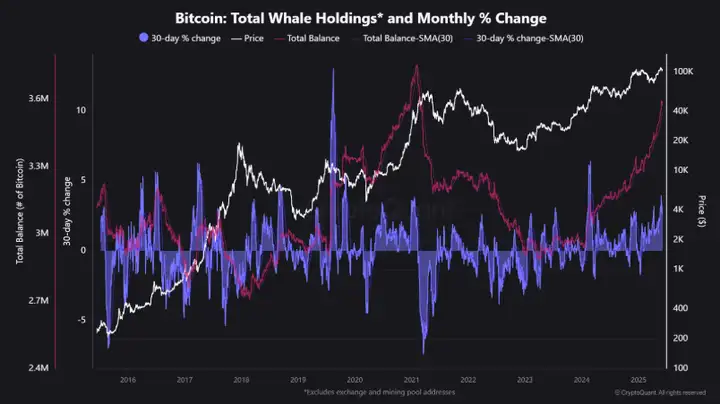

Signals from Bitcoin whales and miners hint at a potential bull market. The latest data from CryptoQuant shows that large BTC holders currently hold a balance of 3.57 million BTC.

VX: TZ7971

This figure is close to the peak of 3.74 million BTC set in early 2021.

Bitcoin whales are increasing their holdings

As whales continue to increase their reserves, the growing accumulation reduces available supply and provides price support.

The current upward trend in whale holdings suggests that institutions and high-net-worth investors view the dip as a buying opportunity and anticipate future price increases.

This index, by excluding exchange addresses and mining pools, reflects the actual balance of large holders. This can more clearly show the strategic accumulation by large investors. The growth in whale positions typically indicates institutional investor confidence and strong fundamental demand, which are key drivers of long-term bull market cycles.

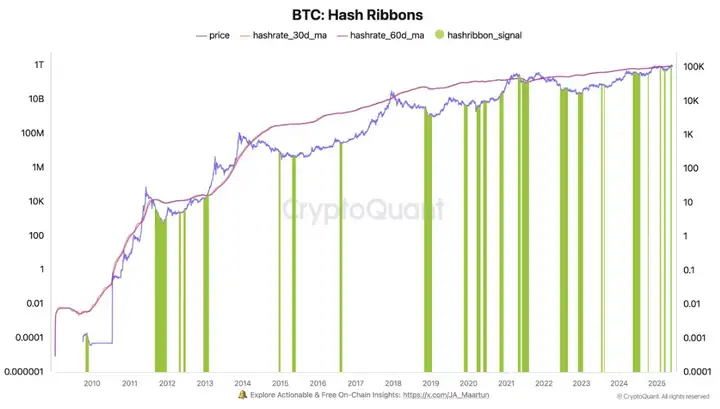

However, not all indicators are bullish. According to CryptoQuant, the Hash Ribbons indicator tracking miner stress recently issued a buy signal.

This usually reflects short-term volatility, as miners face profitability challenges, forcing some to sell Bitcoin to survive.

Historically, these short-term tensions often lay the foundation for sustained price increases. Miner capitulation may trigger initial price drops.

But ultimately, it will squeeze weaker participants out of the market and lead to supply tightness.

Last week, Bitcoin price rose significantly. Influenced by a public dispute between Musk and Trump, Bitcoin price briefly dropped below $101,000, causing nearly $1 billion in liquidations.

However, Bitcoin quickly rebounded above $105,000, showing strong buying pressure.

Technical analysis also remains bullish, with the "cup and handle" pattern on the Bitcoin daily chart suggesting a bullish breakout if the flagship asset successfully breaks through $108,000.

Additionally, large institutional investor activity supports the current bullish outlook. In recent days, Bitcoin futures open interest increased by over $2 billion, while financing rates remain low.

This creates a good foundation for potential short squeezes.

Can BTC maintain the $100,000 psychological support?

Currently, whale accumulation data and miner stress data define a clear trading range. Strong support is located between $100,000 and $102,000.

This means that even during short-term adjustments, BTC may maintain the $100,000 psychological level.

Meanwhile, resistance is in the $108,000 to $110,000 area, and breaking through this could push prices to $120,000.

Catalysts such as continued miner selling should be closely monitored, as these factors can quickly impact price trends.

Moreover, macroeconomic events involving the Federal Reserve and global trade dynamics could exacerbate volatility.

Previous bull markets began when significant liquidity was released during macroeconomic difficulties. Currently, economic pain is accumulating, but liquidity has not yet started, so the bull market is certainly ongoing. Currently, buy on small dips, buy big on large dips, and boldly accumulate. Public chains, those with revenue, and those with strong fundamentals should be the first choice.

PIN AI

Project Name: PIN AI

Release Mechanism: Locked for one month, then linearly released over 12 months

Estimated Listing Price: $10-18

Expected Listing: Q2 2025

Monad

Project Name: Monad

Estimated Opening Price: $6-10

Expected Listing: Q2 listing on top exchanges like Binance, OKX

Release Mechanism: Lock 1, release 12

0G

Token Name: 0G

Release Mechanism: Lock 1, release 12

Total Token Supply: 1 billion

Estimated Opening Price: $10-15

Expected Listing: Q2 debut on three major exchanges

Collector

Token Name: COLL

Total Token Supply: 1 billion

Estimated Opening Price: $1-1.5

Track: RWA

Project Benchmark: ONDO

Expected Listing: Q2 debut on three major exchanges

Zerobsae

Token Name: ZB

Release Mechanism: Lock 1, release 12

Total Token Supply: 1 billion

Estimated Opening Price: $7-10

Expected Listing: Q2 debut on three major exchanges