Last night, the US stock market and crypto market experienced significant fluctuations. Initially, discussions about trade issues with Trump led to a market warmup, but later Trump and Musk clashed over the "Big and Beautiful Act" on their respective social platforms. With these "gods fighting," the markets suffered, with US stocks and crypto markets experiencing sharp declines. Bitcoin nearly dropped below $100,000. The market seems to view the conflict between these two prominent US figures as a dangerous signal, with subsequent developments worth watching.

VX: TZ7971

On a positive note, Circle went public on the New York Stock Exchange on June 5th with the stock ticker "CRCL", priced at $31 per share and opening above $75, exceeding market expectations. Traditional markets view this as an optimistic indicator of the recent US crypto trend.

However, the crypto market interprets this differently. Recalling Coinbase's NASDAQ listing in April 2021 during the market peak, when Bitcoin first broke $62,000, the crypto market subsequently crashed, with Bitcoin falling below $30,000 by July. Whether history will repeat remains uncertain, especially with worsening US economic data, Trump-Musk tensions, and unclear tariff factors that might potentially devastate the crypto market.

Bitcoin dropped to $101,579, declining 3.5% in 24 hours and 4.5% over the week, with major exchanges liquidating nearly $1 billion. This decline coincides with the escalating political conflict between Elon Musk and Donald Trump - an unusual but profound factor disrupting market order and prompting investor withdrawals.

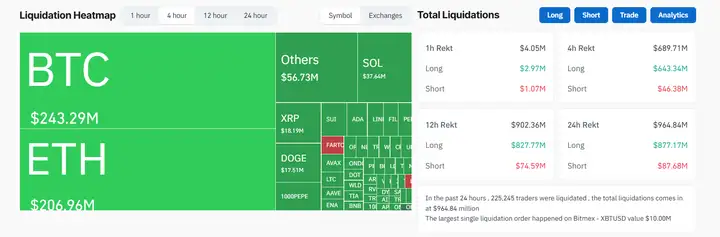

Nearly $1 Billion Liquidated

Liquidation data shows $964.84 million in positions were liquidated in 24 hours, with $877.17 million from long positions. Bitcoin's total liquidation was $243.29 million, followed by Ethereum at $206.96 million. Over 225,000 traders were liquidated during this period.

Sudden leverage position liquidations reflect growing market participant concerns about broader macroeconomic risks and unpredictable domestic political impacts on digital asset markets.

Can Bitcoin Maintain $100,000?

Technically, Bitcoin remains above the critical $100,000 psychological support level. A decisive break could trigger new sell-offs and liquidations, especially with dominant long-position leverages. If long positions continue liquidating at this rate, Bitcoin might test $95,000-$98,000 before finding significant support.

Bitcoin's short-term prospects remain fragile until tensions ease or the market finds a new catalyst.

Tokens to Watch Benefiting from Circle's Listing

ENA: A hot target under stablecoin narrative

ONDO: BlackRock announced a 10% subscription of Circle's IPO shares, and Ondo's US Treasury token OUSG is based on BlackRock's BUIDL fund core underlying assets.

CRV: Curve is a primary venue for stablecoin trading, with USDC being a core liquidity pool asset.