In the past 24 hours, a large-scale position liquidation occurred in the cryptocurrency market, with a significant number of leverage traders experiencing losses.

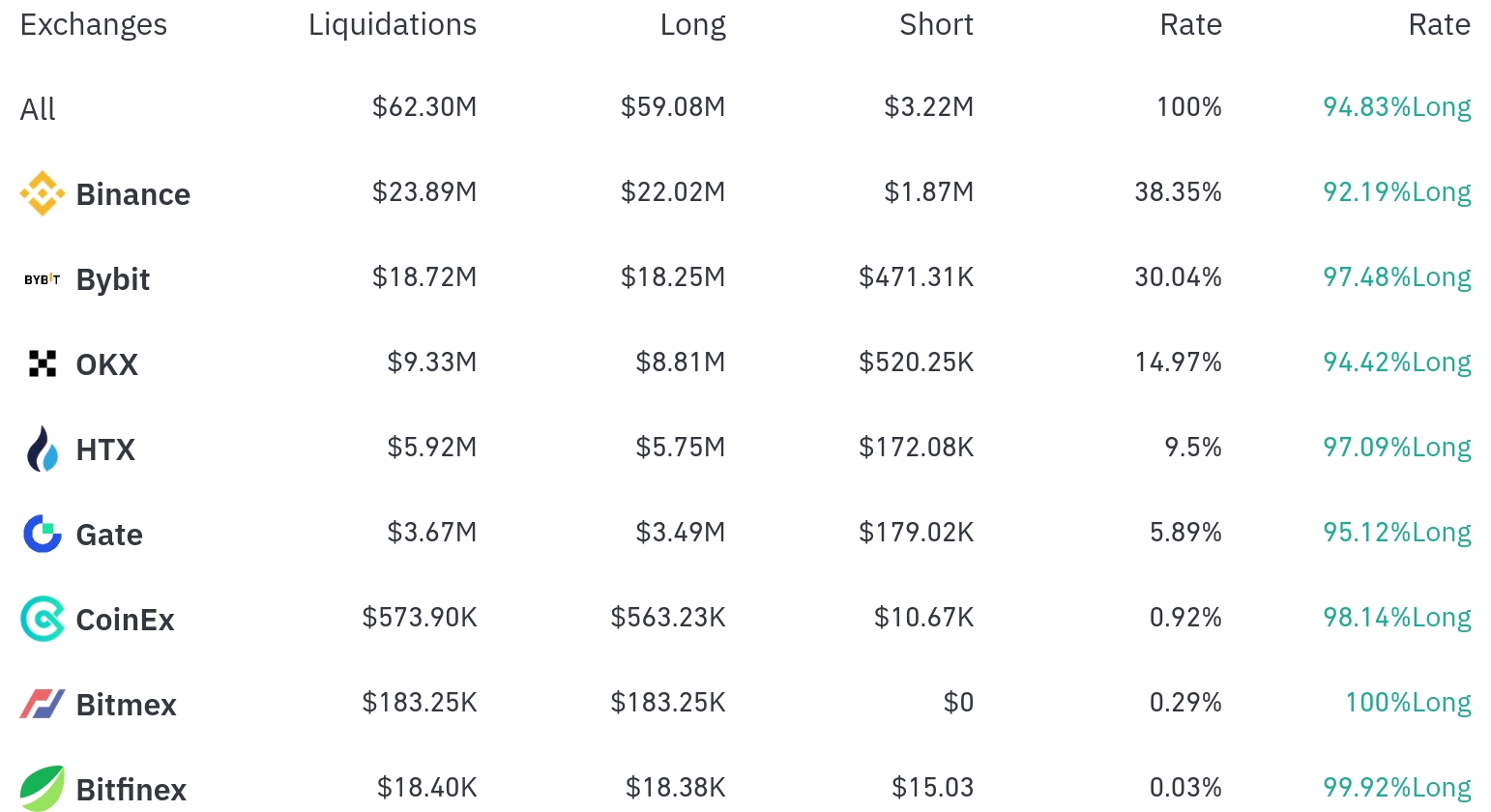

According to the currently aggregated data, Binance recorded the highest liquidation at $23.89 million (38.35%) based on a 4-hour period. Among these, long positions accounted for $22.02 million, representing 92.19%, while short positions were $1.87 million.

Bybit experienced liquidations of $18.72 million (30.04%), with long positions reaching $18.25 million, accounting for 97.48%. OKX saw liquidations of $9.33 million (14.97%), with long positions at 94.42%.

HTX and Gate also experienced liquidations of $5.92 million (9.5%) and $3.67 million (5.89%) respectively, with both exchanges having over 97% long position liquidations. Overall, long position liquidation ratios were overwhelmingly high across all major exchanges.

By coin, Ethereum (ETH) recorded the highest liquidation volume. Approximately $57.69 million in positions were liquidated in 24 hours, with $12.74 million in long positions and $0.29 million in short positions liquidated within 4 hours. Currently, Ethereum is trading at $2,602.92, down 0.43%.

Bitcoin (BTC) saw liquidations of $43.60 million in 24 hours, with $7.57 million in long positions and $0.10 million in short positions liquidated within 4 hours. Bitcoin's price is currently at $104,534.5, down 1.10%.

Notably, the FARTCO Token experienced liquidations of $7.08 million in 24 hours, with a price drop of 11.63%. Within 4 hours, $1.34 million in long positions and $0.09 million in short positions were liquidated.

Doge (DOGE) saw liquidations of $6.01 million in 24 hours, accompanied by a 3.23% price drop, with $2.01 million in long positions liquidated within 4 hours.

The Trump-related Token (TRUMP) also showed a 4.25% price drop, with $0.58 million in long positions liquidated within 4 hours and total liquidations of $1.29 million in 24 hours.

This large-scale liquidation event indicates increasing volatility in the cryptocurrency market, with the liquidation pattern heavily skewed towards long positions suggesting growing downward market pressure. Investors need to be more cautious about leverage trading in the current market conditions.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>