Author: Mask

Web3technology, with blockchain at its core, is reshaping the global financial, social, and commercial ecosystem through innovative models such as decentralization, smart contracts, and crypto assets. As this field rapidly develops, the financial risks, data security challenges, and legal gaps have prompted regulatory authorities to actively intervene. The United States, European Union, Singapore, and Hong Kong, as key hubs for global Web3 development, have each constructed distinctive regulatory frameworks.

This article will deeply analyze the Web3 regulatory policies of these four jurisdictions from dimensions such as regulatory agencies, policy frameworks, core rules, and market impacts, revealing their commonalities and differences, and exploring the future direction of global regulatory coordination.

United States

Enforcement-First Model under Securities Law

I. Multi-Headed Regulatory System and Policy Trends

The United States presents a typical "multi-headed regulation" characteristic for Web3, involving multiple federal agencies such as the Securities and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC), Financial Crimes Enforcement Network (FinCEN), and state regulatory agencies.

After Trump took office on January 20, 2025, he appointed Mark T. Uyeda as Acting SEC Chair and Caroline Pham as Acting CFTC Chair, aiming to provide a more stable and predictable policy environment for the cryptocurrency industry, achieving a transition from "regulation through enforcement" to "clarifying the regulatory framework".

On January 23, 2025, Trump signed an executive order "Strengthening U.S. Leadership in Digital Financial Technology", aimed at promoting U.S. leadership in digital assets and financial technology, supporting responsible development of the cryptocurrency industry.

The executive order proposed establishing a "Presidential Digital Asset Market Working Group" to discuss federal regulatory measures for stablecoins and national digital asset reserve plans, and explicitly prohibit "establishing, issuing, circulating, or using" Central Bank Digital Currency (CBDC).

II. Establishing Strategic Bit Reserves

On March 6, 2025, Trump signed an executive order "Establishing Strategic Bit Reserves and U.S. Digital Asset Inventory" and held the first Cryptocurrency Summit at the White House on March 7, demonstrating his commitment to making the U.S. the "global cryptocurrency capital". However, on March 7, cryptocurrency prices continued their recent downturn, with Bit prices falling rapidly, falling short of market expectations.

On January 23, the Senate Banking Committee established a Digital Assets Committee, chaired by Senator Cynthia Lummis, reflecting the importance attached to regulation and development in the cryptocurrency field.

In May 2025, there were reports that the Stablecoin Bill was advancing and the U.S. dollar digitization process was approaching a turning point. The Trump team might support writing legal stablecoins (such as USDC) into the national economic strategy, which, if realized, would make stablecoins the "commercial hub" of the federal government's digital financial system, rather than competitors to Bit.

III. State-Level Regulatory Characteristics

Beyond the federal regulatory framework, states have also developed distinctive regulatory models:

• New York's BitLicense is the most influential crypto asset license, requiring businesses to comply with strict consumer protection and anti-money laundering requirements.

• Wyoming adopts a relatively friendly regulatory attitude, recognizing cryptocurrency as money through a series of laws and allowing banks to provide digital asset custody services.

Europe

MiCA Framework's Unified Regulatory Attempt

I. MiCA: Unified Rules for the European Crypto Asset Market

The European Union, through the Market in Crypto-Assets Regulation (MiCA), has become the global Web3 regulatory "pioneer". This regulation, effective in 2024, establishes comprehensive rules for crypto asset issuance and market trading:

• Classified Regulation: Categorizing crypto assets into Electronic Money Tokens (EMT), Asset Reference Tokens (ART), and utility tokens. Non-Fungible Tokens (Non-Fungible Tokens) and Central Bank Digital Currencies (CBDC) are not within the MiCA regulatory scope.

• Licensing Requirements: Companies providing crypto asset services must register as Virtual Asset Service Providers (VASP), meeting capital, reserve, and information disclosure requirements.

• Stablecoin Special Provisions: Setting reserve asset, capital, and daily liquidity limits for stablecoin issuers, particularly restricting the usage scale of non-euro stablecoins in the eurozone.

II. Member State Implementation and Market Reaction

1. MiCA implementation adopts a "dual-track" transition period:

• Crypto service providers already operating in the EU have a 12-18 month transition period to adapt to new rules.

• New market entrants must immediately comply with MiCA regulations.

2. Market reactions are polarized:

• Compliant enterprises welcome the legal certainty brought by unified standards, facilitating free operation in 27 member state markets.

• Innovative enterprises are concerned that strict compliance requirements may suppress flexibility, especially for DeFi projects.

I. Regulatory Agencies and Legal Framework

Singapore's Web3 regulation is led by the Monetary Authority of Singapore (MAS), adopting a balanced mode of "risk grading" and "sandbox testing":

• Core Regulations: Primarily based on the Payment Services Act (PSA) and the Securities and Futures Act (SFA) for classifying and regulating digital payment tokens (DPT) and security tokens.

• Regulatory Bodies: MAS is responsible for licensing and comprehensive supervision, while the Accounting and Corporate Regulatory Authority (ACRA) is responsible for corporate registration compliance.

II. Licensing System and Compliance Requirements

Singapore implements a categorized license management for crypto businesses:

• DPT service license: Applicable to wallet services, exchanges, and custodian institutions, requiring compliance with anti-money laundering (AML), fund security, and minimum capital regulations.

• Capital Market Service License: Targeting security token issuance and trading, subject to strict regulation under the SFA.

MAS has set up a moderately relaxed exemption period for startups, allowing limited business operations before fully meeting requirements. This progressive regulatory approach has attracted well-known enterprises like Circle and Paxos to settle in.

III. Regulatory Trends and Market Impact

1. Regulatory Tightening Trend in Singapore for 2024-2025:

• Stablecoin Regulation: The 2023 Stablecoin Regulatory Framework requires issuers to meet 1:1 reserve anchoring, independent auditing, and daily liquidity requirements.

• DTSP New Regulations: In May 2025, MAS will release stricter regulatory guidelines for Digital Token Service Providers (DTSP), to be implemented without transition period from June 30, 2025, requiring unlicensed services to cease immediately.

2. Despite Stricter Regulation, Singapore Remains One of the Most Attractive Web3 Centers in Asia, with Advantages Including:

• Clear and Predictable Legal Framework

• Constructive Dialogue Between Regulators and Industry

• Advantageous Geographic Location, Radiating ASEAN Markets

Hong Kong

Transformation from a "Gray Area" to a Compliant Experimental Field

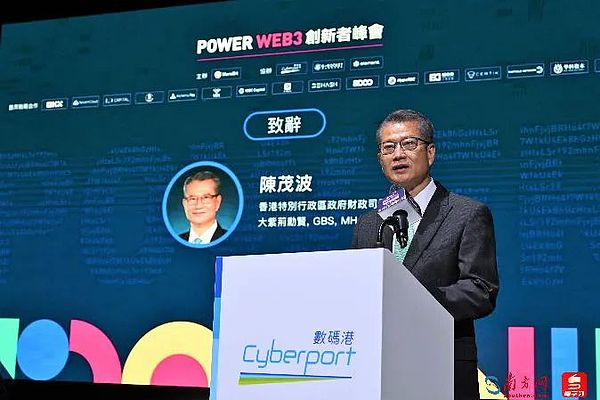

Hong Kong's Financial Secretary Chen Maobo has made important statements about Web3 on multiple occasions, reflecting Hong Kong's proactive attitude and regulatory approach towards Web3 development:

On April 7, 2025, at the "2025 Hong Kong Web3 Carnival" event, Chen Maobo stated that Hong Kong is committed to promoting the development of the third-generation internet (Web3.0), planning to create a balanced and innovation-supporting regulatory framework that maintains fair market competition while encouraging industry innovation.

He pointed out that blockchain technology is demonstrating enormous potential, significantly improving transaction efficiency, reducing costs, and enhancing market transparency. The development of Web3.0 based on blockchain technology is also accelerating. Hong Kong consistently adheres to the principle of "same business, same risks, same regulation" and is dedicated to establishing an appropriate framework for Web3.0 development.

Chen Maobo mentioned that Hong Kong is among the first globally to establish a clear licensing system for Virtual Asset Trading Platforms (VATP), with the Securities and Futures Commission having issued 10 VATP licenses to date. In 2024, Hong Kong was the first to approve virtual asset spot ETFs, making it the largest virtual asset ETF market in the Asia-Pacific region, bridging traditional finance and crypto innovation.

I. Regulatory Framework Evolution

Hong Kong's Web3 regulation has undergone significant transformation:

• Before 2022: A relatively loose "regulatory vacuum" period, attracting numerous crypto companies to register.

• 2022-2023: Transitioning to the "same business, same risks, same regulation" principle through the Virtual Asset Policy Declaration and VASP licensing system.

• 2024 to present: Fully implementing the licensing system and establishing global compliance standards.

II. Core Regulatory Measures

1. Hong Kong adopts a multi-agency collaborative supervision model:

• SFC: Responsible for Virtual Asset Trading Platform (VATP) licensing and security token regulation.

• HKMA: Participates in stablecoin and payment-related service regulation.

2. Key regulatory requirements include:

• Licensing System: All VATPs must obtain License 1 (Securities Trading) and License 7 (Automated Trading Services) issued by SFC.

• Asset Custody: Requires custody of customer assets through a wholly-owned subsidiary, obtaining a TCSP license.

• Investor Protection: Currently limited to professional investors participating in securities token trading, with retail investor protection achieved through access restrictions.

III. Market Development and Policy Support

1. Hong Kong Enhances Competitiveness through Multiple Measures:

• Approve virtual asset spot ETF in 2024, becoming the largest virtual asset ETF market in the Asia-Pacific region.

• 2025 Policy Declaration: Plan to expand regulatory framework, potentially including more clear stablecoin rules.

2. Hong Kong's Advantages:

• Capital and talent advantages from international financial center status

• Potential connection opportunities with mainland market

• Clear regulatory expectations and legal certainty

I. Regulatory Philosophy Differences

II. Specific Area Regulatory Comparison

1. Stablecoin Regulation:

• United States: Potentially relaxed regulation, focusing on payment function

• European Union: Strict capital and reserve requirements, limiting non-euro stablecoins

• Singapore: 1:1 anchoring requirements, independent audit and daily liquidity

• Hong Kong: 100% reserve funds bank-hosted, licensing system to be implemented within the year

2. Securities Tokens:

• United States: Strictly apply securities laws, requiring registration or exemption

• European Union: ART tokens apply MiCA, other securities tokens follow securities laws

• Singapore: Apply SFA, but with small issuance exemption

• Hong Kong: Require disclosure of asset ownership and smart contract risks

3. Decentralized Applications:

• United States: High-pressure regulation, strict law enforcement

• European Union: MiCA retains partial exemption space

• Singapore: Sandbox mechanism supports experimentation

• Hong Kong: No clear regulatory framework yet, may be included in VASP scope

In the future, as emerging issues like real-world asset tokenization (RWA) and on-chain privacy develop, global regulatory coordination will become more important. Regulatory authorities need to find a dynamic balance between protecting the financial system and maintaining technological vitality, while industry participants need to develop adaptive strategies in a complex and changing regulatory environment. The future of Web3 depends not only on technological innovation but also on regulatory wisdom. Only by exploring viable models within the rule framework can this revolutionary technology realize its transformative potential.