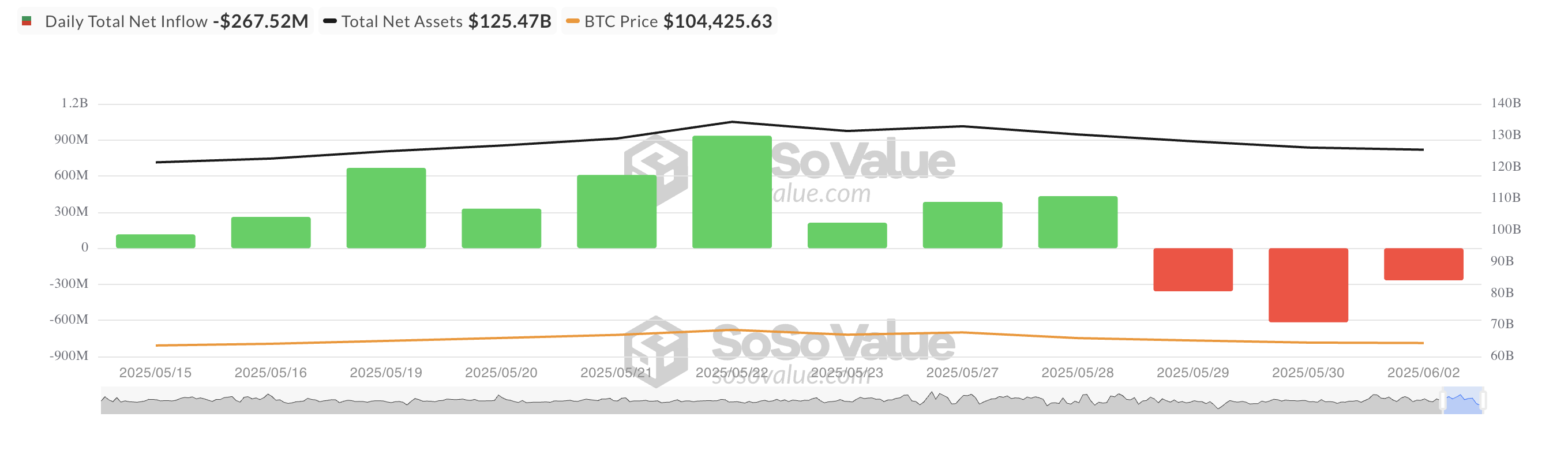

Bitcoin remained around $105,000 during the past week. This led to a slowdown in ETF activity. On Monday, outflows from US-listed spot BTC ETFs exceeded $250 million. This marks three consecutive days of withdrawals.

This indicates that institutional interest is declining as BTC enters a correction phase.

BTC ETF, Outflows for the Third Day amid Price Adjustment

On Monday, institutional investors removed capital from US-listed spot BTC ETFs. This suggests a decrease in their cryptocurrency exposure. According to SosoValue, the net outflow from these funds reached $268 million. This marks three consecutive days of continuous outflows.

The slowdown in ETF inflows was triggered as BTC entered a correction around the $105,000 level. This has begun to significantly impact institutional sentiment. During the past week, the major coin fluctuated within a narrow price range, with investor enthusiasm decreasing.

However, this is not unusual. During price adjustments, institutional investors tend to rotate capital to alternative assets or remain on the sidelines. This often leads to a decrease in ETF activity and short-term inflows.

Bitcoin Bulls, Derivatives Market Movement

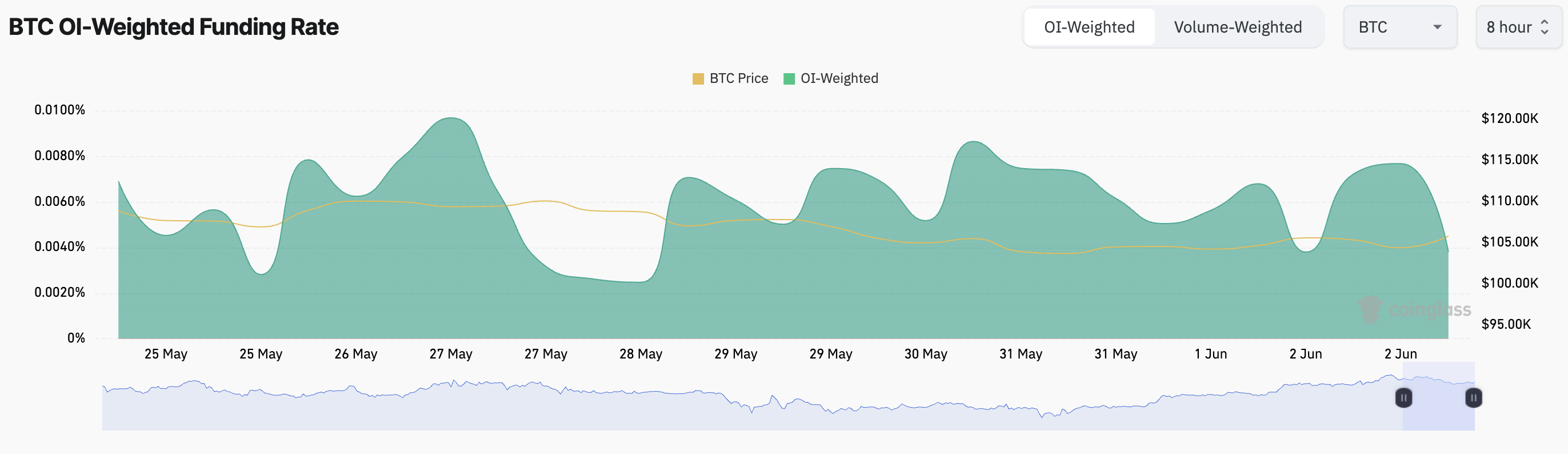

Bitcoin is currently trading at $105,422, rising 1% over the past day. Bullish pressure continues across the coin's futures market. Traders are expecting a continued rally.

This is reflected in the coin's positive funding rate, currently at 0.0038%.

The funding rate is a periodic payment exchanged between long and short traders in perpetual futures contracts. This aligns the contract price with the spot market. When positive, long position holders pay short position holders. This indicates that bullish sentiment dominates the market.

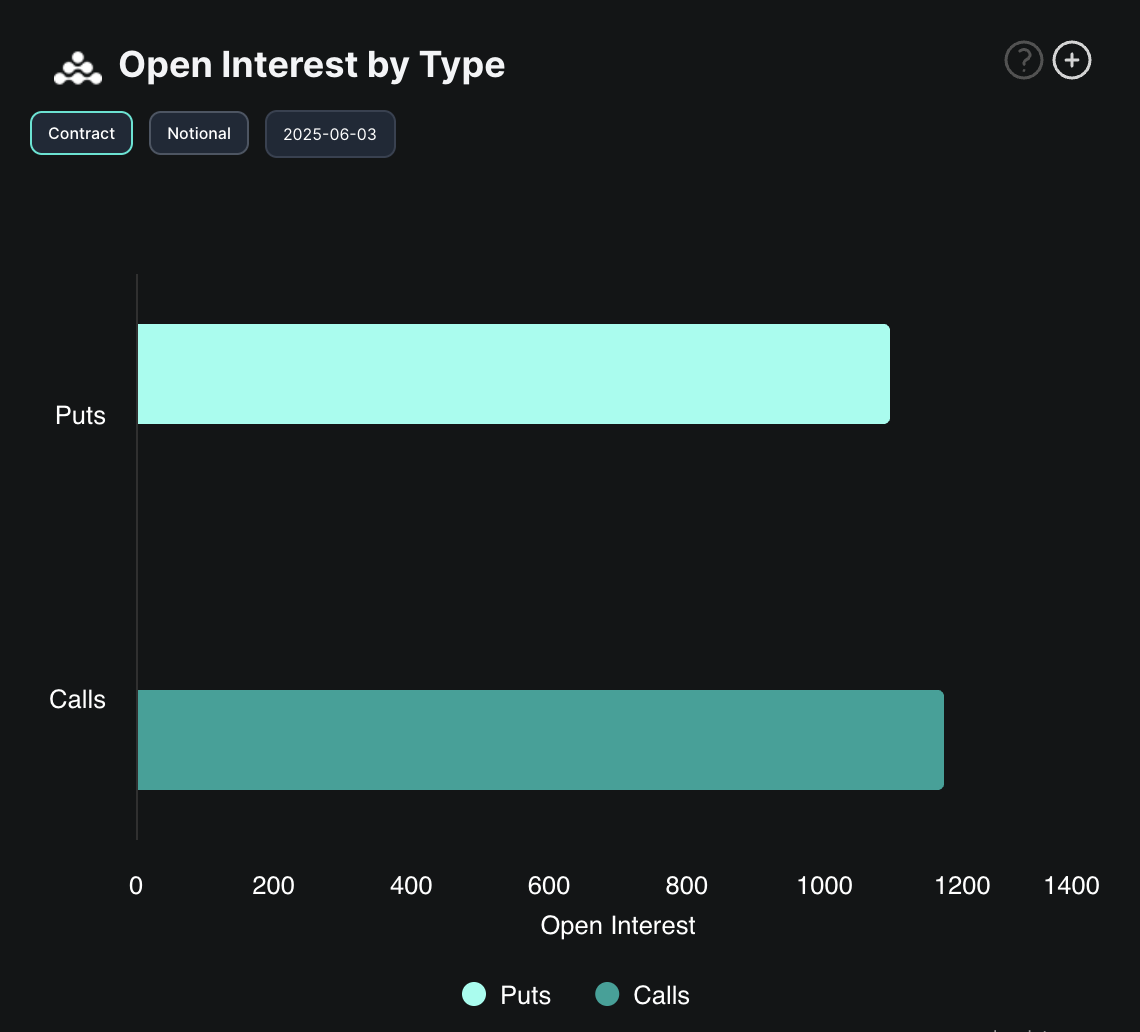

Moreover, this trend is also apparent among BTC options traders, as evidenced by today's high demand for call options. Call options give the holder the right to buy an asset at a predetermined price. The increased call demand suggests traders expect BTC to experience a rally.

These indicators suggest that while institutional ETF flows are decreasing due to BTC's recent price stagnation, derivatives traders remain optimistic and are preparing for an upward breakout.