Written by: Chi Anh, Ryan Yoon, Tiger Research

Translated by: AididiaoJP, Foresight News

Abstract

Currently, Ethereum still leads in the RWA market, thanks to its first-mover advantage, past institutional cases, deep on-chain liquidity, and decentralized architecture.

L1 blockchains with faster transaction speeds and lower costs, as well as RWA-specific chains designed for compliance, are addressing Ethereum's limitations in cost and performance. These emerging platforms position themselves as next-generation RWA infrastructure by offering superior technical scalability or built-in compliance features.

The key growth in the next stage of RWA will depend on three factors: on-chain regulatory compatibility, a service ecosystem built around real-world assets, and sufficient on-chain liquidity.

How is the RWA Market Developing Currently?

Tokenization of Real-World Assets (RWA) has become one of the mainstream trends in the blockchain industry. Global consulting firms like Boston Consulting Group (BCG) have released broad market predictions, and Tiger Research found that the industry is growing in emerging markets like Indonesia.

So, what exactly are RWAs? They refer to converting tangible assets such as real estate, bonds, and commodities into digital tokens. The tokenization process inevitably relies on blockchain infrastructure. Currently, Ethereum leads in the infrastructure supporting such tokenization.

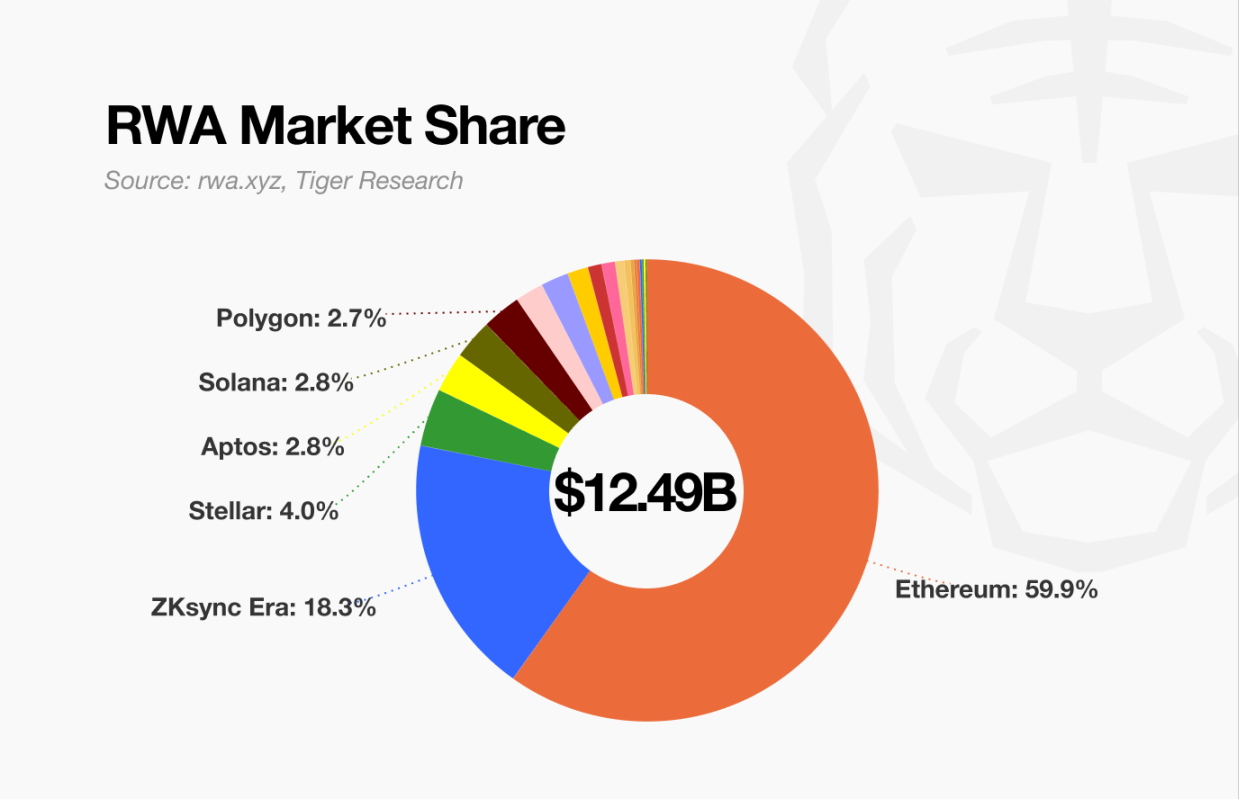

Source: rwa.xyz, Tiger Research

Despite increasing competition, Ethereum maintains its dominance in the RWA market. Some RWA blockchains have emerged, and Solana, which has established itself in the DeFi field, is also expanding into the RWA domain. Nevertheless, Ethereum still occupies over 50% of market activity, highlighting its solid market position.

This report examines the key factors behind Ethereum's current dominance in the RWA market and explores the critical elements that may impact growth and competition in the next stage.

Why Does Ethereum Remain Leading?

2.1. First-Mover Advantage and Institutional Trust

The reasons for Ethereum becoming the default platform for institutional tokenization are evident. It was the first to establish key tokenization smart contract standards and actively prepared for the RWA market.

Supported by a highly active developer community, Ethereum established key tokenization standards like ERC-1400 and ERC-3643 long before competing platforms emerged. This early foundation provided the necessary technical and regulatory basis for institutional RWA project attempts.

Many institutions prioritize evaluating Ethereum before considering alternatives. Some important initiatives by large financial companies or institutions helped Ethereum become crucial RWA infrastructure:

Morgan Stanley's Quorum and JPM Coin (2016-2017): To support enterprise use cases, Morgan Stanley developed Quorum, a permissioned fork of Ethereum, and JPM Coin for inter-bank transfers. This demonstrated that Ethereum's architecture could meet data protection and compliance regulatory requirements even in private forms.

Societe Generale Bond Issuance (2019): Societe Generale FORGE issued a 100 million euro collateralized bond on Ethereum's public mainnet. This showed that regulated securities can be issued and settled on a public blockchain while minimizing intermediary involvement.

European Investment Bank Digital Bond (2021): The European Investment Bank collaborated with Goldman Sachs, Santander Bank, and Societe Generale to issue a 100 million euro digital bond on Ethereum. The bond was settled using a Central Bank Digital Currency (CBDC) issued by a French bank, highlighting Ethereum's potential in fully integrated capital markets.

These successful pilot cases enhanced Ethereum's credibility. For institutions, trust is generated based on verified use cases and recommendations from other regulated participants. Ethereum continues to attract interest and forms a continuously reinforcing adoption loop.

Source: Securitize

For example, in 2018, Securitize officially announced building tools on Ethereum to manage the entire lifecycle of digital securities. This move laid the foundation for BlackRock's eventual launch of BUIDL (currently the largest tokenized fund issued on Ethereum).

[The translation continues in the same manner for the rest of the text.]Emerging Challengers Reshape the Landscape

Ethereum made tokenized finance feasible. However, it also exposed some structural limitations that hinder broader institutional adoption. These barriers primarily include limited transaction throughput, latency issues, and unpredictable fee structures.

To address these challenges, Layer 2 Rollup solutions such as Arbitrum, Optimism, and Polygon zkEVM have emerged. Major upgrades including Merge (2022), Dencun (2024), and the already launched Pectra (2025) have enhanced Ethereum's scalability. However, the network still cannot surpass traditional financial infrastructure. For example, Visa processes over 65,000 transactions per second, while Ethereum has not reached this level. For institutions requiring high-frequency trading or real-time settlement, these performance gaps remain a critical constraint.

Latency and final confirmation also pose challenges. Block generation averages 12 seconds, and with additional confirmations needed for secure settlement, final confirmation typically takes up to three minutes. During network congestion, delays can further increase, challenging time-sensitive financial operations.

More critically, gas fee volatility is concerning. During peak periods, a transaction fee can exceed $50, and even under normal conditions, fees often surpass $20. This fee uncertainty complicates business planning and may undermine the competitiveness of Ethereum-based services.

Securitize is a prime example. After encountering Ethereum's limitations, the company expanded to other platforms like Solana and Polygon, while also developing its own blockchain Converage. Although Ethereum played a crucial role in early institutional experiments, it now faces increasing pressure to meet the demands of a more mature, performance-sensitive market.

3.1. High-Throughput and Cost-Efficient General Blockchains Are Emerging

As Ethereum's limitations become increasingly apparent, more institutions are exploring alternative general blockchains. These platforms can address Ethereum's key performance bottlenecks, especially in transaction speed, fee stability, and finalization time.

[Image]

Source: rwa.xyz, Tiger Research

Despite ongoing collaboration with institutional investors, the actual scale of tokenized assets (excluding stablecoins) on these platforms remains far below Ethereum's. In many cases, tokens launched on general chains are still part of a multi-chain deployment strategy dominated by Ethereum.

Nevertheless, there are signs that emerging platforms are making meaningful progress. In private credit, new tokenization schemes are emerging. For instance, on zkSync, the Tradable platform has gained attention, occupying over 18% of activity in the field, second only to Ethereum.

At this stage, general blockchains are just beginning to establish themselves. Platforms like Solana, with a rapidly growing DeFi ecosystem, now face a strategic question: how to convert this momentum into a sustainable position in the RWA domain. Excellent technical performance alone is insufficient. Solana needs to meet institutional investors' trust and compliance expectations.

Ultimately, the success of these blockchains in the RWA market will depend less on raw throughput and more on their ability to provide tangible value. Differentiated ecosystems built around each chain's unique advantages will determine their long-term positioning in this emerging field.

[The translation continues in the same manner for the rest of the text...]