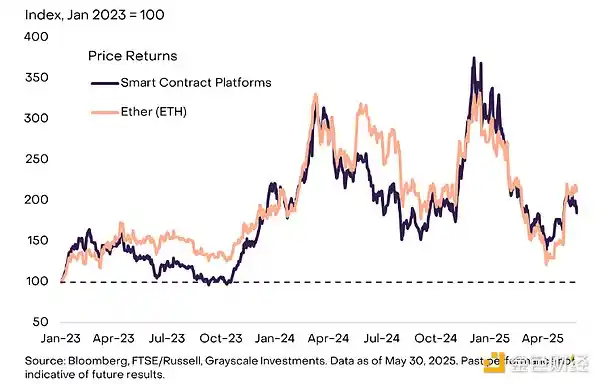

Figure 5: ETH Performance Basically Synchronized with Crypto Sector

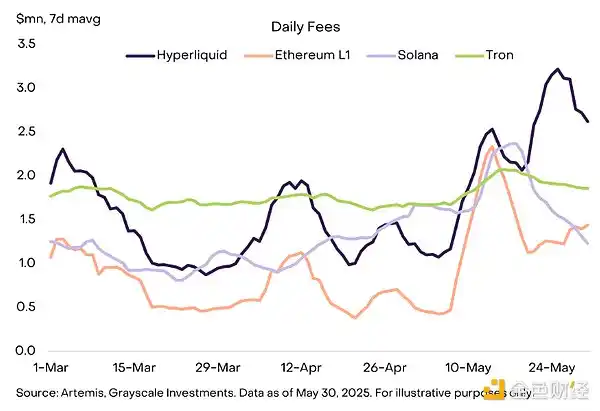

Although ETH performed strongly this month, the most outstanding performer among large assets with a market cap over $5 billion is the HYPE token from Hyperliquid. Hyperliquid is both a professional perpetual contract decentralized exchange (DEX) and a general smart contract platform. Its Hypercore product currently occupies over 80% of the on-chain perpetual contract trading volume. During May, Hypercore's perpetual contract trading volume exceeded $1.7 billion, and its daily revenue at the end of the month even surpassed the top three smart contract platforms by fee income - Ethereum, Tron, and Solana (Figure 6). Last year, the protocol set a record for the largest airdrop in crypto history, valued at over $8 billion at current prices, prompting the entire industry to rethink token economics and financing models without venture capital support. Hyperliquid has maintained high natural usage and strong liquidity, and will increasingly compete with centralized derivatives trading platforms like Binance and Bybit in the future.

Figure 6: Hyperliquid Fee Income Surpasses Top Smart Contract Platforms

AI Crypto Sector Performance

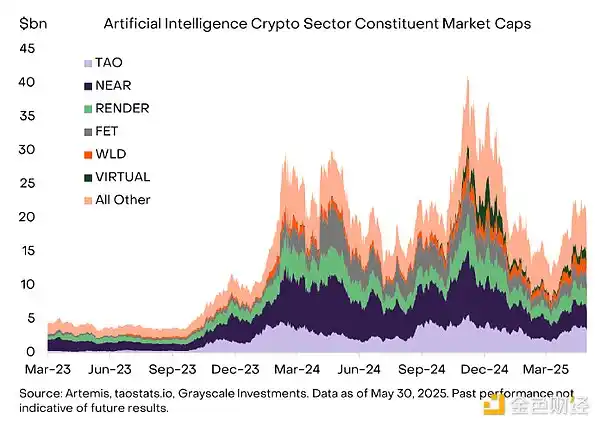

With the rapid development of blockchain AI technology, Grayscale Research recently added an "Artificial Intelligence Crypto Sector", becoming the sixth independent sector in our crypto industry classification framework. Currently, this sector contains 20 tokens with a total market cap of around $20 billion (Figure 7).

Figure 7: Current Market Cap of AI Crypto Sector Around $20 Billion

Notable projects in this sector recently include Worldcoin - an identity network founded by Sam Altman aimed at establishing a "proof of humanity" system to address the increasingly serious human/robot identification challenges in the AI era. This month, Worldcoin announced an important milestone: completing a $135 million financing through a16z and Bain Capital Crypto acquiring WLD tokens in the open market. The project has attracted widespread attention through measures such as appearing on the cover of Time magazine, promoting the iris scanning device "Orb" in the US market, and launching the crypto wallet World App. Other important developments in the blockchain AI field include rising attention to Bittensor subnets and Tether, a top stablecoin issuer, disclosing plans to launch an AI agent network based on a crypto-native architecture.

In the coming months, the crypto market will likely continue its current driving logic: Bitcoin's macro demand generated by stagflation risks and tariff uncertainties, continuous improvement of regulatory environments in the US and overseas, and technological innovations in areas like blockchain AI. This asset class has performed excellently in the past two years, and the supporting factors of fundamental improvements still exist.