When the Binance Alpha points system threshold quietly broke through 200 points at the end of May, a covert arms race had spread across the global crypto community: users frantically staking BNB, trading obscure tokens at high frequencies, and even paying high gas fees to transfer assets across chains - all operations aimed at securing an entry ticket for the Lagrange (LA) airdrop on June 4th. This "on-chain carnival" directed by Binance's official team pushed the Alpha platform's single-day transaction count to a historical peak of 715,000, with BNB Chain's total transaction volume soaring to $480 million.

However, behind the glamorous traffic data, a sharp contradiction is emerging: Is Lagrange's touted "zero-knowledge co-processing revolution" merely a technological bubble driven by capital? And can Binance Alpha's carefully designed points game mask the inherent flaws in LA's token economics?

I. Star Team and Capital Carnival: An Overestimated "ZK Newcomer"

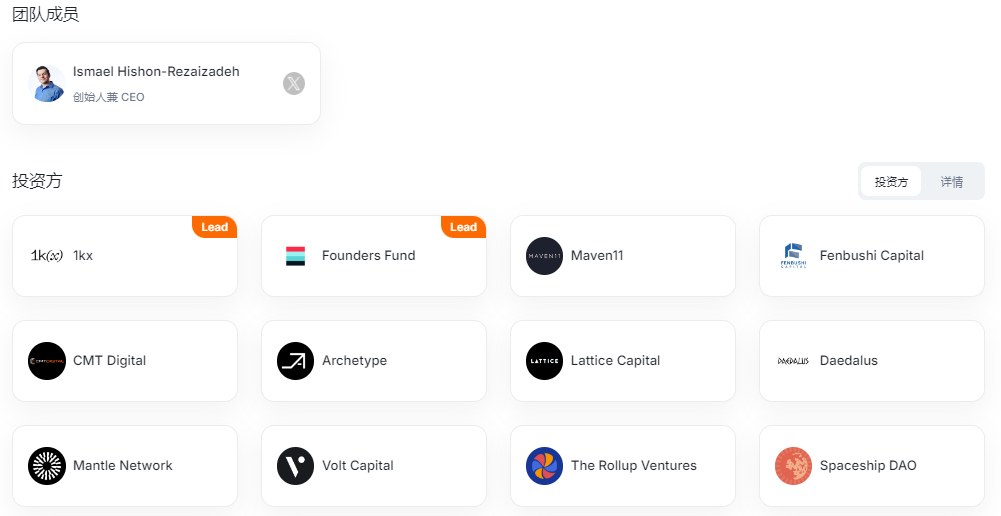

Lagrange Labs, leveraging the "zero-knowledge co-processor" concept, completed $17.2 million in financing within two years (pre-seed round of $4 million + seed round of $13.2 million), led by Founders Fund, with top VCs like Archetype, 1kx, and Maven11 following, forming a luxurious lineup.

Founder Ismael Hishon-Rezaizadeh's (McGill background, former DeFi engineer and venture capitalist) resume looks glamorous but exposes critical shortcomings: lack of substantial experience in ZK technology R&D, the team has not disclosed core technical members' academic or engineering backgrounds, and the technical whitepaper does not reveal cryptography experts' names.

More worryingly, its financing rhythm is highly synchronized with market hype: after the pre-seed round in May 2023, coinciding with the ZK track's rising heat, the seed round financing in May 2024 soared to $13.2 million, with valuation bubbles emerging. VCs' massive bets are essentially a "narrative premium" rather than a verification of technological maturity - identical to the capital path before many ZK projects collapsed in 2023.

II. Core Technology: Idealized "Super-Parallel ZK" and Realistic Bottlenecks

Lagrange's "cross-chain verifiable big data computation" is supported by three major modules:

- State Committee (LSC): Generating state proofs based on EigenLayer re-staking nodes, claiming to "shorten cross-chain challenge periods", but actually only confirmed 2 million+ blocks, with testnet data (weekly average of 127,000 proofs) negligible in real high-concurrency scenarios;

- ZK Co-processor: Claiming to support complex computations like SQL queries, yet not publicly disclosing key proof generation efficiency indicators (such as single proof cost, throughput limit);

- Cross-chain Interoperability: Attempting to verify multi-chain states through ZK proofs, but initially only compatible with EVM chains, with support for non-EVM ecosystems like Solana remaining at the roadmap stage.

Core doubts include:

- "Super-parallel" concept is vague: Official documentation does not define the specific implementation of parallel architecture, with the claim of "horizontally scaling any number of operators" seeming more like marketing rhetoric;

- Unsustainable economic model: Nodes must stake LA tokens to generate proofs, but the pricing mechanism for proof fees (priced in LA) is not disclosed, and once token prices fluctuate, node rewards will violently oscillate, threatening network stability;

- Competitive technology overwhelms: Unlike Risc Zero, Succinct, and other ZK projects that have achieved FPGA hardware acceleration, Lagrange still relies on general computing, with proof efficiency questionable.

III. Token Economics: Inflation Trap and Value Capture Dilemma

LA token total supply is 1 billion, with initial circulation including 10% airdrop (100 million) and VC unlock shares, with fatal flaws in its economic design:

High Inflation Diluting Long-term Holder Interests:

Fixed annual inflation rate of 4%, with new tokens entirely allocated to nodes (Provers), equivalent to annually dumping 40 million LA tokens into the market (valued around $5 million at seed round valuation). Before application demand rises, pure inflationary incentives will lead the token into an "selling pressure spiral".

Abnormally High Airdrop Ratio, Concentrated Short-term Selling Pressure:

10% airdrop far exceeds similar projects (usually ≤5%), and after Binance Alpha goes live on June 4th, airdrop recipients can immediately sell tokens. Combined with potential unlock windows from the VC seed round (completed in May 2024), market absorption faces a severe test.

Weak Value Capture Scenarios:

Token usage is limited to paying ZK proof fees, node staking, and governance, but protocol revenue entirely depends on proof demand. Currently, the testnet has only generated 400,000+ proofs, and if mainnet cannot attract large-scale adoption by on-chain applications (such as DeFi derivative pricing, chain game AI computation), LA will become a "rootless tree".

IV. Launch Expectations: Speculation Bubble and Value Restoration Game

In the short term, LA's launch on Binance Alpha might replicate the ZK track's typical "listing hype":

- Positive factors: Coinbase ecosystem endorsement, $17.2 million financing halo, airdrop expectations driving traffic;

- Hype risks: VCs' average cost is extremely low (over 3x valuation difference between pre-seed and seed rounds), with early investors having strong token selling motivations.

Long-term value depends on two realistic constraints:

Technology Implementation Progress:

Officially claiming "mainnet launch by late May 2024", but as of June 3rd, no mainnet contract address or audit report has been disclosed, with high delay risks;

Ecosystem Collaboration Authenticity:

Despite mentioning "5 billion USD ETH re-staking", no integration cases from top DeFi or cross-chain bridges have been published, with partner lists mostly comprising venture capital firms, ecosystem building remaining theoretical.

V. Investment Warning: Why LA is Not an Ideal Target?

VC-Driven Bubble:

Capital-intensive entry driving up valuation, with severe mismatch between technological maturity and financing amount. Referencing 2023 ZK track average market sales ratio (P/S) already dropped below 3x, if LA lists at 10 billion FDV (fully diluted valuation), it needs annual revenue exceeding $30 million - while the total ZK proof market is currently less than $10 million.

Inherent Token Economic Deficiencies:

4% inflation rate will become a "death spiral" trigger during bear markets (similar to Terra's collapse mechanism), with no burning mechanism to offset inflation.

Red Ocean Track Competition:

Facing giants like Polygon zkEVM and StarkNet that already monopolize 80% of developer ecosystems, Lagrange's "co-processor" positioning lacks sufficient differentiation while facing the most challenging engineering problems in zero-knowledge proof field - proof recursion and hardware acceleration.

Conclusion

A profound, immeasurable chasm exists between Lagrange's capital narrative and technological innovation. In an era where ZK proofs have not yet found scalable commercial scenarios, its token model appears more like a financial engineering designed for VC exit rather than a sustainable protocol economy. Investors participating in LA trading must be clear: this is not betting on a technological revolution, but dancing with a sickle in a liquidity carnival - and history proves most will become fuel when the bubble bursts.