Author: Cool Play Lab

If I give you 1 RMB or virtual currency worth 1 RMB, what would you choose?

Perhaps most Chinese people will choose their own legal currency. After all, legal currency is easy to circulate and its value is stable. As for virtual currency, its price soars and plummets, it is too complicated and not stable enough.

However, if this question is put in Africa, Southeast Asia, South America, or the Middle East, the answer may be just the opposite. People would rather have virtual currency than legal tender of equal value.

01 The poorest continent falls in love with virtual currency

The image of Africa's poverty and backwardness has long been deeply rooted in people's minds. When people think of Africans, the images that come to their minds are skinny refugees, looking pitiful and holding a few crumpled banknotes to buy things.

You may not believe it, but now people are using online payment. While we are still stuck in stereotypes, Africa has become the region with the fastest development of digital finance and the most widespread application of virtual currency.

In 2023, the number of registered digital payment accounts in Africa reached 856 million, accounting for half of the global registered accounts and contributing more than 70% of the total growth of global registered accounts. In Kenya, the proportion of adults using digital payment reached 75.8%, South Africa was 70.5%, Ghana was 63%, and Gabon was 62.3%. What does this mean? The popularity of digital payment in these poor "black Africa" countries even surpasses many developed countries, such as Germany, where the penetration rate is only 42%.

So, the reality is that you can see the familiar payment codes and QR code scanning cash registers everywhere in Africa.

What is even more outrageous is that Africans, who are struggling to make ends meet, are actually addicted to cryptocurrency trading. From July 2023 to June 2024, "Black Africa", that is, Africa south of the Sahara Desert, traded a total of $125 billion worth of cryptocurrencies on the chain, with Nigeria alone trading $59 billion. If you look at the growth rate, it's even more terrifying. Since 2021, the number of cryptocurrency users in "Black Africa" has increased 25 times, ranking first in the world, surpassing all Internet-developed regions.

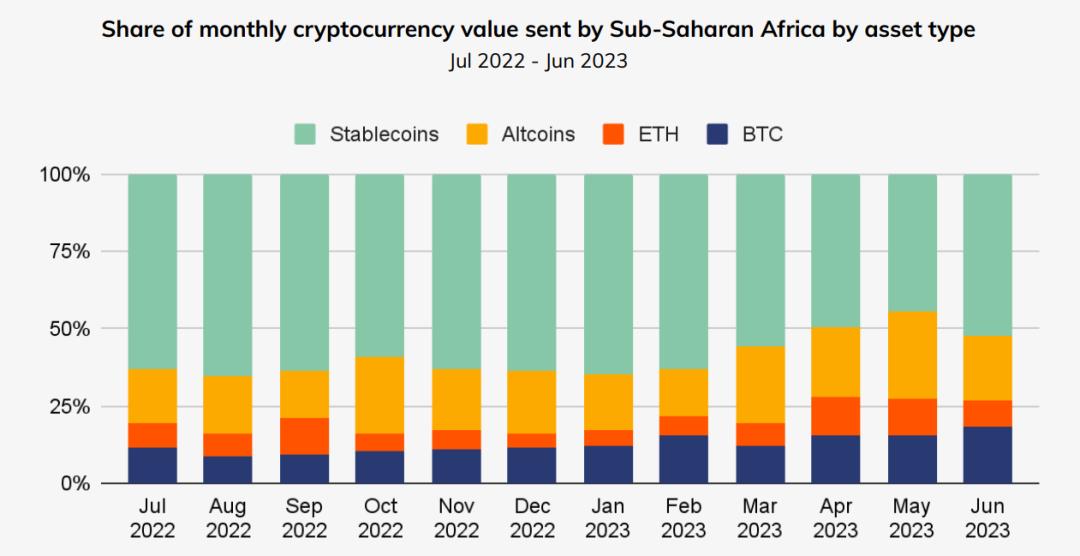

Many Chinese netizens’ concept of encrypted virtual currency mainly comes from Bitcoin, whose price often goes on a roller coaster ride, so it is easy for everyone to attribute the trend of Africans playing with virtual currency to "being crazy because of poverty and wanting to get rich overnight by gambling on virtual currency." This is not the case. Among the cryptocurrencies traded by Africans, more than 50% are a special currency, stablecoin.

Medium

Stablecoins, in simple terms, are encrypted virtual currencies that are linked to legal tender or real assets. The purpose of their existence is to provide price stability for cryptocurrency market transactions. One of the representatives of stablecoins, USTD, commonly known as Tether, is designed to be pegged 1:1 with the US dollar. For every Tether issued, the issuing company will hold $1 in asset reserves.

When stablecoins were first created, they were intended to lock in profits from cryptocurrency trading. After users make profits from buying and selling unstable currencies such as Bitcoin, they may face the problem of "inconvenient withdrawal". The best solution is to create a new currency with a stable price, exchange the profits for it, and continue to store them in the virtual world. To use an inappropriate analogy, Bitcoin is like stocks in the virtual world, and stablecoins are cash in the virtual world.

This characteristic of stablecoins makes Africans' eyes light up, as if a life-saving straw has appeared before their eyes.

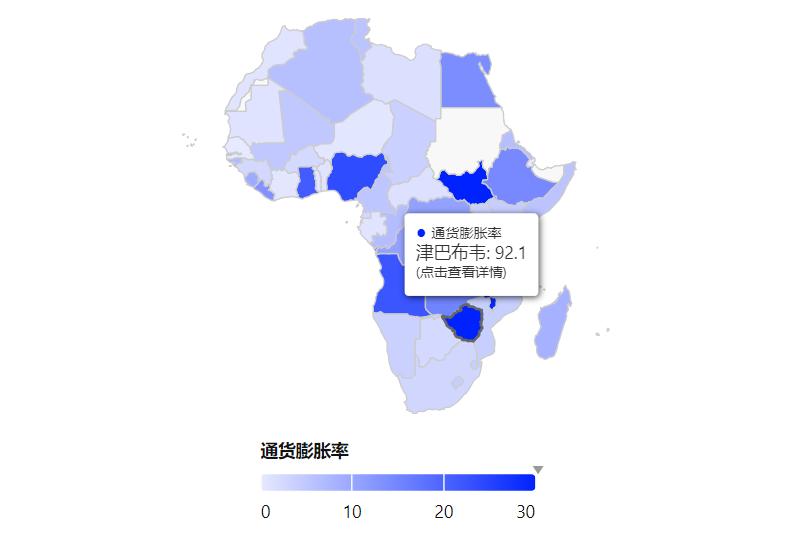

For them, high inflation is an indelible psychological shadow. Since most of the "black African" countries have poor economic and governance capabilities and are extremely vulnerable to the impact of the international situation, the government will issue currency indiscriminately to make up for the deficit when it is short of money, and then there will be coups and civil wars from time to time. These chaos lead to frequent hyperinflation. In 2024, Africa's average inflation rate reached an astonishing 18.6%, far exceeding the recognized red line of 3%. Zimbabwe, a wonder in the world, even raised the inflation rate to 92%.

In other words, the money you work hard to earn may depreciate by 1/5 or even 1/2 in a year. If inflation gets out of control, it may even turn into waste paper.

After years of this, Africans naturally lost confidence in their own country's legal currency and wanted to convert their income into more stable foreign currencies. In terms of recognition and liquidity, the first choice is of course the US dollar. However, African countries are not like us, which can create a trade surplus by being the world's factory. They only sell some minerals and fruits, and can't earn much US dollars. They have to use the money to import various scarce materials, and there is actually not enough foreign exchange reserves in the bank. Moreover, the adults above are not stupid. They directly control foreign exchange. Even if they have US dollars, they will not exchange them to you.

Moreover, it is extremely difficult for Africans to find a bank to exchange money because of backward infrastructure and few bank branches. More than 350 million adults in Africa cannot enjoy financial services, and 55% of adults do not have a bank account at all.

If ordinary people really want to exchange for US dollars, they can only go to the black market to be slaughtered. In Zimbabwe, which we mentioned earlier, the black market exchange rate is almost twice the official exchange rate. The official exchange rate is 27 Zimbabwe dollars to 1 US dollar, while the black market exchange rate is 50:1. After Sudan fell into war two years ago, the official Sudanese pound to US dollar exchange rate remained at 560:1, while the black market exchange rate was 2100:1.

Without dollars and banks, what does Africa have? The answer is mobile phones. Thanks to a certain industrial Cthulhu in the East, Africa has obtained a large number of cheap smartphones, with a penetration rate of over 70%. In this case, Africa must try to find a way to survive from digital finance.

The answer they found is stablecoins. Virtual currency trading platforms represented by Yellow Card allow users to purchase stablecoins with legal tender in African countries, while stablecoins led by Tether are directly anchored to the US dollar, which is equivalent to allowing users to freely exchange foreign exchange, thereby realizing asset value preservation.

The exchange rate offered by Yellow Card is generally slightly lower than the official exchange rate, but it is much better than the black market. For example, the current official exchange rate in Nigeria is 1590 naira to 1 US dollar, while Yellow Card charges 1620 naira for 1 Tether. They make a profit from the difference, and users are not ripped off, so everyone is happy.

For those Africans who do not have bank accounts or cannot find bank branches, the emergence of stablecoins has also made financial management exceptionally simple. You only need to register your own trading platform account, and then find a local middleman. You give him the fiat cash in your hand, and he transfers the stablecoin to your account. This completes the exchange + deposit, which is convenient and fast. You just need to pay the dealer a little handling fee.

And stablecoins solve more than just the problem of inflation. Due to the backwardness and inefficiency of the financial system, the cost of cross-border remittances in "black African" countries is extremely high, with losses as high as 7.8%, far higher than the average cost of 4%-6.4% in other parts of the world. Overseas workers remit money to their home countries, and multinational companies invest and transfer profits, all of which are plundered by the banking system. After stablecoins became popular, everyone abandoned the original remittance channels and switched to direct transactions with stablecoins. Some platforms only charge a handling fee of 0.1% to transfer stablecoins between overseas accounts and domestic accounts, which is free if rounded up.

There are stablecoins in the company's account, and employees also want to buy stablecoins, so everyone will think, why bother with this, so many companies begin to pay wages directly in stablecoins.

Blockworks

Salaries have become stablecoins, and deposits are also stablecoins. As a result, no one has much fiat cash in their hands, and it is troublesome to exchange it. Forget it, just scan the code to pay. Therefore, stablecoins have further promoted the vigorous growth of digital payments in Africa.

Moreover, unlike the popular digital payments in China, major payment software in Africa are deeply integrated with stablecoin trading platforms. You can seamlessly complete the exchange of stablecoins and legal tender while scanning the code to pay. Some platforms even allow the direct use of stablecoins for consumption, saving the exchange. Many large chain supermarkets also cooperate with stablecoin trading platforms to encourage the use of stablecoins for payment, and even provide 10% cash back on consumption.

Pick n Pay South Africa

Africa has answered the inflation crisis with stablecoins, and many countries in the world have given the same answer.

For example, Turkey has been facing high inflation due to a series of chaotic economic policies since 2021, which has forced Turkey to become the world's fourth largest cryptocurrency market, with an annual trading volume of $170 billion, surpassing the entire "Black Africa" in one fell swoop, and 2 out of every 5 Turks hold cryptocurrencies. In 2022, the Turkish lira plummeted by more than 30% in a few months, and the Turks collectively turned to stablecoins for risk hedging. The transaction volume of Turkish lira to purchase Tether once accounted for 30% of the total global fiat currency to Tether...

Another major emerging market for stablecoins is South America, where many countries also face the problem of chaotic monetary policy. For example, in Argentina, because President Milley has frequently made major monetary policy moves, the people are concerned about legal tender. After Argentina officially abolished currency control measures in April this year, the trading volume of stablecoin exchanges immediately soared by nearly 100%.

The stablecoin craze in these countries once again shows that the places where new things are popularized and promoted the fastest are not necessarily economically developed countries, but countries facing survival crises. Only when there is pressure can there be motivation for change.

02 Hidden Corner

If we only look at the properties of stablecoins being anchored to the US dollar and fighting inflation, it is easy to overlook that its essence is still cryptocurrency.

Although blockchain technology is open and transparent, the real identity information of both parties in the transaction is usually hidden behind the wallet address. For stablecoin transactions, even if the wallet address is known, it is difficult to directly link it to the real person or entity. In addition, stablecoin transactions do not require the central bank to provide authoritative endorsement, so they are naturally not regulated by the traditional financial system. This attribute has led stablecoins into hidden corners and provided a medium for transactions that cannot be seen in the light.

We mentioned earlier that South America is also an emerging market for stablecoins. It is not entirely for the purpose of fighting inflation. Some countries value the difficult-to-trace nature of cryptocurrencies. Drug lords in Mexico, Brazil, and Colombia use Tether on a large scale to launder money and transfer drug funds. Last May, Maximilien Hoop Cartier, the heir of the famous jeweler Cartier, was arrested by the US police. He was accused of dealing with Colombian drug lords, trying to smuggle 100 kilograms of cocaine and launder hundreds of millions of dollars in drug money, and these transactions were entirely conducted through Tether.

There are countless similar cases. The angry US law enforcement agencies simply pointed the finger at the source of the problem, Tether, the issuer of Tether. Last October, the US federal government suddenly announced a large-scale criminal investigation into Tether to investigate whether the cryptocurrency was used by third parties to finance illegal activities such as drug trafficking, terrorism and hacker attacks, or to launder the proceeds of these illegal activities.

Similar situations have also occurred in Southeast Asia. As we all know, this is a gathering place for online gambling, wire fraud, and human trafficking. However, as countries step up their crackdown efforts, bank cards will be frozen at the slightest sign of abnormality, and the traditional channels for criminals to transfer funds are almost disabled. As a result, local areas have begun to use stablecoins for transactions on a large scale.

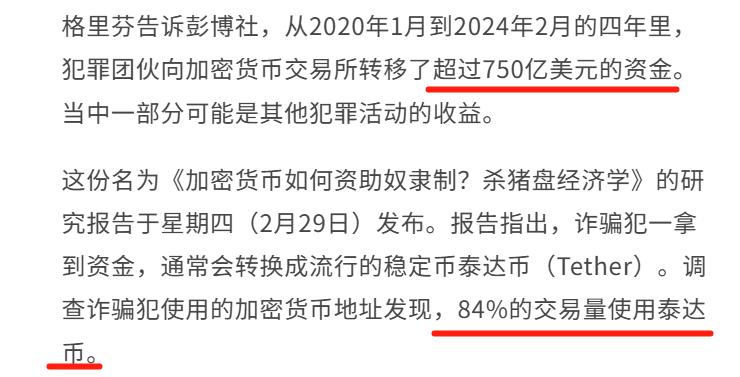

How big is the scale? According to statistics from American scholars, in the four years from January 2020 to February 2024, criminal gangs transferred more than $75 billion to cryptocurrency exchanges, of which 84% of the transactions used Tether.

Tether expressed strong dissatisfaction with this statistical report, claiming that "every asset is seizable and every criminal is arrestable", but Tether did not deny the number of 75 billion itself.

Lianhe Zaobao

Another country that treasures stablecoins is Russia. The Russians have no interest in online gambling scams, but they need stablecoins to replace the existing foreign trade settlement system.

Since the Russia-Ukraine conflict, Russia has been subjected to various sanctions and was directly kicked out of SWIFT. SWIFT is the core information transmission network of the global financial system. It connects more than 11,000 banks and financial institutions in more than 200 countries and regions around the world. It is mainly responsible for the safe and efficient transmission of cross-border transaction instructions. Being kicked out of SWIFT means that Russia can no longer conduct cross-border trade settlements through its original banks.

However, the world needs Russia's resources, and Russia still needs the world's goods, especially war-related materials. In order to prevent these hidden trades from being tracked, stablecoins have become a substitute for the US dollar for foreign trade settlement.

As early as 2021, Russia had cleared its US dollar foreign exchange reserves. However, an unknown amount of stablecoins flowed into Russia secretly. In any case, the West caught it in April last year, and $20 billion worth of Tether was transferred to Russia.

TechFlow

03 How much profit can stablecoins bring?

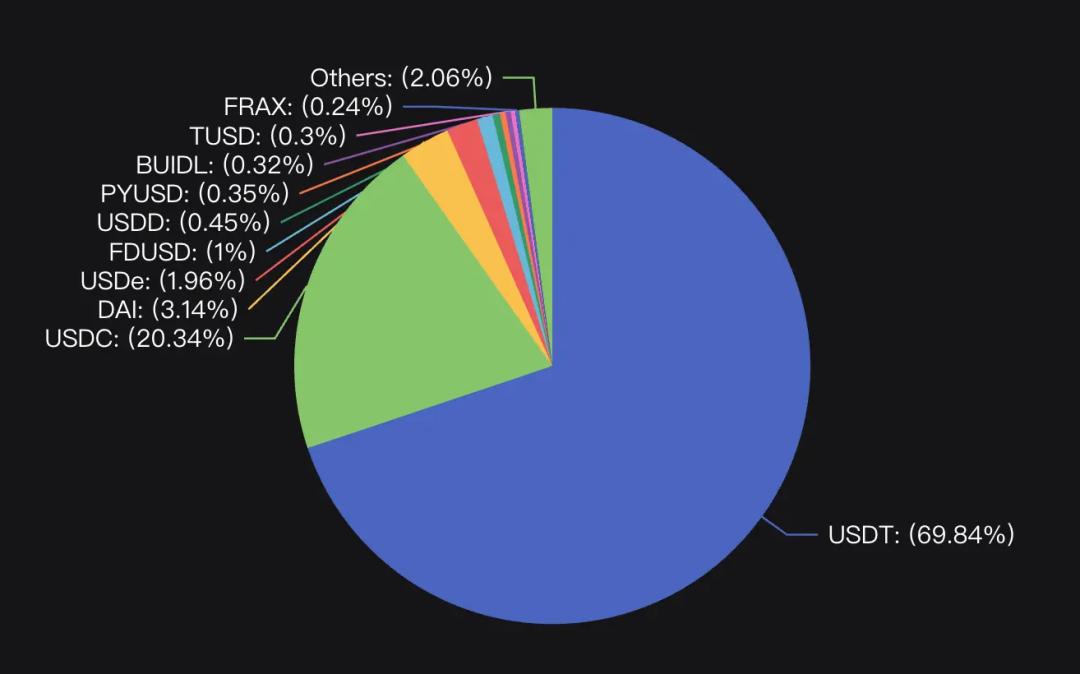

Ordinary people who are avoiding inflation are using it, criminals are using it, and countries under sanctions are also using it... Relying on the new demand, the scale of stablecoins has grown rapidly. In the past six years, the total holdings have increased by about 45 times, reaching US$246 billion. The annual transaction volume has exceeded US$28 trillion, surpassing Visa and Mastercard, which represent traditional banks.

You may be curious about what benefits the companies issuing stablecoins have gained in this prosperity?

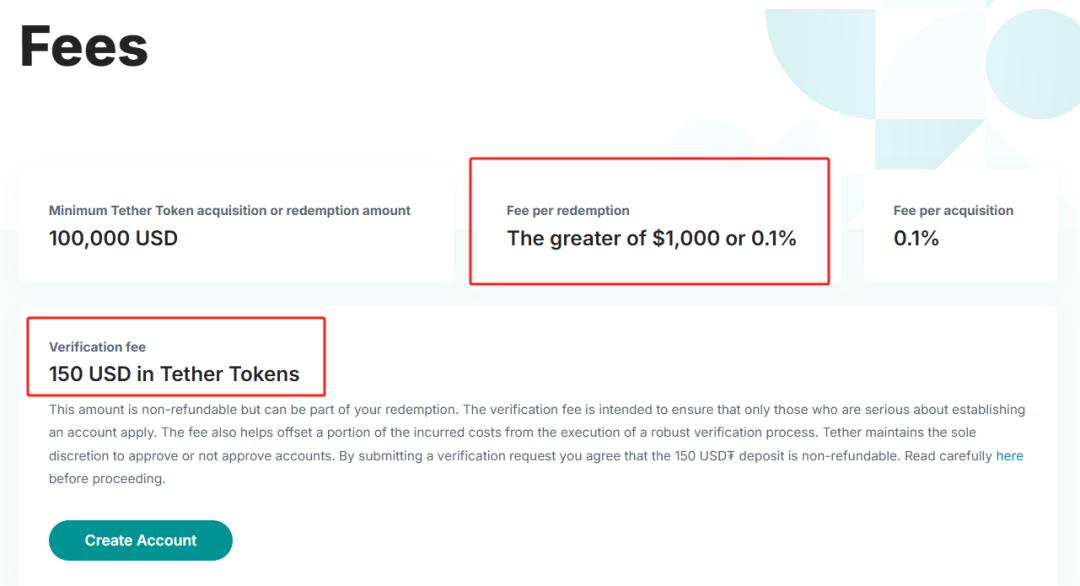

Their first source of income is handling fees. Users need to pay the issuer to mint or redeem stablecoins. For example, Tether charges a handling fee of 0.1%. Although it seems low, it is a huge sum of money as long as the scale is large enough. The total scale of Tether issued by Tether has exceeded 120 billion US dollars. In addition, Tether has set a starting price. If your actual paid handling fee is less than 1,000 US dollars after proportional calculation, it will also be charged at 1,000 US dollars. For those who register an account for the first time, Tether will also charge a verification fee of 150 US dollars.

Another big source of profit is the appreciation of the huge amount of anchors held by stablecoin issuing companies. Let's take Tether as an example. Since Tether is pegged to the US dollar at a 1:1 ratio, every time a user casts a Tether, it is equivalent to depositing one US dollar in Tether, right? Tether does not have to pay any interest for these wealth, but Tether itself deposits the anchored US dollar in the bank, and the bank will pay interest, earning the difference. In addition, Tether will take out a small part of the cash and lend it to its attractive companies, thereby earning higher interest than the bank.

At the same time, Tether does not use U.S. dollar cash entirely to complete its reserves. Among the assets used for anchoring, 66% are U.S. Treasury bonds and 10.1% are overnight reverse repurchase agreements. These assets are also stable, but the returns are higher than the interest on cash deposits, which can exceed 4%. Considering the holding amount of US$120 billion, this is another huge income.

Not only that, the company can also earn the price difference by repurchasing stablecoins. Although Tether is designed to be 1:1 with the US dollar, in actual operation it is still affected by market supply and demand and sentiment, and there will be a small fluctuation of one or two percentage points. As the old saying goes, don’t underestimate this small ratio. If it corresponds to a total amount of US$120 billion, it can make a huge fortune.

Whenever there is tightening of regulation or some criminal allegations, public opinion will begin to question Tether, and some users will sell them in batches, causing Tether to depreciate slightly. At this time, Tether will use its reserves to repurchase Tether on a large scale and destroy it.

For example, in 2018, when Tether fell to 98%, Tether quickly repurchased 500 million coins. They paid $500 million for minting the coins, and you only spent $490 million on the repurchase, making a net profit of $10 million. You also used this real money repurchase to stabilize market confidence and prevent further runs. It was a big deal.

Relying on these three sources of profit, Tether, which has only 150 employees, earned $13 billion in 2024, surpassing financial and technology giants such as BlackRock and Alibaba, and making some Fortune 500 companies ashamed. The average profit of $93 million per person is the highest in the world.

04 Shadow dollar, reshaping hegemony?

The impact of stablecoins on the world is not just to nurture a few new Internet giants. What is most worthy of attention is that it is seamlessly migrating the US dollar hegemony from the traditional financial system to the blockchain world.

Think about it, stablecoins need an anchor that is recognized by the whole world, right? If you have to choose one from the fiat currency, then due to historical inertia, the issuing company is likely to choose the US dollar or US bonds with the highest reserve recognition. From the Pacific Ocean to the Arctic Ocean, everyone likes the US dollar. Currently, Tether, which has the highest share among stablecoins, as well as USDC, which has the second share, and FDUSD, which has the fifth share, all adopt the anchor model of US dollars/US bonds and their equivalents.

This means that the more stablecoins are in circulation, the more US dollars they have, forming a closed loop of "users buy stablecoins → issuers increase their holdings of US dollars/buy US debt". This makes stablecoins a kind of shadow dollar, which continuously strengthens the use and circulation of US dollars worldwide, and also provides new sales channels for US debt, greatly strengthening the financing capacity of the US government. At present, Tether has surpassed Germany to become the world's 19th largest buyer of US Treasury bonds, and the money it uses to buy US Treasury bonds comes from countless users, which is equivalent to the whole world increasing its holdings of US Treasury bonds.

If this trend continues, the already precarious hegemonic position of the US dollar will be further consolidated through stablecoins; although other countries will be able to decide their own monetary policies, the extensive use of shadow dollars in daily life and cross-border trade will greatly weaken the monetary sovereignty of these countries.

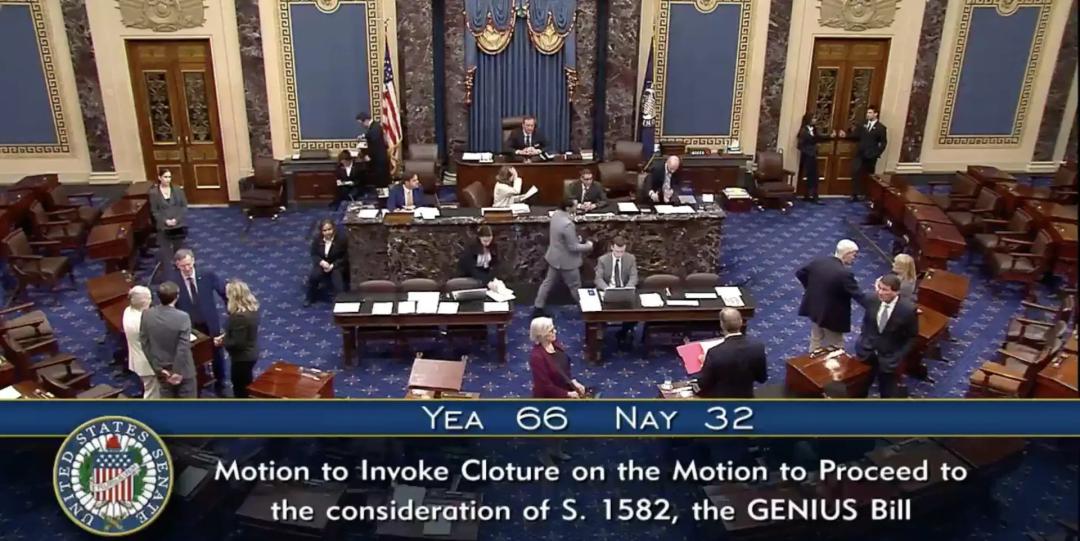

So you will find that the top leaders in the United States have already smelled this opportunity and are betting heavily on stablecoins. Not long ago, the United States passed the GENIUS Act, which mainly contains the following points:

First, it is required that each stablecoin issued must be backed by an equivalent amount of US dollar cash or US debt;

Second, stablecoin issuers must register with the U.S. federal government and disclose their reserves on a monthly basis to ensure the safety of funds and comply with anti-money laundering and anti-crime regulations;

Third, if the issuing company goes bankrupt, stablecoin holders will be given priority for redemption.

These few simple regulations are surprisingly powerful. First, it is stipulated by law that stablecoins must be anchored to the US dollar/US Treasury bonds. Secondly, it strengthens the supervision of issuing companies, which can give users greater confidence and lead to more wealth being exchanged for stablecoins, that is, for US dollars/US Treasury bonds. According to industry insiders, after the implementation of the bill, the total supply of stablecoins will increase from the current US$246 billion to US$2 trillion by the end of 2028, which will generate US$1.6 trillion in new demand for short-term US Treasury bonds, which can just help the United States resist the wave of US Treasury bond selling.

Trump, the promoter of the bill, has personally joined the game. The stablecoin USD1, issued with the support of the Trump family, also adopts the same USD/US Treasury anchoring. He uses his influence to endorse the stablecoin and also takes a piece of the pie. Currently, the share of USD1 has reached seventh place among stablecoins.

Other countries have been trying to dismantle the hegemony of the US dollar for many years, and naturally do not want to see the US dollar continue to dominate through anchoring, so magic is needed to defeat magic. As a bridgehead for Chinese finance, Hong Kong has passed a bill on May 21 to issue stablecoins anchored to the Hong Kong dollar. It will conduct a small-scale trial in advance, and may allow banks, large Internet companies, financial technology companies and other institutions to apply for stablecoin issuance licenses. JD.com, which is familiar to everyone, has already entered the game, and JD-HKD, which is anchored 1:1 with the Hong Kong dollar, is undergoing sandbox testing.

Other countries are not to be outdone. Currently, Singapore, the European Union, and Russia are all considering launching stablecoins anchored by their own legal currencies.

The financial war between countries is shifting from sovereign currencies to cryptocurrencies.

05 The next generation of financial nuclear bombs

There is a joke on the Internet that the Federal Reserve’s vault is Schrödinger’s box. It has not been publicly inspected for decades. Who knows whether the gold reserves inside are still there?

This also applies to stablecoins. Although they claim to have a 1:1 reserve ratio with the US dollar/US Treasury bonds, there is always an information gap between the issuing company and the user, and the audit report may not always be true and accurate. When the scale of stablecoin usage grows, it is inevitable to encounter a crisis of trust. What if the reserves are quietly misappropriated? What if the bank where the reserves are located is affected by systemic risks?

In 2023, Silicon Valley Bank in the United States encountered an operational crisis, causing the second largest bank bankruptcy in US history. USDC, which ranks second in the stablecoin market, has $3.3 billion in reserves deposited in the bank. After the news was exposed, USDC, which was pegged to the US dollar at a 1:1 ratio, broke free and plummeted to $0.87 in just a few hours. The more it fell, the more severe the user run, which directly forced USDC into a desperate situation. In the end, the Federal Reserve used $25 billion to backstop Silicon Valley Bank to stabilize USDC.

In other words, stablecoins are not absolutely stable, and the risk of collapse of the traditional financial system will still be passed on to them. To use a foreigner's metaphor, "stablecoins cannot avoid car accidents, they are just slow-motion car accidents."

For those countries that still rely on the US dollar for transactions, the old SWIFT system is a financial nuclear bomb. If you are kicked out, you are finished. Using cryptocurrency transactions seems to circumvent the supervision of this system, but it has become a more powerful nuclear bomb. Stablecoins have no nationality or position, but the issuing companies behind them do. Your opponents just need to catch the companies and beat them up.

After the news that Russia used Tether to circumvent sanctions was exposed, many countries in the United States and Europe threatened Tether, saying that if they did not deal with it, they would investigate it. In order to show its loyalty, Tether directly froze $27 million worth of Tether on the Russian crypto exchage Garantex, causing the platform to suspend all trading and withdrawal services, and the website to enter maintenance mode. The assets of many Russian users were directly cleared, and they lost all their money.

In the past, we have said that the global circulation of cryptocurrencies has formed a trend towards financial decentralization.

The emergence of stablecoins just shows that this may not be the case, it is just replacing the old center with the new one.