South Korea elected Lee Jae-myung as the new president, sparking optimism in the country's cryptocurrency industry.

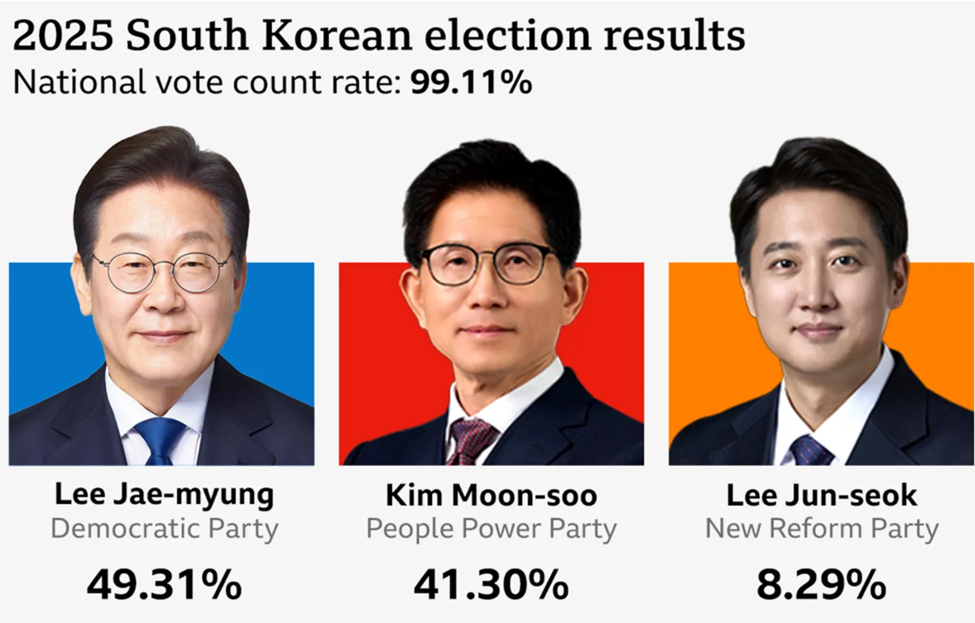

Lee Jae-myung, a center-left politician from the Democratic Party, won the election on Tuesday with 49.31% of the vote, defeating his conservative rival Kim Moon-soo.

Lee Jae-myung's Election Marks a New Era for South Korea's Cryptocurrency Policy

The voter turnout reached 79.4%, the highest in 28 years, indicating strong public backlash against the previous government. More importantly, this signifies a crucial moment for digital asset policy in South Korea, one of the most active cryptocurrency markets in Asia.

Lee Jae-myung's election promises are keeping investors and developers on edge. He publicly committed to allowing South Korea's 884 billion dollar national pension fund to invest in Bitcoin and other cryptocurrencies.

He also pledged to approve a Bitcoin spot ETF and develop a won-pegged stablecoin to reduce capital outflow and increase domestic adoption.

"South Korea's 884 billion dollar national pension fund will be able to invest in Bitcoin. Very positive for Bitcoin," wrote Mister Crypto on X.

South Korea's cryptocurrency community has long demanded clear regulations and greater access to institutional investment tools.

With over 18 million cryptocurrency users, South Korea has historically been a leader in retail enthusiasm and technological innovation. However, legal uncertainty and capital controls have kept the cryptocurrency economy stagnant. Lee Jae-myung's victory could change this.

"To promote youth asset formation and cryptocurrency institutionalization, President Lee Jae-myung promised to introduce a spot cryptocurrency ETF, issue a won-based stablecoin, and establish an integrated market monitoring system," reported local Korean media Blockmedia.

These reforms aim to increase transparency, improve investor protection, and support youth asset formation during economic stagnation.

However, significant legal obstacles remain. Currently, South Korean cryptocurrency assets are not classified as financial products. This status prevents ETF approval and limits institutional participation.

Experts say Lee Jae-myung's success depends on securing legal clarity and realigning the government's stance on digital assets.

Bitcoin ETF, National Pension Investment, and Won Stablecoin in Focus

Cryptocurrency was a rare bipartisan issue in the election. Both major candidates supported pro-cryptocurrency policies, indicating a growing recognition that blockchain and digital assets are central to Korea's innovative economy.

Beyond ETFs, stablecoins are emerging as a strategic focus. At a recent seminar hosted by Hashd and Four Pillars, developers, banks, and regulators discussed the future of won-based stablecoins.

Alex Lim from Layer Zero said the event captured a new spirit in South Korea's cryptocurrency space.

"The noise has decreased, and sincerity has increased... There's a greater conviction about building practical and specific utility," Lim wrote in a post.

Lim emphasized that South Korea's fintech, IP, content, and commercial distribution power make it a natural center for real-world stablecoin use cases.

"The first wave of stablecoin innovation here will not be about trading volume or yields. It will be about real-world adoption," he added.

South Korea seems to prefer a bank-led issuance model, but there's consensus that broader participation from fintech and capital markets is essential.

Nevertheless, Lee Jae-myung's path may not be easy. He inherits a deeply divided nation, a fragmented opposition party, and a pending trial for election law violations that he has postponed.

"I will fulfill the great responsibility and mission entrusted to me," BBC reported, quoting Lee Jae-myung's statement to journalists.

With cryptocurrency now firmly on the national agenda, expectations for South Korea's digital asset future are higher than ever.