The Bitcoin rebound that started the night before yesterday was because the price fell to the previous strong support level of around 100,000, triggering a larger-scale phased rebound rather than an ordinary band correction.

From the news perspective, this round of gains was driven by the US employment data that exceeded expectations and the strong upward movement of the US stock market. We immediately reported the positive news when the data was released and successfully captured this wave of gains.

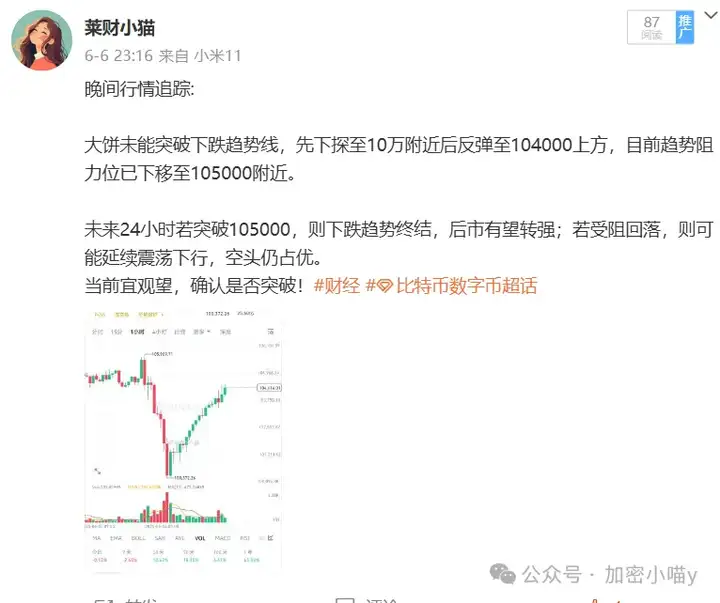

From a technical perspective, the current daily line of BTC is positive and reverses the previous negative line, and the bullish momentum is strong, but it is close to the key resistance area suppressed by MA30. If it cannot effectively stand at 106,000 in the short term, there is a risk of falling back after a high rise, so it is not recommended to chase the high position, and wait for the rebound to end before choosing an opportunity to go high.

Attention! Something has happened to the biggest investor in the crypto on Wall Street.

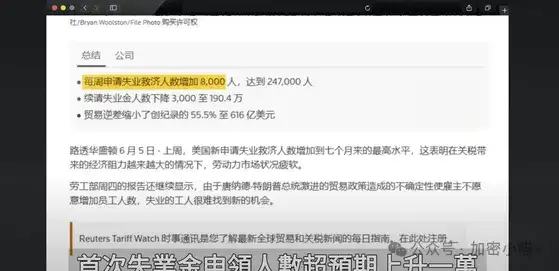

M Employment data continues to weaken: the latest initial jobless claims exceeded expectations by 10,000, an increase of more than 5%, which is the second consecutive increase; the small non-farm ADP added only 37,000 jobs, far below the expected 110,000, almost halved twice. Affected by factors such as tariffs, economic fatigue has begun to emerge, and the current false prosperity may just be a bubble before the recession.

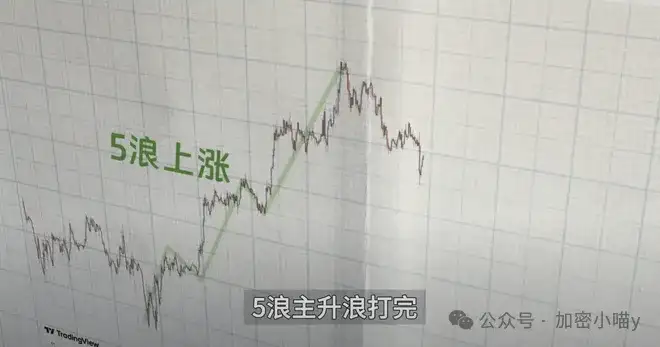

Add a caption to the image, no more than 140 characters (optional). From a technical perspective, #Bitcoin has completed 5 or even 7 waves of growth. According to the wave theory, it is now in the ABC callback stage. This round of rebound may be a B-wave rebound, and the target may be close to 107,000, after which it may usher in the main decline of the C wave.

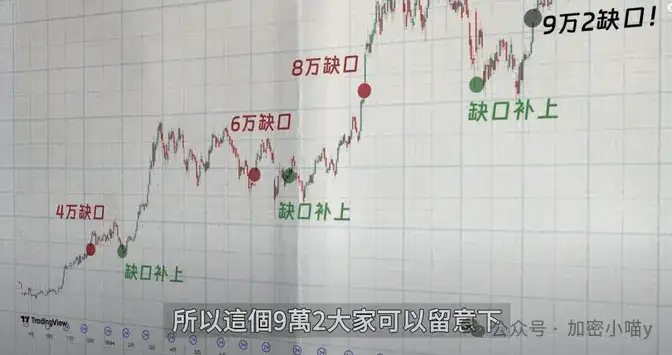

In addition, there is a gap at 92,000 for Bitcoin on the CME futures chart. Historically, all CME gaps have been filled eventually. Referring to the past examples of 40,000, 60,000, and 80,000, the position of 92,000 deserves high attention.

Looking at the unemployment data, on the other hand, it is actually good for the market in the long run. Because employment continues to weaken, the probability of the Federal Reserve cutting interest rates in advance has risen rapidly. Currently, the probability of a rate cut in September has reached 55%. Once the money is released, the crypto is expected to usher in the long-awaited incremental funds.

Therefore, it is expected that the price of the currency may continue to adjust in July and August due to weak economic data and repeated inflation; and the market is expected to restart after the Fed cuts interest rates in September or October. This is highly consistent with our previous judgment and Spoofy's operation rhythm. Spoofy has been reducing his position since 110,000, and is still selling at the current price of 100,000, indicating that he believes that it is not a good time to buy the dips in the long term. Looking back at his previous operations, he usually waits for one or two months after leaving the market before re-entering the market. Therefore, we don't need to rush to buy the dips. First pay attention to the CME gap of 92,000 and follow the trend. If there are whale entering the market, I will notify you as soon as possible, remember to follow me.

The crypto has encountered a series of "blood-sucking incidents" this month.

First, USDC issuer #Circle went public on the Nasdaq last Thursday , and its stock price soared by nearly 200%, sucking away a large amount of market funds. Next, Solana ecosystem project PumpFun will pre-sell 20% of its tokens (about $1 billion) at a valuation of $5 billion, which is expected to trigger capital outflows from mainstream currencies such as Bitcoin. A similar situation occurred when Trump issued the currency on January 17, directly dragging the market into a bear market. I have reminded everyone many times before to stop profits in time and not to covet the tail market. As a result, Bitcoin has fallen 10% from its high in the past few days, so be sure to be vigilant.

In addition, ZK and ZRO, which we mentioned a few days ago, will unlock a large number of tokens in mid-June, accounting for more than 20% of the current circulation, and the selling pressure is huge. We have short at a high level and made a profit of 20%. If ZK rebounds, I am still bearish. I will update the operation ideas every day. If you are interested, you can pay attention.

Yesterday I mentioned paying attention to Sui . Many people think it is not fun now, but I saw an opportunity because of this. After looking around, I bought the project $SUIMON on Sui. The current market value is only 1.7 million, which is low, and it is worth betting on its potential.

The spot #SUI is currently in a range-bound trend, with prices fluctuating between about 2.77 and 4.01, with key support levels at 2.29 and 1.05 USD, and major resistance levels at 4.77 and 6.01. The RSI is 45.11, and the negative AO indicator shows that bullish momentum is weakening and bearish pressure is rising.

There is no clear trend at present, but short-term traders can pay attention to the rebound opportunities of 2.29 support, while being alert to the possible selling pressure around 4.77. For swing traders, it is particularly important to pay attention to the key points of rebound and breakthrough within the range.

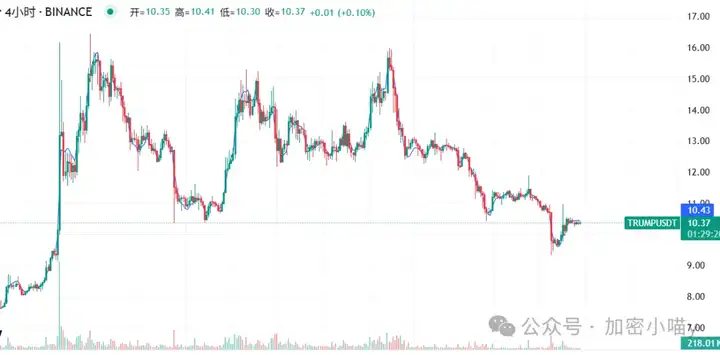

Looking at the market, although #TRUMP fell below the key support, it did not accelerate its decline, indicating that the downward momentum was insufficient and it was a false decline. In the short term, it is likely to fluctuate around the support level and then rebound.

# PEPE dropped from a high of 1.6 to 1.0, a drop of more than 30% . To return to its original position, it needs to rise by about 60%. At present, 0.98 is its key defense line. Further decline is of little significance and is not conducive to maintaining the interests of the main force. Therefore, as long as this position is maintained, the main force is more inclined to pull up, and the current direction of minimum resistance is still above.

The article ends here! If you are confused in the crypto, you might as well consider making a layout with me and harvesting the dealer! You can join the community VX+Q group without any threshold (join the group to communicate +Q: 3806326575 or V: Mixm5688), get market analysis, individual currency recommendations and good news, make arrangements in advance, and there are occasional live market analysis! If you have any questions, you can also ask questions in the group and provide the best answers!