Cryptocurrency, especially Bitcoin (BTC), has often been mentioned as having the potential to provide substantial returns to investors. However, now many people believe that Bitcoin can be the key to early retirement.

Bitcoin promises impressive growth and long-term value, offering a unique opportunity for those seeking financial independence. Therefore, some experts have proposed several strategies to achieve retirement through Bitcoin investment.

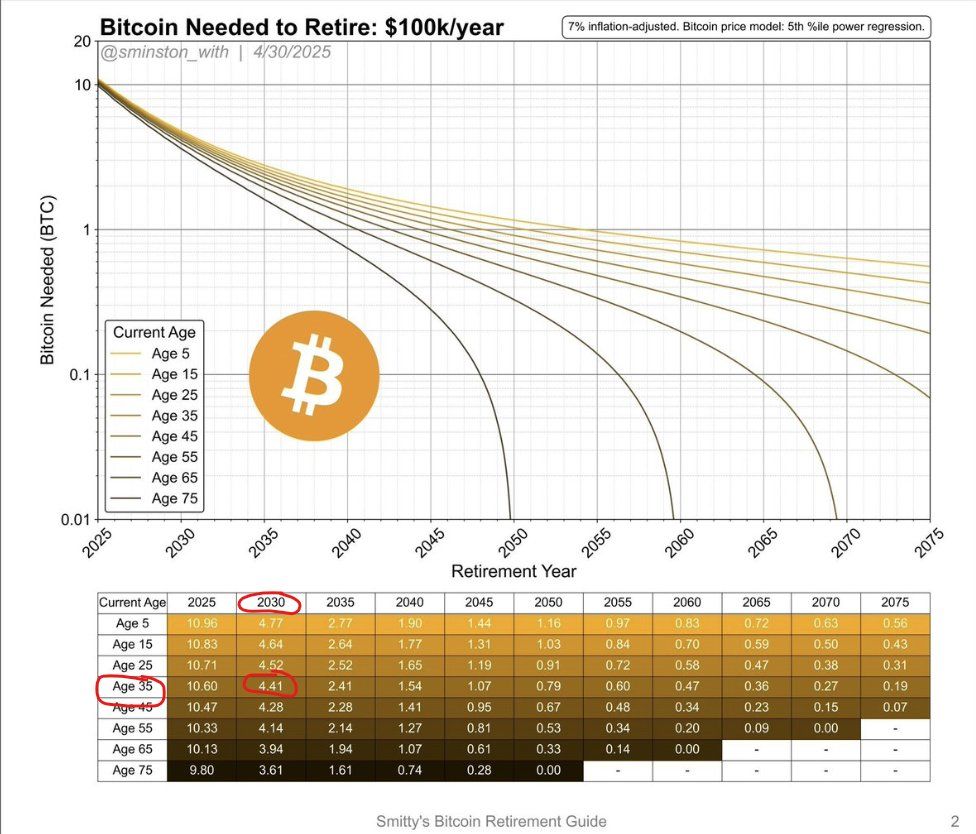

Retirement with an Annual Target of $100,000, How Much Bitcoin is Needed?

Cryptocurrency analyst David Battaglia recently shared a detailed analysis on X. He presented a model estimating the amount of Bitcoin needed to retire with an annual income of $100,000, considering two key factors.

First, he adjusts for living expenses increase and currency value depreciation by considering an annual inflation rate of 7%. Second, the model uses a Bitcoin price model based on the fifth percentile power regression, conservatively estimating Bitcoin's future value.

According to the data, the amount of BTC needed for retirement varies depending on the retirement start year and individual's age. The earlier the retirement date, the more BTC is required.

For example, a 35-year-old planning to retire in 2030 would need approximately 4.41 BTC (currently worth $460,000).

"This means that the Bitcoin price in 2030 will be high enough that 4 BTC can provide an annual $100,000 when gradually invested or used." – Battaglia

Battaglia explained that if investors withdraw 4% or inflation-adjusted amounts annually (common in financial independence, early retirement), by 2030, 4 BTC should be worth at least $2.5 million. This means each BTC should be valued at $584,112 in 2030.

"The key is inflation and Bitcoin price growth: the model adjusts the $100,000 value considering 7% annual inflation. This means the purchasing power of $100,000 in 2030 will be lower than in 2025. Additionally, Bitcoin price grows according to the regression model, reducing the required BTC amount over time (descending lines)." – Battaglia

He suggested two main methods to access this income: gradually selling Bitcoin or entrusting assets to institutions for fixed annual payments.

However, he warned about the risks of third-party custody. Battaglia also emphasized the importance of tax strategies, recommending residing in tax-free jurisdictions like Paraguay to maximize returns.

"What's clear is that Bitcoin's price is approaching a point that could provide lifelong financial independence for holders. The bad news is that those who don't act in the next few years won't have enough Bitcoin. We're also assuming Bitcoin's 2030 price very modestly." – Battaglia

Complementing Battaglia's approach, an analyst using the pseudonym Hornet Hodler developed a Bitcoin calculator inspired by the FIRE model used in traditional finance.

This tool integrates various Compound Annual Growth Rate (CAGR) models tailored to Bitcoin's unique market cycles. The calculator allows users to predict Bitcoin's future value and determine sustainable withdrawal rates based on different growth scenarios.

"This is an excellent retirement planning tool for Bitcoin investors. Select a model, choose your retirement timing, and estimate the amount." – Fred Kruger

For example, Model 6 uses a conservative middle line with power law, balancing early-stage price growth with later-stage return reduction to ensure realistic predictions for retirement planning.

This tool helps investors estimate the required Bitcoin amount and how to withdraw funds without depleting their portfolio. By smoothing annual returns with CAGR, the Hodler's calculator provides a practical framework for long-term retirement planning through cryptocurrency.

Early Retirement with Bitcoin? Mark Moss's 5-Year Plan

Meanwhile, Mark Moss offers a unique strategy focusing on tax efficiency and asset preservation. Moss explained his "5-year retirement plan" in a YouTube video.

This involves accumulating Bitcoin, utilizing tax-free loans, and creating wealth through asset growth without depleting the principal.

"The rich use debt to invest and create additional income streams. In contrast, ordinary people use debt to buy things that make the rich richer. Don't do that. We want to buy assets that make us richer. Now, let's talk about the cheat code. The cheat code is Bitcoin," Moss said.

Moss claims this method provides a stable income source while the Bitcoin portfolio continues to appreciate. He argues this approach can lead to retirement in just 5 years. Borrowed funds can cover living expenses while the underlying asset's value increases, with the possibility of leaving a legacy for future generations.

"We believe that in about 5 years, Bitcoin will be the size of a global store of value asset like gold. Bitcoin and gold will be at similar levels, around $20 trillion," he claimed.

However, not everyone agrees on cryptocurrency's retirement potential. Cryptocurrency trader Sybil argued that "retiring" from cryptocurrency is almost impossible.

"You cannot 'retire' in cryptocurrency. Have you seen anyone who has succeeded and left our industry? Except for those who had to run away. Even these people have created new accounts and come back. It becomes so addictive that it is impossible to leave she.

She emphasized cases of famous personalities who earned earned millions of dollars temporarily left the industry and returned to seek more wealth and fame. Their That the cryptocurrency space operates like an endless casino. casino. Individuals cannot completely exit exit the trading cycle, and temof and money they earned, bound people to the industry.

In conclusion, BTC provides a unique opportunity for early retirement through various strategies. From David Batallia's inflation-adjusted model to Mark Moss's tax-efficient approach.

Tools ALSO helps investors plan their retirement. However, as sibpointed out, The's can for people to completely completely withdraw. provide path to financial independence, but requires, market understanding, and discipline are needed.

Disclaimer: This article This written for informational purposes and not. The strategies are speculative and may not as expected expected.. Cryptocurrency investment is highly volatile and carries significant risks. Always conduct thorough research and consult a financial financial advisor before making investment decisions.