Written by: Nick D. Garcia, Breed Investment Partner

Translated by: BitpushNews

Key Points

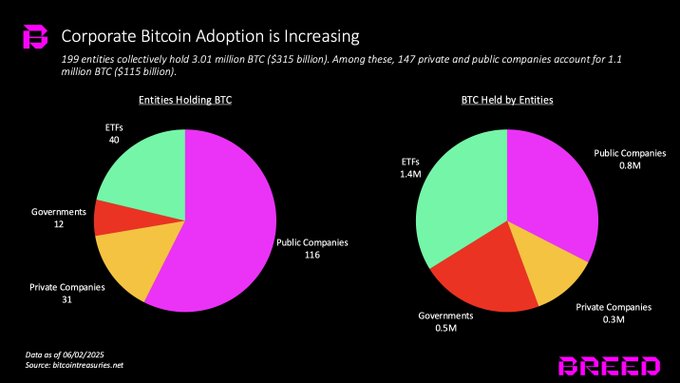

The next stage of Bitcoin's development has arrived: companies are adopting Bitcoin on their balance sheets. As of May 2025, 199 entities collectively hold 3.01 million BTC (approximately $315 billion), and this number continues to grow rapidly.

Companies primarily holding Bitcoin will be viewed as Bitcoin holding companies, with valuations similar to the largest Bitcoin company, Strategy. To survive, these companies must pay attention to a critical premium indicator called "Multiple on Net Asset Value" (MNAV) - the most crucial measurement.

The MNAV premium depends on market trust in the core team and their execution capabilities. These teams must implement Strategy's strategy: increasing Bitcoin holdings per share through debt financing, stock issuance, and cash flow reinvestment. Currently, new entrants are expanding this approach.

The greatest threat is a prolonged bear market that erodes the MNAV premium, coinciding with debt maturity. Newly established Bitcoin treasury companies face greater risks due to more stringent capital raising conditions and higher leverage.

Once the industry begins to experience failures, the most powerful players may acquire struggling companies and consolidate. Fortunately, since most financing is equity-based, the contagion risk is limited; however, those companies heavily reliant on debt pose a greater systemic threat.

A New Stage: Companies Competing to Adopt Bitcoin

We have witnessed Bitcoin's rise in recent years. Not only has its price increased, but its adoption and recognition have also crossed the chasm. Key milestones include:

In September 2021, El Salvador recognized Bitcoin as legal tender;

In January 2024, BlackRock launched the IBIT ETF;

The U.S. President made Bitcoin a strategic economic priority;

And in the summer of 2025, Bitcoin adoption on corporate balance sheets surged.

According to Bitcointreasuries.net, 199 entities currently hold 3.01 million BTC ($315 billion). Among them, 147 private and public companies hold 1.1 million BTC ($115 billion).

Recently, a wave of companies announced new Bitcoin treasury strategies. These companies include enterprises with diversified balance sheets and companies specializing in Bitcoin treasury, covering different countries and industries, and led by trusted teams.

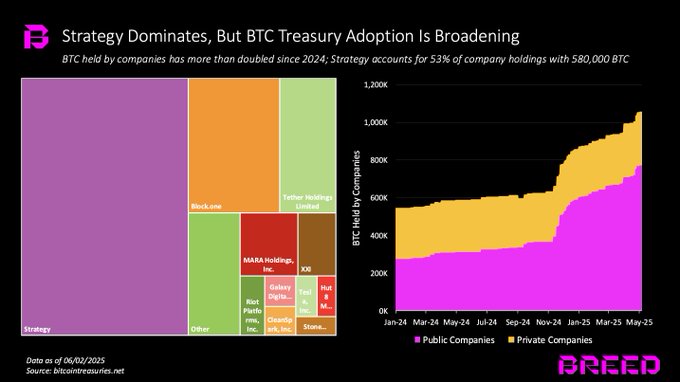

Since early 2024, the amount of Bitcoin held by companies has more than doubled. Strategy holds over 580,000 BTC, accounting for 53% of total corporate holdings. Other companies holding over 10,000 BTC include:

Block.one (164,000)

Tether (100,500)

MARA Holdings (49,140)

Twenty One (31,500)

Riot Platforms (19,200)

Galaxy Digital (12,800)

CleanSpark (12,100)

Tesla (11,500)

Hut 8 (10,300)

With its scale, reputation, and countercyclical nature, Strategy is essentially destined to continue leading Bitcoin holding companies. However, what's more noteworthy is that Strategy's model is being imitated. More and more companies are incorporating Bitcoin into their balance sheets, and new companies specializing in Bitcoin treasury are emerging, which has profound implications for Bitcoin.

[Translation continues in the same manner for the rest of the text]Next Direction

The expansion of Bitcoin treasury companies is still in its early stages; however, this model has begun to extend to other crypto assets—

For example: Solana: DeFi Development Corp (market value of $100 million, holding over 420,000 SOL), Upexi, and Sol Strategies; Ethereum: SharpLink Gaming, which raised $425 million in financing led by ConsenSys.

It is expected that more companies globally will adopt this model, covering more assets and using higher leverage to pursue success.

Most companies will fail. Fortunately, since most financing is equity-based, the contagion risk is low. However, companies heavily dependent on debt pose a systemic threat.

Ultimately, only a few companies will be able to maintain the MNAV premium in the long term. They will need to rely on strong leadership, strict execution, shrewd market operations, and unique strategies to continuously drive the per-share value of Bitcoin, regardless of market fluctuations.