Many KOLs compare the current market situation with November 2021, believing it is a Double Top and the end of the bull market.

However, they only look at charts, ignoring the differences in fundamentals and market sentiment. Currently, we are at the end of rate cut expectations and quantitative tightening, with ETF and US stock companies continuously buying BTC, whereas in November 2021, it was the end of loose policies and the start of rate hikes. In terms of market sentiment, while BTC has reached a new high, ETH and Altcoins have just experienced a sharp drop, and market sentiment is low; at that time, the NFT and blockchain gaming boom was still ongoing.

I believe the main upward wave has not truly begun, and bulls may continue after a one or two-month adjustment. Bitcoin: Last night, it rebounded from 105,000 to 106,700 and was blocked, oscillating between 105,000-106,500. Breaking through 106,500 and stabilizing at 107,000 would have a chance to challenge 110,000. If it doesn't break 106,500, it will continue to oscillate at high levels. Ethereum: It reached 2,650 but didn't stabilize, dropped to 2,563 and rebounded, currently around 2,640. To continue rising, it needs to break through 2,650 and then look at 2,730. Support is at 2,580, with a major support zone at 2,500-2,450, advising stop-loss if it breaks.

From the recent performance of BTC and ETH, funds are more inclined to flow into ETH, with a clearly stronger trend, providing a favorable environment for Altcoin activity. Currently, the #AI track is quite hot, with FET leading, WLD and INJ maintaining strong momentum, worth continued attention. In the L2 and modular direction, ARB and ZK performed brilliantly yesterday, while OP is limited by relatively weak market cap. The previously sluggish staking sector, JTO, has also significantly strengthened in the past two days, also worth noting.

The market focus still cannot avoid Trump. Three major events occurred in the past few hours:

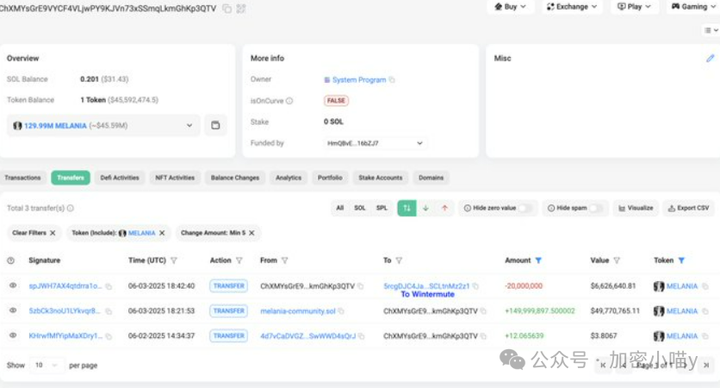

1. Melania's team transferred 20 million MELANIA tokens to market maker Wintermute, enhancing liquidity (worth about $6.62 million);

2. Wallets related to $TRUMP injected over $46 million in assets on platforms like Binance, OKX, Coinbase, and Bybit;

3. World Liberty Financial surprise airdrop, distributing a total of $4 million, 47 tokens worth $1 each to $WLFI buyers.

Okay, after reviewing the overall market situation, let's continue to look at the Altcoin situation!

PEPE

Although initially seen as a joke coin, Pepe Coin has established itself in the market through social media hype, like Dogecoin and SHIB. Currently, the #PEPE brand heat remains, with market recovery expectations warming up. Recent rapid price increases, coupled with continuously positive uncleared contract financing rates, suggest meme funds may be brewing a comeback.

In the short term, PEPE is blocked at 0.00001688 (Fibonacci 0.5), with RSI falling from the overbought zone, weakening momentum, and may enter a consolidation phase. If RSI stabilizes and the trend resumes, PEPE needs to effectively break through 0.00001688, to potentially challenge 0.00002837 in the coming months or by the end of 2025. Otherwise, if blocked, it may trigger a pullback and break the upward structure.

XRP

Ripple CTO David Schwartz recently clearly stated that XRPL's future will go beyond cryptocurrency, moving towards building a more complete and efficient financial system. He believes that XRPL combined with #XRP and RLUSD stablecoins can not only be used for payments but also cover traditional financial scenarios like loans and investments, creating infrastructure similar to a bank or fintech, but faster and more open. He emphasizes that XRPL is not just XRP, but a platform supporting real asset tokenization, stablecoins, and lending market tokens. Although the ecosystem will be more diverse, XRP still has core advantages - no counterparty needed, default payment fee usage, and central position in automatic bridging and liquidity design.

However, Schwartz also candidly admits that it's currently difficult to quantify XRP's value and its actual connection to XRPL activities, which is one of the key challenges for future development. Overall, Ripple is building a decentralized financial stack centered on XRP but not limited by it. XVG

Verge (#XVG) has always focused on user privacy and fast transactions since its inception, ensuring security through PoW mechanism. However, with the rise of more feature-rich emerging L1 blockchains, Verge faces fierce competition. Nevertheless, its low-cost, privacy-focused transaction experience still attracts some users and speculators. If the team can introduce smart contracts and achieve new partnerships, XVG may continue its bullish trend.

Technically, since its 2017 historical high, XVG has been in a long-term symmetrical triangle consolidation, currently near the end of the pattern, which may signal an imminent breakthrough. If the trend continues, XVG might challenge its historical high again by the end of 2025.

That's it for the article! If you're feeling lost in the crypto world, consider joining me in layout and harvesting from market makers! You can join the community VX+Q group (join group+Q: 3806326575) to get market analysis, individual coin recommendations, and favorable news, prepare in advance, and enjoy irregular live market analysis! You can also ask questions in the group and get the best answers!