT entered the market at an early stage and firmly occupied the first-mover advantage in both the centralized exchange (CEX) and DeFi eras. At the same time, relying on companies with credit endorsements provided by public audits in traditional society to issue stablecoins is also an important reason for being accepted by both traditional financial markets and Web3.0 markets.

2.3.2. Stablecoins issued by decentralized collateral assets can also gain market trust

Based on the blockchain smart contract to pledge crypto assets, the issuance of stablecoins under excess reserves can also gain market trust. Crypto assets are pledged to smart contracts, which lock the crypto assets on the chain and issue a certain number of stablecoins. Since the crypto assets on the chain do not naturally maintain price stability against the US dollar, there is a risk of price fluctuations in the pledged assets. In order to achieve stable prices and redemption of stablecoins, this type of stablecoin uses an over-collateralized model to achieve credit transfer - that is, the value of the pledged crypto assets exceeds the amount of the issued stablecoins, and when the market fluctuates (especially when the price of the pledged assets falls), the blockchain smart contract liquidates the pledged assets (and purchases stablecoins at the same time) to ensure the redemption ability of the stablecoins. The difference between this model and the first model is that it does not rely on the credit of centralized institutions. The largest and most typical examples of this model are USDe and DAI - USDe is issued on the basis of DAI and based on the new Sky protocol, and can be considered an upgraded version of DAI (the two can be freely exchanged at an unlimited 1:1). In 2024, MakerDAO changed its name to Sky Ecosystem and launched a stablecoin product called USDS. All crypto assets that can be collateralized can generate DAI under the control of the Sky protocol through a smart contract called Maker Vault. The price drop of the collateral will lead to the risk of insufficient collateral value. The protocol will sell the collateral (i.e. buy DAI) according to the set parameters to support the value of DAI anchored to the US dollar at a 1:1 ratio.

From the perspective of the composition of collateral assets, as of May 5, 2025, the main collateral of USDS is ETH tokens, accounting for more than 92%.

How to ensure the stability of DAI? In other words, ensuring that DAI holders can redeem is the core of DAI's stable anchoring. The DAI issuer interacts with the Sky Protocol Vault contract on the chain and deposits enough collateralized crypto assets into the vault (the asset value is greater than the DAI issuance amount to ensure that DAI can be redeemed). Under market fluctuations, if the price of the collateralized crypto assets falls, there is a risk that the collateral assets cannot be redeemed for the redemption of the issued DAI. The vault liquidates and auctions the collateralized assets according to the agreement of the contract procedure, and the liquidation is carried out by redeeming DAI. This mechanism is similar to the margin mechanism of futures contracts. When the margin is insufficient, the open positions will be liquidated in advance. The Sky protocol has designed a corresponding auction price mechanism to ensure that the value of the vault's collateralized assets can redeem the DAI circulating in the market, which is to ensure the "stability" of the DAI price.

2.3.3. Algorithmic stablecoin: full trust in blockchain algorithms, currently small in scale

The above two stablecoin models are to issue corresponding stablecoins by pledging assets. USDT is a company's fully auditable asset reserve, while USDS/DAI realizes the asset mortgage and redemption mechanism through blockchain smart contracts. The latter's liquidation mechanism pricing and treasury governance are not completely decentralized. Driven by the demand of decentralized financial native users for fully decentralized stablecoins, a mechanism that completely relies on algorithmic mechanisms to achieve stablecoin value anchoring has emerged, that is, products that maintain stablecoin prices in the trading market through algorithms have emerged one after another. This price stabilization mechanism of algorithmic stablecoins is generally similar to the market arbitrage/hedging mechanism under algorithmic control. In theory, it ensures that stablecoins remain anchored, but the practice is still in its early stages, and it is not uncommon for them to deviate from the anchored price level. The scale of algorithmic stablecoins is still relatively small. Compared with the second category, algorithmic stablecoins rely entirely on decentralized smart contract algorithms and basically do not require human intervention. As an innovative track, algorithmic stablecoins have historically had several different arbitrage/hedging mechanisms, but overall there are not many projects that have been successfully run for a long time.

The representative of algorithmic stablecoins is currently the third largest USDe, issued by the Ethena protocol. Generally speaking, whitelisted users deposit crypto assets such as BTC, ETH, USDT or USDC into the Ethena protocol to mint stablecoins of equal value, and the protocol establishes short positions on CEX exchanges to hedge against price fluctuations of its reserve assets and maintain the value of the issued stablecoins. This method is similar to the hedging mechanism in commodity futures, which is an automatically executed neutral hedging strategy that is completely controlled by algorithms.

3. RWA: An important application area of stablecoins

Since the beginning of this year, the price of Bitcoin has fallen to a certain extent, driving the cryptocurrency market downward, while the RWA market has maintained a good upward trend. According to rwa.xyz data, as of May 6, the scale of RWA has exceeded US$22 billion, and it has shown a trend of continuous growth since the beginning of this year. From the perspective of scale growth, it does not seem to be affected by the decline in Bitcoin prices. From the perspective of RWA composition, private credit and US Treasury tokenization have contributed to a large scale and growth.

RWA has become an important engine to promote the development of the cryptocurrency market, which is inseparable from the active participation of traditional financial institutions. Taking the tokenized U.S. Treasury market as an example, the main fund BUIDL was jointly launched by BlackRock and Securitize, and BENJI was launched by Franklin Templeton. It can be seen that traditional financial institutions embracing RWA has gradually become a trend.

As a track with certain growth potential, RWA's demand for stablecoins is also obvious. RWA puts real-world assets on the chain, and USDT is the bridge between the real world and the Web3.0 world.

3.1 The institutionalization trend of RWA highlights the important role of stability

Although RWA was born in the wild world of Web3.0, it has now shown a certain "institutionalization" trend - especially the Bitcoin ETF has strengthened the recognition of Web3.0 by traditional financial institutions and markets, and this trend is natural. Take Ondo as an example, it is a US blockchain technology company whose mission is to accelerate the Web3.0 process of the traditional wealth world by building platforms, assets and infrastructure that bring financial markets to the chain. Recently, the company announced the launch of a new technology program, Ondo Nexus, which aims to provide real-time liquidity for third-party issuers of tokenized U.S. Treasury bonds. In other words, Ondo Nexus provides redemption and exchange services for tokenized treasury bonds, enhancing the liquidity and practicality of tokenized treasury bonds, while building infrastructure for a wider range of RWA asset classes. Its customers include Franklin Templeton, WisdomTree, Wellington Management and Fundbridge Capital, while leveraging the 7×24-hour all-weather liquidity provided by existing relationships with companies such as BlackRock and PayPal. In addition, on February 12, the company announced a strategic partnership with World Liberty Financial (WLFI), which is supported by Donald Trump Jr. (son of US President Trump), to introduce traditional finance onto the chain by promoting the development of RWA. RWA has accelerated into the "institutionalization" era.

With Ondo Nexus, investors in the tokenized treasury bonds of partner issuers will be able to seamlessly redeem their RWA assets in a variety of stablecoins, thereby enhancing the liquidity and utility of the entire ecosystem, improving the investability of the RWA space, and increasing confidence in the liquidity of on-chain assets. In 2024, the total locked value (TVL) of RWA assets in the company's tokenized treasury bond category exceeded US$3 billion, achieving good results.

With the support of traditional financial institutions, Ondo has obtained good liquidity support, which plays a vital role in attracting customers from traditional financial markets. After all, many of these customers’ assets are not on the chain.

4. The traditional payment market is developing stablecoins: payment and interest-bearing

As a bridge between Web3.0 and the real world, stablecoins have a two-way role. Not only are real-world assets on the chain through stablecoins, but the application of stablecoins is also penetrating into the real-world market. We can expect that the application of stablecoins in cross-border payments will be worth looking forward to. At the same time, as an asset similar to shadow "legal currency", if users can generate interest when holding stablecoins, it will be another important breakthrough.

It is not new that traditional payment institutions such as Mastercard support the use of stablecoins. This is an active bid by traditional financial institutions for Web3.0 financial traffic. Since the DeFi system provides an interest-bearing method for crypto assets, this is an advantage for on-chain assets. In terms of interest-bearing, traditional financial institutions are also seeking higher attractiveness. Payment giant PayPal is stepping up its efforts to develop its stablecoin PYUSD market. Recently, the company is preparing to start offering 3.7% interest on balances to US users holding PYUSD. The plan will be launched this summer, and users will earn interest while storing PYUSD in PayPal and Venmo wallets. PYUSD can be used through PayPal Checkout, transferred to other users, or exchanged for traditional US dollars.

As early as September 2024, Paypal officially announced that it would allow payment partners to use PayPal USD (PYUSD) to settle cross-border remittances through Xoom, allowing them to take full advantage of the cost and speed advantages of blockchain technology; in April of that year, the company allowed its US Xoom users to use PYUSD to transfer money to overseas relatives and friends without paying transaction fees. Xoom is a service under PayPal. As a pioneer in the field of digital remittances, it provides fast and convenient remittances, bill payments and mobile phone recharge services to relatives and friends in about 160 countries around the world.

In other words, stablecoins are beginning to be adopted by the traditional payment market, and generating interest is an important means of potentially attracting customers.

On May 7, 2025, Futu International Securities announced that it would officially launch crypto asset recharge services such as BTC, ETH, and USDT, providing users with Crypto+TradFi (traditional finance) asset allocation services. Recently, three years after abandoning the Libra/Diem project, Meta is in contact with a number of crypto companies to discuss the application of stablecoins, exploring cross-border payments to creators through stablecoins to reduce costs. It is a general trend for traditional financial/Internet institutions to begin to deploy crypto asset services and share Web3.0 financial traffic.

Of course, cryptocurrency project parties are also actively expanding into traditional financial markets. On April 1, local time in the United States, Circle, the issuer of stablecoin USDC, submitted an S-1 form to the U.S. Securities and Exchange Commission, applying for listing on the New York Stock Exchange with the stock code CRCL. Circle reported that by the end of 2024, its stablecoin-related business revenue was US$1.7 billion, accounting for 99.1% of total revenue. Circle is expected to become the first listed stablecoin issuer in the U.S. market. If Circle is successfully listed this time, it will further promote the development of the U.S. stablecoin market, and at the same time accelerate the acceptance of stablecoins by traditional financial users, especially institutional users-after all, the traditional users of stablecoins are still from the cryptocurrency market.

5. How should stablecoins be regulated?

Cryptocurrency was born in the wild. As a brand new thing, its development process has been accompanied by a game with supervision. Taking the US market as an example, the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), the Financial Crimes Enforcement Network (FinCEN) responsible for anti-money laundering (AML), terrorist financing (CFT) and the Office of the Comptroller of the Currency (OCC) (responsible for supervision related to national banking business) and other regulatory departments have the willingness and cases to regulate cryptocurrencies. In fact, as a new thing, cryptocurrency has also largely touched the regulatory scope of the above departments, and various regulatory departments are also striving to strengthen the dominant power of cryptocurrency supervision. However, there are currently no mature regulatory laws and regulations. All departments are implementing supervision according to existing laws and regulations or their own understanding. In the process of development, cryptocurrency projects often face regulatory intervention and legal proceedings from regulators. Take Tether, the issuer of USDT, as an example. In the early days, it faced accusations from the New York Attorney General's Office that it had problems such as opaque operations and deceiving investors. After a 22-month investigation, the New York Attorney General's Office announced in February 2021 that it had reached a settlement agreement with Tether, and Tether paid a fine of $18.5 million and was banned from providing related products and services to New York citizens. There are many similar accusations from regulators against cryptocurrency projects or platforms. This is the current reality facing cryptocurrency regulation - the lack of a sufficiently complete legal framework has caused cryptocurrencies to wander in a gray area.