Any earlier-than-expected interest rate cut by the Federal Reserve (Fed) could trigger a strong BTC surge, bringing this leading currency back to the psychological high of $112,000.

The crypto market is closely monitoring US monetary policy, and an unexpected Fed rate cut would have a profound impact on the prices of BTC and many other cryptocurrencies.

VX:TZ7971

If the next two rate cuts occur much earlier than the market expects, it will have a significant impact on price trends, especially for BTC and some other digital assets.

Target $112,000 - An Important Psychological Threshold

Data shows that BTC reached a new high of $111,970 on May 22nd, slightly retreating to $103,574 at the time of writing. However, $112,000 remains a bullish target for many traders - a level with significant psychological and technical importance.

A sufficiently strong catalyst, such as a rate cut or improved risk sentiment, is needed for BTC to break through $112,000 and establish a higher price range.

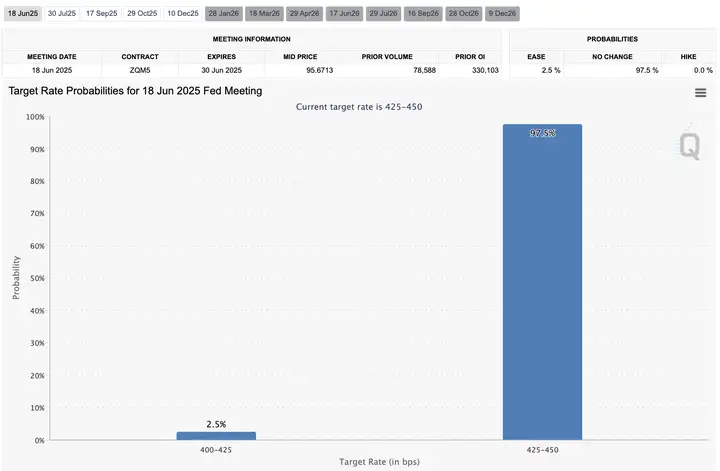

According to the CME FedWatch tool, there is a 97.5% chance that the Fed will maintain interest rates between 4.25% and 4.5% at its policy meeting on June 18th. However, the Fed has "sufficient data" to begin adjusting rates but still faces unpredictable variables, especially from US trade policy.

Trump's tariffs and trade policies remain a significant unknown. The Fed needs a clearer understanding of these policies' impact before taking action.

The US International Trade Court recently blocked Trump's attempt to impose tariffs, stating it exceeded his authority. However, the appellate court later allowed the policy to proceed, with Trump doubling import tariffs on steel and aluminum to 50% - a move that could exacerbate inflationary pressures and affect the Fed's monetary policy path.

Recent signs of weakness in the US economy suggest that strong employment reports might be a reason for the Fed to delay any easing policies, which could limit BTC's upside in the short term.

Today's fear index is 52, slightly increased but still neutral.

There's not much to say about the market situation, with short-term fluctuations and no clear catalyst. Given the low liquidity over the weekend, it's best to hold onto current spot positions. With BTC at $100,000 and Ethereum at $2,400, just hold on. Last night's non-farm data was impressive, and the US is currently facing internal and external challenges, with recession becoming increasingly apparent, which might indirectly stimulate the Fed to cut rates. Additionally, we see news of companies entering BTC every day, both familiar and new faces, with continuous buying pressure, so there's no need to worry.

Finally, to any family members taking the college entrance exam, best wishes for success!!!