On June 6th, boosted by the positive signal of a mild cooling in the labor market, the Nasdaq index jumped over 1% intraday, and Bitcoin surged more than 3%, both escaping the drag of Trump and Musk's "Twitter clash". Within two days of ADP and non-farm data releases, Trump unusually called for Powell to cut rates quickly four times on social media. Although Powell continues to ignore Trump's calls, the "rate cut trade" has quietly become one of the hottest themes currently.

According to federal rate futures pricing, the market expects the Federal Reserve to cut rates by a cumulative 45 basis points in the second half of the year (with a median expectation of 25 basis points each in September and December), with a 58% probability of initiating the first rate cut at the September FOMC meeting. Notably, the CME FedWatch tool shows an even stronger easing expectation - the indicator shows a 62.4% probability of at least a 25 basis point cut in September, indicating that some traders are betting on earlier and more aggressive easing policies.

The key reason for the market's extraordinary attention to the first rate cut is that, based on historical backtesting since 1990, the average cumulative rate cut within 12 months after the Federal Reserve's first rate cut is 175 basis points. Currently, rate futures pricing shows that from September 2025 to December 2026, the federal funds rate will be cut by a cumulative 125 basis points, meaning the first rate cut will mark the beginning of a new easing cycle.

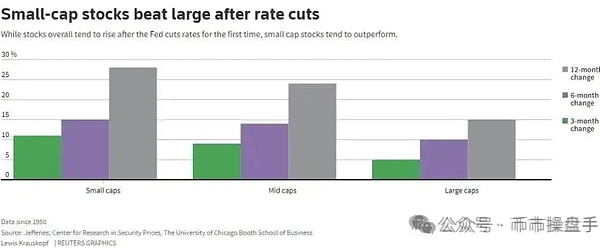

Historically, rate cuts usually become a catalyst for small-cap stocks and Altcoins. According to Jefferies data, since 1950, after the Federal Reserve's first rate cut, small-cap stocks have averaged gains of 11%, 15%, and 28% after 3, 6, and 12 months, respectively, all higher than large-cap stocks' 5%, 10%, and 15%.

1. Compared to large enterprises, small businesses generally have higher debt levels. Rate cuts help reduce borrowing costs, which for small companies relying on bank loans and floating-rate debt means reduced financial costs and improved profit margins.

2. Falling interest rates reduce the attractiveness of fixed-income financial products like bonds and bank deposits, thereby driving funds towards high-risk, high-yield assets, ultimately leading to increased market risk appetite.

Therefore, the Russell 2000 index and Altcoins will likely strengthen again between July and August 2025. However, it's important to emphasize that the nature of this Altcoin market is still an oversold rebound, with its intensity likely weaker than the two major rebounds in 2024 (in March 2024, the median increase of the top 100 cryptocurrencies was 376%; in November 2024, the median increase was 404%). In a market with increasingly token dumping and institutionalization, the "Altcoin season" is almost impossible to reproduce. In a sense, the Altcoin rebound's biggest function is to provide an opportunity for historically trapped investors to exit calmly.

In terms of selection, stablecoins are undoubtedly the most certain direction currently. On June 6th, 2025, Circle's stock price once touched $123, a nearly 300% surge from its IPO price of $31. Although its circulating market value once exceeded $28 billion, Circle's net profit for the entire year 2024 was only $156 million. Such a high valuation premium largely reflects the market's high recognition of the long-term development prospects of stablecoins and the RWA track.

On April 30th, 2025, the U.S. Treasury Borrowing Advisory Committee (TBAC) submitted a report to the U.S. Treasury showing that the stablecoin market value will grow from about $234 billion in April 2025 to $2 trillion in 2028, an increase of about 8.3 times. As the most important infrastructure for stablecoins, ETH currently has a market share of 55%, with stablecoin transactions accounting for 35%-50% of Ethereum's fee income. Assuming this proportion remains unchanged and trading volume grows proportionally with market value, Ethereum's stablecoin-related fee income in 2028 could increase 5-7 times, reaching $1.2 billion to $1.68 billion.

Additionally, Ethereum has an 81% market share in the tokenization market. If the RWA market scale grows from hundreds of billions to trillions of dollars, Ethereum as the primary settlement layer can also obtain considerable fee income. In other words, once the GENIUS stablecoin bill passes, ETH should be the first project to receive a value revaluation.