Written by: Nancy, PANews

As rumors of Pump.fun's token launch spread again, the already fragile liquidity defense line on the Solana chain was breached, tearing apart the market confidence still in recovery, and on-chain risk aversion sentiment quickly heated up.

On-chain "slot machine", only 3.6% of users profit over $500

Recently, rumors surrounding Pump.fun's upcoming token launch have once again stirred market turbulence. According to Blockworks, citing multiple sources, Pump.fun plans to raise $1 billion through token sales, with a valuation of $4 billion, and the tokens will be sold to public and private investors. Although the official release time has not been confirmed, the platform's social accounts hint at a potential launch within two weeks.

In fact, this is not the first time a token launch plan has been circulated. As early as February this year, Wu Blockchain reported that Pump.fun planned to issue tokens through a Dutch auction on a CEX and had provided detailed token issuance preparation documents to the CEX. However, at that time, market liquidity was significantly drawn away by the personal MEME coin issued by Trump and his wife Melania, and the plan ultimately did not materialize. Now, with the market environment slightly warming up, Pump.fun's token launch plan seems to be back on the agenda.

However, this on-chain "money printing machine" is facing a significant decline in market enthusiasm.

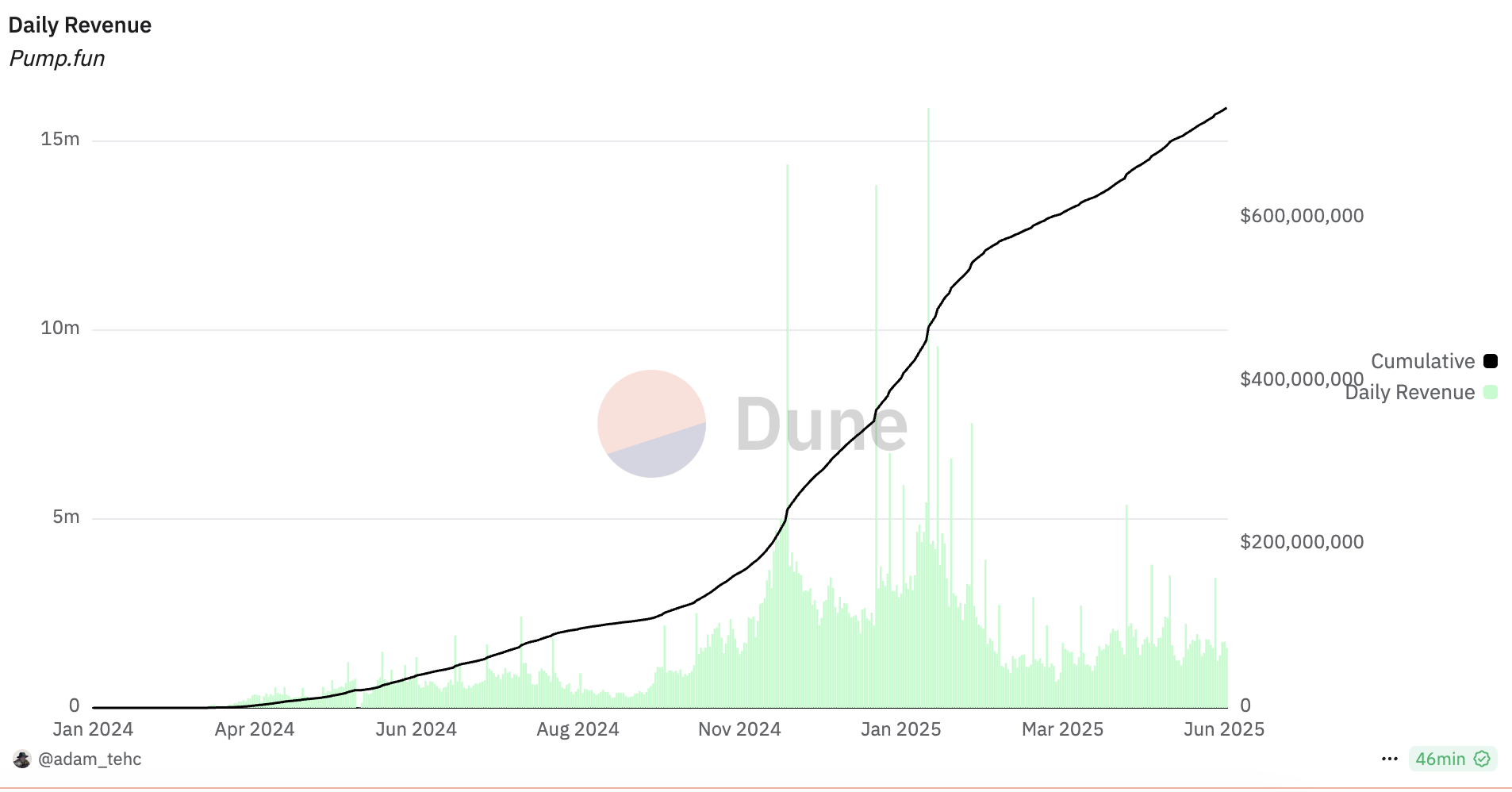

According to Dune data, as of June 4, the platform's cumulative revenue has exceeded $730 million, with a single-day revenue peak approaching $15 million. However, since February 2025, the platform's revenue growth has significantly slowed down, with most daily revenues now stabilizing in the millions of dollars range.

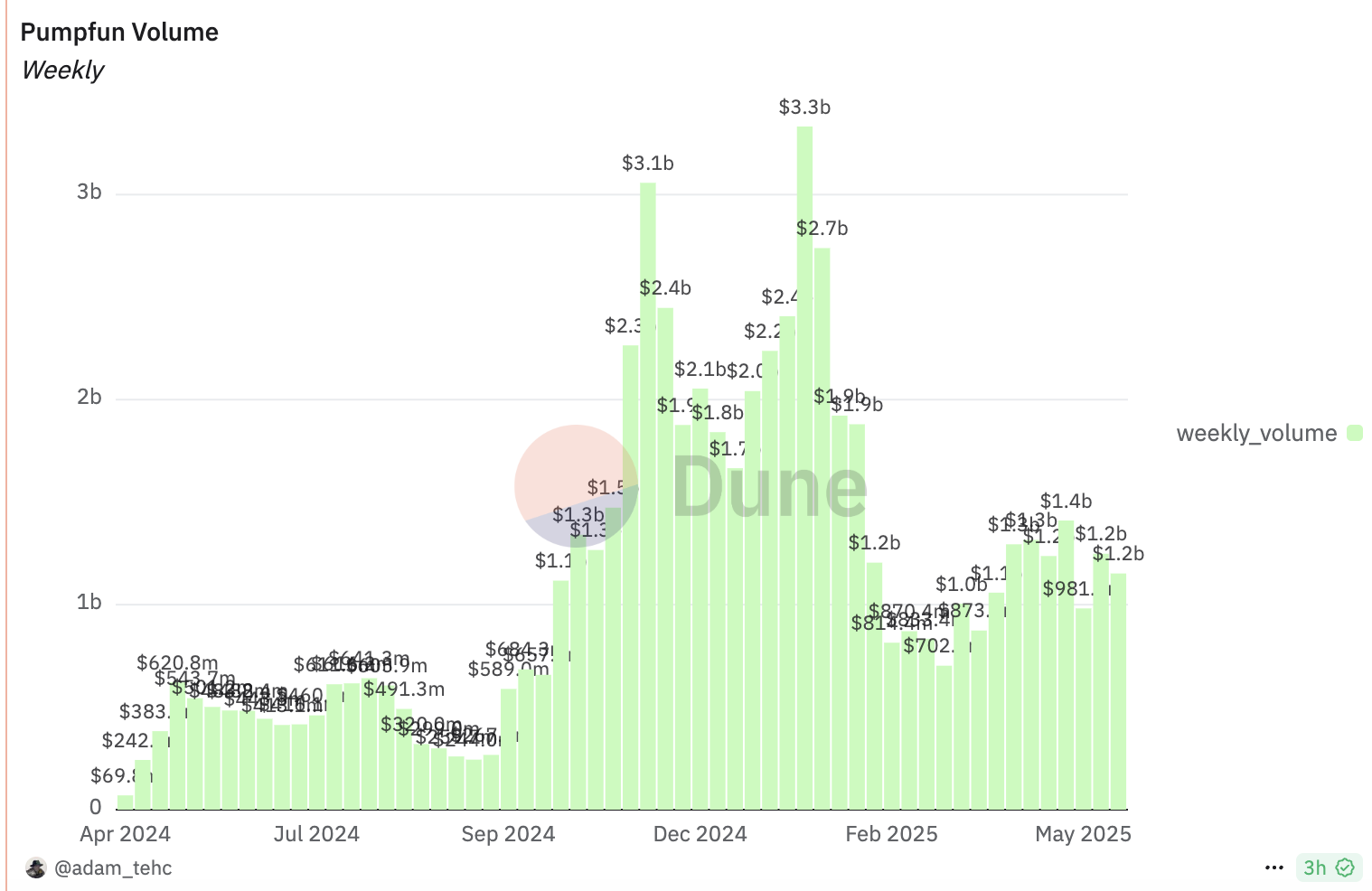

In terms of trading volume, Pump.fun set a historical record of $3.3 billion in a single week in late 2024, and although there have been several rebounds to the $1 billion level, it has been difficult to return to its peak. The trend of weakening liquidity has somewhat diminished the platform's popularity and user participation willingness.

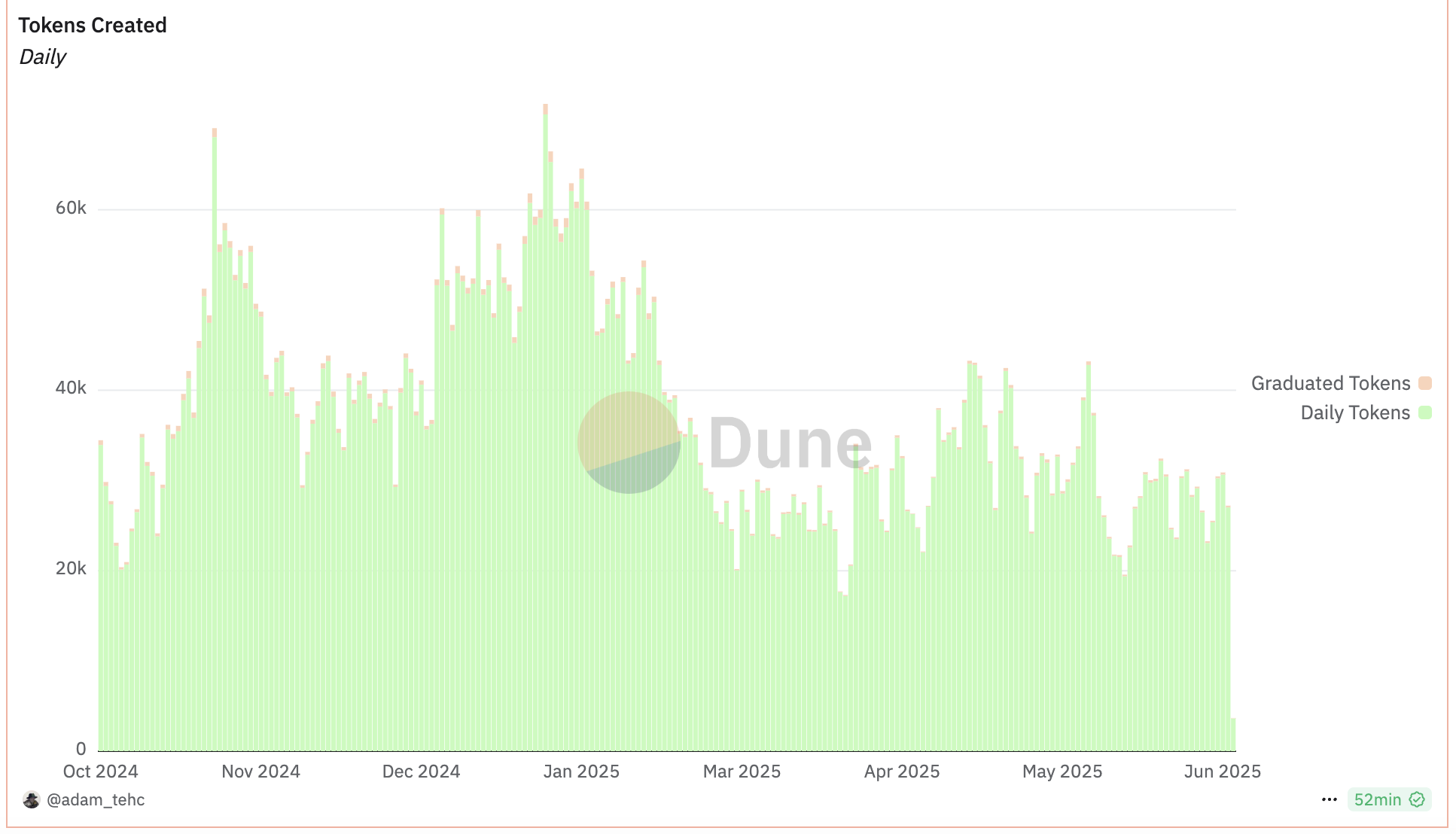

In terms of token creation, Pump.fun has accumulated over 11.02 million tokens to date, with a single-day token creation peak once reaching 70,000 (in January 2025). However, this number has now dropped to around 30,000 per day, indicating a cooling of user participation enthusiasm.

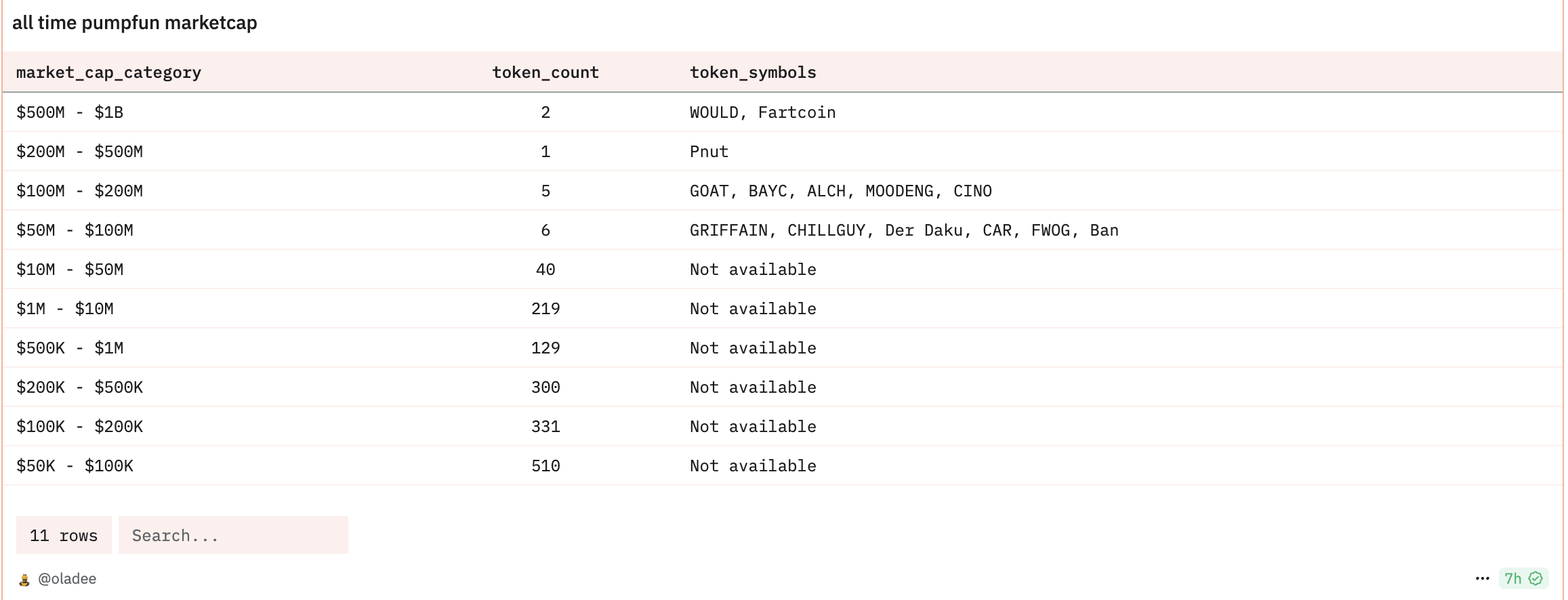

It is worth noting that among the massive MEME coins, very few projects have a significant market cap. According to Dune statistics, currently only 14 tokens have a market cap exceeding $50 million, and only 259 tokens have a market cap between $1 million and $50 million, with the remaining approximately 14,000 tokens at a micro market cap stage. This also shows that most tokens are stuck in the internal market self-hype stage, lacking external fund absorption capacity.

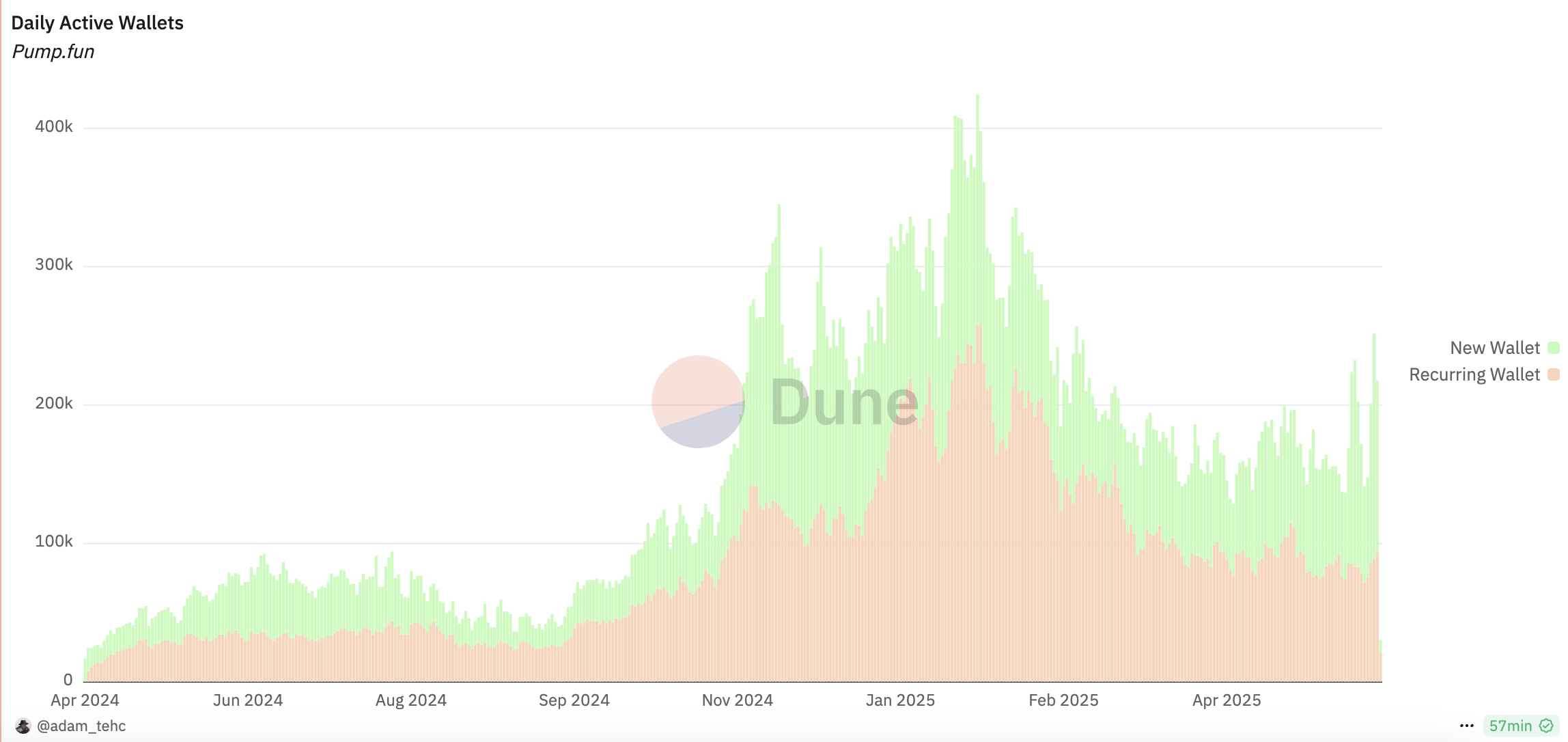

At the user level, Pump.fun is also facing a new traffic cliff and a situation where old users are struggling to maintain it. Dune data shows that Pump.fun reached its peak in late January 2025, with daily active wallets once breaking 400,000, where new user influx was key to driving user number surge. However, as market sentiment cooled, active wallets declined, and the platform's activity is mainly maintained by old users' reuse, with new user contribution significantly dropping. This trend also confirms that many Pump.fun users frequently attempt to create and hype MEME coins, but very few can establish sustainable value, leading to short user cycles and weak retention.

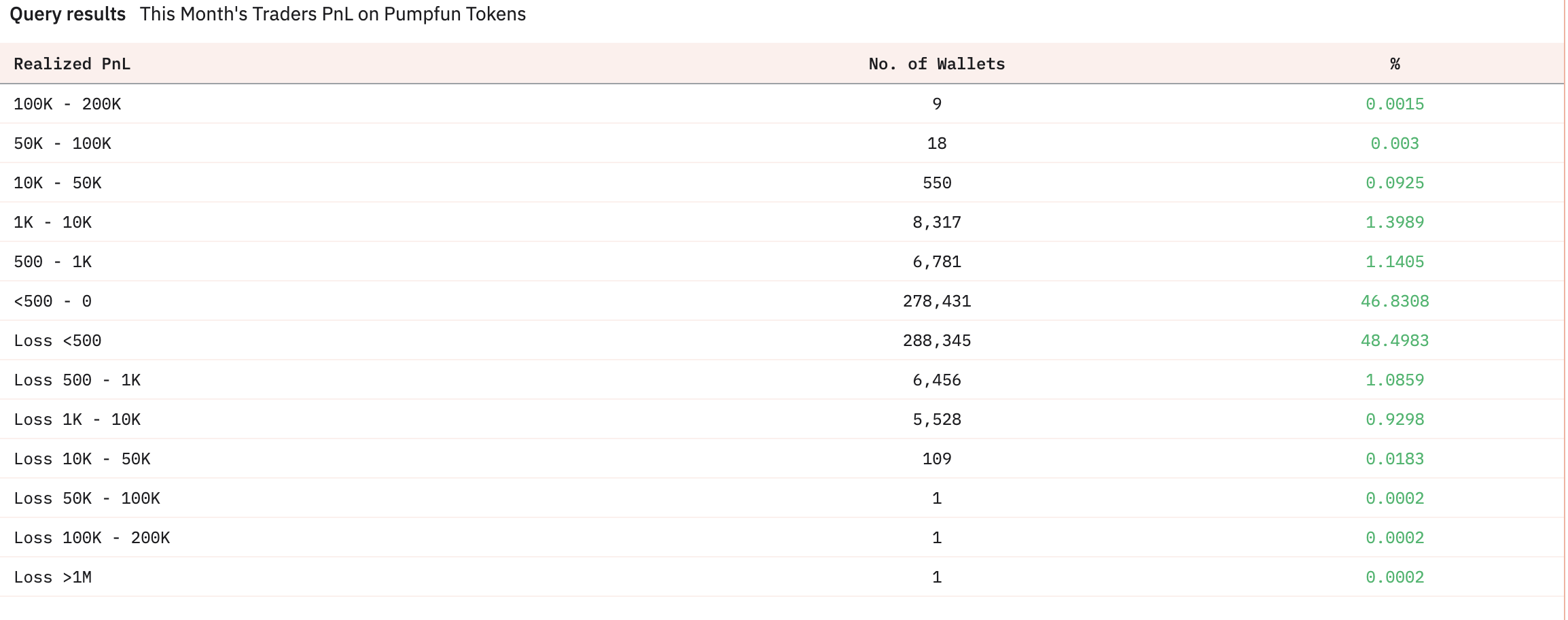

Moreover, behind Pump.fun's narrative of sudden wealth is a stark survivorship bias. Dune data shows that about 594,000 wallets participated in trading this month, with only 3.6% of users achieving substantial profits over $500. More surprisingly, only 27 wallets profited over $100,000, representing just 0.0045% of total traders; wallets with profits over $10,000 were 577, accounting for only 0.1%. In contrast, the loss ratio is much higher, reaching 52.5%, including extreme cases of million-dollar losses. These data clearly show that a few whales have taken most of the profits, while most retail investors merely serve as liquidity fuel.

With user growth hitting a ceiling, token quality worrying, and liquidity exhausted, whether Pump.fun's token launch can leverage market sentiment and support a $4 billion valuation remains highly uncertain.

Solana risk aversion sentiment heats up, high valuation token launch sparks controversy

The news of Pump.fun's high-valuation token launch has made many investors worry about whether it will replay the final wave of revelry when APE token was launched.

"The last top-tier with a $4 billion valuation was Yuga Labs that issued APE, claimed to be the last glory of that bull market, after which the market's copycat tokens were all halved. Now Pump.fun has the same $4 billion valuation, but the fundraising amount is more than twice that of APE back then. These exchanges are accelerating listing frequency these days, probably trying to avoid the big blood-sucking two weeks from now," crypto KOL @AB wrote.

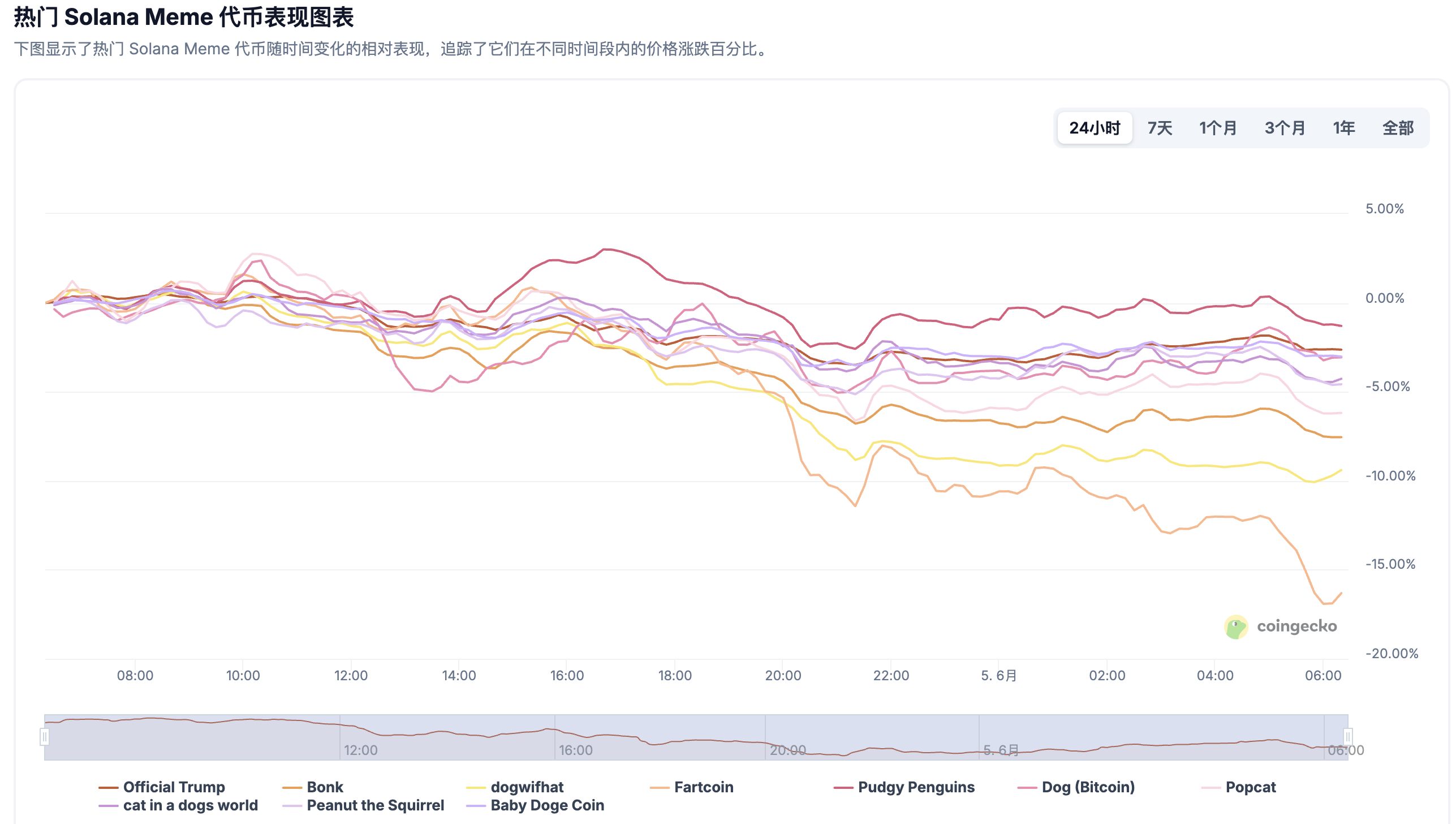

Looking at the fund flow on the Solana chain, risk aversion sentiment is heating up, and MEME coins are collectively declining. According to CoinGecko data, popular MEME coins in the Solana ecosystem have generally experienced different degrees of callback in the past 24 hours. Meanwhile, Artemis data shows that Solana has become the third-highest net capital outflow blockchain network in the past 24 hours.

Independent researcher @Haotian bluntly pointed out that Pump.fun's current valuation is "extremely bubbled", and questioned how a MEME launch platform's valuation could exceed most DeFi blue-chip protocols, raising four core criticisms: (1) Unreasonably high and bubbled market valuation: Pump.fun's attention economy is dependent on the short-term high FOMO of market MEME coins, essentially a non-rational product driven by "gambling". This means Pump.fun's business model's monetization capability is entirely a product of short-term market spotlight, not a sustainable normalized profit logic; (2) Fragile business moat easily overtaken: Pump.fun seized Solana's high-performance and low-cost technical dividends and the era's dividend of MEME culture going mainstream. This business model built on others' infrastructure is essentially a "dependent" business. Once significant changes occur in the Solana ecosystem, its business model's fragility will be exposed; (3) Launchpad's tool-like attributes make it hard to create an ecosystem: Currently, even if it's "profitable", it's just a "token issuance tool". The attempt to transform from a pure Launchpad to a complex MEME economic ecosystem itself contains a paradox: the core of MEME culture is precisely simplicity, directness, and viral spread. Excessive functional stacking will only make the platform lose its original "wildness"; (4) Extremely high valuation will subvert the original value innovation system: Pump.fun's ultra-high valuation is sending a dangerous signal to the entire industry: in the current crypto ecosystem, "traffic aggregation + speculative realization" might be valued more than "technical innovation + infrastructure". He believes the key is whether Pump.fun can truly build a sustainable business moat after obtaining massive capital. Otherwise, this abnormal valuation will bring massive innovation disasters to the entire industry, signaling a more utilitarian, short-sighted crypto future far from the technical geek origin.

KOL@xingpt added from a valuation perspective that Pump.fun's annualized revenue in the past 30 days was $77.98 million, and with a corresponding FDV of $5B, its FDV/annualized revenue ratio is 64, which is relatively high. In the long term, Pump is definitely not worth this valuation, and its earnings certainty is not as good as DeFi leaders like Ray/Cake. However, if the market is good, the team might create FOMO and potentially multiply its value. Given the current valuation and sentiment on X, I don't think it's necessary to be overly bearish or even short at the opening. Holding cash and observing is sufficient.

However, crypto KOL@加密韋馱 stated that discussing merits without historical context is nonsense. Solana's current on-chain battlefield position is directly due to Pump.fun, which solved the end-to-end liquidity solution from zero liquidity to AMM and then to CEX, standardizing on-chain safety (pool withdrawal, contract toxicity), building a PVP on-chain culture, and forming substantial SOL lockup. Pump.fun's emergence is equivalent to an on-chain iPhone moment, being the first to recognize the extremely short attention span of the younger generation, despising traditional value, and enjoying PVP. From a value investment perspective, Pump is the largest consumer application network with a price-to-earnings ratio of only 5, making it a genuine value investment target. He believes there are only two moats in the crypto space: liquidity and screen time.

"Stop fantasizing about Pump.fun's airdrop." Regarding market fantasies about Pump.fun's airdrop, Weirdo Ghost Gang founder sleepy pointed out that Pump.fun has already completed its cold start through its product and has no motivation to issue an airdrop. In fact, airdrops have increasingly become a tool for short-term attention capture. While seemingly "incentivizing users," they rarely truly retain loyal users. Airdrop ≠ user loyalty. Airdrops are merely traffic release mechanisms used to amplify a project's influence in a short time. However, Pump.fun already has a stable and massive user base, so it doesn't need to supplement attention through airdrops or create topics with them.

Overall, although the Pump.fun token issuance news has reignited market discussion, behind this heat lies the fragility of market structural liquidity, the ebb of user participation sentiment, and the massive bubble of the MEME narrative.