This week, Circle, the second largest issuer of stablecoins, is going public. This has added fuel to the enthusiasm for stablecoins. BQ must be very excited. Then, the Hong Kong stock market ignited a wave of hype about financial technology companies after the stablecoin bill. Now we have come to the U.S. stock market, which has the most stable reaction. BTC and others are also very stable.

Let me briefly introduce Circle's situation. According to the prospectus, I got the 24-year annual report:

Research on stablecoins began more than a year ago, but I personally have never thought that stablecoins are a big deal. After all, USDT/USDC are not new. Today I will briefly talk about some of my thoughts during the research process. Please be gentle with me if there are any immature parts.

Recently, everyone has a unanimous feeling that stablecoins have suddenly become a very big thing.

There is no doubt that this will have a significant impact on the entire blockchain application, the entire payment system, and the entire financial system. People in the virtual asset circle are very happy because this is the top priority this year besides the strategic reserve of Bitcoin. In addition to this, I am also curious about what changes will happen to banks and traditional payment players.

Some questions:

What regulatory and market signals does Circle's listing send? (The United States is undoubtedly pushing hard)

1:1 To what extent will high-quality reserves and interest-free clauses shrink the credit funnel of commercial banks?

If the market value of stablecoins reaches 2 trillion US dollars, how much will the credit multiplier be lowered?

Deposit-Token, on-chain T-Bill, RWA loan - which channel can best pull leverage back to the entity?

How can the handling fee of a single 200 USD remittance be reduced by 99.9% from T+1 to seconds?

How are the messaging, clearing, settlement, and compliance layers rewritten by blockchain?

How does Visa/MA convert “commission” income into “rules + SaaS” income?

Who will make the most money in the new pool? Who will have to completely transform?

Why is the permissioned consortium chain the lowest-friction on-chain chain?

When the financial anchor moves to “on-chain government bonds + central bank repurchase”, how will macro-control respond?

This article is an in-depth exploration of more than a year of research. Welcome to leave a message for discussion.

Key points of this article

Circle IPO and regulatory inflection point

Circle's listing + GENIUS Act (1:1 HQLA, prohibition of interest payments) marks the recognition of "narrow banking" by legislation, and the entry of stablecoins from the gray area into the regulated US dollar system.

Passive contraction of credit multiplier

Stablecoins move demand deposits to the 100% reserve pool, raising the cash ratio c and depressing the money multiplier M. If the US dollar stablecoin reaches $2 trillion in 2030, it can squeeze ≈ $1.1 trillion in loanable base, structurally pushing up loan interest rates.

How does “cash on the chain” replenish credit?

Three ways:

① Tokenized Deposit (RLN/JPM Coin) — pays interest but is subject to Basel + FDIC constraints;

② On-chain T-Bill/ABS — low financing cost and limited contribution of macro leverage;

③ RWA loan pool/digital debt - directly connected to the entity, but KYC and liquidity must be resolved.What really determines whether the multiplier can recover is the free swap of stablecoin↔deposit and the speed of loan asset securitization.

Payment stack rewrite: speed × cost difference

200 USD cross-border remittance: 1 hour/6.6% fee → <1 second/0.0001% fee.

50 USD credit card: 1.8% MDR, T+1 → 0.02% handling fee, instant settlement.

Messaging, clearing, settlement and compliance are all real-time; reconciliation hours, funds in transit and handling fees are reduced by 70%, 100% and ≥90% respectively.

Visa / Mastercard role shift

Upgrade from a "credit card clearinghouse" to an operator of "global chain rules + compliance middle platform".

The gross profit margin of credit card transactions fell by 25-40%, but the gross profit margin of compliance API and data SaaS could reach 75%, and the overall net profit remained at 60%+.

Winners and imbalances

Earn more : Stablecoin issuers (eat 100% reserve interest rate spread), Visa/MA (rules + data fees), cloud vendors and compliant SaaS, acquiring banks' node hosting and multi-currency exchange business.

Forced to transform : small card-issuing banks that rely on interchange and high-fee cross-border remittance companies.

Minimum friction winding path

A permissioned consortium chain led by G-SIB + central bank, with Visa/MA acting as super nodes and rule issuers.

Technical blueprint: L0 BFT consensus, L1 wCBDC + Deposit Coin, L2 contract template, L3 certificate-based access.

Core conclusion (personal opinion is immature)

The legalization of stablecoins improves payment efficiency, but weakens the credit leverage of commercial banks ; if on-chain deposits and post-loan securitization progress slowly, the US credit multiplier will permanently move downward.

Payment profits shifted from "commissions" to "compliance and data" . Visa/MA took the lead in turning rules, SLAs, and blacklists into SaaS to maintain high profit margins.

Supervision + alliance chain is a realistic implementation path : it not only meets KYC/AML, but also retains the profit pool of banks, networks and cloud vendors, and promotes the migration of funds, rules and data to the chain.

First, what impact will stablecoins have on the credit system?

If stablecoins affect residents’ savings, is it possible that they will affect the credit derivation process?

Will the convenience and speed of stablecoins make people convert most of their funds into stablecoins instead of keeping them in banks for a long time, which will affect the bank's balance sheet and further affect the bank's lending quota? How big will this impact be?

First, let’s clarify the requirements of the GENIUS Act:

1:1 high quality reserve

- Issuers must maintain reserves at regulated custodians, which can only be central bank reserves, cash, T-Bills, overnight reverse repo and other HQLA; they may not hold corporate bonds, loans or assets with a term of > 90 days

License + Asset Isolation

- Non-bank issuers need to obtain federal or state licenses, reserves must be legally isolated from operating assets, and bankruptcy proceedings are allowed to be independent of liquidation

No interest may be paid

(Draft Article 105) - Legislators are concerned about the emergence of a "money fund-like interest rate race" that would trigger a large-scale migration of deposits.

How do funds flow from the banking system to stablecoins? In simple terms, it is similar to bank-to-securities transfers, or deposits into securities accounts, which are exchanged for USDT or USDC through various channels and stored in digital currency wallets. The issuer of stablecoins buys treasury bonds, reverse repurchases, or money market funds that are almost principal-protected and highly liquid as collateral at a 1:1 ratio. In this process, money is transformed from demand deposits into assets on non-bank balance sheets such as treasury bonds.

So how does this process affect credit derivation?

Where c = “monetization ratio” (cash/deposits), r = required reserve ratio, and e = excess reserve ratio.

Deposit → Stablecoin = Similar to turning current deposits into "digital cash"

In terms of statistical caliber, the deposit denominator decreases and c increases ⇒ the multiplier moves downward - banks need more capital and wholesale liabilities to support the same scale of loans. At the same time, the outflow part no longer becomes the counterparty of the loan account , but is locked in T-Bills - for the private sector, "credit creation" is replaced by "treasury bond holdings" .

Scale Effect

If all of it comes from demand deposits, the bank's loanable base shrinks ≈ the same amount × average risk weight (≈ 70%) / minimum capital ratio (10%) ≈ $1.4 trillion in potential loan capacity . This is a static approximation; in reality it will be partially offset by capital replenishment, ABS securitization, and wholesale financing. The current US dollar stablecoin is ≈ $260 billion, accounting for only ~1.2% of US M2; if it is increased to $2 trillion (~10%) by 2030 according to the Treasury scenario

Judging from the formula of currency derivation, as well as the technology of integrated stablecoins and blockchain, the result is that stablecoins themselves will not reduce the "payable money", but they lock the money into a 100% reserve framework, reducing the bank's "credit derivative leverage" .

The result is likely to be a structural contraction in credit supply and an increase in loan costs , while short-term government bonds and central bank liabilities will expand. The real net effect depends on: the speed of stablecoin penetration, whether banks launch their own on-chain deposits, the alternative ability of the capital market to finance the real economy, and the intensity of regulatory policies.

Credit-derived shocks: recalibrating magnitude

Assumption: By 2030, the market value of USD stablecoins will be ≈ $2 trillion (TBAC neutral scenario)

Let’s assume that 80% of the funds come from U.S. demand/money market deposits.

Key points – The migration of stablecoins is manifested as RWA + ON RRP on the asset side, which essentially weakens the “funnel caliber” of commercial banks’ exogenous credit creation and leaves the leverage to the Ministry of Finance/Central Bank.

There are several ways to get money back into the credit markets:

In a word: to turn 100% reserve "on-chain cash" back into capital that can derive credit, it is necessary to either turn it back into deposits, or let it buy on-chain credit assets packaged by banks or enterprises. The latter is already expanding rapidly, and the former depends on whether banks and regulators can find a sustainable balance between interest rates, capital and stablecoin payment advantages.

Technological changes may not have a big impact on the consumer experience. If we switch perspectives, we will find that the payment method of stablecoins is likely to be the same as WeChat Pay for consumers. The underlying technology is a revolutionary change, but for consumers, it is still the wallet, even the credit card, and the POS machine. So if stablecoins are widely promoted and the people who use stablecoins cover the majority of consumers, I am curious that not everyone will go back to trade Meme coins or even Bitcoin.

The demand for financial management will still return to low-risk and low-return methods, that is, the credit market, bond market, and current and fixed deposits. In other words, whether funds can return to the credit market within the framework of the GENUIS Act will not have a significant impact on credit derivatives.

First, similar to current and fixed deposits, this is considered the safest way to increase value. If it is converted to stablecoins, it becomes a bank "buying back" stablecoins and paying interest. Users transfer USDC/USDT to commercial banks → Banks cancel these stablecoins on or off the chain and open an interest-bearing Tokenized Deposit (or ordinary deposit) to users. However, GENIUS Act §105 explicitly prohibits "payment stablecoins" from paying interest directly; once the bank pays interest, the token is no longer a stablecoin but a deposit , which must fall into the bank's balance sheet and be subject to FDIC insurance, Basel capital, and LCR/NSFR .

From the perspective of capital/liquidity impact, funds become loanable liabilities again, and the credit multiplier is restored; but banks must set aside 4.5-8% CET1 and 100% LCR , and the liability cost is higher than demand deposits. Recently, JPMorgan Chase, the king of Wall Street investment banks, JPM Coin and BIS "Regulated Liability Network (RLN)" are connecting tokenized deposits with the central bank's settlement layer, with the goal of retaining the loanable nature on the chain.

Therefore, regulation is a big problem here. Of course, this may be solved by segmenting the products, that is, paying stablecoins to buy special bank coins, and the bank coins can pay interest. But the bigger problem is the issue of competitiveness.

“Competitive interest rate” does not mean to compare with DOGE or other high-risk tokens, but to compare with

The ratio of Tokenized T-Bill/Money-Fund (4.3%–4.6% APY) with almost no risk on the chain and redeemable on T+0 - taking BlackRock-Securitize BUIDL as an example, the current annualized dividend is ≈ 4.5%.

The brokerage money funds (Vanguard 4.21%, Fidelity 3.93%) that can be opened with a phone call on the chain are better.

It even has to be compared with the Federal Reserve 's ON RRP "Pure Treasury Daily Repurchase" floor rate (4.30%, mid-May).

In other words, if on-chain deposits (tokenized deposits) want to absorb the US dollars originally parked in stablecoins, they must provide returns that are "close to those of money market funds"; otherwise, everyone can exchange USDC for T-Bill tokens such as BUIDL and JTRSY with just two lines of code, and get the same security, more interest, and the same 24×7 liquidity.

These are some of the second methods, including using stablecoins to directly invest in Tokenized Bonds/ABS/MBS

Take BlackRock BUIDL as an example, $1.7 bn in assets; T-Bills, reverse repo; deployed on 7 chains, daily interest calculation, monthly dividends, completed by issuing additional BUIDL tokens;

②On-chain loan pool (DeFi-RWA Pools) , stablecoin → DAO treasury → loan to SME/mortgage service providers, recover the interest rate difference, Maple, Centrifuge, Goldfinch have facilitated ~$4 bn RWA loans; default protection relies on Tranche design, insurance or over-collateralization; ②On-chain loan pool (DeFi-RWA Pools), stablecoin → DAO treasury → loan to SME/mortgage service providers, recover the interest rate difference, Maple, Centrifuge, Goldfinch have facilitated about $4 billion in RWA loans; default protection relies on Tranche design, insurance or over-collateralization;

<span leaf="" table",{"interlaced":null,"align":null,"class":null,"style":"min-width:173px;"},"table_body",null,"table_row",{"class":null,"style":null},"table_cell",{"colspan":1,"rowspan":1,"colwidth":[123],"width":null,"valign":null,"align":null,"style":null},"node",{"tagName":"strong","attributes":{},"namespaceURI":"http://www.w3.org/1999/xhtml"}]'> ③On-chain supply chain/factoring, tokenized accounts receivable NFT → pledge for liquidity, SAP and DBS are doing PoC; buyer's credit guarantee is still required.

Pain points : KYC/AML, investor threshold, information disclosure, secondary liquidity. If a private chain + permission system (such as RLN/Onyx) is used, the compliance cost can be controlled but the open liquidity is sacrificed; the public chain is the opposite.

So, it looks like:

The technical barriers are low

——On-chain DvP is mature; the main constraints are regulatory classification and capital rules . Once "on-chain deposits" are regulated as deposits, whether banks can offer competitive interest rates depends on the difference between asset-side yield and capital cost.

Tokenized Bonds/ABS

It is likely to be launched first in the closed qualified investor market , attracting stablecoin funds by reducing issuance/settlement costs and improving divisibility, but the contribution of the macro credit multiplier will be limited .

Truly amplify credit

The solution is to either make stablecoin ↔ deposit freely reversible (RLN, Onyx), or quickly securitize loan assets to on-chain funds (Tokenized Covered-/ABS). The game between the two paths will determine who will "long" the credit leverage in the future.

The GENIUS Act brings the daily "spending" experience to the 21st century, but it transfers the cheapest and stickiest bank funds to the "100% reserve" system. In the future, if banks cannot "pull these dollars back to the balance sheet" with high-interest on-chain deposits or rapid on-chain securitization, the US credit multiplier will tend to move downward - loan interest rates will rise, more financing will turn to securitization and DeFi channels, and the anchor of financial stability will gradually move from "bank balance sheet" to the new framework of "on-chain treasury bonds + central bank repurchase".

Switching from the perspective of currency to the level of circulation may have a greater impact

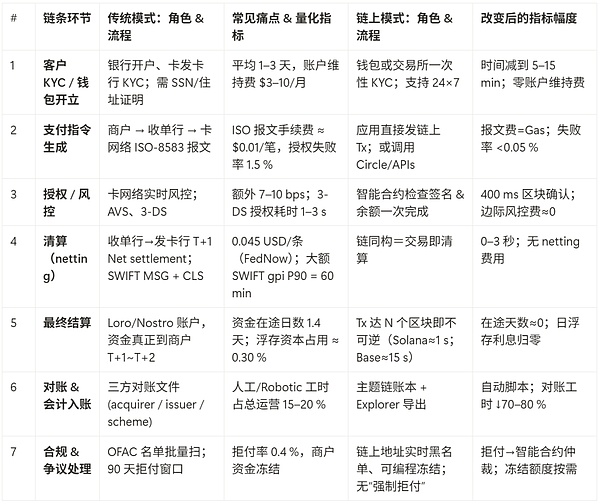

Starting with stablecoins, we boldly speculate that the natural superiority of blockchain technology is indeed very suitable for application in the entire financial payment system, and at the current point in time, blockchain technology has all the capabilities to solve all financial problems. The first is payment, which is also the superiority of blockchain compared to traditional SWIFT, fast and secure. The following is a set of quantifiable indicators to explain the changes in speed and cost that "traditional payment stack → blockchain base" can bring.

First, single cross-border/retail payment: from T+hours-days/ 1–6% rate → second-level/ <0.1%

How to explain the difference between "traditional payment stack → blockchain base" in terms of speed and cost ? The following is divided into three typical scenarios:

1. Cross-border remittance of USD 200

With traditional practices (SWIFT gpi), 90% of payments can reach the receiving bank within 1 hour, but they often have to wait until the next day for settlement to be actually credited to the account; the global average transaction fee is 6.62% (approximately US$13.24 per transaction).

On-chain approach (Solana + USDC) The Solana block generation time is about 0.4 seconds, and once confirmed on the chain, the transfer can be made again; the single network fee is about US$0.00025, equivalent to 0.000125% (≈ 0.0125 bps) .

Result: The speed of arrival was compressed from "1 hour - overnight" to "sub-second", and the cost was directly reduced from 6.62% to about one hundred thousandth, with a cost saving of more than 99.9%.

2. $50 in debit card purchases in the U.S.

Merchants using traditional methods (Visa/Mastercard) have to pay an average combined card swipe fee of about 1.8%, and the funds are settled in batches the next day.

On-chain approach (Base L2 + USDC) On Coinbase's Base network, the same amount of USDC payment usually only requires a handling fee of US$0.007-0.009, which is approximately less than 0.02%; the final settlement is made once the Gas is paid.

Result: The merchant fee burden was reduced by about 97%, and the settlement time was shortened from T+1 to a few seconds, so cash flow can be recovered immediately.

3. $10,000 enterprise batch salary (100 employees, $100 per person as an example)

Traditional approach (Same-Day ACH batch)

Same-day ACH still takes anywhere from a few hours to 1–2 days, and costs about $0.29 per transaction to process internally on average.

On-chain approach (Tron + USDT)

The Tron network can confirm a block in about 3 seconds, and the on-chain fee for batch salary payments is about US$0.002 per payment (which is in the "near-zero fee" range).

Results: Payment delays were reduced by 1-2 days, and the cost per transaction was reduced by nearly 99%. Finance can immediately invest or recycle the salary funds that were originally "in transit".

How to read core quantitative indicators?

Speed: Look at the “final irreversible arrival time” - traditional cross-border transactions are recorded in hours or days, while on-chain transactions are recorded in seconds.

Cost: Use "actual deduction ÷ amount received" to convert into bps (parts per ten thousand) ; reducing from hundreds of bps to single digits or even less than 0.1 bps is the biggest economic dividend on the chain.

Changing the base from "bulk net amount + intermediary fee" to "real-time on-chain payment + pure network fee" can simultaneously increase the speed by three orders of magnitude and reduce the fee by two orders of magnitude . This is precisely the core business motivation for stablecoins and blockchain to be regarded as the next generation of payment tracks.

Second, what are the network throughput and availability like?

In terms of the four dimensions of “how many transactions per second (TPS) can be run”, “how long does it take to finally record the account”, “how much does a single transaction cost”, and “whether it can be online 24/7 throughout the year”, the gap between traditional payment networks and several mainstream chains is already very obvious:

VisaNet

The peak value of laboratory stress testing is over 65,000 TPS. The commercial network promises 99.9999% availability (i.e., downtime of no more than 32 seconds a year). The authorization delay is about 300 milliseconds, but the actual fund settlement is still the next day.

FedNow (Real-time ACH)

The Fed's test peak is about 2,000 TPS; the official price list shows $0.045 per transaction plus $0.01 for the "request-to-pay" message, and the hard cost of each transaction is directly written into the fee list. The slowest settlement is 20 seconds, but member banks can choose to turn on the machine only during working hours.

Solana Mainnet

The normal rate is 3,000 TPS, and it can exceed 10,000 during surge periods; the block interval is 0.4 seconds, and the basic transfer fee is maintained at around US$0.00025 all year round; the online rate has remained above 99.6% in the past year (no major downtime in Q1 2025).

Ethereum L2: Base

After batch aggregation, it can easily reach more than 100 TPS when uploaded to the mainnet at one time; the common fee for a single USDC payment is less than 1/50 cent, and the final settlement is made once the chain is written.

Tron

It is generally recognized that the commercial TPS is around 2,000, and it is designed to have zero or near-zero transaction fees. Blocks are generated every 3 seconds, and the average annual availability is about 99.9%.

"Centralized card networks" still lead in peak throughput and SLA, but the single transaction cost of blockchain is two orders of magnitude lower and the payment speed is two orders of magnitude higher - especially in cross-border and small-amount scenarios.

Third, what are the structural changes taking place at the payment stack level?

The message layer used to rely on asynchronous transmission of ISO-8583 / ISO-20022 messages; now "transactions themselves are messages" and can be checked in real time. As a result, the network packet loss rate is almost zero, and the number of bank reconciliation return orders can be reduced by 50-80% according to the RFP of the four major banks.

At the clearing layer, the traditional approach relies on batch netting, from T+1 to T+2; after switching to the chain, the net amount is synchronized when a block is written, and the number of days funds are in transit is reduced from an average of 1.5 days to zero, and the corporate finance department no longer pays interest on "float in transit".

Settlement (ultimately irreversible) was originally done through SWIFT Nostro/Loro or Fedwire for final netting, and the clearing bank still had to provide guarantees; in-chain atomic settlement allows the credit exposure window to be directly reduced from "hours" to "seconds".

At the reconciliation/audit level, three-party reconciliation documents and manual adjustments were routine in the past; with full nodes or block browsers, audits can automatically pull data. The internal estimate given in the bidding of the Big Four banks is that the reconciliation hours can be reduced by about 70%.

Compliance/risk control layer, the traditional model is post-screening in batches; on-chain, addresses can be whitelisted or frozen in real time before entering the chain, and the interception of suspicious transactions is shortened from "several hours" to "several seconds". Visa Crypto Credential API and Mastercard MTN's real-time compliance interface commercialize this gap.

The overall KPI has been rewritten: "funds arrive in seconds, funds in transit are zero, handling fees are reduced by more than 90%, and reconciliation manpower is reduced by 70%" - this set of quantitative differences is the core driving force for corporate treasury, cross-border e-commerce and even street merchants to move to the chain.

The GENIUS Act will force stablecoins to have ≥ 1:1 high-quality reserves → no interest . The speed/cost advantage for on-chain payments remains unchanged; if banks connect on-chain deposits (Deposit Tokens) , they need to add FDIC 6–9 bp to the compliance costs, making it difficult for the fee rate to be lower than 0.1%.

For cross-border small remittances, World Bank data shows 6.62% → 0.05–0.1% on-chain, with an average saving of >99%.

If we further disassemble the payment chain and analyze each link in the chain, taking a cross-border B2C payment (a US e-commerce company refunds 200 USD to a Mexican consumer) as an example, we can compare them one by one.

Traditional track = "Card network + SWIFT/Loro account + local clearing system"

On-chain track = "Direct payment with stable currency (USDC/SPL or TRC-USDT)"

The role change of traditional payment networks

At present, all payments are radiated outward from a centralized network, and this center is a huge network built by VISA and Mastercard covering more than 2,000 banks around the world. As far as we know about blockchain, the first characteristic that comes to mind is decentralization. So in the process of this technological change, how will the roles of Visa and Mastercard change, and how will their value capture change?

Each link in the payment chain: traditional positioning, pain points on the chain and Visa/Mastercard’s response

Identity and Compliance Layer

Past: Visa/Mastercard was responsible for BIN numbers, PCI-DSS, and 3-DS regulations, and assisted issuing banks in account opening, KYC, and blacklist management.

On-chain pain points: Blockchain addresses are inherently anonymous, and “on-chain accounts” need to be mapped to real identities.

Visa's Crypto Credential and Mastercard's MTN Rulebook issue verifiable certificates to wallets or issuing banks, automatically verify AML/OFAC during transactions, and support dynamic blacklisting of addresses. Visa has piloted cross-border stablecoin remittances with Crypto Credential in Argentina and Brazil; Mastercard will release MTN in 2023.

Authorization Layer

In the past: 130 milliseconds-level real-time risk control (VAA, MCA) on the network side determined the release and limit.

Pain points on the chain: Once a stablecoin transfer is on the chain, it is irreversible and fraud must be intercepted before writing to the chain.

Run the "pre-authorization API" first on the private chain or L2, and broadcast the transaction only after passing; the traditional refund logic is rewritten as "freeze after pre-authorization". Mastercard's Crypto Sandbox has jointly tested "pre-locking" stablecoins with JPM Onyx.

Liquidation Layer

Past: Daily or real-time netting by member banks, processed via VisaNet / MasterCom.

On-chain pain points: The stablecoin itself has been received in real time, but the bank’s general ledger still needs to record the net amount.

Open USDC settlement accounts for member banks and automatically exchange USDC back to fiat currency to make up the net balance; or directly allow member banks to generate Visa settlement files on the chain. Visa has used USDC to complete millions of dollars of real settlement for some card issuers on Solana and Ethereum.

Final settlement of funds

Past: Fedwire or ACH debits from Nostro accounts.

On-chain pain points: If the recipient only accepts on-chain assets, there will still be a “chain ↔ silver” fault.

Issue Stablecoin Settlement Node (Visa) or MTN settlement subchain (Mastercard), synchronize with the bank's core account in real time, and become the Layer-0 boundary. Mastercard MTN has been positioned as a "regulated private chain interconnection layer", and the first batch of banks are conducting PoC.

Merchant acceptance and payment experience

Past: 65 million terminals worldwide, merchant fee rate (MDR) approximately 1.3–2.5%.

On-chain pain points: wallet fragmentation and poor user experience.

Pack on-chain payment into "existing card number + network ID" and launch Visa×Bridge stablecoin card and Mastercard-OKX crypto debit card. Visa stablecoin card has been launched in three Latin American countries; Mastercard-OKX card is planned to be launched in Q2 2025.

Data and Value-added Services

Past: High-margin businesses such as consumer insights, loyalty, and chargeback arbitration.

On-chain pain points: Transaction data is public but lacks merchant semantics, and there is no traditional level of risk control metadata.

Map on-chain metadata to MCC/SKU tags and continue to sell retail data packages, points, and advertising. Visa will open the On-chain Spend Analytics API to card issuers starting in 2025 (covering Solana and EVM chains).

Network Governance and Technical Standards

Past: Guaranteed 100% availability of global nodes and business rules.

On-chain pain point: decentralized networks lack a unified SLA.

In private chains or L2 topologies, it acts as a "super node + rule issuer" to provide banks and FinTechs with compliant subnets with SLAs. Mastercard MTN promises 99.999% SLA and launches programmable payment standards.

Quantifiable new value brought by on-chain solutions

Cross-border settlement speed : SWIFT gpi is usually T+1; Visa's USDC solution can shorten the arrival time to 30 minutes-2 hours. Visa still charges a settlement fee of 9-14 bp, but the issuing bank saves a whole day of capital cost in transit.

Merchant net fee rate : Traditional domestic card swiping averages 180 bp; "stablecoin cards" can reduce the merchant's net burden to 45-60 bp, with about 80% of the profit being passed on to merchants and consumers, and the rest continuing to belong to the network and issuing bank.

Chargeback processing time : 45-90 days for traditional process; real-time chargeback can be achieved after on-chain pre-authorization and smart contract freezing. Visa/Mastercard still charges a dispute management fee of US$15-25 per case.

On-chain AML compliance costs : If banks build their own on-chain compliance systems, they need to add chain analysis and data interfaces; if they switch to Visa Crypto Credential, they only need to pay about 3-5 bp of certificate and API subscription fees each year, which is equivalent to packaging "compliance" as a network service for sale.

So in conclusion, the roles of Visa and Mastercard have been upgraded from "acquiring + settlement giants" to "operators of global on-chain payment rules, identities and disputes."

The income structure will shift from traditional card processing fees to value-added services, including data, risk control, and agency operations. With the promotion of stablecoins, the income of these two giants may fall first and then rise.

Assuming that the total global payment volume grows at a compound annual growth rate of 9%, blockchain payments account for about 45% of the card volume; the on-chain net commission is 5-8 bps, and the traditional card MDR continues to decline to 80-120 bps.

5–7 years later, after the GENIUS Act is enacted and on-chain payments become “mainstream B-grade”, the profit profiles of Visa and Mastercard will be roughly as follows:

Visa 's total net revenue may decline slightly by 5% compared to fiscal year 2024, or it may increase slightly by up to 10%. Its traditional "card swipe fee" revenue is expected to shrink by about 25-40%. However, the emerging on-chain settlement and compliance middleware business is expected to contribute $2-5 billion per year. At the same time, the proportion of high-gross-margin value-added services such as data, risk control and agency operations will increase from 29% in 2024 to about 45%. Under the combined effect, the operating profit margin will drop slightly from the current 68% to a level still above 60%.

Mastercard 's total net income range is slightly better, and may be flat to about 15% higher than in 2024. The traditional card swipe fee sector will also shrink, but the decline will be slightly smaller, between 20% and 35%. On-chain settlement/compliance middleware has also become a new growth pole, which is expected to bring in annual revenue of US$2 billion to US$4 billion. Since Mastercard focuses more on value-added services than Visa, its data and risk control businesses will further increase the proportion of total revenue to about 55% (about 40% in 2024). After the high-gross-profit VAS offsets the decline in fees, the overall operating profit margin is expected to remain unchanged at about 60%.

The "commission pool" in the era of card swipe fees will continue to shrink, but the two major networks have reshaped their revenue structure by relying on on-chain compliance middleware and data services. Although their profit margins have been slightly compressed, they are still at the "high ground" of the payment industry.

The identity of the centralized role has faded, but the monopoly of Visa and Mastercard is not because they are at the center, but because of their long-term win-win cooperation with more than 2,000 banks around the world and the 65 million existing merchant terminals they have laid out. As long as there are points, the composition of the network will naturally emerge under new technologies, and it will still be generated around the inherent points in a way with minimal friction.

Under the GENIUS Act, on-chain payments must meet the following requirements: 1:1 reserve disclosure, OFAC instant blacklist, freezing function... - these are exactly the "global rules + SLA" businesses that Visa/MA is good at.

65 million merchants have existing terminal financial equipment with a depreciation period of 7 years; they can receive stablecoins by simply flashing the firmware → Merchants have no motivation to switch to the new independent network.

Multi-chain/private chain interconnection, Visa supports Solana, ETH L2, and Circle Private Circuit; Mastercard directly promotes MTN private chain → "locks" the bank in its own Layer-0.

As a more radical point of view holds: "Digital currency is actually the US dollar", and the stablecoin payment network is naturally still a US dollar payment network, that is, it is still a payment network established mainly by the United States.

The path of least friction

Assuming that the current blockchain is a technological change that must be completed, this is a big deal, as it requires adjusting the entire technology stack built over the past few years. Therefore, the path with the least friction may be the path with the least changes in supervision and multi-party cooperation. Otherwise, a system that has been running stably for many years is almost difficult to shake, and it must be carried out in a way that minimizes the interests of all parties to have a chance to make new technological changes. Therefore, there may be a big gap from the most optimistic scenario. The vision of Fin-tech companies being able to dominate all technologies in the future financial industry is likely to be difficult to achieve. It is more likely that Fin-tech companies will shine in the existing huge network and provide services to all parties without changing the distribution of major interests.

Therefore, a more likely path is that the G-SIB Alliance or the central bank will take the lead in establishing a licensed consortium chain (consortium DLT) , with VISA and Mastercard acting as "super nodes + operations/compliance hubs . "

The possible overall blueprint of the technical architecture will be:

L0 — underlying consensus layer

The network uses a high-throughput consensus protocol such as BFT or HotStuff, and consists of about 100-300 nodes: 27 global systemically important banks (G-SIBs), several clearing banks, and central bank observation nodes. Visa and Mastercard are inserted as "super validators", holding 2-4% of the block production rights, and are responsible for providing SLA guarantees and ledger audit services to member banks.

L1——Settlement Asset Layer

The basic assets circulating on the blockchain will be "wholesale CBDC (Central Bank Reserve Token)" and Deposit Coin issued by commercial banks. Visa / MA operates a "settlement gateway SDK" to connect the on-chain balance with the bank's core account in real time to ensure consistency between the total and sub-ledgers.

L2 - Business Logic Layer

Functions such as cross-border PVP, securities DVP, tokenized certificates of deposit, and real-time salary payment are all encapsulated as smart contract templates. Visa/MA sells escrow services such as dispute arbitration, rate calculation, and AML/OFAC interface at this level, which is equivalent to writing "network rules" into smart contracts.

L3 - Access Layer

The core banking system, FinTech wallets, and even IoT terminals are connected through APIs. Identity and compliance are guaranteed by Visa Crypto Credential or Mastercard MTN certificate system: address whitelist, dynamic blacklist, and real-name mapping are all completed at this layer.

Ready-made references : Mastercard MTN has brought banks, wallets and payment companies into a single rules network; Visa B2B Connect 2.0 has also evolved from Hyperledger Fabric to being able to anchor multiple chains, and there will be no technical barriers to directly migrating to wCBDC/Deposit Coin assets in the future.

Division of responsibilities for governance and compliance

Network rules (e.g. MDR rates, chargeback windows)

The real decision-maker is the Alliance Chain Board of Directors, whose members include large banks, Visa, Mastercard, and several payment giants. However, the rules are still drafted and iterated by Visa/MA, and the two companies make money from "network rule maintenance fees."

Node operation and SLA

The daily operation and maintenance of the nodes are outsourced to professional operators (IBM, AWS, VisaNet data center, etc.). Visa/MA can directly undertake the node hosting service, and each bank has to pay it about US$500,000 to US$1 million per year.

Regulatory data interface

Regulators such as the central bank, SEC, and FinCEN require real-time mirroring and sandbox testing environments. Visa/MA is responsible for providing "Compliance API + Regulatory Sandbox" and charges a SaaS subscription fee.

Data Privacy and Interoperability

On-chain transactions use the ISO-20022 labeling system; Visa Data Analytics reprocesses the original Tx into SKU or MCC-level business insights, and then sells them to merchants or banks for a second time.

Overall, the technical architecture and governance architecture together upgrade Visa/Mastercard from a "card swiping clearing house" to a "compliance and data middle-office operator", which not only retains the right to speak on network rules, but also opens up a new source of profit from node hosting and data value-added.

Conclusion: The Fed, the ECB, and the HKMA all chose “permissioned chain + central bank node + commercial bank super node” in experiments such as mBridge and Project Agorá, precisely because this is the DLT topology that can achieve regulatory compliance the fastest.

Under this new licensing alliance chain, the huge pool formed by the triangular distribution network of card issuance, acquiring and settlement in the payment network's distribution system will be transformed into multiple small pools of compliance, service, etc.

Who earns more ?

Stablecoin and Deposit-Coin Issuer (Bank or Asset Management Company)

The narrow bank model on this chain is the most direct: 100% of all reserves are used to buy short-term government bonds or central bank reverse repurchases, with an annualized yield of about 5%. Traditional banks can only get 20% to 30% of the interest rate difference from current deposits, but now issuers can retain the full amount, so the profit elasticity is the greatest. After the "100% reserve" is confirmed by legislation, the interest-earning model is legalized, which is equivalent to gathering all the interest rate difference originally scattered in the commercial bank's table to the issuer.Visa and Mastercard

The gross profit margin of card swipe fees will decline, but the two companies have a natural monopoly on network rules, dispute arbitration and real-time compliance API. They make "terms + blacklist + SLA" into SaaS, with a gross profit of 75%. Although the income from card swipes has shrunk, the new compliance/data fees are enough to offset it, and the overall net profit is likely to remain the same or even increase slightly.Cloud vendors and KYC/AML SaaS providers

Every time a permissioned chain is built, services such as node hosting, real-time chain analysis, and address risk scoring are required. On-chain supervision visualization makes these data subscriptions a "ticket to the network", and node hosting fees and compliance API fees will become a continuous source of income.Acquirers and Payment Service Providers (PSPs)

Traditional acquiring rates are declining, but they can resell software services such as multi-currency exchange, on-chain node hosting, merchant SaaS, etc. Software subscriptions have high gross margins and low marginal costs, and can still expand the profit pool overall.

Who earns less or needs to transform ?

Small card issuing banks that rely on interchange

In the past, they relied on authorization and liquidation risks to make a profit from the price difference; real-time settlement on the chain has weakened this profit. If they do not transform to issue their own Deposit-Coin and undertake node operations, they can only watch the interest and fee income shrink.High-fee cross-border remittance specialist

The global average cross-border fee of 6.6% has been reduced to about 0.1% in the on-chain stablecoin track. The gross profit has almost evaporated, and they have to switch to on-chain compliance modules or foreign exchange hedging services to maintain their business.

Under the alliance chain model, the "old pool" (MDR 180 bps) is split, but the new pool (node hosting, compliance certificate, reserve interest rate spread, data service) is large enough to allow banks, Visa/MA, and cloud/KYC providers to obtain high-gross-profit new income of ≥ 50 bps .

Consumers and merchants get the lion’s share of the speed and fee concessions; banks, networks, and FinTech maintain or even increase profits by issuing narrow-bank stablecoins, selling nodes/compliant SaaS, and dispute arbitration ;

Therefore, it is not the case that "only users benefit and all institutions lose money", but rather that profits are redistributed and the pricing model is changed from commission to service fee - this is exactly the business motivation for banks, Visa, and Mastercard to promote blockchain.