SUI has risen by 12% in the last 24 hours, recovering investors' confidence. However, this price increase could be a disaster for traders as it may trigger significant liquidations when the altcoin reaches key price levels.

The recent uptrend is a double-edged sword that could have potential consequences for short traders.

SUI Traders Face Losses

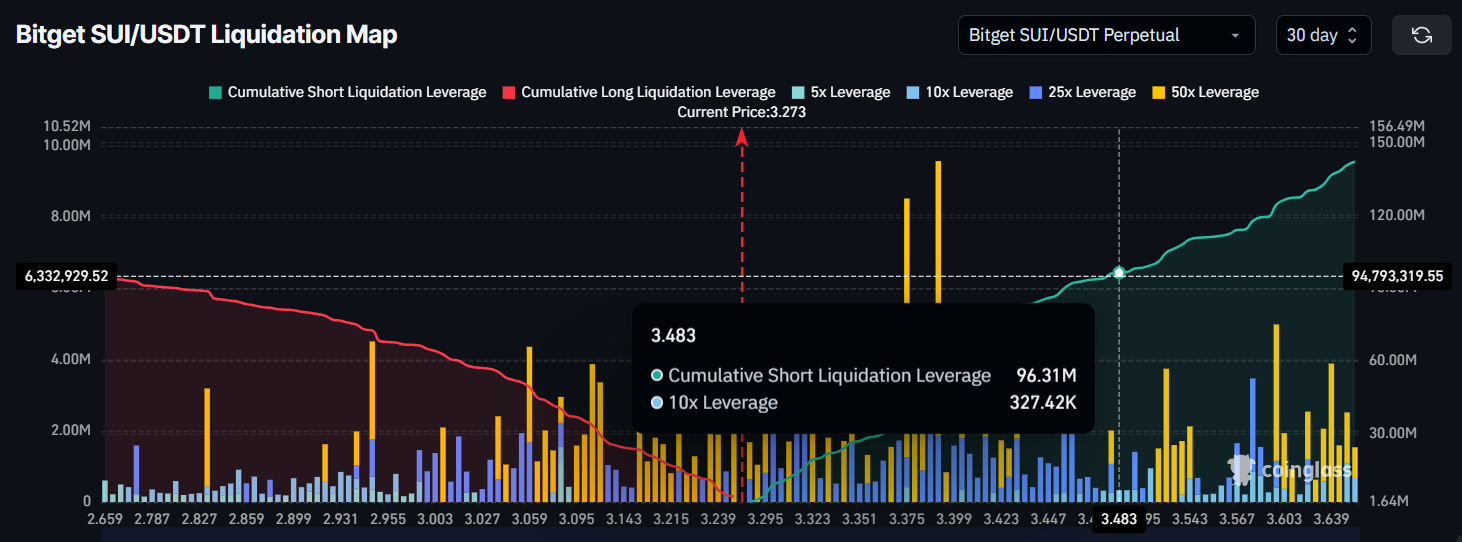

According to liquidation data, SUI could see $96 million in liquidations if the price reaches $3.48. This will primarily affect short traders who anticipated a price decline.

If SUI rises to this critical level, short contracts will be liquidated, forcing traders to cover their positions, which will further accelerate price increases.

This potential liquidation event highlights SUI's volatility and the risks faced by traders betting against it. A sharp price surge could force short traders to close their positions, potentially unintentionally fueling the uptrend.

Consequently, this scenario could exacerbate price increases, leaving both short and long traders at the mercy of unpredictable price movements.

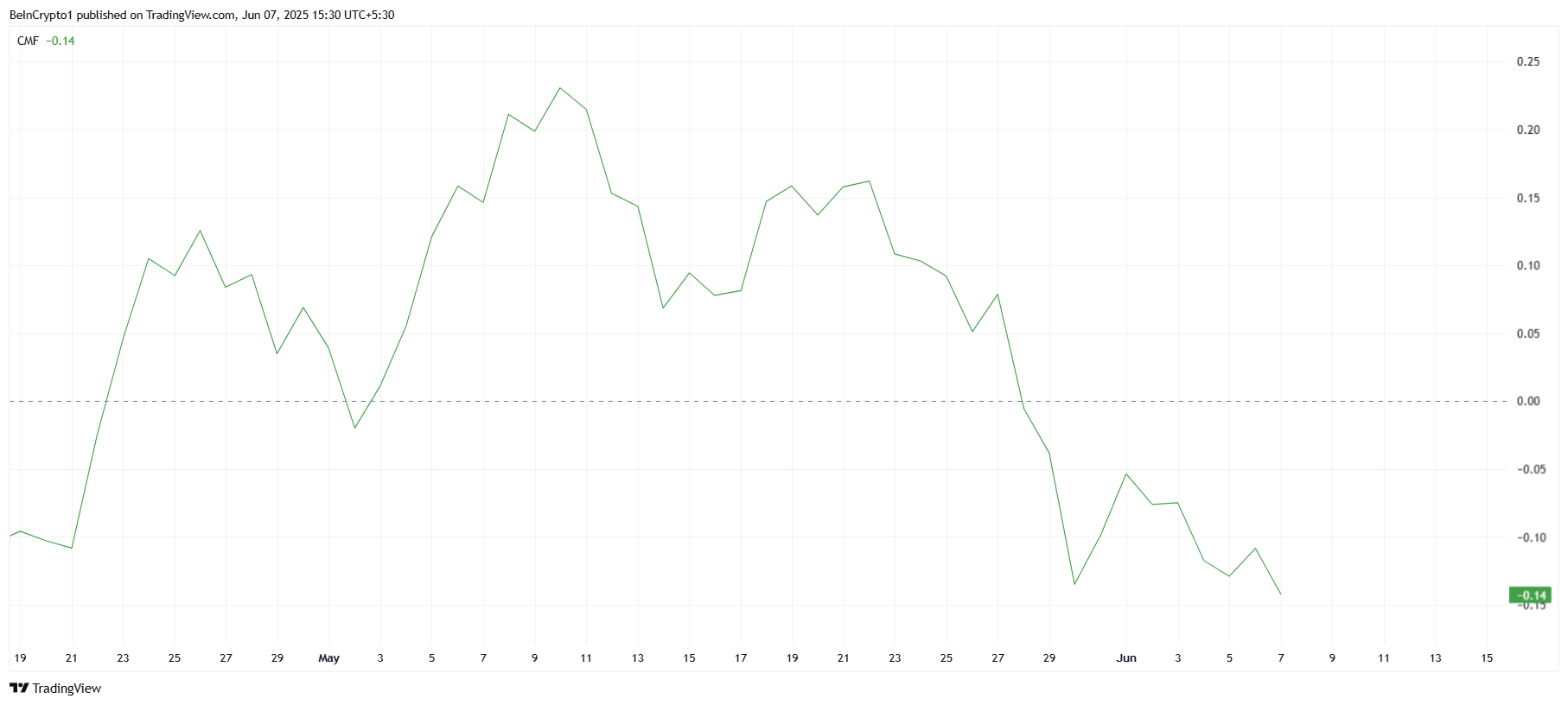

Despite the recent 12% increase, the Chaikin Money Flow (CMF) indicates a decline, suggesting a lack of investment inflow. The CMF currently shows negative momentum, indicating that investors are not fully supporting SUI's price increase.

The recent rise appears to be driven by short covering rather than broad buying interest.

If outflows continue, SUI's price may face additional pressure. The lack of strong buying support and the CMF's decline suggest that the recent uptrend may not be sustainable.

If these outflows persist, they could reduce the optimism generated by the recent rise and lead to a price reversal.

SUI Attempts Price Surge

At the time of writing, SUI is trading at $3.27, up 12% in the last 24 hours. The current price is facing resistance at $3.33, which previously acted as an important barrier.

Considering the ongoing outflows, it seems unlikely that SUI will break through this resistance level in the short term.

If SUI fails to break the $3.33 resistance, it could return to lower levels like $3.13 or $2.91, erasing the recent gains. This indicates a continuation of the correction phase, hindered by a lack of strong buying pressure.

However, the Parabolic SAR indicator is approaching key levels, and a potential candlestick reversal below could signal the start of an uptrend.

If SUI successfully breaks $3.33, the price could rise to $3.48. Breaking this level would invalidate the bearish outlook, triggering a wave of short position liquidations and further driving up the price.