Abstract

Recently, with the successive legislative passage of the US GENIUS Act and Hong Kong's Stablecoin Regulation, market attention to the stablecoin theme has rapidly increased. Considering Circle's upcoming listing and Tether's financial report, the stablecoin theme also has a comparable business model that, as a major transformation in financial technology, is worth noting.

stablecoins to some extent serve as a "pricing tool" for the cryptocurrency market, which is a supplement or even replacement to traditional fiat currency transactions. Shortly afterter stablecoins were born, the main trading pairs theablpairs, therefore, stablecoins play the role of "fiat currency" in trading tools and value circulation. Exchanges (including DEXs decentralized exchanges), Bitcoin spot and futures trading pairs are mainly based with on USDT and other stablecoins, for futures contracts with larger trading volumes, where mainstream exchanges' forward contracts ((futures contracts with US dollar stablecoins as margin) are almost all USDT pairs>

a technical perspective, stablecoins represent the next generation of payment technology.p From a policy perspective, stablecoins will promote monetary internationalization. stablecinsoin isissuedsuinvolves centralized institutions and must comply with regulatory requirements, users may be spread globally, more like cash placed in personal wallets through blockchain technology, with its transaction clearing and settlement also borne by blockchain infrastructure.,encing tallocation shows that 80% of its assets in US Treasury bonds and Treasury-like assets, and as the future issuance scale increases,, holdings will continue.>> The market has underestimated the universality of RA If we compare stablecoin ismarket funds,Wequivalent to REIBeyond currency,, Rmap more diverse assets on-chain and enable trading, with current potential in electricity, computing power, real estate and other assets, and stablecoisins precisely one of the most fundamental RWA products..

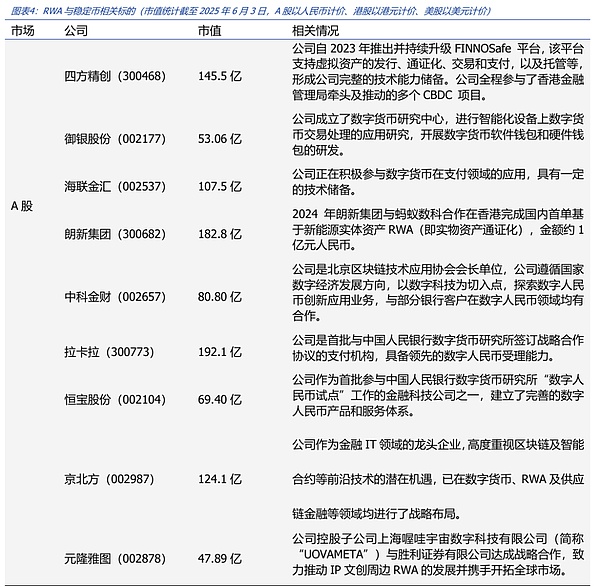

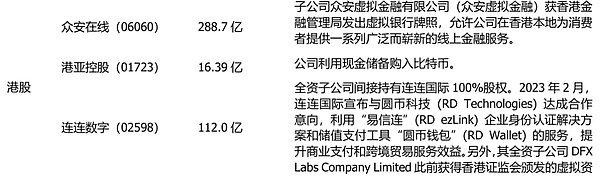

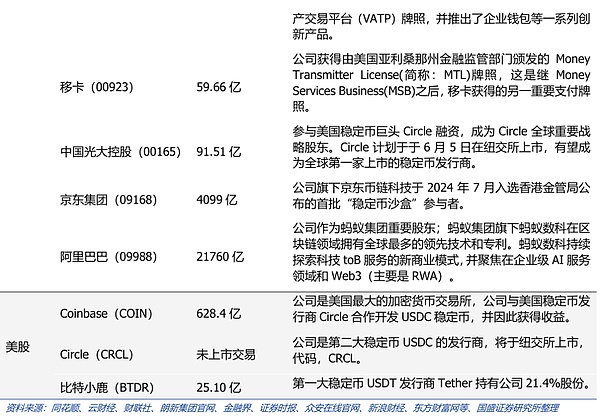

<>Recommendation: Continuous Catalysts, Major Financial Technology Transformation. focus on catalysts such as Circle's listing and Hong Kong's official licensing; for stock targets, focus on US stocks like Circle, Coinbasese; Hong Kong stocks like ZhongAn Online, Lianlian Digital, Yicard; A-shares like Sifang Precision, China Financial Certification, Heng, Jingbbeifang,, LanxGroup,Gyun Image.>Reminder: Blockchain technology R&D not meeting expectations; uncertainty in regulatory policies; Web3.0 business model not landing as expected.subsequent the rest of the translation follows the same professional and accurate approach.RWAand Stablecoin's Rapid Development Drive Regulatory Follow-up.On May 20th, the "Guiding and Establishing the U.S. National Stablecoin Innovation Act" (GENIUS Act) passed the procedural vote in the U.S. Senate, marking significant progress in the bill; subsequently, the bill will enter the Senate's full vote stage. On May 21st, the Hong Kong Legislative Council passed the "Stablecoin Regulation Draft," establishing a licensing system for stablecoin issuers in Hong Kong and improving the regulatory framework for virtual asset activities. Whether in the U.S. market or the Hong Kong market, the driving force behind regulators' positive push for stablecoin legislation is inseparable from the rapid development of stablecoins and the RWA market. Previously, the Hong Kong Monetary Authority had publicly released the first batch of stablecoin issuer sandbox list, including JD.com's JD Chain Technology (Hong Kong), Circle Innovation Technology, and a joint application from Standard Chartered Bank (Hong Kong), Animoca Brands Limited, and Hong Kong Telecommunications (HKT).

Traditional payment institutions like Mastercard supporting stablecoin usage is no longer novel, and RWA has become a new option for corporate financing, which is a proactive attempt by traditional financial institutions to capture Web3.0 financial traffic.For example, as early as August 2024, Sunyard Group (300682.SZ) collaborated with Ant Digital to complete China's first RWA based on new energy physical assets in Hong Kong, with an amount of approximately 100 million yuan. On May 7th, 2025, Futu Securities International announced the official launch of crypto asset deposit services for BTC, ETH, USDT, and other cryptocurrencies, providing users with Crypto+TradFi asset allocation services.

In the U.S. capital market, stablecoins will help bridge traditional finance and cryptocurrency markets.The USDC stablecoin issuer Circle's IPO may become the first landmark event after the U.S. stablecoin bill "GENIUS Act" passes. As of June 2nd, Circle disclosed the latest progress of its NYSE IPO listing, with a maximum valuation of $7.2 billion; BlackRock plans to subscribe to 10% of Circle's IPO shares. This is a typical case where, under the momentum of stablecoins, traditional capital markets and cryptocurrency markets will deeply integrate—stablecoins will absorb more financial flow from traditional capital markets, while stablecoin issuers will obtain more financing capabilities from traditional capital markets.

We believe thatRWAand stablecoins entering traditional financial markets will most focus on stablecoin payment and international payment fields.In the past, RWA and stablecoins, as the most basic infrastructure and tools in the cryptocurrency market, have established a scaled commercial ecosystem. In the real world, stablecoin payment and international payment fields are a potential market. Previously, payment giant Stripe acquired the stablecoin trading company Bridge for $1.1 billion. Recently, the company announced that stablecoin financial accounts using Bridge technology now cover 101 countries/regions. These institutions can receive payments through cryptocurrencies or bank transfers and use stablecoins for global payments. In other words, Stripe is trying to connect stablecoin payments with traditional banking payment systems, bringing new development potential for stablecoins in the payment field.

4. Investment Recommendation: Focus on RWA and Stablecoin-related Sectors

We believe that under the promotion of stablecoin-related regulatory bills in the U.S. and Hong Kong, the RWA and stablecoin markets will usher in rapid development. We recommend focusing on RWA and stablecoin industry chain-related targets.

5. Risk Warnings

Blockchain technology R&D not meeting expectations: Bitcoin's underlying blockchain-related technologies and projects are in the early stages of development, with risks of technological R&D not meeting expectations.

Uncertainty of regulatory policies: Blockchain and Web3.0 projects involve multiple financial, network, and other regulatory policies during actual operation. Currently, regulatory policies in various countries are still in the research and exploration stage, without a mature regulatory model, so the industry faces risks of regulatory policy uncertainty.

Web3.0 business models not landing as expected: Web3.0-related infrastructure and projects are in the early stages of development, with risks of business models not landing as expected.