The GENIUS Stablecoin Bill in the United States has entered a critical moment of final negotiation, and Circle has simultaneously pressed the fast-forward button on its IPO sprint, attempting to ring the Nasdaq bell as the "first stablecoin stock" with its first trading day set for June 5th.

At the intersection of policy signals and market betting, four years after its IPO push, Circle's old shareholders can finally cash out at a large proportion through the IPO window, obtaining returns of several to dozens of times their initial investment. Meanwhile, Circle is leveraging policy tailwinds to raise its issuance scale and pricing range, attracting endorsements from Wall Street giants like BlackRock and JPMorgan Chase. The deep logic behind this involves both a bold bet on the prospects of a compliant U.S. stablecoin and a re-evaluation of Circle's global expansion capabilities and USDC's ecosystem dominance.

Investment Institutions Await Exit After Over 11 Years, Wall Street "Takes Over" Subscription

Against the backdrop of a failed SPAC listing in 2022, USDC stablecoin market share volatility, and increasingly stringent global regulations, Circle has ultimately restarted its IPO process, opening a new channel for crypto financial companies to enter traditional capital markets.

According to Circle's initial prospectus submitted to the U.S. SEC, it plans to issue 24 million Class A common shares, with the company issuing 9.6 million shares and the remaining 14.4 million shares to be sold by existing shareholders, with a planned pricing range of $24 to $26 per share. This investor secondary share proportion far exceeds the primary issuance by the company, which is extremely rare in tech company IPOs and typically only occurs when founders and early institutions are eager to partially exit at the listing stage or seek to reduce dilution impact.

However, shortly after, Circle raised its IPO issuance scale and price range: The new plan is to issue 32 million shares, with the company's self-issuance proportion significantly increased to 24 million shares, existing shareholder sales reduced to 8 million shares, and the pricing range adjusted to $27 to $28 per share. Calculated at the high end, this transaction could raise up to $896 million, valuing the company at nearly $6.2 billion, and with potential dilution factors like employee stock plans, restricted stock units (RSUs), and warrants, the fully diluted valuation would be around $7.2 billion.

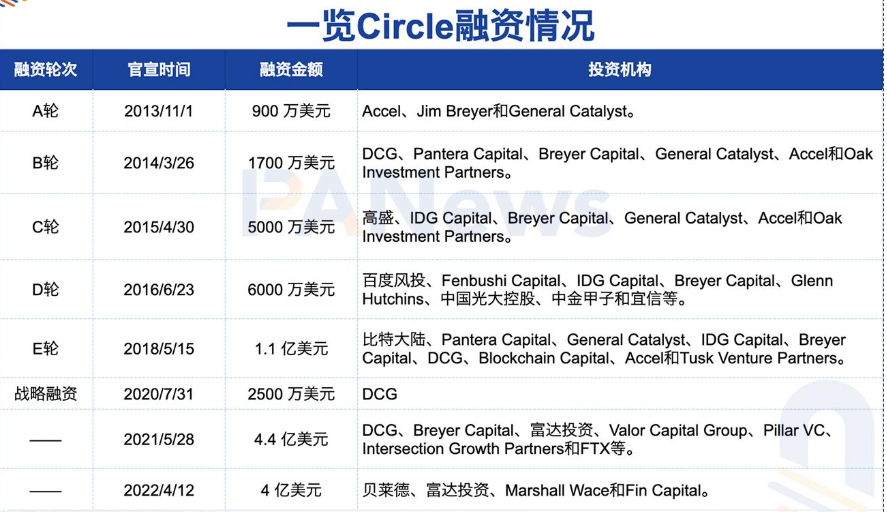

Notably, the list of shareholders participating in this share sale includes not only Circle co-founders Jeremy Allaire and Sean Neville but also several well-known venture capital firms, including Accel, Breyer Capital, General Catalyst, IDG Capital, and Oak Investment Partners, with these institutions selling between 8%-10% of their holdings. Based on financing timelines, these institutions' investments can be traced back to as early as 2013, spanning over 11 years.

Compared to the unsuccessful SPAC transaction in 2022 (which had a valuation of $9 billion), this IPO returns with a slightly lower valuation but a more robust structure and more positive market feedback.

According to Bloomberg, citing informed sources, Circle's IPO subscription orders have already exceeded the available shares by multiple times. For instance, tech investment firm ARK Investment Management (founded by Cathie Wood) has expressed interest in purchasing up to $150 million of Circle stock. Simultaneously, global asset management giant BlackRock plans to purchase about 10% of the IPO shares, estimated at $86.4 million to $89.6 million based on the pricing range.

Pricing Strategy May Reserve Growth Potential, with Opportunities and Concerns Coexisting

At a critical point where the stablecoin track is accelerating compliance evolution and the crypto industry is moving towards mainstream adoption, Circle's IPO prospectus submission is not just a capital market sprint but also a "arbitrage" of the U.S. regulatory cycle. Once successfully listed, Circle will become the first stablecoin issuing enterprise to enter the U.S. stock market, an achievement symbolic of Coinbase's listing moment.

With its strong profitability, solid compliance advantages, extensive market expansion capabilities, and endorsements from traditional financial giants like BlackRock, Circle has constructed a high-quality asset narrative framework.

On one hand, according to the prospectus, Circle's total revenue in 2024 reached $1.676 billion, a year-on-year growth of about 15.6% from $1.45 billion in 2023. Currently, the stablecoin market is in a high-speed expansion phase, but projects with strong profitability and clear financial data are rare, making Circle's revenue growth a scarce label.

Its core product USDC is already the world's second-largest stablecoin, with a current market value exceeding $61.4 billion. Although a significant market share gap with USDT remains, USDC has built a strong cognitive moat in terms of compliance, transparency, and regulatability. USDC's multi-chain deployment (including Ethereum, Solana, Base, and Avalanche) and continuous expansion into diverse scenarios like DeFi, payments, and cross-border settlements also support its gradual market value recovery.

Notably, Circle and BlackRock have become staunch allies, even temporarily abandoning issuing their own stablecoin to support USDC. The prospectus reveals that they are strategic partners. In a new Memorandum of Understanding (MOU) signed in March 2025, BlackRock agreed to be Circle's priority partner for stablecoin reserves and promised not to issue competitive U.S. dollar payment stablecoins. They agreed that Circle would entrust at least 90% of its U.S. dollar custodial reserves (excluding bank deposits) to BlackRock's management, with BlackRock agreeing not to develop or release its own stablecoin. The agreement is valid for four years. This collaboration not only strengthens USDC's risk resistance from a liquidity management perspective but also brings trust endorsement from the traditional financial market.

On the other hand, Circle's valuation strategy has growth potential. Circle's IPO valuation is around $7.2 billion, with a share price range of $27 to $28, and based on its $155 million net profit in 2024, the price-to-earnings ratio is approximately 45.61 to 47.30 times. In the current global tech sector environment with generally high valuations and tightened risk appetite, Circle's valuation is not exaggerated in the crypto industry and can be considered rational and quite attractive. Remember, Coinbase's price-to-earnings ratio was once as high as 300 times at its initial listing.

More critically, Circle is racing to capture the GENIUS bill window. The timing of this IPO is no coincidence but a precise bet on the U.S. regulatory cycle. Coinciding with significant progress in the U.S. stablecoin legislation GENIUS, which aims to establish a clear regulatory framework for U.S. dollar stablecoins, this means stablecoin issuers will enter a new "licensed" stage. In other words, the GENIUS bill represents a superimposed dividend of regulatory arbitrage and market re-evaluation for Circle - preemptively completing compliance endorsement before the bill's official implementation and winning recognition from investors and policymakers through Nasdaq listing.

However, despite Circle's impressive revenue growth, its profit structure has obvious vulnerabilities.

First, Circle's current revenue relies on U.S. Treasury bond yields, which essentially represent a pro-cyclical dividend. If the Federal Reserve enters a rate-cutting cycle, Circle's reserve earning capacity will face systematic decline.

Second, Circle's profit margins are structurally squeezed by multiple partner collaborations. According to prospectus information, Coinbase, as its core partner, is entitled to up to 50% of USDC reserve revenue profit sharing. In 2024, Circle paid Coinbase profit sharing of $900 million, accounting for more than half of its annual revenue. Additionally, Circle's collaboration with Binance reveals high incentive costs. In November 2024, Circle paid Binance a one-time prepayment of $60.25 million and promised monthly incentives based on USDC custody balance over the next two years, provided Binance holds at least $1.5 billion in USDC. This strategy of relying on top platforms to gain market share can drive market value but significantly compresses Circle's actual profit space.

Overall, Circle's listing application is not only a staged validation of its business model but also reflects its keen insight into regulatory environments and financial cycles. However, whether Circle can truly fulfill the expectations of being the "first stablecoin stock" depends on how it finds the best path balancing innovation and compliance within increasingly complex regulatory frameworks and financial cycle fluctuations, continuously optimizing its profit structure and steadily promoting global expansion.