The second-largest stablecoin giant Circle submitted its prospectus at the end of May, preparing to go public on Nasdaq, with an initial estimated valuation of $5.4 billion.

Unexpectedly, a few days later, perhaps due to the hot concept of stablecoin+RWA, Circle announced raising its valuation from $5.4 billion to $7.2 billion.

The RWA concept has been notably different since the beginning of this year. Favorable U.S. and Hong Kong stablecoin policies, combined with Wall Street's attention to RWA projects represented by BlackRock, and the current situation of established investors entering the stablecoin market, have rapidly popularized the RWA and stablecoin concepts, with even A-share stablecoin concepts being driven to limit up by Hong Kong stocks.

As the third crypto industry giant to have a native Nasdaq IPO (after Coinbase and Antalpha), what related targets in the crypto market can be speculated on?

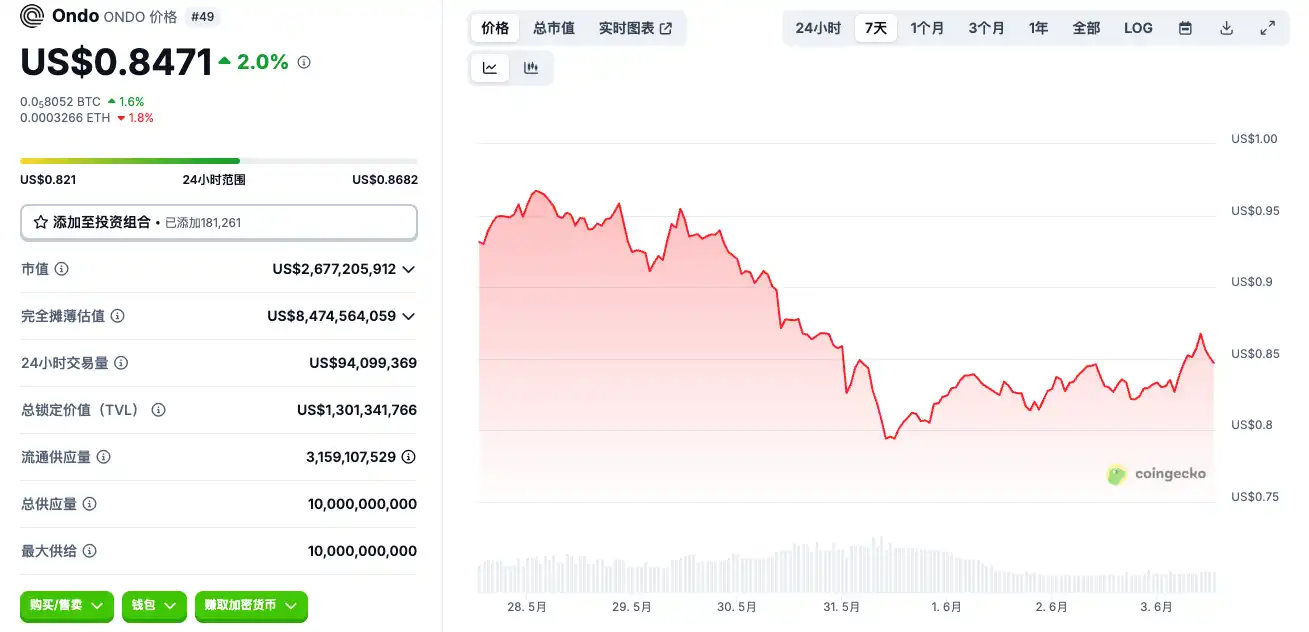

ONDO

BlackRock announced buying 10% of Circle's IPO shares at the end of May, becoming a new shareholder of Circle. BlackRock's most important partner in the RWA track is Ondo. The U.S. Treasury token OUSG issued by Ondo uses BlackRock's BUIDL fund as one of its core underlying assets, and users purchasing OUSG are equivalent to indirectly holding shares of BlackRock's U.S. Treasury fund.

However, the market cap is quite high, with ONDO currently at $2.6 billion.

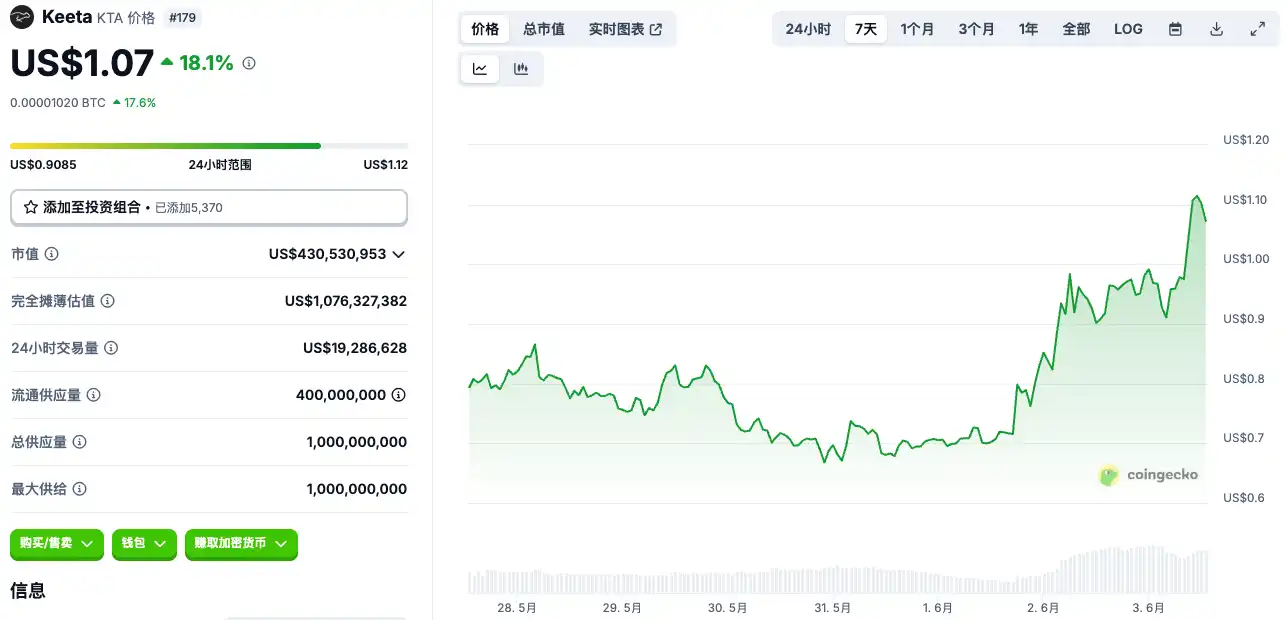

KTA

The close relationship between Coinbase and Circle goes without saying. So besides being beneficial to COIN stock, Circle's listing also allows exploration of the Base blockchain. The market has already given an answer - the RWA blockchain KTA on Base has 10x in a month, now with a market cap of $400 million. In hindsight, Base+RWA+small market cap made KTA an extremely suitable choice for capital.

ENA

Although not closely related to Circle, it is still a primary target that comes to mind for stablecoin concepts and has experienced speculative trading. Coinbase just urgently added ENA to its listing plan, seemingly predicting market moves. With a $1.9 billion market cap, it appears slightly more favorable compared to ONDO.

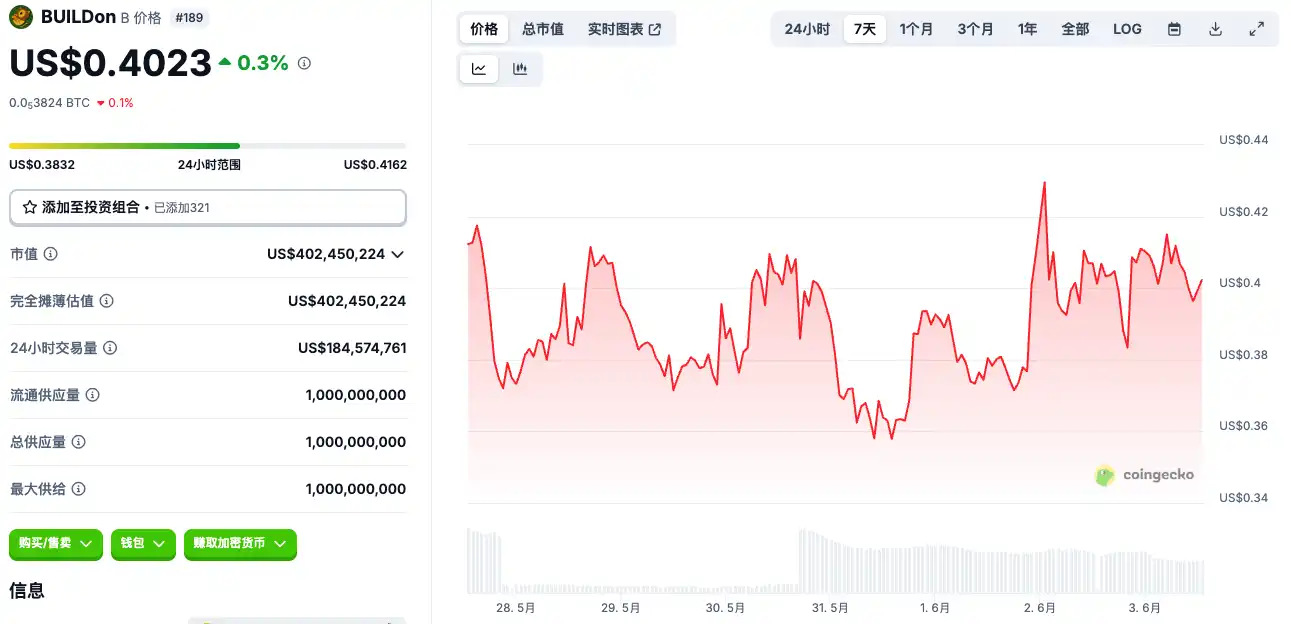

B

vapor0x concluded that since January 2024, Circle's treasury address has been continuously transferring USDC to Binance, most likely in preparation for the IPO to increase activity. He stated: "More dramatically, on the same day as the first large USDC transfer - January 31, 2024 - Binance Earn platform launched a time-limited promotion including USDC. The coincidence of this timing is almost impossible."

So under the support of USDC+USD1, will the BSC's B, a $400 million stablecoin meme, be chosen by capital?