Regarding the upcoming Altcoin season in 2025, the market has made multiple predictions. However, so far, these predictions have not come true. Has the Altcoin season ended before it even began?

VX:TZ7971

Although the Altcoin season has been delayed, it has not completely ended.

What is hindering the arrival of the 2025 Altcoin season?

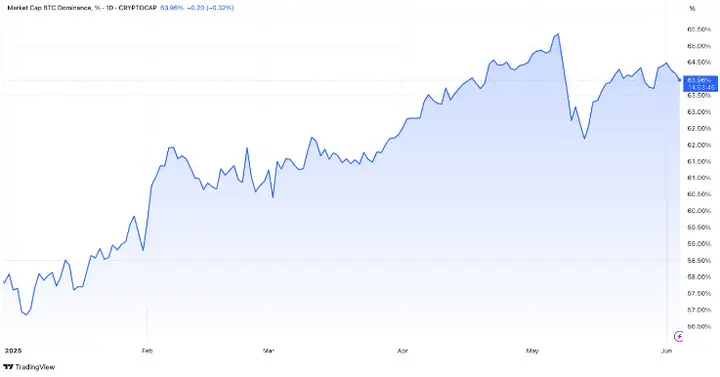

Bitcoin is leading in the current cryptocurrency cycle, with its market dominance (BTC.D) steadily rising. In May, its market dominance reached 65.3%, the highest level since 2021. Although BTC.D slightly declined mid-month, it has since rebounded and reached 63.1% at the time of writing.

Meanwhile, BTC price has also surged significantly, reaching a historical high of $111,970 last month. Historically, Altcoin seasons typically follow strong Bitcoin rallies, as funds begin to flow into smaller cryptocurrencies.

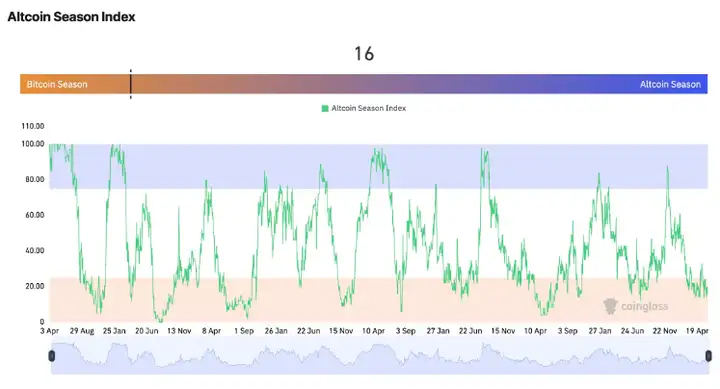

Although some cryptocurrencies have recently shown strong increases, these rallies are mostly isolated. Additionally, Coinglass data shows that the Altcoin season index is currently only 16.

This has raised concerns about why capital flow patterns have not been replicated. Institutional investors have primarily driven the current Bitcoin bull market, with little interest in Altcoins.

BTC remains the mainstream trading asset. As long as market sentiment continues to view Bitcoin as a safe haven, funds flowing to Altcoins will be restricted. Moreover, structural risks such as smart contract vulnerabilities, legal uncertainties, and operational errors have reduced Altcoins' attractiveness to off-market capital.

Some meme coins performed well during short-term "surge" periods. However, macroeconomic instability, declining liquidity, and the growing trend of short-term "surfing" rather than long-term Altcoin holding have hindered large-scale capital movement.

Many now believe that the traditional Altcoin model has structural flaws due to its high centralization and team execution risks.

Bitcoin's growth has been largely driven by institutional investment and clearer spot ETF regulation.

ETF trading volumes have attracted liquidity towards Bitcoin, increasing its share in total market depth and reducing Altcoin liquidity. This has led to widening bid-ask spreads, reducing the appeal of large investments in small assets and further consolidating Bitcoin's dominance.

Spot ETFs allow investors to directly invest in BTC. In previous cycles, Altcoins served as alternatives. Now, as institutional investors continue to accumulate BTC, the cycle has almost reset. Meanwhile, retail investors remain cautious after the deleveraging phase of 2022-2023.

A wave of new token issuances is another important factor

This has diluted capital and investor attention.

Liquidity is currently sparsely distributed, with 98% of total market cap still locked in the top 100 tokens, meaning little funds flow into new projects. Low conversion costs make traders easily attracted by momentary hype, and many founders prioritize rapid token price increases over building sustainable utility, which is crucial for driving broad and continuous capital flow.

Why the 2025 Altcoin season may still become a reality

Despite these factors, the Altcoin season still has potential. The current situation suggests that the Altcoin season is merely delayed, not disappeared.

Bitcoin's current excellent performance may continue short-term. After the Quantitative Tightening (QT) cycle ends and a new Quantitative Easing (QE) policy is launched, Altcoins may see a revival. Postponing purchases is more meaningful. Historically, when Bitcoin price stabilizes in a certain range, risk appetite shifts towards external assets.

As ETF demand stabilizes and Bitcoin volatility decreases, capital flow typically shifts towards more volatile assets.

Therefore, an Altcoin season in late 2025 or early 2026 is possible.

Signs of the Altcoin season have begun to appear.

The stark contrast in ETF fund flows is one of the most obvious signs of market capital rotation. Despite macroeconomic and geopolitical turbulence, Ethereum ETF has recorded inflows for 11 consecutive days, totaling over $630 million. Meanwhile, Bitcoin ETF has seen outflows for three consecutive days, totaling over $1.2 billion.

The increase in Altcoin ETF applications and some companies adopting Altcoin reserve strategies in their treasuries indicate growing institutional investor interest in Bitcoin alternatives as the market cycle continues to evolve.

In the current market cycle, ETH is clearly leading the Altcoin rotation and capital flow, followed by other currencies like XMR, ENA, HYPE, AAVE, and ARB, which have risen over 5%, while BTC only rose 0.6% during Tuesday's recovery.

Moreover, Bitcoin's consolidation at higher price levels typically creates performance space for Altcoins, especially when risk appetite rises and investors start seeking higher beta opportunities. Given that Bitcoin has been stable above $100,000 for 25 consecutive days, a true Altcoin season may be imminent.

If the current Altcoin momentum continues and institutional interest increases, we might see a strong Altcoin breakthrough in the coming weeks.