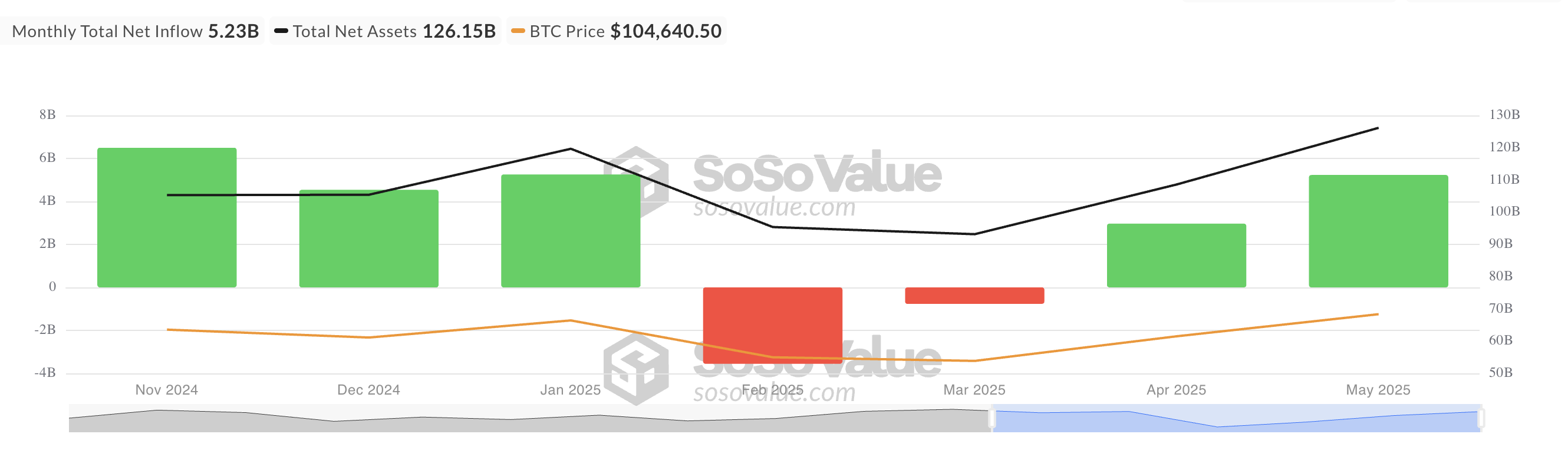

Bitcoin spot ETF saw a surge in demand during May, with total net inflows exceeding $5.23 billion.

This represents an increase of over 70% from the April figure, reflecting a significant increase in institutional interest as Bitcoin reached a new all-time high.

BTC ETF Inflows Surge 76% in May

According to SosoValue's data, BTC ETF demand increased again in May, with net inflows reaching $5.23 billion. This is a 76% increase from April's $2.97 billion, marking the largest monthly inflow since January.

The surge in demand coincided with BTC reaching a new all-time high of $111,968. This milestone was achieved due to continued retail momentum and increased institutional investor interest, injecting new optimism across the market.

As BTC price rises, ETF products have become increasingly attractive to large-scale investors seeking exposure to digital assets.

This ongoing institutional participation may bring price stability and reduced volatility, potentially setting the stage for BTC's further rise in June.

BTC Market, Mixed Signals

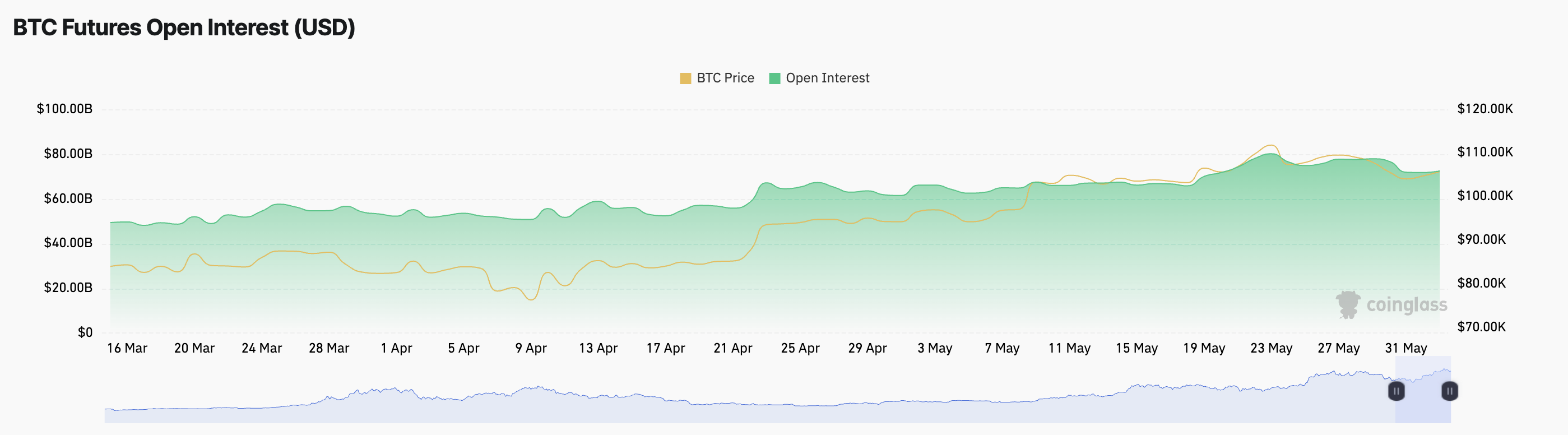

Amid a slight rebound in trading activity today, BTC is trading up 1% at $105,216. Rising futures open interest confirms a surge in demand for the king coin, reaching $72.47 billion, up 1% in the past day.

Open interest represents the total number of unsettled derivatives contracts like futures or options. An increase in open interest indicates growing market participation and capital inflow.

This suggests BTC market momentum is gradually strengthening, showing confidence in the price trend.

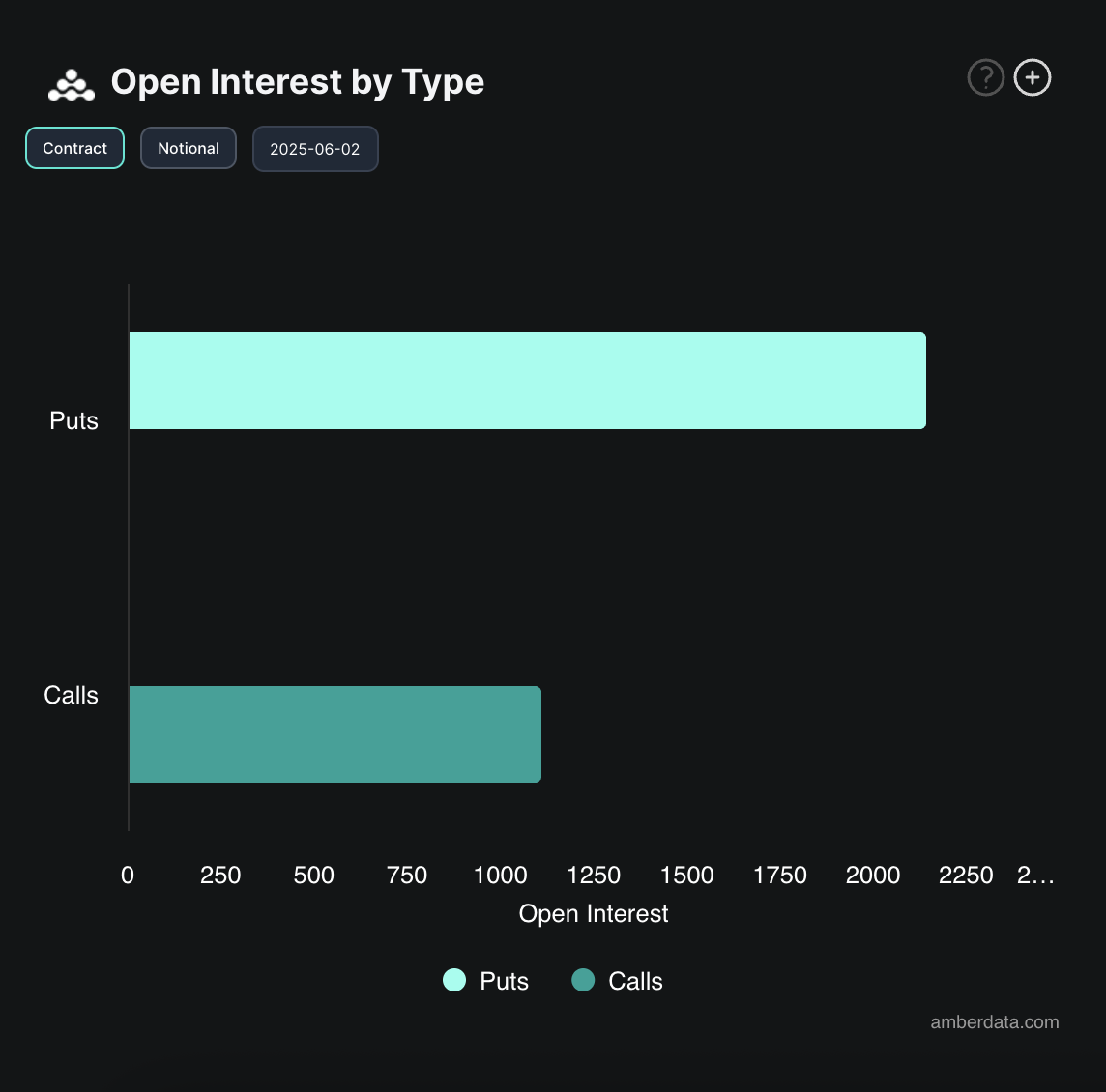

However, the options market indicators show signs of bearish hedging. According to Deribit, today saw a significant increase in put contract demand, indicating many traders are preparing for potential downsides even as the underlying asset rises.

This highlights a divided market sentiment: strong long-term fundamentals are overshadowed by short-term uncertainty.