Author: hoeem Source: X, @crypthoem Translated by: Shan Ouba, Jinse Finance

Has the bull market even started? You might think after reading the title: "Is this person crazy?" And after reading it, you might think: "I need to prepare for the bull market."

Yes, Bitcoin has risen from $16,000 to $110,000 in the past three years, but has the bull market really started?

I know this sounds crazy, but there are some reasonable evidences that suggest it hasn't truly begun, because the macroeconomic environment hasn't created conditions for a "real" bull market.

We have indeed seen the largest institutional adoption in history, but what about Altcoins? Throughout the entire cycle, they seem to have been suppressed, repeatedly entering small bear markets.

I watched a video by @Jesseeckel on YouTube, where he delved into what triggered the bull markets in 2013, 2017, and 2021. No, it's not just a four-year cycle issue. There are more factors. And since then, we haven't seen similar conditions... at least not yet. So I decided to organize his video content into an article.

If you research what truly ignited the "frenzy", you'll find it's not narrative, nor blind hope, but macroeconomic liquidity mechanisms. And right now, we're just in the "first act".

Jesse proposed a concept: "11 Liquidity Power Rings". And the twelfth power ring is the core that governs everything.

If you want to know:

Why past cycles suddenly erupted

What macroeconomic tools truly inject momentum

What triggered it all

Then you must read on:

Why the Crypto Bull Market Hasn't Started Yet

A complete macro framework to help you precisely judge the timing before the next wave begins. How liquidity enters the crypto market's "11 Power Rings":

All major crypto bull markets have one thing in common: they coincide with massive liquidity injections in the global economy. These liquidity surges are not random events, but initiated by central banks and fiscal authorities, pulling one or more of the following macro levers:

Rate Cuts – Lowering borrowing costs, encouraging debt-driven growth

Quantitative Easing (QE) – Central banks buying government bonds, injecting cash into the system

Forward Guidance (promising no rate hikes) – Influencing market sentiment by releasing future low-rate expectations

Reducing Reserve Ratios – Banks can lend more funds

Relaxing Capital Regulations – Reducing institutional risk-taking restrictions

Loan Forbearance Policies – Maintaining credit flow even with defaults

Bank Bailouts or Backstops – Preventing systemic collapse and restoring confidence

Large-Scale Fiscal Spending – Government directly injecting funds into the real economy

US Treasury General Account (TGA) Fund Release – Injecting cash from the Treasury's account into the market

Overseas QE and Global Liquidity – Actions by other countries' central banks influencing the crypto market through capital flows

Emergency Credit Mechanisms – Temporary loan tools established during crises

These actions not only drive traditional asset appreciation but also trigger the "speculative frenzy" Jesse mentions. Cryptocurrencies, as the highest-risk but highest-potential assets in the system, often benefit the most.

The activation level of each "power ring" varies. But once multiple are activated simultaneously, their effect is exponentially amplified, bringing feverish rises to various markets.

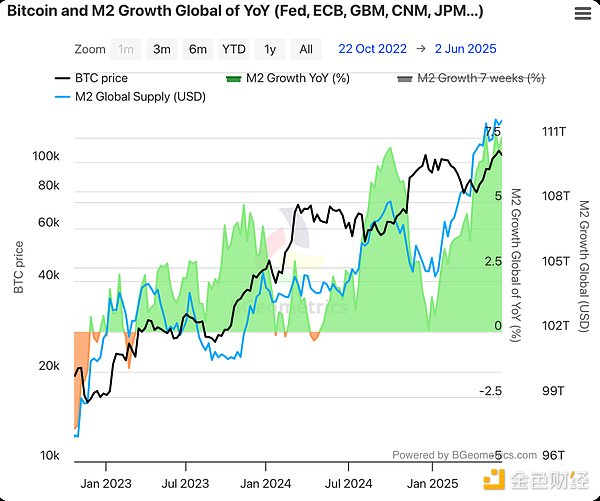

(Translation continues in the same manner, maintaining the original structure and meaning while translating to English)Tracking the growth rate of currency. Historically, before all major market movements, M2 has shown rapid growth. Currently, the M2 growth rate is roughly flat, and although there is a local upward trend, it is far from the levels seen before previous bull markets → This is a clear signal: the momentum of economic recovery has not yet arrived.

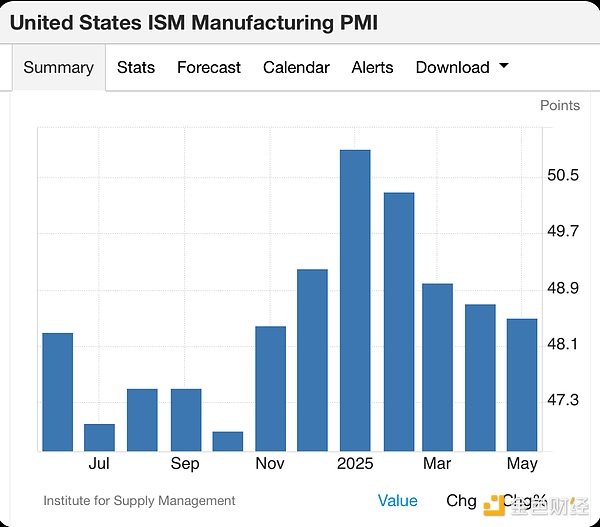

2. ISM Manufacturing PMI (Purchasing Managers' Index)

A reliable business cycle indicator. A PMI above 50 indicates economic expansion. Historically, when PMI approaches or exceeds 60, the crypto market often experiences a major rally.

In this cycle, PMI barely touched 50 before declining again.

Data shows that the macroeconomic environment has not yet fundamentally changed, which is also why we have not seen a truly euphoric market.

Conclusion: The Bull Market is Still "Loading"

Each previous crypto bull market emerged after a liquidity wave triggered by macroeconomic pain points. Now, the pain is brewing, but policy measures have not yet arrived.

Most of the "11 liquidity power rings" remain closed. Only when economic difficulties force policymakers to activate them will we see the environment for the next speculative frenzy.

In the short term, cryptocurrencies may continue to rise slowly, but without true liquidity inflow, the market will still be fundamentally constrained. The real bull market begins when the power rings light up